Sales Tax Software

In the modern business landscape, where precision and efficiency are paramount, sales tax management has evolved into a complex yet critical aspect of financial operations. Enter sales tax software – a technological innovation designed to streamline and automate the intricate process of calculating, collecting, and remitting sales taxes.

This innovative solution has become a necessity for businesses, particularly those with a multi-state or global presence, to ensure compliance with the ever-changing tax regulations and avoid potential penalties. As such, the market is witnessing a surge in the adoption of sales tax software, with businesses recognizing its ability to enhance accuracy, efficiency, and overall tax management.

Revolutionizing Tax Compliance with Sales Tax Software

Sales tax software is a game-changer for businesses, offering a comprehensive suite of tools and functionalities to simplify the complex world of sales tax compliance. By automating tax calculations, businesses can ensure accurate tax assessments, avoiding under- or over-charging customers and mitigating the risk of audit penalties.

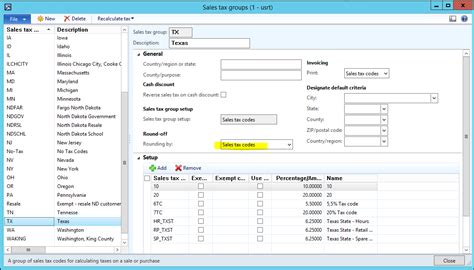

The software's ability to integrate seamlessly with existing accounting and ERP systems further enhances its value. This integration facilitates real-time tax calculations based on the latest rates and rules, ensuring businesses stay up-to-date with the dynamic nature of sales tax regulations.

Key Features and Benefits

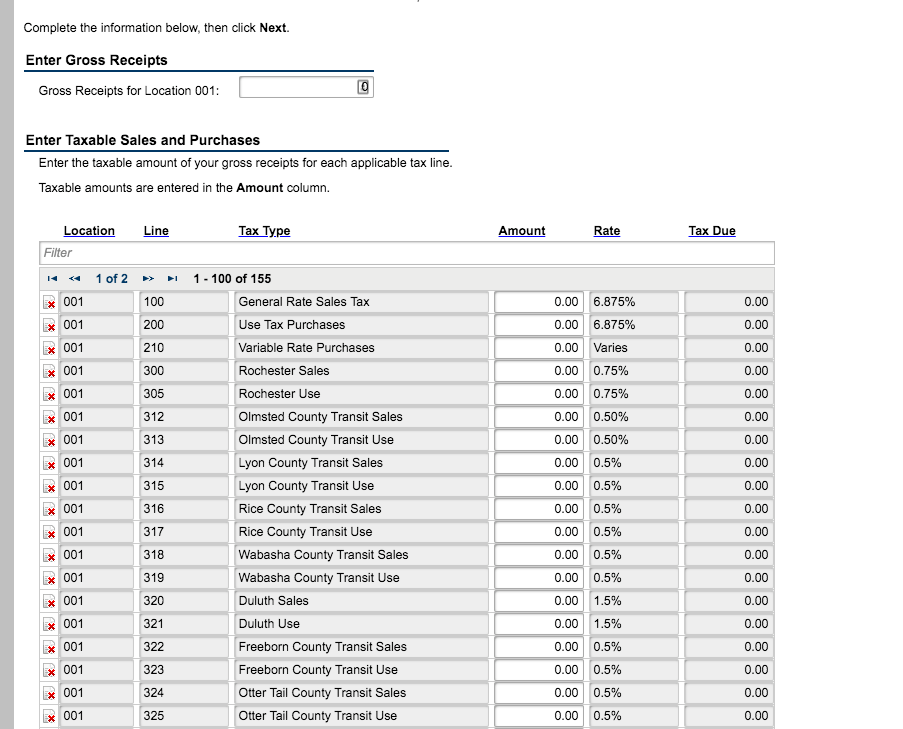

One of the standout features of sales tax software is its tax rate determination capability. The software can accurately identify the applicable tax rates for each transaction, considering factors such as product type, customer location, and sales channel. This level of precision is crucial for businesses operating in jurisdictions with complex tax structures.

Additionally, sales tax software offers a robust tax filing and remittance process. It automates the preparation of tax returns, generates necessary reports, and facilitates the timely remittance of taxes to the appropriate authorities. This not only saves businesses time and resources but also reduces the risk of errors and late payment penalties.

The software's reporting and analytics capabilities further empower businesses with actionable insights. Businesses can generate comprehensive reports on sales tax data, including tax collected, remitted, and due, as well as tax rate changes and compliance trends. These insights enable businesses to make informed decisions, optimize their tax strategies, and identify areas for improvement.

| Key Feature | Benefit |

|---|---|

| Automated Tax Calculation | Ensures accuracy and compliance |

| Real-time Tax Rate Updates | Keeps businesses informed of the latest regulations |

| Seamless Integration | Efficiently connects with existing systems |

| Tax Filing Automation | Saves time and reduces errors |

| Advanced Reporting | Provides valuable insights for decision-making |

Furthermore, sales tax software often includes a robust tax rule engine, which enables businesses to set up and manage tax rules specific to their industry and location. This flexibility ensures that the software adapts to the unique needs of each business, catering to their specific tax requirements.

The software's data security measures are also a notable advantage. With data encryption and secure storage, businesses can trust that their sensitive tax information is protected from potential breaches or unauthorized access.

Implementing Sales Tax Software: A Step-by-Step Guide

Implementing sales tax software requires a strategic approach to ensure a smooth transition and optimal results. Here’s a step-by-step guide to help businesses navigate the process successfully.

Step 1: Assess Current Tax Management Processes

Before implementing sales tax software, it’s crucial to understand the current tax management processes within the organization. This includes evaluating the manual or semi-automated systems in place, identifying pain points, and understanding the areas where automation can bring the most value.

