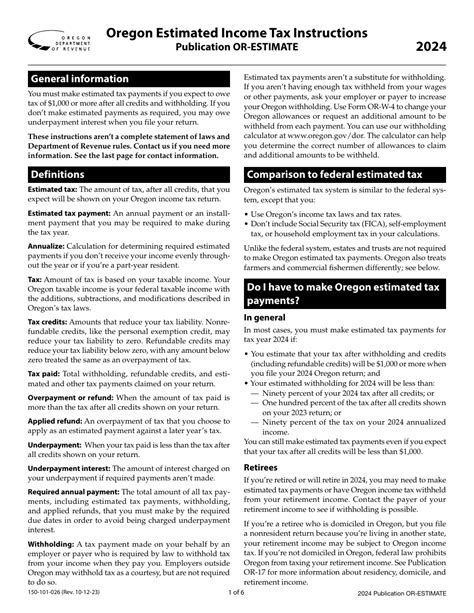

Estimate Oregon Income Tax

Oregon's income tax system is unique among US states, as it primarily relies on a progressive tax structure with a graduated rate system. Understanding how this system works and calculating your estimated income tax is essential for financial planning and ensuring compliance with state tax regulations.

Oregon’s Income Tax Structure: A Comprehensive Overview

Oregon’s income tax system is designed to be fair and equitable, taking into account an individual’s or household’s financial circumstances. The state imposes taxes on various income sources, including wages, salaries, interest, dividends, and capital gains. Here’s a detailed breakdown of how the system operates:

Progressive Tax Rates

Oregon’s progressive tax structure means that as your income increases, so does your tax rate. This ensures that those with higher incomes contribute a larger proportion of their earnings to the state’s revenue. The tax rates are divided into brackets, and the income earned within each bracket is taxed at a specific rate.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $4,000 | 5.0% |

| $4,001 - $7,500 | 6.0% |

| $7,501 - $12,500 | 7.0% |

| $12,501 - $25,000 | 8.0% |

| $25,001 - $125,000 | 9.0% |

| $125,001 and above | 9.9% |

These rates are subject to change based on legislative decisions, so it's essential to refer to the most recent tax tables for an accurate calculation.

Personal Exemptions and Deductions

Oregon offers personal exemptions and deductions to reduce the taxable income of individuals and families. These exemptions and deductions can significantly impact the final tax liability.

- Personal Exemption: Every taxpayer is entitled to a personal exemption, which reduces the taxable income. The amount of this exemption varies based on the taxpayer's filing status and can be found in the state's tax instructions.

- Standard Deduction: Oregon allows taxpayers to claim a standard deduction, which further reduces taxable income. The standard deduction amount is adjusted annually and depends on the taxpayer's filing status.

- Itemized Deductions: Taxpayers can opt to itemize their deductions instead of taking the standard deduction. This involves listing specific expenses that qualify for tax deductions, such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

Calculating Your Estimated Tax

Estimating your Oregon income tax liability involves several steps. Here’s a simplified guide:

- Determine Your Income: Start by calculating your total income for the tax year. This includes wages, salaries, business income, interest, dividends, capital gains, and any other taxable sources.

- Apply Personal Exemptions and Deductions: Subtract any applicable personal exemptions and deductions from your total income to arrive at your taxable income.

- Apply Tax Rates: Using the tax rate schedule provided by the state, calculate the tax due on each income bracket. Sum up these amounts to find your total tax liability.

- Consider Additional Credits and Adjustments: Oregon offers various tax credits, such as the Low-Income Tax Credit and the Working Family Credit, which can further reduce your tax liability. Check if you qualify for any of these credits and apply them accordingly.

Real-World Example: Calculating Estimated Tax for a Single Taxpayer

Let’s consider an example to illustrate the estimation process. Meet Sarah, a single taxpayer residing in Oregon.

Sarah’s Income and Deductions

Sarah’s annual income consists of the following:

- Wages: $50,000

- Interest Income: $1,000

- Capital Gains: $5,000

She is entitled to the following deductions:

- Personal Exemption: $2,000

- Standard Deduction: $3,000

Step-by-Step Calculation

- Total Income: 50,000 + 1,000 + 5,000 = 56,000

- Apply Deductions: 56,000 - 2,000 (Personal Exemption) - 3,000 (Standard Deduction) = 51,000 (Taxable Income)

- Tax Calculation:

- 4,000 x 5.0% = 200

- 3,500 x 6.0% = 210

- 10,000 x 7.0% = 700

- 33,500 x 8.0% = 2,680

- Total Tax: 200 + 210 + 700 + 2,680 = $3,810

Therefore, Sarah's estimated Oregon income tax liability for the year is $3,810.

FAQs: Addressing Common Concerns and Questions

How often do Oregon’s tax rates change, and where can I find the latest information?

+Oregon’s tax rates are subject to legislative changes, typically occurring annually. To stay updated, refer to the official website of the Oregon Department of Revenue, which provides the most recent tax tables and instructions.

Are there any special considerations for taxpayers with multiple sources of income?

+Yes, when dealing with multiple income streams, it’s crucial to ensure that each source is taxed correctly. Consult with a tax professional or use specialized tax software to accurately calculate the tax liability for each source and combine them for a comprehensive estimate.

What are the consequences of underestimating or overestimating my income tax?

+Underestimating your tax liability can result in penalties and interest charges, while overestimating may lead to unnecessary withholding or payments. It’s essential to strike a balance and aim for an accurate estimate to avoid financial penalties.

Are there any tax credits available for specific expenses or situations in Oregon?

+Oregon offers various tax credits, such as the Low-Income Tax Credit, the Working Family Credit, and the Child and Dependent Care Credit. These credits can significantly reduce your tax liability. Check the eligibility criteria and apply for the credits you qualify for.

Estimating your Oregon income tax liability is a crucial financial task that ensures compliance with state regulations. By understanding the progressive tax structure, applying personal exemptions and deductions, and staying informed about tax laws, individuals can accurately calculate their estimated tax and plan their finances effectively.