Florida Vehicle Sales Tax

Florida, known for its sunny beaches and diverse landscape, is a popular state for vehicle purchases. Understanding the intricacies of vehicle sales tax in Florida is crucial for both residents and prospective buyers. In this comprehensive guide, we delve into the specifics of Florida's vehicle sales tax, providing a detailed analysis of the rates, exemptions, and unique features that make it an important consideration for vehicle ownership.

Unraveling Florida’s Vehicle Sales Tax Landscape

Florida’s vehicle sales tax structure is a critical component of the state’s revenue generation and an essential aspect of vehicle ownership. Unlike some other states, Florida has a straightforward approach to sales tax, with a uniform rate applied across the state. However, this simplicity belies the complexity of the underlying regulations and the impact they can have on your vehicle purchase.

Understanding the Sales Tax Rate

The sales tax rate for vehicles in Florida is set at 6% of the total purchase price. This rate is applicable to both new and used vehicles, making it a consistent factor in the cost of vehicle ownership. However, it’s important to note that this rate can be subject to change, and it’s advisable to check for any recent updates before finalizing your vehicle purchase.

| Tax Category | Rate |

|---|---|

| Vehicle Sales Tax | 6% |

| Title Transfer Fee | 2.15% (of the first $100,000 of the purchase price) |

Calculating the Tax

To calculate the sales tax on a vehicle purchase in Florida, you simply multiply the purchase price by the sales tax rate of 6%. For example, if you purchase a car for 20,000, the sales tax would amount to 1,200.

However, it's important to consider that this calculation is based on the total purchase price, which includes any additional costs such as dealer fees, optional equipment, and taxes. These additional costs can significantly impact the overall sales tax you'll owe.

Exemptions and Special Considerations

Florida, like many states, offers certain exemptions and special considerations when it comes to vehicle sales tax. These exemptions can provide significant savings for eligible buyers, making it crucial to understand your eligibility and the application process.

Military Exemption

Active-duty military personnel and their spouses are eligible for a full sales tax exemption when purchasing a vehicle in Florida. This exemption applies to both new and used vehicles and is a significant benefit for those serving our country. To avail of this exemption, military personnel must present their military ID and complete the necessary paperwork at the time of purchase.

Disability Exemption

Individuals with disabilities in Florida are entitled to a sales tax exemption on the purchase of vehicles equipped with special modifications to accommodate their disability. This exemption is designed to promote accessibility and independence for people with disabilities. To qualify, individuals must provide documentation of their disability and the necessary modifications to their vehicle.

Trade-In Exemption

When trading in your old vehicle for a new one, Florida allows for an exemption on the sales tax for the trade-in value. This exemption helps offset the cost of upgrading your vehicle and encourages the replacement of older, less efficient models. To claim this exemption, ensure that your trade-in vehicle is registered in your name and that the trade-in value is reflected in the purchase contract.

First-Time Buyer Exemption

Florida offers a sales tax exemption to first-time vehicle buyers who purchase a vehicle that costs less than $50,000. This exemption is designed to encourage vehicle ownership and provide a financial boost to those entering the market for the first time. To qualify, buyers must meet certain residency requirements and provide proof of their first-time buyer status.

Title Transfer Fee

In addition to the sales tax, Florida imposes a title transfer fee on vehicle purchases. This fee is calculated as 2.15% of the first 100,000 of the purchase price. For example, if you purchase a vehicle for 50,000, the title transfer fee would amount to $1,075. This fee is used to cover the costs associated with registering and titling your vehicle in Florida.

The Impact of Florida’s Vehicle Sales Tax

Florida’s vehicle sales tax structure has a significant impact on the cost of vehicle ownership in the state. While the 6% sales tax rate is consistent across the state, the additional fees and exemptions can add complexity and potential savings to the equation.

Financial Considerations

For buyers, understanding the financial implications of Florida’s vehicle sales tax is crucial. The sales tax and title transfer fee can add a substantial amount to the overall cost of a vehicle purchase. However, the availability of exemptions can provide significant savings for eligible buyers. It’s essential to carefully calculate these costs and consider your eligibility for any available exemptions.

Economic Impact

Florida’s vehicle sales tax structure has a notable economic impact on the state. The revenue generated from vehicle sales tax contributes significantly to the state’s budget, funding various public services and infrastructure projects. This revenue stream is a vital component of Florida’s economic health and stability.

Environmental Considerations

Florida’s vehicle sales tax structure also has environmental implications. The trade-in exemption, for instance, encourages the replacement of older vehicles with newer, more efficient models. This can lead to reduced emissions and a positive impact on the state’s environmental footprint. Additionally, the disability exemption promotes the use of accessible vehicles, supporting a more inclusive and sustainable transportation system.

