Sales Tax On Cars In New Jersey

Sales tax on cars in New Jersey is a topic that affects many residents and car buyers in the state. Understanding the sales tax regulations and how they apply to vehicle purchases is crucial for both consumers and businesses. In this comprehensive guide, we will delve into the intricacies of sales tax on cars in New Jersey, covering everything from the applicable tax rates to the various exemptions and scenarios that buyers may encounter.

Understanding Sales Tax in New Jersey

New Jersey, like many other states, imposes a sales and use tax on the purchase of tangible personal property, including vehicles. The sales tax is a percentage-based tax calculated on the purchase price of the vehicle. It is collected by the seller and remitted to the state to fund various government services and infrastructure projects.

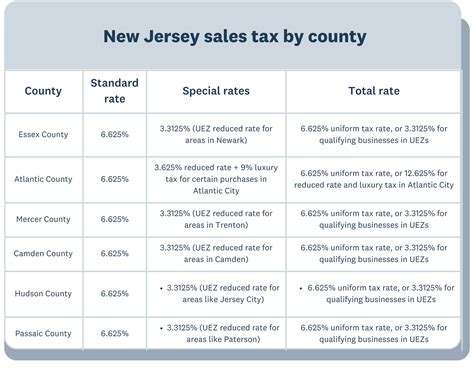

The sales tax in New Jersey is administered by the New Jersey Division of Taxation, which provides guidelines and regulations for both businesses and consumers to ensure compliance. It is important to note that sales tax rates can vary across different jurisdictions within the state.

Statewide Sales Tax Rate

The statewide sales tax rate in New Jersey is 6.625% as of 2023. This rate is applied uniformly across the state and is a combination of the state’s base sales tax rate and any additional local taxes. However, it is essential to be aware that certain municipalities may impose additional local sales taxes, resulting in a slightly higher effective tax rate.

| Component | Tax Rate |

|---|---|

| State Sales Tax | 6.625% |

| Local Sales Tax (Average) | Varies by Municipality |

Calculating Sales Tax on Car Purchases

When purchasing a car in New Jersey, the sales tax is calculated based on the total purchase price, including any additional fees and charges. Here’s a step-by-step breakdown of how sales tax is applied to car purchases:

Step 1: Determine the Purchase Price

The first step is to identify the actual purchase price of the vehicle. This includes the base price of the car, any optional features or upgrades, and additional fees such as destination charges and dealer preparation fees.

Step 2: Calculate the Taxable Amount

Once the purchase price is determined, the sales tax is calculated on the taxable amount. In New Jersey, the taxable amount includes the purchase price, less any applicable trade-in allowance. For example, if you trade in your old vehicle and receive a trade-in value of $5,000, that amount is deducted from the purchase price before calculating the sales tax.

Step 3: Apply the Sales Tax Rate

Using the statewide sales tax rate of 6.625%, the sales tax is calculated by multiplying the taxable amount by the tax rate. For instance, if the taxable amount of your car purchase is 30,000, the sales tax would be 2,000 ($30,000 x 0.06625).

| Purchase Price | Taxable Amount | Sales Tax |

|---|---|---|

| $30,000 | $30,000 | $2,000 |

Sales Tax Exemptions and Scenarios

While the general rule is that sales tax applies to car purchases in New Jersey, there are certain scenarios and exemptions where buyers may be eligible for reduced or no sales tax. Understanding these exemptions is crucial to ensure compliance and maximize savings.

Vehicle Type Exemptions

New Jersey offers sales tax exemptions for specific types of vehicles, providing relief to buyers in certain circumstances. Here are some notable exemptions:

- Electric Vehicles (EVs): New Jersey promotes the adoption of environmentally friendly vehicles by offering a sales tax exemption for the purchase of new electric vehicles. This exemption is applicable to EVs with a base price of $50,000 or less.

- Hybrid Vehicles: Similar to EVs, New Jersey provides a sales tax exemption for the purchase of new hybrid vehicles with a base price of $50,000 or less. This incentive encourages the use of fuel-efficient transportation.

- Motorcycles and Mopeds: Sales tax is not applicable to the purchase of motorcycles and mopeds in New Jersey, making these modes of transportation more affordable for riders.

Special Circumstances

In addition to vehicle type exemptions, New Jersey offers sales tax relief in certain special circumstances. These scenarios include:

- Out-of-State Residents: If you are an out-of-state resident and purchase a car in New Jersey, you may be exempt from paying sales tax in your home state. However, you must register the vehicle in your home state and pay any applicable taxes there. This scenario is known as the exemption from reciprocity and applies to residents of states with reciprocal tax agreements with New Jersey.

