Multnomah County Tax

Welcome to a comprehensive guide on Multnomah County's tax system, where we delve into the intricate world of taxation and explore its impact on residents and businesses alike. In this article, we will unravel the complexities of Multnomah County's tax landscape, offering a deep dive into its structure, rates, and implications. Whether you're a homeowner, a business owner, or simply curious about the financial landscape of this vibrant county, this guide is designed to provide you with expert insights and practical information.

Understanding the Multnomah County Tax Structure

Multnomah County, located in the heart of Oregon, boasts a diverse and thriving community, and its tax system plays a crucial role in supporting the county’s infrastructure, services, and overall development. The county’s tax structure is a carefully crafted framework that ensures the equitable distribution of financial responsibilities among its residents and businesses.

The foundation of Multnomah County's tax system lies in a combination of property taxes, personal income taxes, and various other levies and fees. This multi-faceted approach allows the county to generate revenue to fund essential services such as education, healthcare, public safety, and infrastructure development.

Property Taxes: The Backbone of County Funding

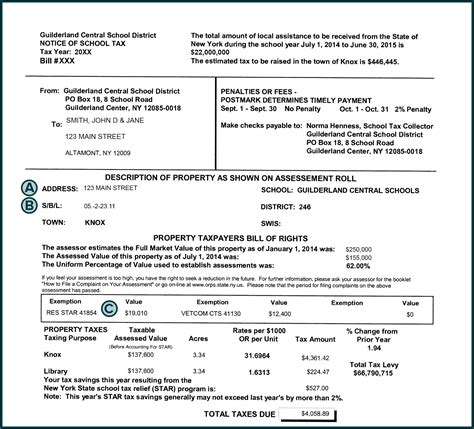

Property taxes are a significant component of Multnomah County’s tax structure. These taxes are levied on real estate properties within the county, including residential homes, commercial buildings, and land. The assessment process involves evaluating the value of each property, taking into account factors such as location, size, improvements, and market conditions.

Once the property values are determined, a tax rate is applied to calculate the amount due. This tax rate is set annually by the county commissioners and is based on the revenue needs of various county departments and services. Property owners receive tax statements detailing the assessed value, tax rate, and the total amount due.

To illustrate, let's consider an example. Suppose a residential property in Multnomah County is assessed at $500,000, and the current tax rate is set at 1.5%. The property owner would be responsible for paying a tax amount of $7,500 ($500,000 x 0.015) for the year.

