Austin Texas Sales Tax

Understanding the intricacies of sales tax is essential for businesses and consumers alike, especially in a bustling city like Austin, Texas. The sales tax landscape can vary significantly from state to state and even within different cities and counties. This article aims to provide a comprehensive guide to Austin's sales tax, shedding light on the rates, regulations, and real-world implications for businesses and shoppers.

Unraveling Austin’s Sales Tax Structure

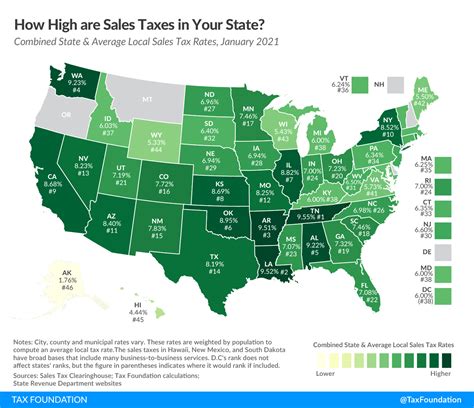

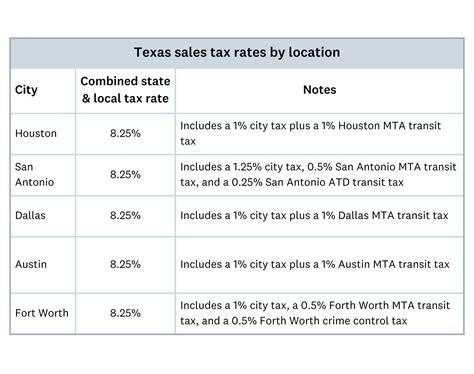

Sales tax in Austin, Texas, is a complex interplay of federal, state, and local tax regulations. While the state of Texas imposes a uniform sales tax rate, cities like Austin have the authority to levy additional taxes to fund local projects and services. This layered approach results in a unique sales tax rate for Austin that goes beyond the standard Texas rate.

The Texas Sales Tax Framework

At the state level, Texas imposes a sales and use tax of 6.25%. This rate is applicable to most tangible personal property and certain services. However, it’s important to note that specific items like groceries, prescription drugs, and some services are exempt from this tax, creating a more nuanced picture of sales tax in the state.

Austin’s Additional Sales Tax

Austin, being a dynamic city with diverse economic needs, has implemented its own local sales tax. This supplemental tax is used to support various city initiatives and services, including public transportation, parks, and cultural programs. As of our latest data, Austin’s local sales tax rate stands at 1.25%, bringing the total sales tax rate within the city limits to 7.5%.

However, it's not as straightforward as adding these percentages together. Sales tax is calculated based on the total taxable value of the transaction, and certain items might be exempt or subject to additional tax rates. For instance, prepared food and certain services may have different tax rates, making the calculation more intricate.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Texas | 6.25% |

| City of Austin | 1.25% |

| Total Sales Tax in Austin | 7.5% |

Impact on Businesses and Consumers

The sales tax rate in Austin can significantly influence both business operations and consumer spending habits. For businesses, especially those with online sales, accurately calculating and collecting sales tax is crucial to avoid legal complications and maintain a positive relationship with customers.

Challenges for Businesses

Businesses operating in Austin, whether brick-and-mortar stores or e-commerce platforms, must navigate the complex sales tax landscape. This involves understanding the tax rates, exemptions, and filing requirements. For online retailers, the challenge is further compounded by the need to determine tax rates based on the shipping destination, not just the business location.

Accurate sales tax calculation and collection are essential to avoid undercharging or overcharging customers, both of which can lead to legal and financial repercussions. Additionally, businesses must stay updated with any changes in tax rates or regulations to ensure compliance.

Consumer Perspective

For consumers, understanding Austin’s sales tax rate is crucial for budgeting and making informed purchasing decisions. The tax rate can significantly impact the final cost of a product or service, especially for high-value items. Consumers might opt to shop around or consider online retailers if they offer more favorable tax rates.

Furthermore, consumers should be aware of the tax implications for specific items. For instance, while groceries are generally exempt from sales tax, other food items like prepared foods or restaurant meals may be taxable. This knowledge can help consumers budget effectively and make more informed choices.