Conduct a thorough assessment of the current processes, documenting the steps involved in calculating, collecting, and remitting sales taxes. Identify the challenges, inefficiencies, and potential risks associated with the existing system. This assessment will provide a clear understanding of the improvements the software can bring and guide the selection of the most suitable solution.

Step 2: Evaluate Sales Tax Software Options

The market offers a range of sales tax software solutions, each with its own features, capabilities, and pricing models. It’s essential to evaluate these options carefully to select the software that aligns best with the organization’s needs and budget.

Consider the following factors when evaluating sales tax software:

- Functionality: Ensure the software covers all the essential features required for your business, such as tax calculation, filing, reporting, and compliance.

- Integration: Check if the software integrates seamlessly with your existing accounting, ERP, and e-commerce systems.

- Usability: Assess the user interface and ensure it is intuitive and easy to navigate for your team.

- Support and Training: Look for software providers that offer comprehensive support and training resources to assist with implementation and ongoing use.

- Pricing: Evaluate the pricing models and compare them to your budget, considering the long-term costs and potential return on investment.

Step 3: Plan the Implementation Process

Once you've selected the sales tax software, it's time to plan the implementation process. This involves defining the project scope, timeline, and resources required. Develop a detailed implementation plan, considering the following aspects:

- Data Migration: Determine how you will migrate your existing tax data to the new software, ensuring accuracy and completeness.

- Training and Education: Plan training sessions for your team to familiarize them with the new software and its features.

- Testing and Quality Assurance: Allocate time for thorough testing to ensure the software functions as expected and identify any potential issues.

- Change Management: Develop strategies to manage the transition, addressing any resistance or concerns within the organization.

Step 4: Execute the Implementation

With the plan in place, it's time to execute the implementation. Follow the steps outlined in your implementation plan, ensuring a smooth transition. Keep the lines of communication open with the software provider and your team to address any challenges or queries promptly.

Step 5: Post-Implementation Review

After the implementation, conduct a thorough review to assess the success of the project. Evaluate the software’s performance, its impact on tax management processes, and the overall efficiency gains. This review will help identify areas for improvement and guide future enhancements or upgrades.

Regularly monitor the software's performance and stay updated with the latest tax regulations to ensure ongoing compliance and optimal use of the software.

The Future of Sales Tax Software

As technology continues to advance, the future of sales tax software looks promising. With the integration of artificial intelligence (AI) and machine learning (ML), sales tax software is poised to become even more intelligent and adaptive.

AI and ML algorithms can enhance the software's ability to learn and adapt to changing tax regulations, making it more accurate and efficient. These technologies can also improve the software's ability to identify and address potential compliance issues, reducing the risk of audits and penalties.

Additionally, the development of cloud-based sales tax software solutions is expected to increase. Cloud-based software offers greater accessibility, scalability, and flexibility, allowing businesses to access their tax data and manage their tax obligations from anywhere, at any time.

The future of sales tax software also lies in its ability to integrate with other financial management systems, such as accounting and ERP software. This integration will create a seamless, end-to-end financial management solution, further streamlining business operations and enhancing efficiency.

Furthermore, sales tax software providers are likely to continue investing in research and development to enhance their products. This could lead to the development of new features and capabilities, such as advanced analytics, predictive modeling, and real-time tax rate updates, to stay ahead of the competition and meet the evolving needs of businesses.

Conclusion

Sales tax software has emerged as a vital tool for businesses to manage their tax obligations effectively and efficiently. With its ability to automate tax calculations, ensure compliance, and provide valuable insights, sales tax software is a powerful asset for any organization. By following a strategic implementation process and staying updated with the latest advancements, businesses can leverage sales tax software to streamline their tax management processes and stay ahead in the dynamic world of sales tax compliance.

FAQ

What is sales tax software, and why is it important for businesses?

+

Sales tax software is a specialized tool designed to assist businesses in managing their sales tax obligations effectively. It automates the process of calculating, collecting, and remitting sales taxes, ensuring compliance with the complex and ever-changing tax regulations. By using sales tax software, businesses can improve accuracy, efficiency, and overall tax management, reducing the risk of penalties and ensuring a smooth tax compliance process.

How does sales tax software work, and what are its key features?

+

Sales tax software works by integrating with a business’s accounting or ERP system to automate tax calculations based on the latest tax rates and rules. It determines the applicable tax rates for each transaction, prepares tax returns, and facilitates the remittance of taxes to the appropriate authorities. Key features include automated tax calculation, real-time tax rate updates, seamless integration, tax filing automation, advanced reporting, and a tax rule engine for customization.

What are the benefits of implementing sales tax software for businesses?

+

Implementing sales tax software offers numerous benefits for businesses. It improves accuracy and compliance, reduces the risk of errors and penalties, saves time and resources, provides valuable insights through advanced reporting, adapts to unique tax requirements, and ensures data security. By streamlining the tax management process, sales tax software enables businesses to focus on their core operations and strategic goals.

How can businesses choose the right sales tax software for their needs?

+

When choosing sales tax software, businesses should evaluate their current tax management processes and assess their specific needs. They should consider factors such as functionality, integration capabilities, usability, support and training options, and pricing models. It’s essential to select a software that aligns with the organization’s requirements and budget, ensuring a smooth implementation process and optimal results.

What are some future trends in sales tax software development?

+

The future of sales tax software is expected to be shaped by the integration of AI and ML, enhancing its accuracy and adaptability. Cloud-based solutions will become more prevalent, offering greater accessibility and scalability. Additionally, the software will continue to integrate with other financial management systems, creating a seamless end-to-end solution. Sales tax software providers will invest in R&D to develop new features, such as advanced analytics and real-time tax rate updates, to stay ahead in the market.