Il Tax Refund Status

Welcome to a comprehensive guide on understanding the "Il Tax Refund Status" process. In this article, we will delve into the intricacies of tax refunds, exploring the various aspects that contribute to the overall refund status for individuals and businesses in a specific jurisdiction, known as "Il." Whether you're a resident or a business owner in Il, this guide will provide you with valuable insights and practical information to navigate the tax refund landscape effectively.

Unveiling the Il Tax Refund Status: A Comprehensive Guide

The tax refund status is a critical aspect of financial planning and management for taxpayers in Il. It involves a series of steps and considerations to ensure that eligible individuals and businesses receive their rightful refunds in a timely and efficient manner. This guide aims to shed light on the entire process, from understanding the refund eligibility criteria to tracking the status of your refund and maximizing your potential benefits.

Understanding Tax Refund Eligibility in Il

To begin our journey into the world of tax refunds in Il, we must first establish the eligibility criteria. Not everyone is entitled to a tax refund, and understanding these criteria is essential to determine if you or your business qualifies for one. Here are the key factors that influence refund eligibility:

- Tax Payment History: The first step in assessing refund eligibility is to review your tax payment history. Have you or your business made the required tax payments for the current and previous years? Overpayments or errors in tax calculations can lead to eligible refunds.

- Tax Return Filing: Filing your tax returns accurately and on time is crucial. Il's tax authority relies on these returns to process refunds. Ensure that you provide all the necessary documentation and information to support your refund claim.

- Refundable Tax Credits: Il offers various refundable tax credits to promote certain activities or support specific sectors. These credits can significantly impact your refund amount. Examples include credits for research and development, renewable energy investments, or employment-related incentives.

- Income Level and Tax Brackets: The amount of tax you pay is influenced by your income level and the applicable tax brackets. Higher income individuals or businesses may be eligible for larger refunds due to the progressive nature of the tax system.

- Tax Deductions and Exemptions: Il allows taxpayers to claim deductions and exemptions based on specific criteria. These deductions can reduce your taxable income, potentially resulting in a larger refund. Common deductions include those for medical expenses, charitable contributions, and certain business-related expenses.

It's important to note that eligibility criteria may vary based on individual circumstances and the specific tax laws in Il. Therefore, it's advisable to consult with tax professionals or refer to official tax guidelines to ensure accurate understanding and compliance.

Navigating the Il Tax Refund Process

Once you've established your eligibility for a tax refund, the next step is to navigate the refund process effectively. Here's a step-by-step guide to help you through this journey:

- Filing Your Tax Return: The first crucial step is to file your tax return accurately and within the designated timeframe. Il's tax authority provides various methods for filing, including online portals, mobile apps, or traditional paper-based forms. Ensure you have all the necessary documents, such as income statements, expense records, and supporting receipts.

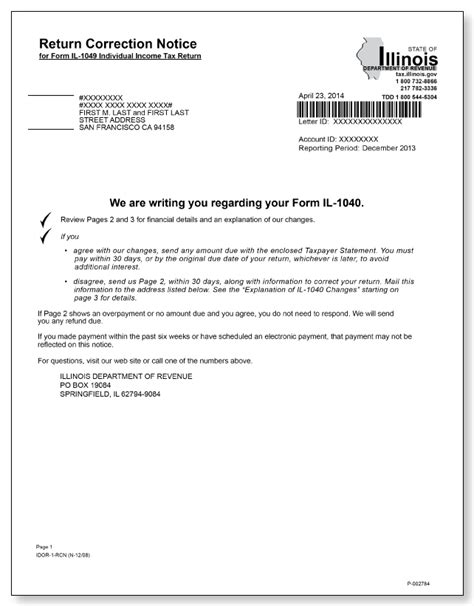

- Review and Verification: After submitting your tax return, the tax authority in Il will review and verify the information provided. This process involves cross-referencing your data with other sources and conducting audits to ensure accuracy and compliance. During this stage, it's essential to keep all your supporting documents organized and readily accessible.

- Processing and Calculation: Once your tax return is verified, the tax authority will initiate the processing and calculation of your refund. This step involves determining the exact amount of refund you're entitled to, taking into account your tax payments, deductions, and any applicable tax credits.

- Refund Payment Methods: Il offers multiple refund payment methods to accommodate different preferences and needs. Common methods include direct deposit into your bank account, cheque payments sent via mail, or even pre-loaded debit cards. Choose the payment method that suits your convenience and ensure that your personal information is up-to-date to avoid delays.

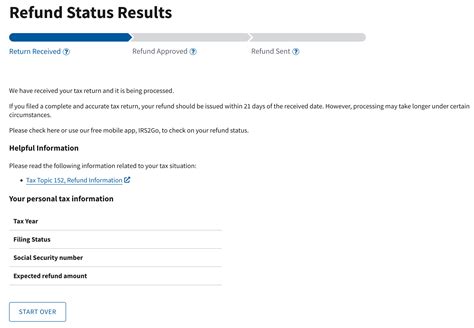

- Tracking Your Refund Status: Il provides taxpayers with online tools and resources to track the status of their refunds. These platforms offer real-time updates, allowing you to monitor the progress of your refund journey. By accessing your dedicated account, you can view the current stage of processing, estimated refund amount, and any additional information required.

