Vt State Tax Refund Status

The Vermont Department of Taxes offers several convenient ways for residents to check the status of their state tax refunds. This article will guide you through the various methods available, ensuring you stay informed about the progress of your refund. Understanding how to track your refund is essential, especially during tax season, to avoid unnecessary delays and stay up-to-date with your financial affairs.

Official Website: A Direct Source for Refund Information

The Vermont Department of Taxes official website is the primary source for checking your state tax refund status. The website provides a user-friendly interface, making it simple for taxpayers to access their refund information quickly. To check your refund status online, follow these steps:

-

Visit the Vermont Department of Taxes website at https://tax.vermont.gov. This is the official and secure online portal for all tax-related matters in the state.

-

Locate the "Check Refund Status" section on the homepage or navigate to the "Refunds" page using the top menu. This section is designed to provide a straightforward path to your refund status.

-

Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) as prompted. This ensures the system can locate your specific tax information accurately.

-

Input the Refund Amount shown on your tax return. This is a security measure to verify your identity and ensure the information provided matches your tax records.

-

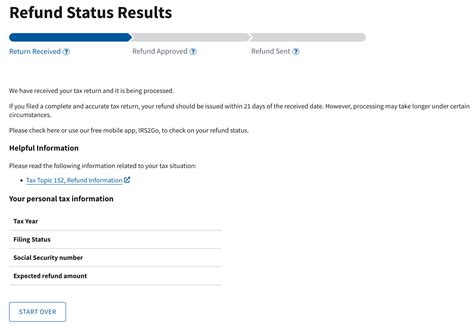

Click the "Submit" button to retrieve your refund status. The system will display a detailed breakdown of your refund, including the date it was issued, the method of payment, and any relevant updates or notifications.

By following these simple steps, you can access real-time information about your Vermont state tax refund. The online portal is designed to be secure and user-friendly, ensuring your privacy and providing a convenient way to manage your tax affairs.

Additional Online Features for Taxpayers

The Vermont Department of Taxes website offers additional features to enhance your tax management experience. These include:

-

Tax Payment Options: Explore various payment methods for your state taxes, including online payments, direct deposit, and payment plans. This section provides a comprehensive guide to ensure you choose the most suitable payment option for your needs.

-

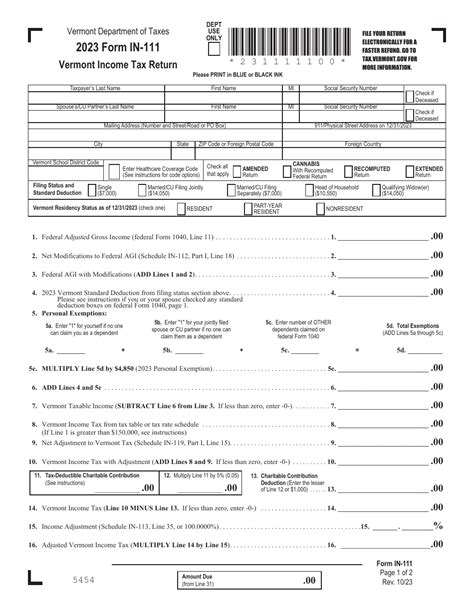

Tax Forms and Publications: Access a wide range of tax forms and publications, including the latest tax rates, deadlines, and guidelines. This resource is invaluable for taxpayers seeking to stay informed and compliant with Vermont's tax regulations.

-

MyVTax Account: Create a personalized account to manage your tax affairs online. With a MyVTax account, you can securely access your tax records, view refund status, make payments, and receive important notifications directly from the Department of Taxes.

These online features provide Vermont taxpayers with the tools they need to efficiently manage their tax obligations and stay informed about their refund status.

Telephone Assistance: A Personalized Option

For those who prefer a more personalized approach, the Vermont Department of Taxes offers telephone assistance. Trained representatives are available to provide guidance and answer specific questions about your refund status. To reach a representative, call the Vermont Department of Taxes at 802-828-2500 or 800-773-2724 (toll-free within Vermont) during regular business hours.

When calling, have your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) ready, along with the refund amount from your tax return. This information will allow the representative to quickly access your records and provide accurate and up-to-date information about your refund status.

Telephone assistance is particularly beneficial for taxpayers who may encounter issues with their online refund status check or have specific questions that require personalized attention.

Important Contact Information

| Department | Contact Details |

|---|---|

| Vermont Department of Taxes |

Address: 133 State Street, Montpelier, VT 05609 Telephone: 802-828-2500 or 800-773-2724 (toll-free within Vermont) Email: vt-dotax@vermont.gov |

| Vermont Taxpayer Assistance |

Telephone: 802-828-2500 or 800-773-2724 (toll-free within Vermont) |

Remember to keep these contact details handy for any future tax-related inquiries.

Mobile App: On-the-Go Refund Tracking

In today's digital age, the Vermont Department of Taxes has embraced mobile technology to provide taxpayers with a convenient way to track their refunds on the go. The Vermont Tax App is available for both iOS and Android devices, offering a user-friendly interface for checking refund status and managing tax affairs.

To use the Vermont Tax App, simply download it from the Apple App Store or Google Play Store. Once installed, follow these steps:

-

Open the Vermont Tax App on your mobile device.

-

Create an account or log in using your existing MyVTax credentials.

-

Navigate to the "Refund Status" section within the app.

-

Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and the refund amount from your tax return.

-

Tap the "Check Status" button to retrieve your refund information. The app will display the current status of your refund, including any updates or notifications.

