Sales Tax In Los Angeles

The sales tax system in Los Angeles, California, is a crucial aspect of the city's economy and financial management. It plays a significant role in funding various public services and infrastructure projects, making it an essential topic for residents, businesses, and visitors alike. In this comprehensive guide, we will delve into the intricacies of sales tax in Los Angeles, exploring its rates, regulations, and impact on the local economy.

Understanding Sales Tax in Los Angeles

Sales tax in Los Angeles is a consumption tax levied on the sale of goods and certain services. It is a vital revenue stream for the city and the state, contributing to the overall tax structure of California. The sales tax system in Los Angeles is a complex interplay of local, county, and state tax rates, each serving specific purposes.

Sales Tax Rates

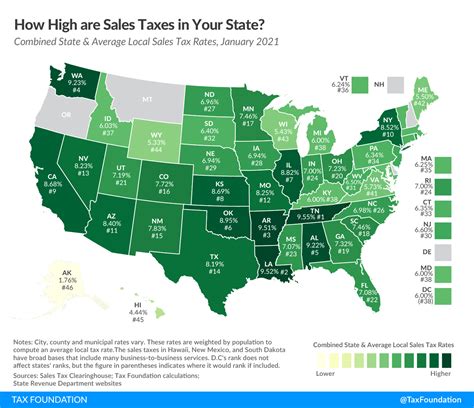

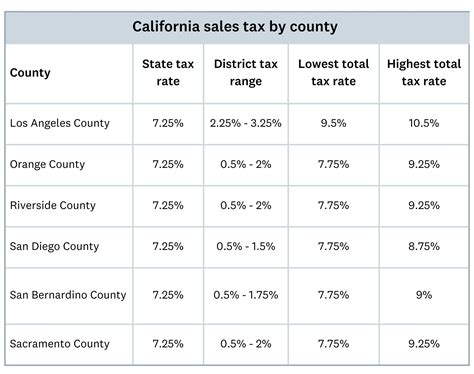

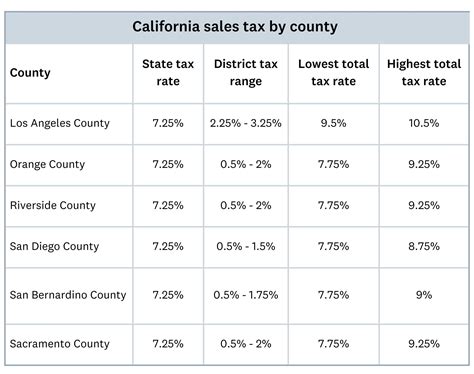

Los Angeles, like many cities in California, has a unique sales tax structure. The total sales tax rate is the combination of state, county, and city taxes, with additional district taxes in some areas. As of [current year], the state sales tax rate in California is 7.25%. This rate is uniform across the state and forms the foundation of the sales tax structure.

The county sales tax rate in Los Angeles County is 0.25%, bringing the combined state and county sales tax to 7.50%. However, the city of Los Angeles imposes an additional 0.50% tax, resulting in a total sales tax rate of 8.00% within the city limits.

It's important to note that Los Angeles County also includes various special districts and municipalities, each with their own additional sales tax rates. For example, the Beverly Hills Unified School District adds a 0.25% tax, while the Los Angeles Community College District levies an extra 0.50% tax. These district-specific taxes can vary significantly, making the total sales tax rate dynamic across different areas of Los Angeles County.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Los Angeles County | 0.25% |

| City of Los Angeles | 0.50% |

| Beverly Hills USD | 0.25% |

| Los Angeles CCD | 0.50% |

| Total (City of LA) | 8.00% |

Sales Tax Exemptions

While sales tax is applicable to most goods and services, there are specific exemptions and exclusions. Some common sales tax exemptions in Los Angeles include:

- Food for home consumption

- Prescription medications

- Certain medical devices

- Clothing and footwear (under a specific value)

- Some agricultural sales and purchases

- Residential rent (unless it includes utilities or other taxable services)

It's essential to consult the California Board of Equalization for a comprehensive list of sales tax exemptions and to understand the specific criteria for each exemption.

