Dallas Texas Property Tax Rate

Dallas, Texas, is a vibrant city known for its diverse neighborhoods, thriving business landscape, and cultural attractions. However, one aspect that often captures the attention of residents and prospective homeowners is the property tax rate, which can significantly impact financial planning and overall cost of living. In this comprehensive article, we delve into the intricacies of the Dallas property tax system, exploring its rates, calculation methods, and the factors influencing these taxes. We aim to provide a detailed understanding of this crucial aspect of homeownership in the Dallas area, offering valuable insights for both current and future residents.

Understanding the Dallas Property Tax Landscape

The property tax system in Dallas, like many other jurisdictions, is a vital source of revenue for local governments, school districts, and other taxing authorities. These taxes contribute to the maintenance and development of essential public services and infrastructure. Understanding how property taxes are calculated and the rates applicable in Dallas is crucial for homeowners to effectively manage their financial obligations.

The property tax rate in Dallas is expressed as a percentage of the assessed value of a property. This assessed value is determined by the Dallas Central Appraisal District (DCAD), an independent governmental body responsible for appraising property values within Dallas County. The DCAD's appraisal process considers various factors, including the property's location, age, improvements, and market conditions.

Key Factors Influencing Property Taxes in Dallas

Several key factors influence the property tax rate in Dallas, shaping the financial landscape for homeowners in the city.

- Appraised Value: The assessed value of a property, as determined by the DCAD, forms the basis for property tax calculations. Properties with higher appraised values generally attract higher tax rates.

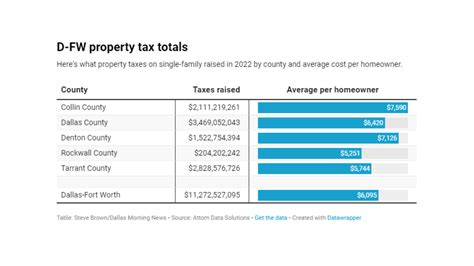

- Taxing Jurisdictions: Dallas County encompasses multiple taxing jurisdictions, including the city of Dallas, various school districts, and special purpose districts. Each jurisdiction sets its own tax rate, which collectively contributes to the overall property tax burden.

- Tax Rate: The tax rate, expressed as a percentage, is a critical factor in determining the property tax amount. It is set annually by the governing bodies of each taxing jurisdiction and can vary significantly across different areas of Dallas.

- Exemptions and Discounts: Dallas offers certain exemptions and discounts that can reduce the property tax burden for eligible homeowners. These include homestead exemptions, which provide a reduction in the taxable value of a property, and senior citizen discounts for homeowners aged 65 and above.

Exploring the Dallas Property Tax Rate

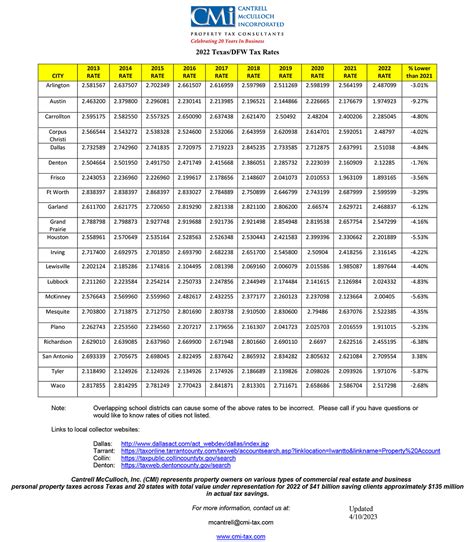

The property tax rate in Dallas is not a uniform percentage applied across the entire city. Instead, it varies depending on the specific taxing jurisdiction in which a property is located. Each jurisdiction sets its own tax rate based on its budgetary needs and the services it provides.

| Taxing Jurisdiction | Tax Rate (2023) |

|---|---|

| City of Dallas | 0.6687% |

| Dallas County | 0.4592% |

| Dallas Independent School District | 1.4200% |

| Dallas County Community College District | 0.2000% |

| Dallas County Hospital District | 0.1150% |

| Dallas County Road District | 0.0515% |

| Dallas County Park District | 0.0200% |

| Total Effective Tax Rate | 2.9344% |

It's important to note that the above tax rates are for the year 2023 and may change in subsequent years. Property owners in Dallas should refer to the official tax rolls or contact the appropriate taxing authorities for the most up-to-date information on tax rates.

