States With Lowest Taxes

Taxes are an inevitable part of life, but understanding the tax landscape can be crucial for individuals and businesses alike when making financial decisions and planning their future. The United States, with its diverse tax structures across different states, offers a range of tax environments that can significantly impact personal and business finances. Let's delve into the states with the lowest taxes, exploring the specific tax rates and the implications for residents and businesses.

The Landscape of Low-Tax States

The United States is home to several states that have implemented tax policies aimed at attracting residents and businesses by offering lower tax burdens. These states have recognized the importance of competitive taxation in fostering economic growth and have tailored their tax structures accordingly. While the concept of low taxes is appealing, it's essential to understand the nuances and consider the overall tax picture, including income, sales, and property taxes.

States with No Income Tax

One of the most notable ways states can reduce tax burdens is by eliminating or significantly reducing income taxes. As of my last update, there are seven states that have taken this approach, offering residents and businesses a substantial advantage when it comes to personal income taxes.

- Alaska: Alaska is unique in that it has no state income tax and also no state sales tax. This combination makes it an attractive destination for those seeking to minimize their tax obligations.

- Florida: Known for its sunny climate and vibrant tourism industry, Florida also boasts no income tax, making it a popular choice for retirees and businesses.

- Nevada: With a thriving entertainment and hospitality industry, Nevada's lack of income tax contributes to its reputation as a tax-friendly state.

- South Dakota: This state has a strong agricultural base and, by forgoing income tax, has created an environment that supports businesses and individuals.

- Texas: As the second-largest state by population, Texas's decision to eliminate income tax has had a significant impact, attracting businesses and individuals alike.

- Washington: Washington's vibrant tech industry and lack of income tax make it a hub for innovation and entrepreneurship.

- Wyoming: Wyoming's low tax burden, including no income tax, has contributed to its reputation as a business-friendly state.

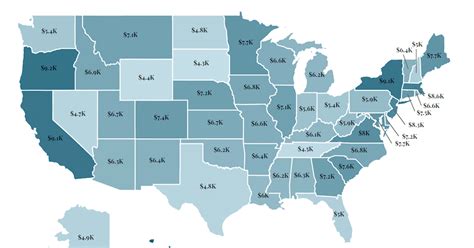

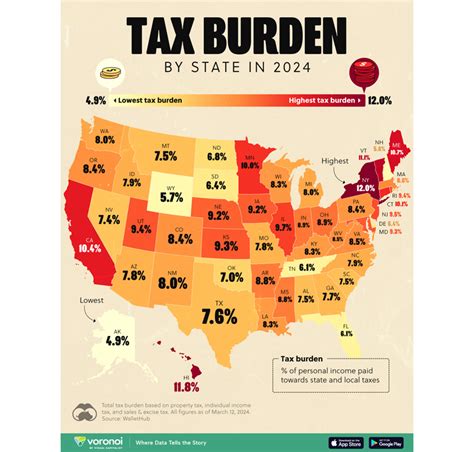

States with Low Overall Tax Burdens

While the absence of income tax is a significant draw, other states have implemented tax policies that result in lower overall tax burdens for residents and businesses. These states have found a balance between income, sales, and property taxes, creating an environment that supports economic growth.

- Tennessee: Tennessee has a relatively low tax burden, with a modest sales tax rate and a limited income tax structure that primarily targets higher incomes.

- Louisiana: Despite its sales tax rate being on the higher end, Louisiana's income tax structure is relatively forgiving, especially for lower and middle-income earners.

- Alabama: Alabama has implemented a progressive income tax system, ensuring that higher incomes bear a greater tax burden while providing relief for lower-income earners.

- Mississippi: With a combination of low income and property taxes, Mississippi offers a competitive tax environment, especially for those with lower incomes.

- Arizona: Arizona's tax structure, including a flat income tax rate, makes it an attractive option for individuals and businesses seeking stability and predictability.

Analyzing the Impact of Low Taxes

The decision to live or operate a business in a low-tax state can have significant financial implications. While the absence of income tax is often a major draw, it's essential to consider the trade-offs and the overall tax picture.