Impact of Sales Tax on the Los Angeles Economy

The sales tax system in Los Angeles has a profound impact on the local economy and the daily lives of residents. Here’s a deeper look at its implications:

Revenue Generation

Sales tax is a significant source of revenue for the city and county of Los Angeles. It funds essential public services, infrastructure projects, and social programs. The revenue generated from sales tax helps maintain and improve public facilities, transportation systems, schools, and emergency services.

Consumer Behavior

The sales tax rate can influence consumer behavior and spending patterns. Higher sales tax rates may encourage consumers to shop online or in neighboring cities with lower tax rates. On the other hand, lower sales tax rates can boost local retail sales and tourism, as consumers may perceive better value in local purchases.

Business Operations

Businesses operating in Los Angeles must navigate the complex sales tax system. They are responsible for collecting and remitting sales tax to the appropriate tax authorities. Proper sales tax management is crucial to avoid penalties and ensure compliance with state and local regulations.

Economic Development

Sales tax revenue plays a vital role in economic development initiatives. It funds infrastructure projects that enhance the city’s competitiveness and attract new businesses and investments. Well-maintained roads, efficient public transportation, and modern public facilities contribute to a thriving business environment.

Sales Tax Compliance and Enforcement

Ensuring sales tax compliance is a critical aspect of the tax system. The California Department of Tax and Fee Administration (CDTFA) oversees sales tax collection and enforcement. Businesses are required to register with the CDTFA, collect sales tax from customers, and file regular tax returns.

Penalties and Audits

Non-compliance with sales tax regulations can result in penalties and audits. The CDTFA has the authority to impose fines and penalties for late or inaccurate tax filings. In severe cases of non-compliance, businesses may face legal consequences.

Audit Processes

The CDTFA conducts audits to ensure businesses are accurately collecting and remitting sales tax. Audits can be random or targeted based on specific criteria. During an audit, businesses must provide detailed sales records and tax documentation for review.

Online Sales and Tax Collection

With the rise of e-commerce, the sales tax landscape has become more complex. Los Angeles, like many cities, is adapting to the challenges of collecting sales tax from online retailers. The CDTFA has implemented measures to ensure that online sales are taxed appropriately, including marketplace facilitator laws and use tax collection requirements.

Future of Sales Tax in Los Angeles

The sales tax system in Los Angeles is likely to evolve in response to changing economic conditions and legislative decisions. Here are some potential future developments:

Tax Rate Adjustments

Sales tax rates may be adjusted to address budget deficits or fund specific initiatives. While rate changes require legislative approval, the city and county of Los Angeles have the authority to propose and implement rate adjustments.

Digital Economy and Tax Collection

As the digital economy continues to grow, Los Angeles will need to adapt its sales tax collection methods. The city may explore innovative approaches to tax collection, such as partnerships with online marketplaces and digital tax collection platforms.

Tax Reform and Simplification

Efforts to simplify the sales tax system and reduce administrative burdens on businesses may be considered. This could involve consolidating tax rates or streamlining tax filing processes to enhance compliance and efficiency.

Conclusion

Sales tax in Los Angeles is a multifaceted system that impacts various aspects of the city’s economy and daily life. From funding public services to influencing consumer behavior, the sales tax structure is a vital component of the city’s financial ecosystem. As Los Angeles continues to evolve, so too will its sales tax system, adapting to meet the changing needs of its residents and businesses.

How often do sales tax rates change in Los Angeles?

+Sales tax rates in Los Angeles can change periodically due to legislative actions or voter-approved measures. It is advisable to stay updated with the California Board of Equalization or the California Department of Tax and Fee Administration for the latest tax rate information.

Are there any sales tax holidays in Los Angeles?

+California, including Los Angeles, does not currently have any statewide sales tax holidays. However, some local jurisdictions or municipalities may offer sales tax holidays for specific items or during certain promotional periods.

How do I register for sales tax collection in Los Angeles?

+To register for sales tax collection in Los Angeles, you need to apply for a Seller’s Permit from the California Department of Tax and Fee Administration. The process involves completing an application, providing business details, and obtaining the permit. Once registered, you’ll be responsible for collecting and remitting sales tax.