- Military Personnel: Active-duty military personnel stationed in New Jersey may be eligible for a sales tax exemption when purchasing a vehicle. This exemption is part of the state's support for military members and their families.

- Trade-In Scenario: In some cases, when trading in a vehicle, the sales tax may be calculated only on the net difference between the trade-in value and the purchase price of the new vehicle. This scenario can result in a reduced tax burden for buyers.

Lease vs. Purchase

When considering whether to lease or purchase a car, the sales tax implications can differ. Here’s a brief overview:

- Lease: When leasing a car, the sales tax is typically included in the monthly lease payments. The tax is calculated based on the capitalized cost of the lease, which includes the vehicle's purchase price, any additional fees, and the residual value.

- Purchase: As mentioned earlier, the sales tax is calculated on the purchase price of the vehicle at the time of purchase. The tax is a one-time expense and is not included in ongoing payments, such as loan installments.

Compliance and Penalties

Ensuring compliance with sales tax regulations is crucial for both buyers and sellers. Failure to comply with sales tax laws can result in penalties and legal consequences. Here are some key points to consider:

Seller’s Responsibility

Sellers, including dealerships and private parties, have a responsibility to collect and remit the appropriate sales tax to the state. They must accurately calculate the tax, provide a clear breakdown to the buyer, and remit the collected tax to the New Jersey Division of Taxation within the specified timeframe.

Buyer’s Responsibility

Buyers also have a role in ensuring compliance. They should review the sales tax calculation provided by the seller and verify that it aligns with the applicable tax rate and any exemptions they may be eligible for. Additionally, buyers should retain the sales tax documentation for future reference and tax purposes.

Penalties for Non-Compliance

Failure to comply with sales tax regulations can result in penalties, interest, and potential legal action. Penalties may include fines, late payment charges, and even revocation of business licenses for repeat offenders. It is crucial for both buyers and sellers to stay informed and adhere to the state’s sales tax guidelines.

Future Implications and Trends

The landscape of sales tax on cars in New Jersey is subject to change and evolution. Here are some potential future implications and trends to consider:

Electric Vehicle Incentives

With the growing popularity of electric vehicles, New Jersey may continue to offer or expand incentives to promote their adoption. This could include extending the sales tax exemption period or increasing the base price threshold for eligible EVs.

Online Sales and Remote Purchases

As online car sales platforms and remote purchasing options become more prevalent, New Jersey may need to adapt its sales tax regulations to accommodate these changes. The state may introduce guidelines for remote sellers to ensure tax compliance in the digital marketplace.

Economic Factors

Economic conditions, such as fluctuations in the automotive industry or overall economic growth, can influence sales tax rates and exemptions. In times of economic downturn, states may consider adjusting tax rates or offering temporary incentives to stimulate car sales.

How often are sales tax rates updated in New Jersey?

+Sales tax rates in New Jersey are generally updated annually or as necessary to align with budgetary requirements. The state budget process often determines any changes to the sales tax rate, and these changes are effective from the start of the fiscal year.

Are there any ongoing efforts to reform sales tax laws in New Jersey?

+New Jersey has had ongoing discussions about sales tax reform, particularly regarding online sales and remote purchases. The state is considering ways to ensure fair taxation for both in-state and out-of-state sellers, which may lead to changes in the future.

Can I negotiate the sales tax rate when purchasing a car?

+No, the sales tax rate is a mandatory charge determined by the state and local governments. It is not negotiable, and both buyers and sellers are expected to comply with the applicable tax rate.

Are there any alternative payment methods to avoid sales tax on car purchases?

+While there are no alternative payment methods to completely avoid sales tax, some buyers may explore creative financing options, such as leasing or utilizing tax-exempt status (for qualifying individuals or organizations), to minimize the tax burden.

What happens if I purchase a car from a private seller in New Jersey?

+When purchasing a car from a private seller in New Jersey, you are responsible for paying the sales tax directly to the state. The private seller should provide you with the necessary documentation, and you can then remit the tax to the New Jersey Division of Taxation.

Understanding the intricacies of sales tax on cars in New Jersey is essential for both consumers and businesses. By staying informed about the applicable tax rates, exemptions, and compliance requirements, buyers can make informed decisions and ensure a smooth car-buying experience. For sellers, accurate tax calculation and timely remittance are crucial to maintain compliance and avoid penalties.

As the automotive industry and tax regulations continue to evolve, staying updated with the latest developments will be key to navigating the sales tax landscape in New Jersey. Whether it’s keeping an eye on potential incentives for electric vehicles or adapting to changes in online sales, staying informed is the best strategy for both buyers and sellers.