York County Taxes

York County, nestled in the picturesque state of Pennsylvania, is renowned for its rich history, vibrant communities, and thriving industries. However, one topic that often sparks curiosity and discussion among residents and businesses alike is the realm of taxation. In this comprehensive article, we delve into the intricacies of York County taxes, exploring the various aspects that make up the fiscal landscape of this vibrant region.

Unraveling the Tax Structure of York County

York County boasts a diverse tax structure, designed to support its robust economy and infrastructure. The county’s tax system is meticulously crafted to ensure fairness and transparency, catering to the needs of its diverse population. Let’s break down the key components of York County’s taxation landscape.

Property Taxes: A Cornerstone of County Revenue

Property taxes form the backbone of York County’s revenue stream. These taxes are levied on both residential and commercial properties, with rates varying based on factors such as property value, location, and usage. The county employs a comprehensive assessment process to ensure accurate valuation, providing transparency to taxpayers.

For instance, consider the case of a residential property owner in York City. The owner, let's call them Ms. Johnson, recently received her annual tax assessment. Based on the property's market value, improvements made, and its location within the city limits, Ms. Johnson's property tax rate was determined to be $2,500 per year. This rate is then used to calculate her tax liability, ensuring a fair contribution to the county's finances.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 1.2 - 1.8 |

| Commercial | 2.0 - 2.5 |

| Industrial | 1.8 - 2.2 |

York County's property tax system not only generates revenue for essential services but also incentivizes property maintenance and development, contributing to the overall prosperity of the region.

Income Taxes: Individual and Business Contributions

York County also collects income taxes from both individuals and businesses operating within its borders. These taxes play a crucial role in funding public services, education, and infrastructure projects.

For individuals, York County imposes a flat income tax rate, currently set at 1.5%. This rate applies to all taxable income, ensuring simplicity and consistency. However, it's important to note that this tax is in addition to state and federal income taxes, making it a vital component of the county's overall tax structure.

On the business front, York County levies taxes on various types of entities, including corporations, partnerships, and sole proprietorships. The tax rates vary depending on the nature of the business and its revenue. For instance, a successful manufacturing company in York County, such as Acme Industries, might pay a higher tax rate compared to a small local bakery due to its larger scale of operations.

| Business Type | Tax Rate (%) |

|---|---|

| Corporations | 1.2 - 1.8 |

| Partnerships | 1.0 - 1.5 |

| Sole Proprietorships | 0.8 - 1.2 |

By collecting income taxes, York County ensures that individuals and businesses contribute proportionally to the county's fiscal health, supporting the well-being of its residents and fostering economic growth.

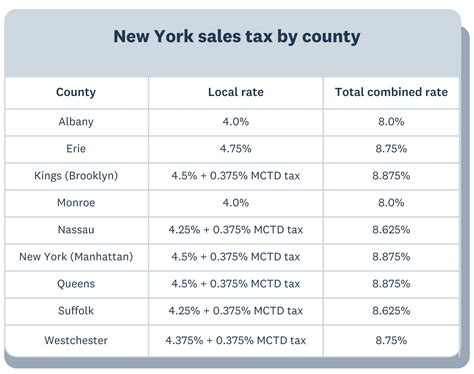

Sales and Use Taxes: Generating Revenue from Consumer Spending

Sales and use taxes are another significant source of revenue for York County. These taxes are applied to the sale of goods and services within the county, as well as to the use or consumption of certain products.

The sales tax rate in York County is set at 6%, which is applied to most retail transactions. This includes purchases made at local stores, online retailers with a physical presence in the county, and even certain services like auto repairs and legal services. The tax revenue generated from sales and use taxes contributes to vital county projects, such as road maintenance and public transportation improvements.

To illustrate, let's consider a local resident, Mr. Smith, who purchases a new television set from an electronics store in York County. The sales tax on this purchase would amount to 6% of the total cost, with the revenue collected going towards enhancing the county's infrastructure and public amenities.

Additionally, York County imposes a use tax on goods purchased outside the county but used or stored within its borders. This tax ensures fairness and prevents businesses and individuals from avoiding sales taxes by making purchases elsewhere. The use tax rate mirrors the sales tax rate, further supporting the county's revenue stream.

Special Taxes and Assessments: Targeted Funding for Specific Projects

In addition to the aforementioned taxes, York County employs special taxes and assessments to fund specific projects and initiatives. These targeted taxes are designed to address unique community needs and infrastructure improvements.

One notable example is the county's stormwater management tax. This tax is levied on properties based on their impervious surface area, such as roofs, driveways, and parking lots. The revenue generated from this tax is dedicated to maintaining and improving the county's stormwater infrastructure, reducing the risk of flooding and improving water quality.

Another special assessment is the York County Library System's property tax, which provides vital funding for the county's extensive library network. This tax ensures that residents have access to a wide range of educational resources and cultural programs, fostering a knowledgeable and engaged community.

