Car Donation Tax Deduction

Car donation is a popular and effective way for individuals to support charitable causes while also taking advantage of tax benefits. In this comprehensive guide, we will delve into the world of car donations and explore the tax deductions that can be claimed. By understanding the ins and outs of this process, you can make an informed decision and maximize the impact of your charitable contribution.

Maximizing Your Car Donation Tax Deduction

Donating a vehicle to a qualified charity is not only a generous act but also a strategic way to reduce your tax liability. The Internal Revenue Service (IRS) allows taxpayers to claim deductions for charitable contributions, including car donations. However, it’s essential to navigate the process correctly to ensure you receive the full tax benefits.

Understanding the Basics of Car Donation Tax Deductions

When you donate a car to a charity, you are eligible to claim a tax deduction based on the fair market value of the vehicle. The fair market value is the price at which the car could reasonably be sold in the open market. This value is crucial as it determines the amount you can deduct from your taxable income.

The IRS provides guidelines for determining the fair market value of donated vehicles. Generally, the value is based on factors such as the make, model, year, mileage, and overall condition of the car. It's essential to accurately assess the vehicle's value to ensure compliance with IRS regulations.

| Donation Value Factors | Description |

|---|---|

| Make and Model | Consider the brand and specific model of the car, as certain makes and models have higher values. |

| Year | Newer vehicles typically have higher values, but classic or rare cars may also command higher prices. |

| Mileage | Lower mileage can increase the value, especially for vehicles with average or high mileage. |

| Condition | The overall condition, including any repairs or modifications, can impact the fair market value. |

Qualifications and Requirements for Tax Deductions

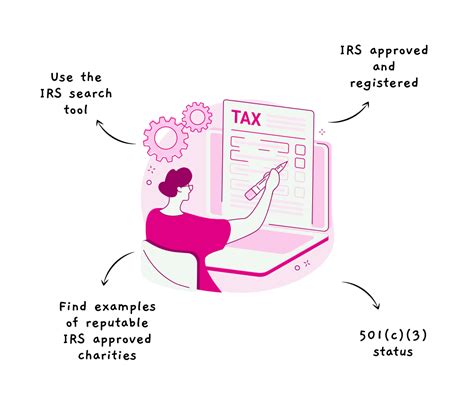

Not all car donations qualify for tax deductions. To ensure you can claim the deduction, you must donate the vehicle to a qualified charitable organization. The IRS maintains a list of eligible organizations, and you can verify their status by checking the IRS Select Check tool.

Additionally, you must meet certain requirements regarding the method of donation and the documentation you provide. The IRS mandates that you receive a written acknowledgment from the charity, which must include specific information such as the vehicle's make, model, and value. This acknowledgment is a crucial piece of evidence for your tax return.

It's also essential to note that the tax deduction is only applicable if you itemize your deductions on your tax return. If you claim the standard deduction, you won't be able to benefit from the car donation tax deduction.

Maximizing Your Deduction: Tips and Strategies

To maximize the tax benefits of your car donation, consider the following strategies:

- Donate to Multiple Charities: If you have multiple vehicles to donate or wish to support various causes, consider spreading your donations across different charitable organizations. This can help you take advantage of multiple deductions.

- Choose the Right Charity: Research and select a charity that aligns with your values and has a strong track record. Some charities may have specific programs or initiatives that require vehicles, making your donation even more impactful.

- Negotiate with the Charity: Discuss the value of your vehicle with the charity. They may be able to provide guidance or assist in determining the fair market value, ensuring you receive the maximum deduction.

- Keep Detailed Records: Maintain a comprehensive record of your donation, including the date, the charity's name and contact information, and any communication regarding the value of the vehicle. These records will be valuable when preparing your tax return.

- Consider Vehicle Condition: While older or high-mileage vehicles may not have a high fair market value, they can still be valuable donations. Charities often use such vehicles for their operations or sell them to generate funds. Don't underestimate the impact of your donation based solely on the vehicle's value.

Real-World Examples and Case Studies

Let’s explore a few real-world scenarios to illustrate the impact of car donation tax deductions:

- Case 1: Classic Car Donation - John, a car enthusiast, donated his well-maintained 1967 Mustang to a local charity. The charity, recognizing the car's value, sold it at an auction for $35,000. John received a tax deduction of $35,000, significantly reducing his taxable income for the year.

- Case 2: High-Mileage Vehicle - Sarah donated her 2005 sedan with over 200,000 miles to a charity that provides transportation for low-income families. Although the car's fair market value was only $1,500, the charity was able to use it for their operations. Sarah claimed a tax deduction of $1,500, contributing to her charitable contribution limit.

- Case 3: Multiple Donations - Mike, a business owner, donated three company vehicles to different charities. He strategically chose organizations with diverse missions, maximizing his tax deductions and supporting various causes. Each vehicle had a different fair market value, and Mike received deductions based on these individual values.

Future Implications and Tax Reform

While car donation tax deductions have been a valuable tool for taxpayers, it’s important to stay updated on potential changes in tax laws. The IRS and government bodies periodically review and update tax regulations, which can impact the process and benefits of car donations.

Recent tax reforms, such as the Tax Cuts and Jobs Act, have introduced changes that affect charitable contributions. For instance, the act increased the standard deduction, which may make it less advantageous for some taxpayers to itemize deductions, including car donations. However, for those who continue to itemize, car donation tax deductions remain a viable option.

It's crucial to consult tax professionals and stay informed about any changes to ensure you maximize the benefits while complying with the latest tax regulations.

How do I determine the fair market value of my donated car?

+You can use online valuation tools, such as Kelley Blue Book or NADA Guides, to estimate the fair market value. These tools consider factors like make, model, year, and condition. Additionally, consult with the charity to get their assessment, as they may have experience with similar vehicles.

Can I claim a tax deduction if I donate a car that’s not in good condition?

+Yes, even vehicles in less-than-perfect condition can be donated and qualify for deductions. The charity may use such vehicles for their operations or sell them for parts. The key is to accurately assess the vehicle’s value and obtain the necessary documentation from the charity.

What if I donate a car but don’t itemize my deductions on my tax return?

+If you don’t itemize your deductions, you won’t be able to claim the car donation as a tax deduction. However, you still contribute to a good cause, and your donation can have a significant impact on the charity’s operations.

Are there any limits to the amount I can deduct for car donations?

+Yes, there are limits based on the type of donation and the organization’s status. For non-cash donations, the deduction is generally limited to 50% of your adjusted gross income. Consult with a tax professional to understand the specific limits and requirements.