Fullerton Sales Tax

Welcome to our comprehensive guide on the Fullerton Sales Tax, a topic that might not be everyone's favorite, but is undoubtedly an essential aspect of doing business and understanding the economic landscape of Fullerton, California. In this article, we will delve deep into the intricacies of sales tax, its implications, and how it affects businesses and consumers alike. By the end of this article, you'll have a clear understanding of the Fullerton Sales Tax, its unique characteristics, and its role in the city's economy.

Understanding the Fullerton Sales Tax

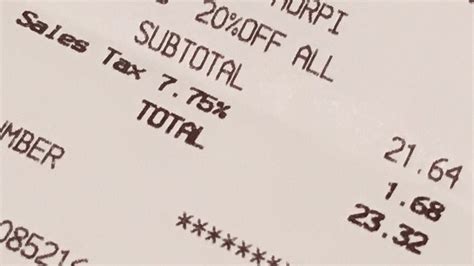

Sales tax in Fullerton, like in many other cities across the United States, is a consumption tax levied on the sale of goods and services. It is a crucial source of revenue for the city and plays a significant role in funding various public services and infrastructure projects. The sales tax rate in Fullerton is not a one-size-fits-all figure; it varies depending on the type of goods or services being sold and the specific location of the transaction.

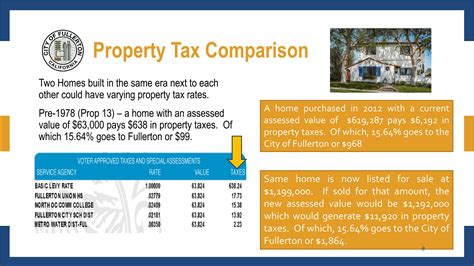

The base sales tax rate in Fullerton is set at 7.25%, which is the state-wide sales tax rate in California. However, this is just the beginning; the city has the authority to impose additional taxes, known as local option taxes, on top of the state rate. These local option taxes are often used to fund specific projects or initiatives within the city, and they can vary significantly depending on the area.

For instance, let's consider the case of a popular shopping district in Fullerton. The city council might decide to implement an additional 2% local option tax to support the maintenance and development of the district's infrastructure. This means that businesses operating within this district would need to collect and remit a total sales tax rate of 9.25% to the city.

Understanding these variations is crucial for businesses, as it directly impacts their pricing strategies and overall profitability. Consumers, too, should be aware of these differences to make informed purchasing decisions.

Taxable Items and Exemptions

Not all goods and services are subjected to the same sales tax rate. California, and by extension, Fullerton, has a range of taxable items and exemptions that can greatly influence the overall tax burden. For instance, groceries, prescription medications, and certain types of machinery are often exempt from sales tax, providing relief to consumers and businesses alike.

| Taxable Items | Tax Rate |

|---|---|

| Clothing and Accessories | 7.25% (state rate) + Local Option Tax |

| Electronics | 7.25% (state rate) + Local Option Tax |

| Restaurant Meals | 7.25% (state rate) + Local Option Tax |

| Hotel Accommodations | Transient Occupancy Tax (varies) |

The above table provides a glimpse into the complexity of sales tax rates in Fullerton. The transient occupancy tax, for example, is a unique tax applied to hotel and lodging establishments, and its rate can vary significantly based on the location and type of accommodation.

The Impact of Sales Tax on Businesses

For businesses operating in Fullerton, understanding and managing sales tax is a critical aspect of their financial operations. The sales tax collected from customers must be accurately reported and remitted to the appropriate tax authorities, which can be a complex and time-consuming process.

Let's take the example of Retailer X, a popular clothing store in Fullerton. With the base sales tax rate at 7.25% and an additional 2% local option tax, Retailer X must collect a total of 9.25% sales tax on all eligible purchases. This not only impacts their pricing strategy but also their record-keeping and compliance processes.

To ensure compliance, businesses like Retailer X often invest in robust accounting systems and software that can automatically calculate and track sales tax. These tools help businesses stay on top of their tax obligations and avoid potential penalties for underreporting or late payments.

Sales Tax and Consumer Behavior

Sales tax rates can also influence consumer behavior, especially in a competitive retail landscape like Fullerton. Consumers are often price-conscious and may choose to make purchases based on the total cost, including sales tax.

Imagine two similar retail stores, Store A and Store B, located just a few blocks apart in Fullerton. Store A collects a total sales tax rate of 9.25%, while Store B, located in a different district, collects a lower rate of 8.25%. This difference in tax rates could potentially sway consumers to choose Store B, especially if they are making significant purchases.

To mitigate this, businesses might consider adjusting their pricing strategies or offering promotional discounts to offset the impact of sales tax. It's a delicate balance, as businesses must also consider their profit margins and the overall competitiveness of their offerings.