These special taxes and assessments demonstrate York County's commitment to addressing specific community needs and improving the quality of life for its residents. By targeting revenue towards specific projects, the county can efficiently allocate resources and make a tangible impact on its citizens' lives.

The Impact of York County Taxes on Residents and Businesses

York County’s tax structure has a profound impact on both residents and businesses within its boundaries. Understanding this impact is crucial for individuals and companies alike, as it influences their financial planning and decision-making processes.

Residential Tax Considerations

For York County residents, taxes play a significant role in their overall financial well-being. Property taxes, in particular, are a substantial expense for homeowners. The county’s tax rates, as we’ve discussed, vary based on property value and location, which can result in varying tax burdens for residents.

Take, for example, a young couple, Mr. and Mrs. Miller, who recently purchased their first home in York County. Their property tax assessment, based on the value of their home and its location, resulted in a tax liability of $3,200 per year. This amount, while significant, is manageable for the couple, and they understand that their tax contributions support essential services like schools, police, and fire departments.

In addition to property taxes, residents also need to consider income taxes. York County's flat income tax rate ensures simplicity, but it's essential for individuals to understand how this tax affects their overall financial picture. By deducting the county income tax from their paychecks, residents can effectively plan their budgets and financial goals.

Furthermore, sales and use taxes impact residents' daily lives. Every time a resident purchases goods or services, they contribute to the county's revenue stream through these taxes. While these taxes may seem small, they collectively fund vital projects and services, such as road repairs, public parks, and community events.

York County's tax structure also provides incentives for homeowners to invest in their properties. By maintaining and improving their homes, residents can potentially increase their property values, which may lead to a higher tax assessment. However, this also means that residents have the opportunity to access more affordable financing options, such as home equity loans, which can be beneficial for various purposes.

Business Tax Implications

York County’s tax structure has a unique impact on businesses operating within its borders. Businesses, whether large corporations or small startups, contribute significantly to the county’s revenue through various tax streams.

For instance, consider a thriving tech startup, TechGenius Inc., located in York County's bustling business district. TechGenius, as a corporation, is subject to the county's corporate tax rate, which is currently set at 1.5%. This tax, combined with state and federal taxes, forms a substantial part of the company's overall tax liability.

However, York County's tax structure also provides incentives for businesses to thrive and expand. The county offers tax abatement programs for businesses that create new jobs or invest in capital improvements. TechGenius, for example, could benefit from these incentives by hiring additional employees or investing in research and development facilities.

Additionally, York County's tax structure encourages business growth through its progressive tax rates. As businesses expand and generate higher revenues, their tax rates may increase slightly, but this also means they are contributing more to the county's fiscal health. This progressive approach ensures that businesses with greater financial success contribute proportionally more to the community's well-being.

Moreover, York County's sales and use taxes impact businesses directly. Retailers, for example, must collect and remit these taxes on their sales, which can influence their pricing strategies and overall profitability. However, the revenue generated from these taxes is essential for funding public services and infrastructure projects that support businesses and their customers alike.

In conclusion, York County's tax structure is a complex yet essential aspect of its fiscal landscape. Property taxes, income taxes, sales and use taxes, and special assessments all contribute to the county's revenue stream and impact residents and businesses alike. By understanding the intricacies of this tax system, individuals and businesses can make informed decisions, plan their finances effectively, and contribute to the prosperity of York County as a whole.

Navigating York County’s Tax Landscape: Tips and Insights

York County’s tax system, while comprehensive and well-structured, can present unique challenges and opportunities for residents and businesses. To navigate this landscape successfully, it’s essential to have a strategic approach and stay informed about the latest tax regulations and incentives.

Understanding Tax Assessment and Appeals

York County’s property tax assessments are a critical aspect of the tax system. It’s crucial for homeowners and businesses to understand how their properties are assessed and the factors that influence these assessments. By staying informed, they can ensure fairness and accuracy in their tax liabilities.

If a taxpayer believes their property assessment is inaccurate or unfair, they have the right to appeal. The appeals process in York County is designed to be transparent and accessible. Taxpayers can gather evidence, such as recent sales data or professional appraisals, to support their case. It's advisable to consult with tax professionals or legal experts to navigate this process effectively.

For instance, a commercial property owner, Ms. Wilson, believes her property's assessment is too high compared to similar properties in the area. By gathering comparative data and seeking expert advice, she can present a strong case for a reassessment. If successful, this could result in a reduced tax liability, providing a significant financial benefit to her business.

Maximizing Tax Incentives and Credits

York County offers various tax incentives and credits to promote economic growth and community development. Residents and businesses should stay informed about these opportunities and explore how they can benefit from them.

For instance, the county provides tax credits for energy-efficient upgrades to residential and commercial properties. By investing in solar panels or energy-efficient appliances, homeowners can not only reduce their utility costs but also qualify for tax credits, making these upgrades more financially feasible.

