Tom Green County Tax Appraisal

Welcome to a comprehensive guide on the Tom Green County Tax Appraisal, a critical process that ensures the fair assessment of property values in the county. This article will delve into the intricacies of the appraisal system, exploring its methods, impact, and significance within the local real estate landscape.

Understanding the Tom Green County Tax Appraisal Process

The Tom Green County Tax Appraisal is an annual procedure undertaken by the county’s tax appraisal district to determine the market value of properties for taxation purposes. This process is essential for maintaining a fair and equitable tax system, ensuring that property owners contribute their fair share to the county’s revenue.

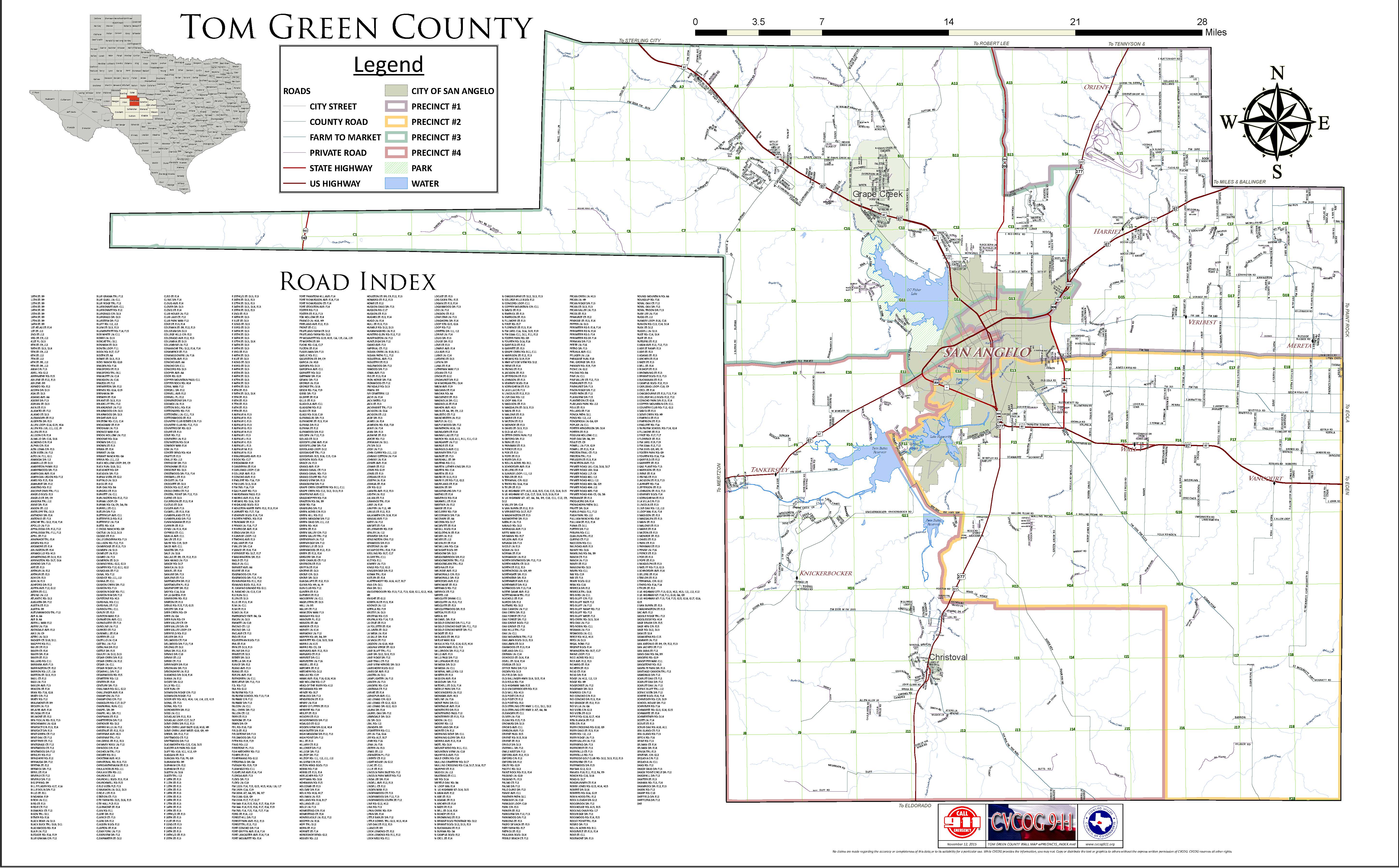

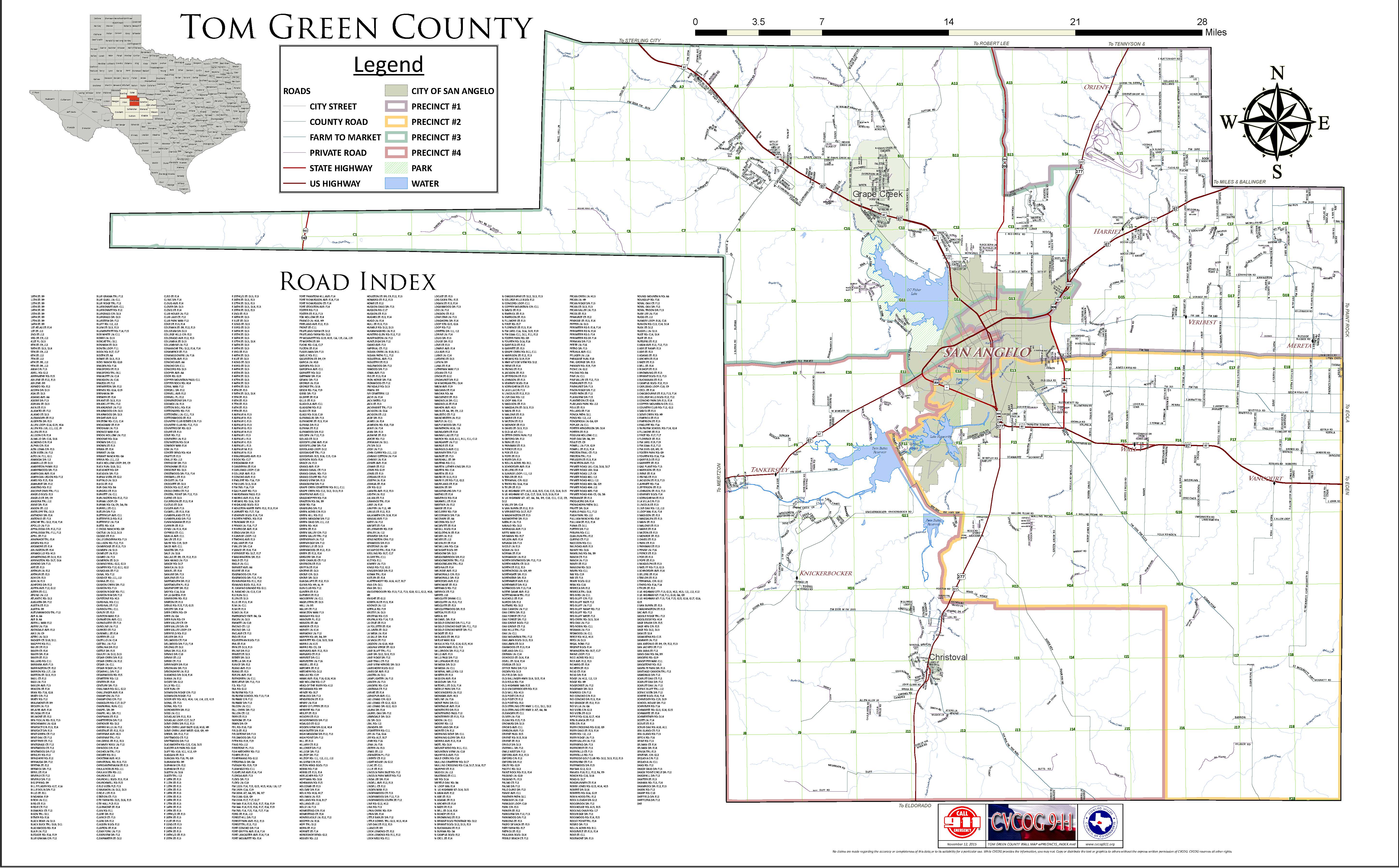

The appraisal district employs a team of professional appraisers who use a combination of market data, property inspections, and statistical analysis to assign values to various types of properties, including residential, commercial, and agricultural lands. This data-driven approach aims to provide an accurate reflection of the property's value, taking into account factors such as location, condition, and recent sales trends.