Attracting Businesses and Investment

States with low taxes, particularly those without income tax, have become magnets for businesses seeking to minimize their tax obligations. This influx of businesses can lead to job creation and economic growth, boosting the state's overall prosperity. Additionally, lower taxes can make a state more attractive to investors, further driving economic development.

Impact on Residents' Finances

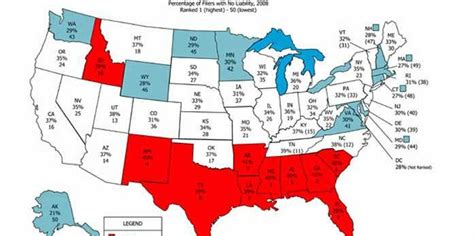

For residents, living in a low-tax state can mean more money in their pockets. The absence of income tax, for instance, can significantly boost disposable income, allowing individuals to save more, invest in their future, or simply enjoy a higher standard of living. However, it's important to consider the trade-off between low taxes and the availability of public services, as states with lower taxes may have less funding for education, healthcare, and infrastructure.

Tax Competition and Policy Considerations

The trend towards lower taxes has sparked a competitive environment among states, each striving to attract residents and businesses. This competition can lead to innovative tax policies and a focus on economic efficiency. However, it also raises questions about the sustainability of low-tax environments and the potential impact on public services and infrastructure.

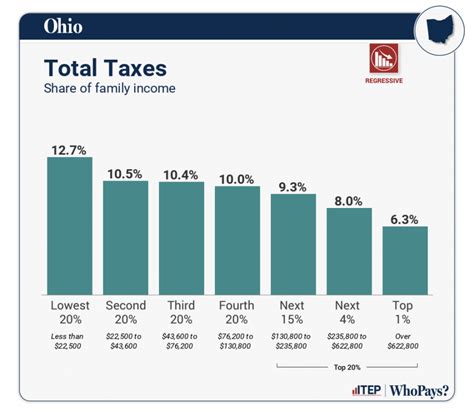

Comparative Analysis: Income vs. Sales Tax

When considering the overall tax burden, it's essential to compare income and sales taxes. While income taxes can be more progressive and targeted, sales taxes can disproportionately affect lower-income earners. States that rely heavily on sales tax may need to consider the potential impact on their resident's financial well-being.

| State | Income Tax Rate | Sales Tax Rate |

|---|---|---|

| Alaska | 0% | 0% |

| Florida | 0% | 6% |

| Nevada | 0% | 6.85% |

| South Dakota | 0% | 4.5% |

| Texas | 0% | 6.25% |

| Washington | 0% | 6.5% |

| Wyoming | 0% | 4% |

| Tennessee | Varies (max 6%) | 7% |

| Louisiana | Varies (max 6%) | 5% |

| Alabama | Varies (max 5%) | 4% |

| Mississippi | Varies (max 5%) | 7% |

| Arizona | Flat 2.59% | 5.6% |

Conclusion: Navigating the Low-Tax Landscape

The decision to live or operate a business in a low-tax state is a complex one, requiring a thorough understanding of the tax landscape and its implications. While low taxes can provide significant financial benefits, it's essential to consider the trade-offs and the potential impact on public services. As states continue to compete for residents and businesses, the tax environment will remain a dynamic and crucial factor in economic decision-making.

Frequently Asked Questions

Which state has the lowest overall tax burden for individuals?

+

Alaska and Wyoming have the lowest overall tax burdens for individuals, with no income or sales tax. This combination makes them highly attractive for those seeking to minimize their tax obligations.

Are there any downsides to living in a state with no income tax?

+

While the absence of income tax is appealing, states with no income tax may have less funding for public services like education and infrastructure. This trade-off is an important consideration when choosing a low-tax state.

Which states have the lowest income tax rates?

+

Tennessee, Louisiana, Alabama, Mississippi, and Arizona all have relatively low income tax rates, making them attractive options for individuals seeking to minimize their income tax obligations.

How do low-tax states impact businesses?

+

Low-tax states can attract businesses by reducing their tax obligations, leading to job creation and economic growth. This influx of businesses can boost the state’s economy and provide opportunities for residents.

Are there any states with no sales tax?

+

Alaska is the only state with no sales tax, making it unique in its tax structure and highly attractive for consumers and businesses seeking to minimize sales tax obligations.