Similarly, businesses can take advantage of tax incentives for job creation, research and development, and capital investments. By staying updated on these incentives, businesses can strategically plan their growth and expansion, knowing they have financial support from the county.

Effective Tax Planning for Residents

For York County residents, effective tax planning is essential to manage their financial obligations efficiently. Here are some key considerations:

- Understand the County's Tax Rates: Residents should familiarize themselves with the county's tax rates, including property, income, and sales taxes. This knowledge empowers them to budget effectively and plan for future expenses.

- Utilize Tax Deductions and Credits: York County residents can benefit from various tax deductions and credits, such as mortgage interest deductions, property tax deductions, and education credits. By taking advantage of these opportunities, residents can reduce their tax liabilities.

- Explore Homeownership Benefits: Owning a home in York County comes with advantages beyond the tax deductions. Homeowners can access lower interest rates on mortgages and build equity over time. Additionally, the county's tax structure encourages property investment, making homeownership a sound financial decision.

- Stay Informed about Tax Changes: York County's tax landscape is subject to periodic changes and updates. Residents should stay informed about any amendments to tax laws, rates, or incentives. This ensures they can adapt their financial planning accordingly.

Strategic Tax Management for Businesses

York County’s tax system presents unique opportunities and challenges for businesses. To navigate this landscape successfully, businesses should consider the following strategies:

- Understand Tax Obligations: Businesses should thoroughly understand their tax obligations, including income taxes, payroll taxes, and sales taxes. Staying informed about the county's tax rates and regulations ensures compliance and avoids penalties.

- Optimize Tax Structure: Businesses can work with tax professionals to optimize their tax structure. This may involve choosing the most suitable business entity, such as a corporation or limited liability company (LLC), to minimize tax liabilities and maximize deductions.

- Explore Tax Incentives: York County offers a range of tax incentives to businesses, including tax abatements, tax credits for job creation, and research and development incentives. By leveraging these opportunities, businesses can reduce their tax burden and reinvest savings into their operations.

- Stay Updated on Tax Changes: Like residents, businesses should stay abreast of any changes to the county's tax laws and regulations. This ensures they can adapt their financial strategies and take advantage of new incentives or deductions.

The Future of York County Taxes: A Look Ahead

As York County continues to thrive and evolve, its tax system will play a pivotal role in shaping its future. The county’s fiscal policies and initiatives will impact residents, businesses, and the overall economic landscape for years to come. Here’s a glimpse into the potential future of York County taxes.

Sustainable Funding for Essential Services

One of the key challenges facing York County is the need to sustainably fund essential services, such as education, public safety, and infrastructure maintenance. The county’s tax structure will likely evolve to address these needs, ensuring that residents and businesses continue to receive high-quality services.

For instance, the county may explore innovative funding models, such as public-private partnerships or impact investing, to support infrastructure projects. By engaging with private investors and leveraging their expertise, York County can develop sustainable funding solutions while maintaining its commitment to fiscal responsibility.

Encouraging Economic Growth and Development

York County’s tax system will continue to play a vital role in fostering economic growth and development. The county may introduce targeted tax incentives and initiatives to attract new businesses, create jobs, and stimulate the local economy.

One potential strategy could be the establishment of enterprise zones, offering reduced tax rates and streamlined regulations for businesses that invest in these zones. This approach has proven successful in other regions, encouraging economic activity and revitalizing underdeveloped areas.

Adapting to Technological Advancements

The digital revolution is transforming the way taxes are administered and collected. York County is likely to embrace technological advancements to enhance its tax system’s efficiency and transparency.

For instance, the county may adopt online tax filing systems, making it more convenient for residents and businesses to submit their tax returns. Additionally, the use of blockchain technology or smart contracts could revolutionize the way taxes are tracked and audited, reducing errors and enhancing security.

Promoting Environmental Sustainability

With a growing focus on environmental sustainability, York County’s tax system may evolve to incentivize eco-friendly practices. The county could introduce tax credits or rebates for businesses and residents who adopt renewable energy sources, implement energy-efficient measures, or engage in sustainable waste management practices.

By aligning its tax policies with environmental goals, York County can contribute to a greener future while encouraging residents and businesses to embrace sustainable practices. This approach not only benefits the environment but also enhances the county's reputation as a forward-thinking and responsible community.

Collaborative Tax Administration

In the future, York County may explore collaborative tax administration models, partnering with other local governments or state agencies to streamline tax processes and reduce administrative burdens.

For example, the county could collaborate with neighboring counties to develop a unified tax collection system, simplifying the process for taxpayers who own properties or operate businesses across county lines. This collaborative approach could enhance efficiency, reduce costs, and improve overall taxpayer satisfaction.

Conclusion: York County Taxes - A Complex Yet Vital System

York County’s tax system is a complex network of property,