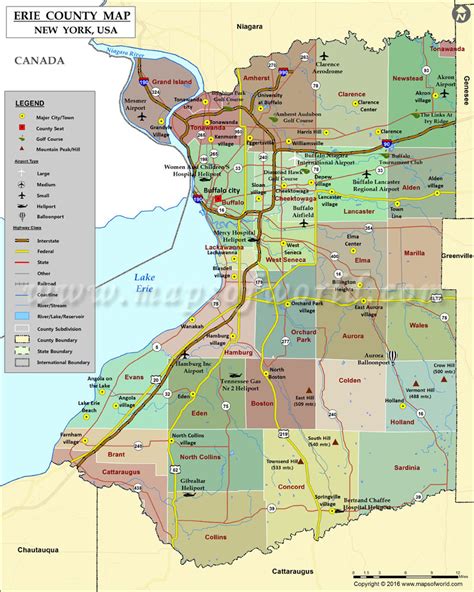

Ny Erie County Tax Collector

The role of the Erie County Tax Collector is a critical position within the local government, responsible for the efficient and effective management of taxes and revenue collection. This article aims to delve into the functions, responsibilities, and impact of the Ny Erie County Tax Collector, shedding light on this essential public service.

An Overview of the Ny Erie County Tax Collector’s Office

The Ny Erie County Tax Collector’s Office is a dedicated department within the county’s administration, tasked with the vital role of collecting and managing taxes and other revenue streams for the county. This office plays a crucial role in ensuring the financial stability and smooth operation of Erie County’s various public services and initiatives.

At the helm of this department is the Erie County Tax Collector, an appointed official who oversees the entire tax collection process and is responsible for implementing the county's tax policies and procedures. The Tax Collector works closely with other county departments, local government agencies, and the state to ensure compliance with tax laws and regulations.

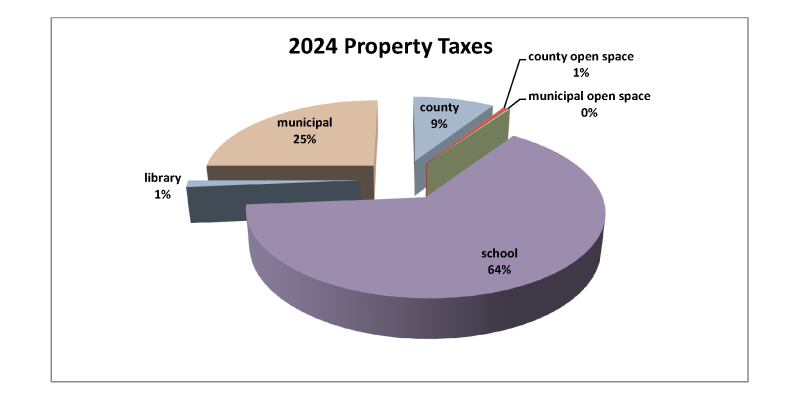

The office's primary mission is to collect taxes efficiently and fairly, ensuring that all residents and businesses contribute their fair share towards the county's operations and development. This includes the collection of property taxes, business taxes, special assessments, and other fees, which are vital for funding essential services such as public safety, education, infrastructure, and community development projects.

The Tax Collection Process

The tax collection process in Erie County is a well-defined and systematic procedure. It begins with the assessment of property values, which forms the basis for calculating property taxes. The county’s assessors work diligently to ensure accurate assessments, taking into account factors such as location, size, improvements, and market trends.

Once the assessments are complete, the Tax Collector's office sends out tax bills to property owners, clearly outlining the amount due and the payment deadline. Property owners have the option to pay their taxes in installments or in full, with convenient payment methods such as online payments, credit card payments, and traditional check or cash payments at designated locations.

The office also provides assistance to taxpayers, offering guidance on tax exemptions, discounts, and payment plans. They work closely with taxpayers to resolve any issues or disputes, ensuring a fair and transparent process. Additionally, the Tax Collector's office maintains records of all tax payments, providing transparency and accountability in the tax collection process.

| Tax Type | Collection Period |

|---|---|

| Property Taxes | Two installments: July to September and December to February |

| Business Taxes | Quarterly payments due in January, April, July, and October |

| Special Assessments | Dependent on the specific assessment, typically paid annually |

The Impact of Effective Tax Collection

Efficient tax collection has a significant impact on the overall well-being of Erie County. It ensures that the county has the necessary funds to invest in critical areas such as education, healthcare, and infrastructure development. Effective tax collection also contributes to the county’s economic growth, as it enables the government to provide essential services that attract businesses and residents.

Moreover, a well-managed tax collection system promotes transparency and accountability, fostering trust between the government and its citizens. It ensures that taxpayers understand the allocation of their contributions, leading to increased civic engagement and a sense of community ownership.

The Ny Erie County Tax Collector's Office is committed to maintaining a fair and equitable tax collection system, ensuring that the county's financial resources are managed responsibly and efficiently for the benefit of all its residents.

Erie County’s Tax Collector: A Leader in Innovation and Community Engagement

Beyond the crucial role of tax collection, the Ny Erie County Tax Collector’s Office has become a driving force for innovation and community engagement within the county. Under the leadership of the current Tax Collector, the office has implemented several initiatives that have transformed the way taxes are collected and managed, enhancing efficiency and transparency.

Digitization and Online Services

In an effort to streamline the tax collection process and improve accessibility for taxpayers, the office has embraced digitization and online services. Taxpayers can now access their tax information, view bills, and make payments online through a secure and user-friendly platform. This has not only reduced the administrative burden on the office but has also provided taxpayers with greater flexibility and convenience.