| Property Type | Assessment Value | Tax Rate | Estimated Tax |

|---|---|---|---|

| Residential Home | $500,000 | 1.5% | $7,500 |

| Commercial Building | $1,200,000 | 1.7% | $20,400 |

| Vacant Land | $350,000 | 1.4% | $4,900 |

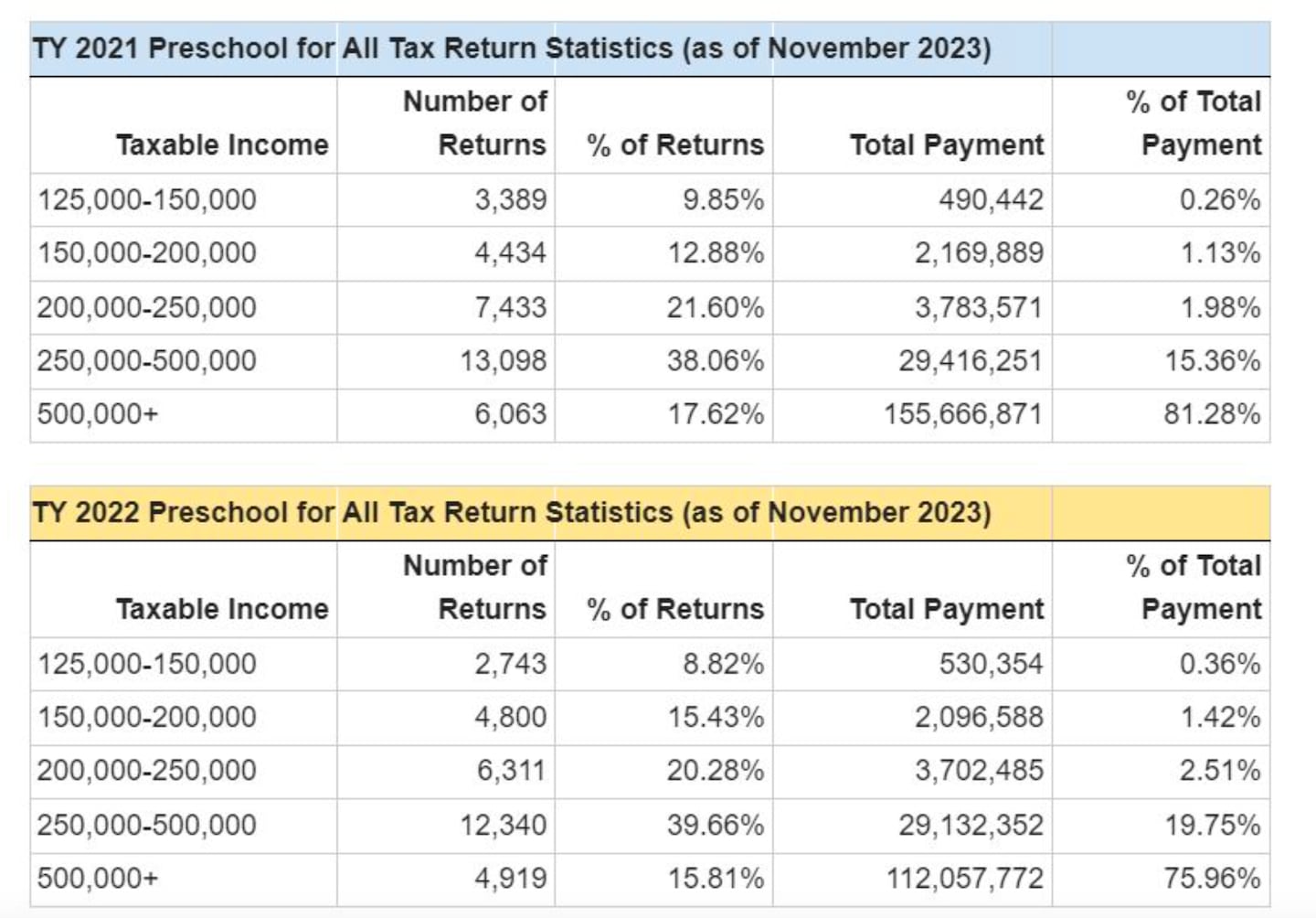

Personal Income Taxes: A Progressive Approach

In addition to property taxes, Multnomah County also collects personal income taxes from its residents. The county’s income tax system follows a progressive structure, meaning that higher incomes are taxed at a higher rate. This approach ensures that those with greater financial means contribute proportionally more to the county’s revenue stream.

The county's income tax rates are typically set within a range, with different brackets corresponding to different income levels. Residents are required to file annual income tax returns, declaring their earnings and deductions. The tax liability is then calculated based on the applicable tax rate for their income bracket.

For instance, if an individual resident's taxable income falls within the $30,000 to $50,000 bracket, they may be subject to a tax rate of 5%. On the other hand, an individual with an income above $100,000 may face a higher tax rate, such as 8%, to contribute more towards the county's funding.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $30,000 | 3% |

| $30,001 - $50,000 | 5% |

| $50,001 - $100,000 | 6% |

| $100,001 and above | 8% |

Other Revenue Sources: Levies and Fees

Beyond property and income taxes, Multnomah County also relies on various other revenue sources to support its operations. These include special levies, which are temporary taxes approved by voters to fund specific projects or initiatives. For example, a levy might be implemented to support local schools, improve transportation infrastructure, or enhance public safety measures.

Additionally, the county collects fees for various services, permits, and licenses. These fees contribute to the overall revenue stream and help cover the costs of providing essential services to residents and businesses. From building permits to business licenses, these fees ensure that the county can maintain and enhance its infrastructure and services.

Impact on Residents and Businesses

The tax structure of Multnomah County has a profound impact on both residents and businesses within the county. Understanding these implications is crucial for making informed financial decisions and navigating the local tax landscape effectively.

Residential Tax Considerations

For homeowners in Multnomah County, property taxes are a significant financial obligation. The annual tax bill can vary based on the assessed value of the property and the prevailing tax rate. It is essential for homeowners to stay informed about property assessments and tax rate changes to budget effectively and plan their financial strategies.

Additionally, the progressive income tax structure affects residents' disposable income. Those with higher incomes may face a higher tax burden, which can influence their spending and investment decisions. Understanding the tax implications can help residents make strategic financial choices to optimize their overall financial well-being.

Business Tax Landscape

Businesses operating within Multnomah County also bear the responsibility of contributing to the county’s tax revenue. Property taxes, income taxes, and various fees impact businesses’ financial health and operational costs.

Commercial property owners face similar tax considerations as residential homeowners. The assessed value of their properties and the prevailing tax rate determine their annual tax liability. Additionally, businesses with higher incomes may be subject to higher income tax rates, impacting their overall profitability.