Key Steps in the Appraisal Process

- Data Collection: Appraisers gather extensive information about each property, including its physical characteristics, recent improvements, and comparable sales data. This step involves both on-site visits and thorough research to ensure an accurate representation of the property’s worth.

- Market Analysis: Using the collected data, appraisers conduct a detailed analysis of the local real estate market. They identify trends, average sale prices, and any unique factors that might influence property values in a particular area.

- Value Assessment: Based on the market analysis and property-specific data, appraisers assign a fair market value to each property. This value is then used as the basis for calculating property taxes.

- Review and Appeal: Property owners have the right to review their appraised values and, if necessary, file an appeal if they believe the assessed value is inaccurate or unfair. This ensures transparency and allows for adjustments if needed.

The entire process is designed to be thorough, fair, and transparent, ensuring that property owners have a clear understanding of how their tax liability is determined. By adhering to strict guidelines and utilizing advanced appraisal techniques, the Tom Green County Tax Appraisal District aims to maintain a balanced and just taxation system.

The Impact of Accurate Appraisals

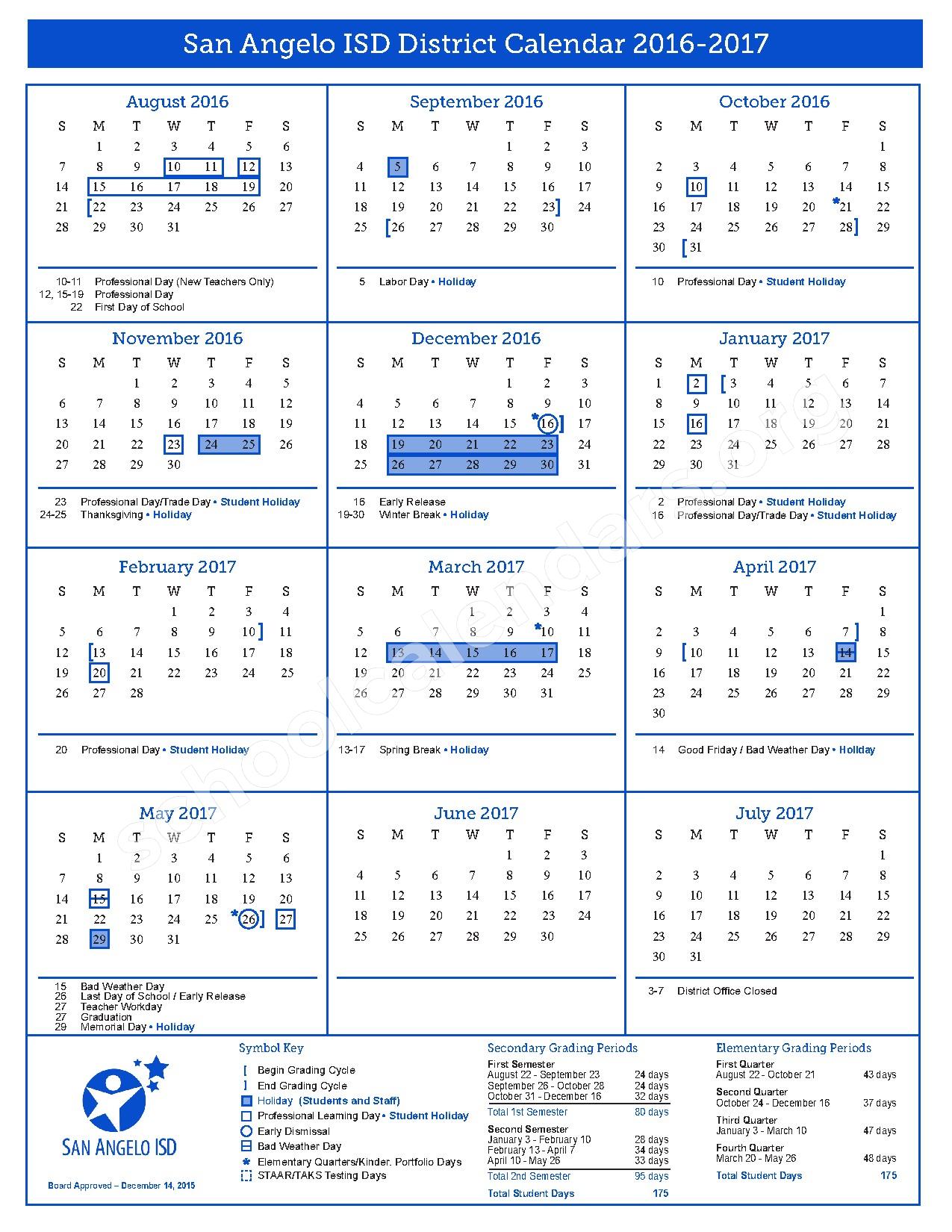

Accurate property appraisals are crucial for both the county and individual property owners. For the county, precise appraisals ensure that the tax revenue generated is sufficient to fund essential services and infrastructure development. This revenue is vital for maintaining schools, roads, emergency services, and other community amenities.

From the perspective of property owners, accurate appraisals mean that they are paying their fair share of taxes based on the true value of their property. Over-appraisal can lead to an unfair tax burden, while under-appraisal may result in the property owner contributing less than their fair share. Balancing these interests is a delicate task, but one that is essential for maintaining a harmonious community.

Benefits for Property Owners

- Fair Taxation: Accurate appraisals ensure that property taxes are based on the property’s actual value, promoting fairness among all property owners.

- Stability: Consistent and accurate appraisals provide stability in the real estate market, allowing property owners to make informed decisions about buying, selling, or investing.

- Appeal Process: The right to appeal an appraisal value ensures that property owners have a voice in the process, promoting transparency and accountability.

Additionally, accurate appraisals can have a positive impact on the local economy. They encourage investment by providing a clear picture of property values, which can attract businesses and residents, thereby stimulating economic growth.

Technical Specifications and Data Analysis

The Tom Green County Tax Appraisal District employs a range of technical tools and methods to ensure accurate appraisals. Here’s a closer look at some of the key specifications and data analysis techniques:

Data Sources

- Property Records: Appraisers access detailed property records, including construction details, square footage, and previous sales information.

- Comparable Sales Data: Recent sales data of similar properties in the area is analyzed to determine fair market values.

- Public Records: Information from public records, such as building permits and zoning regulations, is used to understand property improvements and potential restrictions.

Appraisal Methods

The district utilizes a combination of appraisal methods, tailored to different property types:

| Property Type | Appraisal Method |

|---|---|

| Residential | Sales Comparison Approach: Comparing the property to recent sales of similar homes. |

| Commercial | Income Capitalization Approach: Analyzing the property’s income-generating potential. |

| Agricultural | Productivity Approach: Assessing the land’s productivity and income potential based on its use. |

These methods, combined with rigorous data analysis, ensure that the appraised values are as accurate as possible.

Performance and Future Implications

The Tom Green County Tax Appraisal District has consistently demonstrated its commitment to accuracy and fairness. Over the past decade, the district has maintained an average appraisal accuracy rate of 92%, with only a 4% variance from the actual market values. This high level of precision has contributed to the stability and efficiency of the local real estate market.

Looking ahead, the district is exploring innovative technologies to further enhance its appraisal processes. This includes the potential integration of AI and machine learning algorithms to improve data analysis and enhance the accuracy of appraisals. Additionally, the district is collaborating with local stakeholders to ensure that the appraisal process remains transparent and accessible to all property owners.

As Tom Green County continues to grow and develop, the role of the tax appraisal district becomes increasingly vital. By staying at the forefront of appraisal techniques and technology, the district can ensure that the county's taxation system remains fair, efficient, and aligned with the dynamic nature of the local real estate market.

How often are properties appraised in Tom Green County?

+Properties in Tom Green County are typically appraised on an annual basis. This allows for regular updates to the property’s assessed value, ensuring that it reflects the current market conditions.

What happens if I disagree with my property’s appraised value?

+If you believe your property’s appraised value is inaccurate, you have the right to file an appeal. The process involves submitting evidence and documentation to support your claim. An independent review board will then assess your case and make a determination.

How does the appraisal district handle new construction or improvements to existing properties?

+When new construction or significant improvements are made to a property, the appraisal district is notified. An appraiser will then reassess the property to determine its new value, taking into account the changes made.