Where Do You Send Nys Tax Returns

Navigating the intricacies of state tax systems can be a challenging task, especially for those who are new to the process or for individuals with complex financial situations. New York State, being one of the most populous and economically diverse states in the US, presents a unique set of rules and regulations when it comes to filing tax returns. Understanding where and how to send your New York State tax returns is crucial to ensure timely and accurate filing, which can save you time, money, and potential legal troubles.

The Importance of Properly Filing Your NYS Tax Returns

Before delving into the specifics of where to send your NYS tax returns, it’s essential to recognize the significance of accurate and timely filing. New York State has a comprehensive tax system, encompassing various income streams, deductions, and credits. Filing your taxes correctly not only ensures compliance with state laws but also allows you to maximize your potential tax refunds or minimize any tax liabilities.

Moreover, timely filing is crucial to avoid late fees, interest charges, and potential penalties. New York State offers various filing options, each with its own advantages and considerations. Understanding these options and choosing the right one for your situation is key to a seamless and stress-free tax filing experience.

Understanding the NYS Tax Filing Options

New York State provides several methods for filing tax returns, catering to different preferences and circumstances. These options include online filing, paper filing, and e-filing through authorized software providers. Each method has its own set of advantages and considerations, and choosing the right one can significantly impact the efficiency and accuracy of your tax filing.

Online Filing

The most common and convenient method for filing NYS tax returns is through the state’s official website. The online filing system, known as NYS e-file, offers a user-friendly interface that guides taxpayers through the process of completing and submitting their tax forms electronically. This method is particularly advantageous for those who are comfortable with technology and prefer the convenience of filing from home.

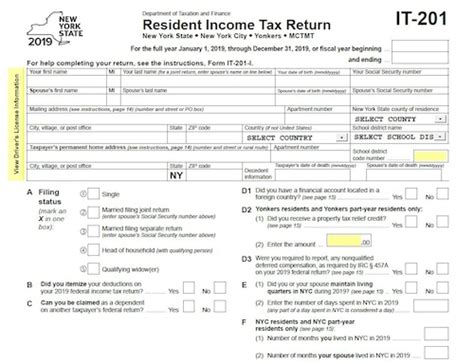

NYS e-file supports various tax forms, including the IT-201 for individual income tax returns and the IT-203 for part-year or nonresident income tax returns. The system automatically calculates taxes owed or refunds due, reducing the risk of errors and simplifying the filing process.

Paper Filing

For taxpayers who prefer a more traditional approach or have complex tax situations, paper filing is an alternative. New York State provides downloadable tax forms, such as the IT-201 and IT-203, which can be printed, completed, and mailed to the appropriate processing center. While this method may be more time-consuming and requires manual calculation of taxes, it offers a sense of control and flexibility for those who prefer a physical record of their tax filing.

E-Filing through Authorized Software Providers

For taxpayers who seek additional support or have more complex tax situations, e-filing through authorized software providers can be a viable option. These software solutions, such as TurboTax or H&R Block, offer guided tax preparation and filing services, ensuring accuracy and simplifying the process. Many of these providers also offer audit support and additional tax-related services.

Where to Send Your NYS Tax Returns

Now that we’ve explored the different filing options, let’s focus on where to send your NYS tax returns based on the chosen filing method.

Online Filing (NYS e-file)

When filing your NYS tax returns online through the NYS e-file system, you won’t need to worry about sending physical forms or documents. The entire process is electronic, and once you’ve completed and submitted your tax return, you’ll receive a confirmation that your return has been successfully transmitted.

It's important to note that the NYS e-file system requires certain security measures, such as a Personal Identification Number (PIN) or an Electronic Filing Identification Number (EFIN) for professional preparers. These measures ensure the security and integrity of your tax information.

Paper Filing

If you opt for paper filing, it’s crucial to send your completed tax forms to the correct address. New York State has designated processing centers for different types of tax returns, and sending your return to the wrong address can cause delays in processing.

For individual income tax returns (IT-201), the mailing address is:

New York State Department of Taxation and Finance

P.O. Box 15564

Albany, NY 12212-5564

For part-year or nonresident income tax returns (IT-203), the mailing address is slightly different:

New York State Department of Taxation and Finance

P.O. Box 15565

Albany, NY 12212-5565

Ensure that you include all necessary documents, such as W-2 forms, 1099s, and any other relevant tax information, in your mailing. It's also advisable to use a trackable mailing service to ensure your return reaches the processing center safely.

E-Filing through Authorized Software Providers

When you choose to e-file your NYS tax returns through authorized software providers, the process of sending your return is typically handled automatically by the software. These providers have established secure connections with the NYS e-file system, ensuring a seamless and accurate transmission of your tax information.

However, it's important to choose a reputable and authorized software provider to ensure the security and privacy of your tax data. Additionally, keep in mind that some providers may charge fees for their services, so it's advisable to compare different options and choose one that best suits your needs and budget.

Key Considerations for Filing NYS Tax Returns

While understanding where to send your NYS tax returns is crucial, there are several other factors to consider to ensure a smooth and successful filing process.

Deadlines and Penalties

New York State has specific deadlines for filing tax returns, and missing these deadlines can result in penalties and interest charges. The standard deadline for filing individual income tax returns is typically April 15th, but this can be extended under certain circumstances. It’s crucial to be aware of these deadlines and plan your filing accordingly to avoid unnecessary fees and penalties.

Payment Options

When filing your NYS tax returns, you may owe taxes or be entitled to a refund. The state offers various payment options, including direct debit, credit card, and electronic funds transfer (EFT). If you owe taxes, choosing the right payment method can help you manage your finances effectively and avoid late payment penalties.

Tax Credits and Deductions

New York State offers a range of tax credits and deductions that can significantly impact your tax liability. From the New York State Child and Dependent Care Credit to the Real Estate Tax Credit, understanding the available credits and deductions can help you maximize your tax savings. It’s essential to research and claim all applicable credits and deductions when filing your tax return.

Seeking Professional Assistance

For taxpayers with complex financial situations, small businesses, or those who simply prefer professional guidance, seeking the assistance of a tax professional can be beneficial. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are authorized to represent taxpayers before the IRS and NYS Department of Taxation and Finance. They can provide expert advice, ensure accurate filing, and offer strategies to minimize tax liabilities.

Frequently Asked Questions

What happens if I miss the NYS tax filing deadline?

+Missing the NYS tax filing deadline can result in penalties and interest charges. The state may impose a late filing penalty of up to 5% of the tax owed for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax balance from the original due date until the tax is paid in full.

Can I file my NYS tax return electronically even if I don’t owe taxes?

+Yes, you can file your NYS tax return electronically even if you don’t owe taxes. The NYS e-file system allows for the filing of both tax returns with refunds and those with no tax liability. This method is efficient, secure, and provides a confirmation of successful transmission.

Are there any advantages to filing my NYS tax return by paper instead of electronically?

+Filing your NYS tax return by paper may be preferable for those who prefer a physical record of their tax filing or have complex tax situations that require manual calculations. However, electronic filing through the NYS e-file system or authorized software providers is generally more efficient, accurate, and secure.