Sales Tax Compliance and Regulations

Ensuring compliance with sales tax regulations is a critical aspect of doing business in Austin. The Texas Comptroller’s Office enforces these regulations, and businesses must adhere to specific guidelines to avoid penalties and legal issues.

Registration and Reporting

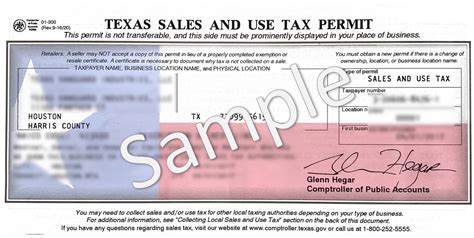

Businesses operating in Austin must register with the Texas Comptroller’s Office to obtain a Sales and Use Tax Permit. This permit authorizes the business to collect and remit sales tax. The registration process involves providing detailed information about the business, including its legal structure, location, and type of goods or services offered.

Once registered, businesses are required to file sales tax returns periodically, typically on a monthly or quarterly basis. These returns involve calculating the total taxable sales, applying the appropriate tax rates, and remitting the collected tax to the Comptroller's Office. Late or inaccurate filings can result in penalties and interest charges.

Audit and Enforcement

The Texas Comptroller’s Office conducts audits to ensure businesses are accurately collecting and remitting sales tax. Audits can be random or targeted based on specific criteria, such as industry type or past compliance history. During an audit, the Comptroller’s Office reviews the business’s records, including sales invoices, tax returns, and financial statements.

If an audit reveals underreporting or undercollection of sales tax, the business may face penalties, interest charges, and even criminal charges in severe cases. Therefore, it's crucial for businesses to maintain accurate records and ensure compliance with sales tax regulations.

Future Implications and Trends

The sales tax landscape in Austin and Texas is subject to change, influenced by economic trends, legislative decisions, and technological advancements. Understanding these potential changes can help businesses and consumers prepare for the future.

Potential Rate Changes

While the current sales tax rate in Austin is stable, it’s not immune to potential changes. The Texas Legislature has the authority to adjust the state sales tax rate, and local governments can propose changes to their local sales tax rates. These changes can occur during legislative sessions, which typically happen biennially.

Businesses and consumers should stay informed about any proposed tax rate changes, as these can significantly impact their operations and spending habits. Keeping an eye on local news and following updates from the Texas Comptroller's Office can provide valuable insights into potential rate adjustments.

Impact of E-commerce and Online Sales

The rise of e-commerce has significantly influenced the sales tax landscape. With online sales, businesses must navigate the challenge of determining tax rates based on the shipping destination, not just their business location. This has led to increased scrutiny and enforcement efforts by tax authorities.

To address these challenges, states and cities have been implementing laws and regulations to ensure online retailers collect and remit sales tax accurately. Businesses operating online must stay updated with these regulations to ensure compliance and avoid legal issues.

Conclusion

Understanding Austin’s sales tax structure is a crucial aspect of doing business in the city and making informed purchasing decisions as a consumer. The city’s unique sales tax rate, a combination of state and local taxes, influences the final cost of goods and services and impacts business operations and consumer spending habits.

For businesses, accurate sales tax calculation and compliance with regulations are essential to avoid legal complications and maintain a positive relationship with customers. Consumers, on the other hand, benefit from understanding the tax implications of their purchases, especially for high-value items, to make more informed choices.

As the sales tax landscape continues to evolve, staying informed about rate changes and regulatory updates is crucial for both businesses and consumers. By staying proactive and adapting to these changes, individuals and businesses can navigate Austin's sales tax environment effectively and efficiently.

What is the sales tax rate in Austin, Texas?

+The total sales tax rate in Austin is 7.5%, which includes a 6.25% state sales tax and a 1.25% local tax.

Are there any items exempt from sales tax in Austin?

+Yes, certain items like groceries, prescription drugs, and some services are exempt from sales tax in Austin.

How often do businesses need to file sales tax returns in Austin?

+Businesses typically file sales tax returns on a monthly or quarterly basis, depending on their sales volume and tax registration status.