Calculating Property Taxes in Dallas

To calculate the property taxes owed on a specific property in Dallas, the following formula is used:

Property Taxes = Assessed Value x Tax Rate

Let's illustrate this with an example. Suppose a homeowner in Dallas has a property with an appraised value of $300,000. Using the total effective tax rate for 2023, the property taxes can be calculated as follows:

Property Taxes = $300,000 x 0.029344 = $8,803.20

This means that the homeowner would owe approximately $8,803.20 in property taxes for the year 2023, based on the given assessed value and tax rates.

Property Tax Trends and Considerations

Understanding the current property tax rates and calculation methods is crucial, but it’s equally important to consider the broader context and trends in the Dallas property tax landscape.

Recent Property Tax Trends in Dallas

Over the past decade, property tax rates in Dallas have generally experienced modest increases, reflecting the city’s growth and evolving needs for public services. However, these increases have been relatively stable, providing homeowners with a degree of predictability in their financial planning.

One notable trend is the increasing focus on school district funding through property taxes. As the Dallas Independent School District (DISD) aims to enhance educational opportunities and infrastructure, it has occasionally proposed tax rate increases to support these initiatives. Homeowners should closely monitor DISD's budget and tax proposals to understand the potential impact on their property tax obligations.

Impact of Property Value Appreciation

The appreciation of property values in Dallas can significantly influence the overall property tax burden. As property values increase, so does the assessed value upon which taxes are calculated. This means that homeowners may experience higher property taxes even if tax rates remain constant.

To mitigate the impact of rising property values, Dallas offers various exemptions and discounts. The homestead exemption, for example, reduces the taxable value of a homeowner's primary residence, providing a financial benefit. Additionally, senior citizens may qualify for the over-65 homestead exemption, which offers further tax relief.

Conclusion: Navigating the Dallas Property Tax Landscape

Understanding the property tax system in Dallas is essential for homeowners to make informed decisions and effectively manage their financial obligations. The city’s property tax rates, while varying across different jurisdictions, provide a critical source of revenue for essential public services and infrastructure development.

By staying informed about tax rates, exemptions, and the broader trends in the Dallas property tax landscape, homeowners can proactively plan their finances and contribute to the vibrant community that Dallas offers. Whether it's leveraging available exemptions, staying engaged with local tax authorities, or exploring opportunities for tax savings, a comprehensive understanding of property taxes empowers homeowners to make the most of their investment in Dallas real estate.

Frequently Asked Questions

How often do property tax rates change in Dallas?

+

Property tax rates in Dallas are typically reviewed and set annually by the governing bodies of each taxing jurisdiction. These rates can change from year to year based on budgetary needs and the services provided by the jurisdiction.

Are there any exemptions or discounts available for property taxes in Dallas?

+

Yes, Dallas offers several exemptions and discounts to reduce the property tax burden for eligible homeowners. These include homestead exemptions, which reduce the taxable value of a homeowner’s primary residence, and senior citizen discounts for homeowners aged 65 and above.

How can I estimate my property taxes in Dallas before purchasing a home?

+

To estimate your property taxes in Dallas before purchasing a home, you can use the assessed value of the property and the current tax rates for the relevant taxing jurisdictions. Multiply the assessed value by the total effective tax rate to get an estimate of the annual property taxes. However, it’s important to note that tax rates and exemptions can change, so this estimate should be used as a rough guide.

What happens if I disagree with the assessed value of my property in Dallas?

+

If you disagree with the assessed value of your property in Dallas, you have the right to appeal the appraisal. The process involves filing an appeal with the Dallas Central Appraisal District (DCAD) within a specified timeframe. It’s recommended to gather supporting evidence, such as recent sales of comparable properties, to support your case. The DCAD will review your appeal and make a determination.

Are there any property tax relief programs available in Dallas for low-income homeowners?

+

Yes, Dallas offers the Residential Homestead Cap program, which provides property tax relief to low-income homeowners. This program caps the increase in the taxable value of a homeowner’s primary residence, protecting them from significant tax increases due to rising property values. To qualify, homeowners must meet certain income and residency requirements.