The online platform offers features such as payment history, tax statement downloads, and the ability to set up automatic payments. Taxpayers can also receive real-time updates and notifications, ensuring they stay informed about their tax obligations and payment deadlines.

Furthermore, the office has implemented a mobile app, allowing taxpayers to access their accounts and make payments on the go. This innovation has been particularly beneficial for businesses and individuals with busy schedules, providing them with a convenient and efficient way to manage their tax responsibilities.

Community Outreach and Education

The Ny Erie County Tax Collector’s Office recognizes the importance of community outreach and taxpayer education in fostering a positive relationship with the public. The office actively engages with the community through various initiatives, aiming to demystify the tax collection process and ensure that taxpayers understand their rights and responsibilities.

The office hosts regular community workshops and seminars, providing taxpayers with an opportunity to learn about tax laws, exemptions, and discounts. These events are often tailored to specific taxpayer groups, such as seniors, small business owners, and first-time homebuyers, addressing their unique tax-related concerns and questions.

Additionally, the Tax Collector's office maintains an active presence in local events, such as community fairs and festivals, where they provide information and resources to taxpayers. They also utilize social media platforms to share tax-related updates, announcements, and educational content, ensuring that taxpayers have access to accurate and timely information.

Collaborative Partnerships

The Ny Erie County Tax Collector’s Office understands the value of collaborative partnerships in enhancing its operations and serving the community better. The office works closely with various local organizations, businesses, and community groups to leverage their expertise and resources.

For instance, the office has partnered with local banks and financial institutions to offer payment options that cater to different taxpayer needs. This includes the ability to pay taxes through direct debit, credit cards, and mobile banking platforms, providing taxpayers with a range of convenient payment methods.

Additionally, the office has collaborated with local universities and colleges to provide internship opportunities for students pursuing careers in finance, accounting, and public administration. These internships offer valuable hands-on experience for students while also contributing to the office's workforce development and innovation efforts.

The Future of Tax Collection in Erie County: Embracing Technology and Transparency

Looking ahead, the Ny Erie County Tax Collector’s Office is poised to continue its journey of innovation and improvement. With a commitment to staying at the forefront of technology and transparency, the office is exploring several initiatives to enhance the tax collection process and further improve taxpayer services.

Artificial Intelligence and Data Analytics

The office is investing in artificial intelligence (AI) and data analytics to optimize its operations and improve taxpayer experiences. AI-powered systems can automate routine tasks, such as data entry and basic taxpayer inquiries, freeing up staff resources for more complex tasks and providing faster response times.

Additionally, data analytics can help the office identify trends, patterns, and potential issues in the tax collection process. This data-driven approach enables the office to make informed decisions, optimize tax policies, and enhance the overall efficiency of the tax collection system.

Enhanced Taxpayer Engagement

The Ny Erie County Tax Collector’s Office aims to further engage with taxpayers, fostering a culture of transparency and collaboration. The office plans to implement interactive features on its online platform, allowing taxpayers to provide feedback, suggest improvements, and report issues directly to the office.

Additionally, the office is exploring the use of virtual reality (VR) and augmented reality (AR) technologies to create immersive educational experiences for taxpayers. These technologies can be utilized to provide virtual tours of the office, offer interactive tax tutorials, and create engaging learning experiences for taxpayers of all ages.

Sustainable and Ethical Tax Collection

The office is committed to ensuring that its tax collection practices are not only efficient but also sustainable and ethical. The Tax Collector’s team is working towards implementing green initiatives to reduce the office’s environmental impact, such as adopting energy-efficient technologies and implementing paperless processes.

Furthermore, the office is dedicated to upholding the highest standards of ethical conduct, ensuring that taxpayer data is protected and that all tax collection practices are fair and unbiased. The office's commitment to integrity and transparency strengthens the trust between the government and its citizens.

Conclusion: A Dedicated Team, Serving Erie County

The Ny Erie County Tax Collector’s Office is more than just a tax collection agency; it is a dedicated team of professionals committed to serving the community and ensuring the financial well-being of Erie County. Through their innovative approaches, community engagement, and commitment to transparency, the office has transformed the tax collection process, making it more efficient, accessible, and taxpayer-friendly.

As the office continues to embrace technology and explore new initiatives, Erie County can look forward to a future where tax collection is not just a necessary process but an opportunity for growth, development, and community engagement. The Ny Erie County Tax Collector's Office is a shining example of how public service can be both effective and innovative, setting a high standard for tax collection offices across the nation.

How can I contact the Ny Erie County Tax Collector’s Office?

+You can reach the Ny Erie County Tax Collector’s Office by phone at (585) 753-1600 or by email at taxcollector@erie.gov. For in-person inquiries, the office is located at 95 Franklin Street, Buffalo, NY 14202. Office hours are Monday to Friday, 8:30 AM to 4:30 PM.

What are the accepted methods of tax payment in Erie County?

+Erie County accepts a variety of payment methods, including online payments, credit card payments, and traditional check or cash payments at designated locations. You can also set up automatic payments through the online platform for added convenience.

Are there any tax exemptions or discounts available in Erie County?

+Yes, Erie County offers various tax exemptions and discounts. These include the STAR exemption for eligible homeowners, the Enhanced STAR exemption for senior citizens, and the School Tax Relief (STAR) Credit for qualified renters. Additionally, the county provides a 1% discount for early payment of property taxes.