Navigating the Process

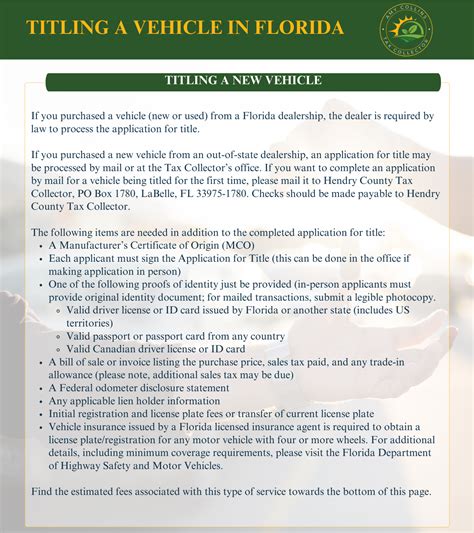

Understanding the intricacies of Florida’s vehicle sales tax is the first step, but navigating the process is equally important. From the initial purchase to the final registration, there are several steps to ensure a smooth and compliant transaction.

Purchase and Documentation

When purchasing a vehicle in Florida, ensure that the sales contract clearly outlines the purchase price, any applicable fees, and the sales tax. This documentation is crucial for both your records and for the registration process. If you’re eligible for any exemptions, make sure to complete the necessary paperwork and provide the required documentation at the time of purchase.

Registration and Title Transfer

After purchasing your vehicle, you’ll need to register it with the Florida Department of Highway Safety and Motor Vehicles. This process involves submitting the necessary paperwork, including the sales contract and proof of insurance. The title transfer fee will be included in the registration process, and you’ll receive your vehicle’s title once the registration is complete.

Maintaining Compliance

To maintain compliance with Florida’s vehicle sales tax regulations, it’s essential to keep your records organized and up-to-date. This includes retaining your sales contract, registration documents, and any exemption paperwork. Regularly review your vehicle’s registration status and ensure that it remains current to avoid any penalties or complications.

Future Implications and Potential Changes

While Florida’s vehicle sales tax structure is currently stable, there are always potential changes on the horizon. The state’s revenue needs and economic conditions can influence future tax policies, and it’s important to stay informed about any proposed changes.

Potential Rate Changes

The 6% sales tax rate is currently a standard across Florida, but it’s not immune to potential changes. The state’s legislative body has the authority to adjust this rate, and it’s essential to monitor any proposed amendments. While a rate increase would impact the cost of vehicle ownership, a decrease could provide significant savings for buyers.

Exemption Adjustments

Florida’s exemptions are designed to provide relief to specific groups of buyers, but they are subject to change. The state may choose to expand or restrict these exemptions based on economic conditions and policy priorities. Staying informed about any changes to the exemption criteria is crucial for buyers who rely on these benefits.

Economic and Environmental Initiatives

Florida’s vehicle sales tax structure may also evolve in response to economic and environmental initiatives. For example, the state may introduce incentives or exemptions to promote the adoption of electric vehicles or other sustainable transportation options. These initiatives can have a significant impact on the cost and accessibility of certain vehicle types.

Conclusion

Florida’s vehicle sales tax structure is a critical aspect of vehicle ownership in the state. From the uniform 6% sales tax rate to the various exemptions and additional fees, it’s a complex system that requires careful consideration. By understanding the specifics of Florida’s vehicle sales tax, buyers can make informed decisions and navigate the process with confidence.

Whether you're a resident or a prospective buyer, staying informed about Florida's vehicle sales tax regulations is essential. The impact of these regulations extends beyond the initial purchase, influencing the economic, environmental, and social landscape of the state. By staying updated and proactive, you can ensure a smooth and compliant vehicle ownership experience in Florida.

How often does Florida update its vehicle sales tax rate?

+Florida’s vehicle sales tax rate is typically reviewed and updated annually by the state legislature. However, in recent years, there have been no significant changes to the rate.

Are there any online resources to calculate the sales tax on my vehicle purchase in Florida?

+Yes, there are several online calculators and tools available that can help you estimate the sales tax on your vehicle purchase. These tools take into account the purchase price, sales tax rate, and any applicable fees.

Can I apply for exemptions online, or do I need to visit a physical location?

+The process for applying for exemptions varies depending on the specific exemption. Some exemptions, like the military exemption, can be processed online, while others may require a visit to a designated office or dealership.

Are there any penalties for not paying the vehicle sales tax in Florida?

+Yes, failure to pay the vehicle sales tax in Florida can result in penalties and interest charges. It’s important to ensure that you pay the tax in a timely manner to avoid any additional fees.

Can I transfer the sales tax paid on my vehicle to another state if I move?

+The ability to transfer sales tax to another state depends on the specific state’s regulations. Some states may allow for a credit or exemption based on the sales tax paid in Florida, while others may require you to pay the sales tax again.