The Vermont Tax App provides a secure and convenient way to stay informed about your refund status, ensuring you can access this information anytime, anywhere.

App Features and Benefits

-

Real-Time Updates: Receive instant notifications about any changes to your refund status, ensuring you're always up-to-date.

-

Secure Access: The app employs advanced security measures to protect your personal and tax information, providing a safe environment for managing your finances.

-

Quick and Easy: With a user-friendly interface, checking your refund status takes just a few taps, saving you time and effort.

By leveraging the power of mobile technology, the Vermont Tax App offers Vermont taxpayers a modern and efficient way to stay informed about their state tax refunds.

Understanding Refund Processing Times

It's essential to understand that refund processing times can vary based on several factors, including the complexity of your tax return, the method of filing, and the volume of tax returns being processed. The Vermont Department of Taxes aims to process refunds as quickly as possible, but it's important to allow for some processing time to ensure accurate and thorough reviews.

Here are some key points to consider regarding refund processing times:

-

Electronic Filing Advantage: Filing your tax return electronically, especially with direct deposit, can significantly speed up the refund process. Electronic returns are typically processed faster than paper returns.

-

Processing Windows: The Department of Taxes processes refunds in batches, and the timing of your refund may depend on when your return was received and processed.

-

Complexity Matters: Returns with complex transactions, such as business income or multiple sources of income, may require additional review, which can extend the processing time.

-

Peak Season Delays: During the peak tax season, particularly around the filing deadline, processing times may be longer due to the high volume of returns being submitted.

By being aware of these factors, you can have a more realistic expectation of when to anticipate your refund. If you have any concerns or if your refund status remains pending for an extended period, it's advisable to reach out to the Vermont Department of Taxes for further assistance.

Tips for a Smooth Refund Process

-

File Early: Submitting your tax return early in the season can reduce processing delays and potential issues.

-

Choose Direct Deposit: Opting for direct deposit as your refund method can expedite the process and provide a more secure way to receive your refund.

-

Review Your Return: Before submitting your tax return, carefully review it for accuracy to avoid potential errors that could delay processing.

-

Keep Contact Information Updated: Ensure that the Department of Taxes has your current mailing address and contact details to avoid any delays in communication.

By following these tips and staying informed about the refund process, you can navigate the tax season with confidence and efficiency.

Future Developments: Enhancing Taxpayer Experience

The Vermont Department of Taxes is committed to continuously improving its services to enhance the taxpayer experience. As technology advances, the department aims to implement innovative solutions to streamline the refund process and provide even more efficient and secure ways to manage tax affairs.

Some potential future developments include:

-

Online Refund Tracking: Further enhancements to the online refund status tool, providing more detailed and real-time updates on the progress of your refund.

-

Mobile App Integration: Expanding the capabilities of the Vermont Tax App to include additional tax management features, such as e-filing and payment options, offering a comprehensive mobile solution for taxpayers.

-

Data Security Measures: Implementing advanced security protocols to protect taxpayer data and ensure the highest level of privacy and security.

-

Artificial Intelligence (AI) Integration: Exploring the use of AI to automate certain refund processing tasks, reducing potential errors and speeding up the overall process.

By staying at the forefront of technological advancements, the Vermont Department of Taxes aims to make the tax refund process more accessible, efficient, and secure for all Vermont taxpayers.

Stay Informed, Stay Connected

To stay updated on the latest developments and improvements to the tax refund process in Vermont, consider subscribing to the Vermont Department of Taxes newsletter or following their official social media accounts. These platforms provide valuable insights, announcements, and tips to help taxpayers navigate the tax landscape effectively.

By staying informed and utilizing the various tools and resources available, Vermont taxpayers can confidently manage their tax obligations and efficiently track their state tax refunds.

Conclusion

Checking the status of your Vt State Tax Refund is now easier than ever with the convenient options provided by the Vermont Department of Taxes. Whether you prefer the official website, telephone assistance, or the mobile app, you can access real-time information about your refund status. By staying informed and leveraging these tools, Vermont taxpayers can efficiently manage their tax affairs and plan their finances with confidence.

Remember, the Vermont Department of Taxes is dedicated to providing a seamless and secure tax experience, and these resources are designed to empower taxpayers with the knowledge and tools they need to navigate the tax landscape successfully.

How long does it typically take to receive a Vermont state tax refund?

+The processing time for a Vermont state tax refund can vary. On average, electronic returns with direct deposit can be processed within 2-3 weeks. However, factors like the complexity of the return, errors, or high volumes during peak season can affect processing times. It’s advisable to allow for some flexibility and plan accordingly.

What should I do if my refund status shows as “Pending” for an extended period?

+If your refund status remains “Pending” for an extended period, it’s recommended to contact the Vermont Department of Taxes for assistance. They can provide specific updates and guidance based on your individual situation. Their contact details are available on their official website.

Can I check my refund status if I filed a joint return with my spouse?

+Yes, you can check the refund status for a joint return using the same methods as for individual returns. Ensure you have the necessary information, such as the SSN or ITIN of both spouses, and the total refund amount shown on your joint tax return.

Are there any alternative methods to receive my state tax refund besides direct deposit?

+Yes, Vermont taxpayers can choose to receive their state tax refund via check. However, direct deposit is generally faster and more secure. If you prefer a check, ensure your mailing address is up-to-date with the Department of Taxes to avoid delays.

What should I do if I believe there’s an error in my refund amount or status?

+If you suspect an error in your refund amount or status, it’s crucial to contact the Vermont Department of Taxes promptly. They can guide you through the necessary steps to resolve the issue and ensure you receive the correct refund amount.