Furthermore, businesses must navigate the county's fee structure, which can include permits, licenses, and other administrative fees. These fees can vary depending on the nature of the business and the services required. Staying informed about these fees and understanding their implications is crucial for business owners to plan their operations and financial strategies effectively.

Economic Development and Tax Incentives

Multnomah County recognizes the importance of fostering economic growth and development. To attract and support businesses, the county offers various tax incentives and programs. These initiatives aim to stimulate investment, create jobs, and promote a thriving business environment.

Tax incentives may include tax abatements, tax credits, or reduced tax rates for qualifying businesses. These incentives are typically designed to encourage specific industries, promote job creation, or support businesses in underserved areas. By providing these incentives, the county aims to stimulate economic activity and contribute to the overall prosperity of the region.

The Future of Multnomah County’s Tax System

As Multnomah County continues to evolve and adapt to changing economic and social landscapes, its tax system is also subject to ongoing evaluation and potential reforms. The county’s leaders and policymakers regularly assess the effectiveness and fairness of the tax structure, considering factors such as economic growth, population dynamics, and community needs.

Tax Reform Initiatives

In recent years, there has been a growing focus on tax reform within Multnomah County. Discussions and proposals have centered around making the tax system more equitable, transparent, and responsive to the needs of residents and businesses. Some of the key areas of focus include:

- Revisiting tax rates and brackets to ensure a fair distribution of tax responsibilities.

- Exploring alternative tax structures, such as a flat tax or a consumption-based tax, to simplify the system and reduce administrative burdens.

- Enhancing tax collection efficiency and reducing compliance costs for taxpayers.

- Addressing concerns related to property tax assessments and ensuring accuracy and fairness in the valuation process.

Community Engagement and Transparency

Multnomah County recognizes the importance of engaging with its residents and businesses in shaping the future of its tax system. Community forums, town hall meetings, and online platforms provide opportunities for stakeholders to voice their concerns, share ideas, and actively participate in the decision-making process.

Transparency is a key priority, with efforts focused on providing clear and accessible information about tax rates, revenue allocation, and the impact of tax decisions on the community. By fostering an open dialogue, the county aims to build trust and ensure that tax policies align with the values and aspirations of its diverse population.

Balancing Revenue and Services

As the county’s needs and priorities evolve, striking a balance between generating sufficient revenue and providing essential services remains a critical challenge. Multnomah County strives to maintain a sustainable and resilient tax system that can adapt to changing economic conditions and community demands.

The county's leaders work closely with financial experts, economists, and community representatives to develop long-term financial plans. These plans consider not only the current revenue needs but also future infrastructure projects, social programs, and economic development initiatives. By taking a proactive approach, Multnomah County aims to ensure that its tax system remains robust and responsive to the evolving needs of its residents and businesses.

Conclusion

In conclusion, Multnomah County’s tax system is a complex yet essential framework that supports the county’s growth, development, and well-being. From property taxes to personal income taxes and various other revenue sources, the county’s tax landscape plays a pivotal role in funding essential services and driving economic prosperity.

As we have explored, the impact of Multnomah County's tax system extends beyond financial obligations. It influences the financial decisions of residents and businesses, shapes the local economy, and contributes to the overall quality of life within the county. Understanding the intricacies of the tax system empowers individuals and businesses to make informed choices and actively participate in the county's financial and economic journey.

As Multnomah County continues to adapt and evolve, its tax system will remain a critical component of its overall strategy. By embracing transparency, community engagement, and a commitment to fairness, the county can ensure that its tax policies reflect the values and aspirations of its diverse population, fostering a thriving and sustainable community for generations to come.

How often do property tax rates change in Multnomah County?

+Property tax rates in Multnomah County can change annually. The county commissioners review and set the tax rates based on the revenue needs of various county departments and services. It is important for property owners to stay updated on any changes in tax rates to accurately calculate their tax obligations.

Are there any tax incentives for businesses in Multnomah County?

+Yes, Multnomah County offers various tax incentives to attract and support businesses. These incentives may include tax abatements, tax credits, or reduced tax rates for qualifying businesses. The county aims to stimulate economic growth, create jobs, and promote a thriving business environment through these initiatives.

How can residents stay informed about tax-related changes and initiatives in Multnomah County?

+Residents can stay informed about tax-related changes and initiatives by regularly visiting the Multnomah County website, which provides up-to-date information on tax rates, assessments, and any proposed reforms. Additionally, attending community forums and town hall meetings can offer valuable insights into ongoing tax discussions and initiatives.