Compliance and Enforcement

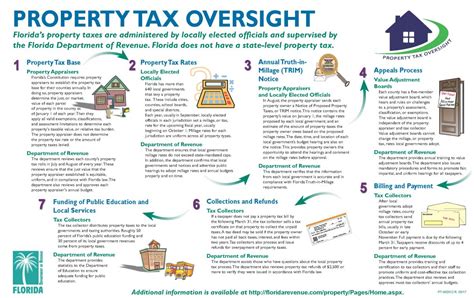

Ensuring compliance with sales tax regulations is a shared responsibility between businesses and consumers. The California Department of Tax and Fee Administration (CDTFA) is responsible for overseeing and enforcing sales tax compliance across the state, including in Fullerton.

The CDTFA provides extensive resources and guidelines to help businesses understand their sales tax obligations. They offer online tools, workshops, and even personalized assistance to ensure businesses are equipped to handle the complexities of sales tax.

For consumers, understanding their role in sales tax compliance is equally important. It is their responsibility to pay the applicable sales tax on their purchases, and they should be aware of their rights and protections under California's sales tax laws.

Audits and Penalties

The CDTFA has the authority to conduct audits of businesses to ensure they are accurately reporting and remitting sales tax. These audits can be comprehensive and may cover a specific period or a random sample of transactions. Businesses found to be in violation of sales tax regulations can face significant penalties, including fines and even criminal charges in severe cases.

To avoid such penalties, businesses should maintain accurate records, implement robust sales tax collection and reporting systems, and stay up-to-date with the latest sales tax regulations and updates.

Online Sales and E-Commerce

With the rise of e-commerce, the landscape of sales tax has become even more complex. Online retailers, regardless of their physical location, must consider their sales tax obligations when selling to customers in Fullerton. This includes collecting and remitting sales tax on eligible purchases, even if the transaction is conducted online.

To simplify this process, the CDTFA has implemented various programs and guidelines to assist online businesses in understanding their sales tax responsibilities. These include nexus rules, which define when a business has a sufficient connection to a state to be subject to its sales tax laws.

Future Implications and Potential Changes

The Fullerton Sales Tax landscape is not static; it is subject to change and evolution as economic conditions and legislative decisions shift. Here are some potential future implications and changes that could impact the sales tax in Fullerton.

- Increasing Local Option Taxes: As the demand for public services and infrastructure projects grows, local governments may consider increasing local option taxes to generate additional revenue. This could result in higher sales tax rates for businesses and consumers.

- Tax Incentives for Businesses: To attract and retain businesses, Fullerton could explore offering tax incentives or exemptions to certain industries or businesses that bring significant economic benefits to the city.

- Sales Tax Simplification: Efforts to simplify and harmonize sales tax regulations across California could lead to more consistent tax rates and processes, making it easier for businesses to comply.

- Online Sales Tax Reform: With the continued growth of e-commerce, there may be further reforms to ensure that online retailers are fairly contributing to the city's tax revenue. This could include more stringent nexus rules or even the introduction of a state-wide online sales tax.

Staying informed about these potential changes is crucial for businesses and consumers alike. It allows them to adapt their strategies and make informed decisions to navigate the evolving sales tax landscape in Fullerton.

Conclusion

In conclusion, the Fullerton Sales Tax is a multifaceted and dynamic aspect of the city's economy. It impacts businesses, consumers, and the overall economic health of the city. Understanding the nuances of sales tax, from the base rate to local option taxes, is essential for all stakeholders involved.

As we've explored in this article, sales tax is not just a numbers game; it has real-world implications on pricing, consumer behavior, and business operations. By staying informed and compliant, businesses can thrive in Fullerton's vibrant economy, while consumers can make confident purchasing decisions knowing they are contributing to the city's growth and development.

Frequently Asked Questions

What is the base sales tax rate in Fullerton, California?

+

The base sales tax rate in Fullerton, California is 7.25%, which is the statewide sales tax rate in California. However, it’s important to note that local governments have the authority to impose additional taxes, known as local option taxes, on top of the state rate.

How do local option taxes impact sales tax rates in Fullerton?

+

Local option taxes are additional taxes imposed by local governments on top of the base state sales tax rate. These taxes can vary depending on the specific location within Fullerton. For example, a popular shopping district might have an additional 2% local option tax, resulting in a total sales tax rate of 9.25% for businesses operating within that district.

Are there any items exempt from sales tax in Fullerton?

+

Yes, there are certain items that are exempt from sales tax in Fullerton and California as a whole. This includes groceries, prescription medications, and certain types of machinery. These exemptions provide relief to consumers and businesses by reducing the overall tax burden on specific essential goods and services.

How do sales tax rates affect consumer behavior in Fullerton?

+

Sales tax rates can influence consumer behavior, especially in a competitive retail landscape like Fullerton. Consumers often consider the total cost, including sales tax, when making purchasing decisions. Lower sales tax rates can make a location more attractive to consumers, potentially influencing their choice of where to shop.

What happens if a business fails to comply with sales tax regulations in Fullerton?

+

Non-compliance with sales tax regulations can result in serious consequences for businesses in Fullerton. The California Department of Tax and Fee Administration (CDTFA) has the authority to conduct audits and enforce compliance. Businesses found to be in violation can face penalties, including fines and, in severe cases, criminal charges.