Child Tax Credit Senate

The Child Tax Credit (CTC) has been a topic of significant interest and debate in the United States, with its expansion and potential future modifications sparking discussions among policymakers, economists, and families alike. In this comprehensive article, we delve into the details of the Child Tax Credit, its historical context, recent developments in the Senate, and its potential impact on American families.

Understanding the Child Tax Credit: A Historical Perspective

The Child Tax Credit is a federal tax benefit designed to provide financial support to families with children. It was first introduced as part of the Taxpayer Relief Act of 1997, signed into law by President Bill Clinton. The initial purpose of the CTC was to offset the costs associated with raising children and to provide a form of tax relief for parents.

Over the years, the Child Tax Credit has undergone several revisions and expansions. One of the most notable changes occurred in 2001 when the credit amount was increased and made partially refundable. This meant that even low-income families who did not owe federal income tax could still receive a portion of the credit as a refund.

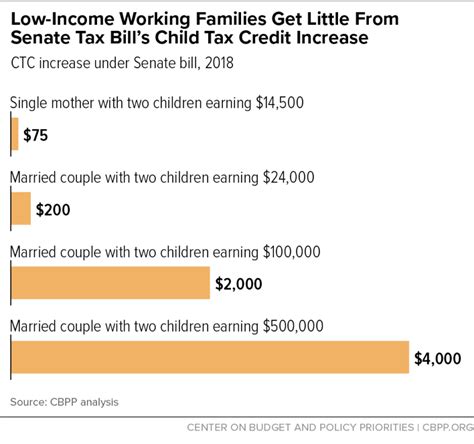

The CTC has since become a vital tool in the fight against child poverty, offering a crucial financial boost to millions of American families. According to the Center on Budget and Policy Priorities, the credit has proven effective in reducing child poverty rates, particularly among families with the lowest incomes.

| Year | CTC Amount | Refundable Portion |

|---|---|---|

| 1997 | $500 per child | Not refundable |

| 2001 | $1,000 per child | $400 refundable |

| 2021 | $3,600 per child under 6, $3,000 per child ages 6-17 | Up to $3,600 refundable |

The recent expansion of the Child Tax Credit in 2021, as part of the American Rescue Plan, has brought the credit to the forefront of political and social discourse.

The Senate’s Role in Shaping the Child Tax Credit

The United States Senate has played a pivotal role in shaping the future of the Child Tax Credit. In 2021, the Senate passed the American Rescue Plan, which included a significant enhancement of the CTC.

The key provisions of the enhanced Child Tax Credit included:

- Increased Credit Amount: The credit amount was raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17.

- Fully Refundable: The entire credit became refundable, ensuring that even families with no taxable income could receive the full benefit.

- Monthly Advance Payments: For the first time, families had the option to receive half of their CTC as monthly advance payments, providing a steady stream of income throughout the year.

The Senate's decision to expand the CTC was driven by several factors, including the desire to provide immediate relief to families struggling financially due to the COVID-19 pandemic. The enhanced credit was seen as a powerful tool to stimulate the economy and support children's well-being.

Bipartisan Support and Challenges

Interestingly, the expansion of the Child Tax Credit in the Senate received bipartisan support, with many recognizing its potential to lift millions of children out of poverty. However, the path to passing this legislation was not without challenges.

One of the primary concerns raised by some senators was the cost of the expanded CTC. To address this, the Senate considered various proposals to fund the program, including raising taxes on high-income earners and implementing new revenue streams.

Additionally, there were discussions about the duration of the enhanced credit. While some senators advocated for a temporary expansion to provide immediate relief, others pushed for making the changes permanent to ensure long-term benefits for families.

The Impact of Senate Decisions

The Senate’s decision to enhance the Child Tax Credit had a profound impact on American families. According to estimates, the expanded CTC lifted approximately 3 million children out of poverty in 2021 alone.

The monthly advance payments proved to be a game-changer for many households. Families reported using the additional income for essential expenses such as groceries, utilities, and childcare. The stability provided by these payments helped reduce financial stress and improve overall well-being.

Furthermore, the enhanced CTC had a positive economic impact. Research suggests that the increased purchasing power of families led to a boost in local economies, with businesses seeing an increase in consumer spending.

Future Prospects and Potential Modifications

As the enhanced Child Tax Credit program nears its scheduled expiration, the Senate is once again at the forefront of discussions regarding its future.

Proposals for extending or modifying the CTC vary, with some senators advocating for a permanent expansion, while others suggest a more targeted approach. One idea gaining traction is the concept of a "Child Allowance," which would provide a regular monthly payment to families with children, regardless of their income level.

The future of the Child Tax Credit is closely tied to broader debates about social safety nets and the role of government in supporting families. The Senate's decisions will have long-lasting implications for millions of American children and their families.

Expert Insights

Analyzing the Potential Impact

If the enhanced Child Tax Credit were to become permanent, experts project a significant and lasting reduction in child poverty rates. The Center on Poverty and Social Policy at Columbia University estimates that a permanent expansion could cut child poverty by nearly 40%.

Furthermore, the stability provided by a permanent CTC could lead to improved educational outcomes for children. Research suggests that consistent financial support during a child's early years can positively impact their cognitive development and future academic success.

However, there are also considerations regarding the cost and sustainability of a permanent expansion. Finding a balance between providing adequate support to families and ensuring fiscal responsibility remains a challenge for policymakers.

Conclusion: The Child Tax Credit’s Impact on Families

The Child Tax Credit has evolved from a tax relief measure to a powerful tool in the fight against child poverty. The Senate’s role in shaping its future is critical, as their decisions directly impact the financial well-being of millions of American families.

The recent enhancements to the CTC have demonstrated its potential to make a significant difference in the lives of children and their families. As the debate continues, it is essential to consider the long-term impact of these policies on the nation's most vulnerable populations.

Stay tuned for further developments as the Senate weighs the future of the Child Tax Credit, a decision that will shape the financial landscape for families across the United States.

What is the Child Tax Credit?

+The Child Tax Credit (CTC) is a federal tax benefit designed to provide financial support to families with children. It offers a tax credit for eligible families, helping to offset the costs of raising children.

How has the Child Tax Credit evolved over time?

+The CTC has undergone several revisions since its inception in 1997. It has been expanded and made more accessible to low-income families, with the most recent enhancement in 2021 providing higher credit amounts and monthly advance payments.

What impact did the Senate’s decision on the CTC have?

+The Senate’s decision to enhance the CTC had a significant impact, lifting millions of children out of poverty and providing financial stability to families. The monthly advance payments proved to be a crucial support during challenging economic times.