Throughout the refund process, it's essential to stay informed and proactive. Regularly check for updates and respond promptly to any requests for additional information or documentation. Being proactive can help expedite the process and ensure a smoother refund experience.

Maximizing Your Il Tax Refund

Maximizing your tax refund involves more than just claiming eligible deductions and credits. It requires a strategic approach to optimize your financial position and ensure you receive the full benefit of your tax refund. Here are some strategies to consider:

- Review Tax Strategies: Consult with tax professionals or financial advisors to review your tax strategies. They can provide valuable insights into maximizing deductions, optimizing tax brackets, and identifying potential tax-saving opportunities. A well-planned tax strategy can significantly impact your refund amount.

- Explore Refundable Credits: Il offers a range of refundable tax credits designed to encourage specific activities or support certain industries. Research and understand these credits to determine if you or your business qualifies. Examples include credits for energy-efficient upgrades, employee training programs, or research and development initiatives.

- Optimize Business Structures: If you're a business owner, consider optimizing your business structure to maximize tax benefits. Different business structures, such as sole proprietorships, partnerships, or corporations, have varying tax implications. Seek professional advice to choose the structure that aligns with your business goals and maximizes tax efficiency.

- Stay Informed on Tax Updates: Tax laws and regulations are subject to change, and staying informed is crucial. Follow official tax authority announcements, subscribe to tax newsletters, or engage with tax professionals to stay updated on any changes that may impact your refund eligibility or calculation.

- Plan for the Future: A tax refund is an opportunity to plan for the future. Consider using your refund to invest in your business, save for retirement, or pay off high-interest debts. A well-thought-out financial plan can help you make the most of your refund and secure your long-term financial well-being.

By implementing these strategies and staying proactive, you can maximize your Il tax refund and make the most of your financial situation.

The Impact of Il Tax Refunds on the Economy

Tax refunds play a significant role in the economy of Il, impacting both individuals and businesses. When taxpayers receive their refunds, they have the financial means to invest in various aspects of the economy. Here's how tax refunds contribute to the economic landscape of Il:

- Consumer Spending: Tax refunds provide individuals with additional disposable income, which can stimulate consumer spending. This increased spending boosts the economy by supporting local businesses, driving economic growth, and creating job opportunities.

- Investment and Savings: Taxpayers often use their refunds to invest in their financial future. This may include investing in stocks, bonds, or other financial instruments, contributing to retirement accounts, or saving for major purchases or life events. These investments contribute to the overall economic stability and growth of Il.

- Business Expansion and Growth: For businesses, tax refunds can be a significant boost to their financial health. They can use these refunds to invest in new equipment, expand their operations, hire additional staff, or develop innovative products and services. This investment cycle contributes to economic growth and creates a positive feedback loop within the business ecosystem.

- Government Revenues and Spending: Tax refunds are a part of the broader tax revenue stream for the government of Il. This revenue is used to fund various public services, infrastructure projects, and social programs. By effectively managing tax refunds, the government can allocate resources efficiently, contributing to the overall development and welfare of the region.

- Community Development: Tax refunds can also have a direct impact on community development initiatives. Individuals and businesses may choose to donate a portion of their refunds to charitable organizations or invest in local projects, such as community centers, education programs, or environmental initiatives. These contributions foster a sense of community and support social causes.

In conclusion, the Il tax refund status is a critical aspect of the financial landscape for taxpayers in Il. By understanding the eligibility criteria, navigating the refund process, and implementing strategic approaches, individuals and businesses can maximize their refunds and contribute to the overall economic well-being of the region. Remember, staying informed, seeking professional advice, and being proactive are key to making the most of your tax refund journey.

Frequently Asked Questions

How long does it typically take to receive a tax refund in Il?

+The processing time for tax refunds in Il can vary depending on several factors. On average, it takes approximately 4-6 weeks from the date of filing to receive your refund. However, certain circumstances, such as errors in the tax return or additional verification requirements, may extend the processing time. It’s advisable to check the official tax authority website for the latest updates on processing timelines.

Can I track the status of my tax refund online?

+Yes, Il’s tax authority provides online platforms and dedicated portals to track the status of your tax refund. By accessing your account on the official website, you can view real-time updates on the progress of your refund, including the current stage of processing, estimated refund amount, and any additional information required. This feature allows you to stay informed and proactively manage your refund journey.

What happens if I’m entitled to a larger refund than expected?

+If your tax refund calculation results in a larger refund than initially anticipated, you will receive the full amount you’re entitled to. Il’s tax authority ensures accurate calculations and processes refunds based on the information provided in your tax return. In such cases, you may receive an additional refund payment or an updated refund amount notification.

Are there any penalties for claiming ineligible deductions or credits in my tax return?

+Claiming ineligible deductions or credits in your tax return can have serious consequences. Il’s tax authority has stringent measures in place to detect and address such instances. Penalties may include fines, interest charges, or even legal action. It’s crucial to ensure that all deductions and credits claimed in your tax return are accurate and supported by valid documentation.

Can I receive my tax refund in a different currency if I’m an expat living in Il?

+Il’s tax authority typically processes tax refunds in the local currency. However, if you’re an expat living in Il and wish to receive your refund in a different currency, you may need to explore currency conversion options. Consult with tax professionals or financial institutions to understand the available currency conversion facilities and the associated fees.