Sales Tax On Texas Vehicles

Sales tax on vehicles is an essential consideration for prospective car buyers, especially in Texas, where the process can vary significantly from other states. Understanding the sales tax structure and the potential costs involved is crucial for anyone looking to purchase a vehicle in the Lone Star State. In this comprehensive guide, we will delve into the intricacies of sales tax on Texas vehicles, exploring the rates, exemptions, and processes involved, to ensure you have all the information needed to make informed decisions.

Understanding the Texas Sales Tax Structure

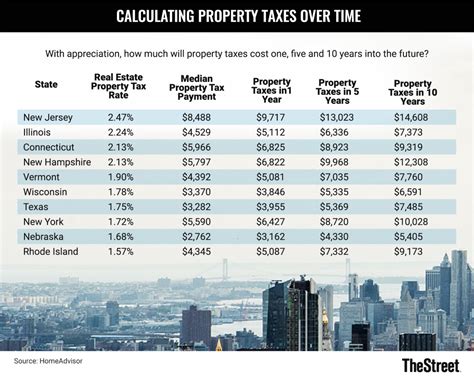

Texas has a unique sales tax system compared to many other states. It operates on a statewide sales tax rate, which is applied uniformly across the state, along with additional local sales taxes that vary depending on the county and city where the purchase is made. This dual structure can result in slightly different tax rates for different regions within Texas.

Statewide Sales Tax Rate

The statewide sales tax rate in Texas is currently set at 6.25%. This rate is applied to most tangible personal property, including vehicles. It is a standard rate and does not vary across the state.

Local Sales Taxes

In addition to the statewide sales tax, Texas allows for local governments to impose their own sales taxes. These local option sales taxes (LOST) can be levied by cities, counties, transit authorities, and other local entities. The rates for these local taxes can range from 0% to 2%, depending on the jurisdiction.

For example, in the city of Houston, the combined sales tax rate is 8.25%, which includes the statewide rate of 6.25% and an additional local rate of 2%. On the other hand, in a county like Jeff Davis, the local sales tax is 0%, meaning the total sales tax rate there is the standard 6.25%.

| County/City | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Harris County (Houston) | 2% | 8.25% |

| Jeff Davis County | 0% | 6.25% |

| Travis County (Austin) | 1.25% | 7.5% |

| Dallas County (Dallas) | 1.5% | 7.75% |

Calculating Sales Tax on Vehicles

To calculate the sales tax on a vehicle purchase in Texas, you need to consider both the statewide rate and the applicable local rate. Here's a simple formula:

Total Sales Tax = (Purchase Price * Statewide Rate) + (Purchase Price * Local Rate)

For example, if you're purchasing a vehicle in Houston (with a combined rate of 8.25%) for $30,000, the sales tax calculation would be:

Total Sales Tax = ($30,000 * 0.0625) + ($30,000 * 0.02) = $1875 + $600 = $2475

Sales Tax Exemptions and Special Cases

While most vehicle purchases in Texas are subject to sales tax, there are certain exemptions and special cases to be aware of:

Trade-Ins

If you're trading in your old vehicle as part of the purchase, the sales tax is calculated on the difference between the trade-in value and the purchase price of the new vehicle. This is known as the trade-in credit.

For instance, if you trade in a vehicle valued at $10,000 and purchase a new vehicle for $30,000, the sales tax is calculated on the difference of $20,000. This can significantly reduce the amount of tax you owe.

Leased Vehicles

Leased vehicles are treated differently when it comes to sales tax. In Texas, you typically pay sales tax on each lease payment, rather than upfront. This means you'll be paying a portion of the sales tax with each monthly payment.

Disabled Veteran Exemption

Veterans who are 100% disabled due to service-connected disabilities are exempt from paying sales tax on vehicle purchases in Texas. This exemption is applicable for both new and used vehicles.

Non-Resident Purchases

If you're a non-resident of Texas and plan to register the vehicle in another state, you may be exempt from paying Texas sales tax. However, you'll need to register the vehicle in your home state and pay any applicable taxes there.

Vehicle Registration and Title Transfer

After purchasing a vehicle in Texas, you'll need to complete the registration and title transfer process. This involves several steps:

- Vehicle Inspection: All vehicles must pass a safety inspection within 90 days of purchase or change of ownership.

- Title Transfer: You'll need to apply for a new title with the Texas Department of Motor Vehicles (TxDMV) and pay the applicable title transfer fee.

- Registration: Register the vehicle with the county tax assessor-collector's office in the county where you live. This involves paying registration fees and sales tax (if applicable) and obtaining license plates.

Registration Fees and Sales Tax

In addition to the sales tax, you'll also need to pay registration fees when registering your vehicle. These fees vary depending on the vehicle's weight and use. For example, passenger vehicles have a standard registration fee of $53.00 for a 2-year registration period.

It's important to note that the registration fee does not include the sales tax. You'll need to pay the sales tax separately when registering your vehicle.

Understanding Texas Vehicle Sales Tax: A Case Study

To better illustrate the process, let's consider a hypothetical case study of John, a resident of Austin, Texas.

John wants to purchase a new car. He finds a vehicle he likes for $25,000. Austin has a combined sales tax rate of 7.5% (statewide rate of 6.25% + local rate of 1.25%).

Using the formula mentioned earlier, we can calculate the sales tax John will pay:

Total Sales Tax = ($25,000 * 0.0625) + ($25,000 * 0.0125) = $1562.50

So, John will pay a total of $1562.50 in sales tax for his new car purchase in Austin.

Sales Tax and Used Vehicles

When purchasing a used vehicle in Texas, the sales tax calculation remains largely the same. The statewide rate and local rate apply to the purchase price of the vehicle. However, there are a few additional considerations:

Private Sales

If you're purchasing a used vehicle from a private seller, you'll typically pay sales tax on the purchase price at the time of registration. It's important to keep all relevant documentation, including the bill of sale, to facilitate the registration process.

Dealer Sales

When buying a used vehicle from a dealership, the sales tax is often included in the final price. Make sure to ask the dealer about the sales tax inclusion and any potential discounts or incentives that might apply.

Frequently Asked Questions

What is the average sales tax rate on vehicles in Texas?

+The average sales tax rate on vehicles in Texas is approximately 7%, which includes the statewide rate of 6.25% and an average local rate of around 0.75%.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any ways to reduce the sales tax on vehicle purchases in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are a few ways to potentially reduce the sales tax burden. These include taking advantage of trade-in credits, qualifying for certain exemptions (like the disabled veteran exemption), or purchasing a vehicle from a dealer that offers sales tax incentives.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often do sales tax rates change in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Sales tax rates in Texas are generally stable and don't change frequently. However, local governments may adjust their local option sales taxes from time to time, which can lead to slight variations in the combined sales tax rate for different regions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Do I need to pay sales tax if I'm buying a vehicle online or from out of state?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you're buying a vehicle online or from out of state and plan to register it in Texas, you'll likely need to pay sales tax. However, if you're a non-resident and plan to register the vehicle in your home state, you may be exempt from paying Texas sales tax.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get a refund if I overpay sales tax on my vehicle purchase in Texas?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, if you overpay sales tax on your vehicle purchase in Texas, you can apply for a refund. The process involves completing a specific form and providing documentation to support your claim. It's advisable to consult with a tax professional or the Texas Comptroller's office for detailed instructions.</p>

</div>

</div>

</div>

Remember, while this guide provides a comprehensive overview, it’s always recommended to consult with tax professionals or the Texas Comptroller’s office for the most up-to-date and accurate information regarding sales tax on vehicles in Texas.