Indiana Property Tax Bill

The Indiana Property Tax Bill is an essential aspect of the state's revenue generation system, impacting property owners across the state. This comprehensive guide delves into the intricacies of the Indiana Property Tax Bill, providing an in-depth analysis of its structure, calculation, and implications for property owners. From understanding the assessment process to exploring strategies for managing tax liabilities, this article aims to equip readers with the knowledge needed to navigate this critical financial obligation effectively.

Understanding the Indiana Property Tax Bill

The Indiana Property Tax Bill is an annual assessment levied on real estate property owners within the state. It is a significant source of revenue for local governments, school districts, and various taxing entities, funding essential services and infrastructure. The tax is calculated based on the assessed value of the property and the applicable tax rates set by these entities.

The assessment process begins with the determination of a property's assessed value, which is influenced by factors such as location, size, and market conditions. This value is then multiplied by the tax rate to arrive at the property tax bill. It is important to note that the tax rate can vary significantly across different areas within Indiana, as it is determined by local authorities.

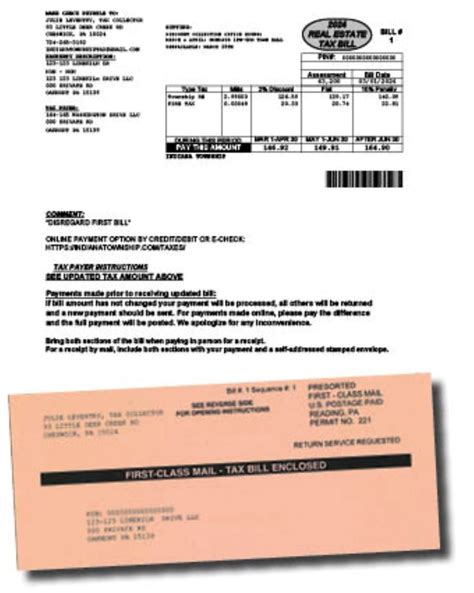

The Indiana Property Tax Bill is typically due twice a year, with payments made in the spring and fall. Property owners receive a tax statement detailing the assessed value, tax rate, and the total amount due. Failure to pay the tax bill on time can result in penalties and interest, and in extreme cases, the property may be subject to a tax sale.

The Assessment Process

The assessment process in Indiana is conducted by the county assessor’s office. Assessors are responsible for determining the fair market value of properties within their jurisdiction. This value is then used as the basis for calculating property taxes.

Assessment involves a comprehensive evaluation of the property, including its physical characteristics, recent sales data of similar properties, and market trends. Assessors may conduct on-site visits or utilize aerial photography and other remote sensing technologies to gather the necessary information. The assessed value is then adjusted to account for any improvements or depreciations since the last assessment.

| Assessment Type | Description |

|---|---|

| General Assessment | Conducted every odd-numbered year, this assessment covers all properties in the county. |

| Partial Reassessment | Performed in even-numbered years, this reassessment targets specific properties with recent improvements or changes in value. |

| Informal Review | Property owners can request an informal review of their assessment if they believe it is inaccurate. |

Tax Rate and Levy Calculation

The tax rate in Indiana is determined by the taxing entities, which include local governments, school corporations, and special taxing districts. These entities decide on the amount of revenue they need to generate to fund their operations and then set the tax rate accordingly.

The tax rate is expressed as a percentage or a dollar amount per $100 of assessed value. For example, a tax rate of $5 per $100 of assessed value means that for every $100 of the property's assessed value, $5 in taxes is owed. This rate can vary widely across different counties and even within the same county, depending on the services provided and the financial needs of the taxing entities.

The tax levy is calculated by multiplying the assessed value of the property by the tax rate. For instance, if a property has an assessed value of $200,000 and the tax rate is $5 per $100, the tax levy would be $10,000.

Managing Your Property Tax Liability

Understanding and managing your property tax liability is crucial for financial planning and ensuring compliance with Indiana’s tax regulations. Here are some strategies and considerations to help you navigate your property tax obligations effectively.

Reviewing Your Assessment

One of the first steps in managing your property tax liability is to carefully review your assessment. Assessments are based on the property’s value, so it’s important to ensure that the assessed value accurately reflects the property’s current market value. If you believe your property has been overvalued, you can request an informal review or appeal the assessment with the county assessor’s office.

During the review process, you can present evidence such as recent sales of comparable properties, property improvements or repairs, or other factors that may impact the property's value. It's important to gather this information in advance and present a strong case to support your appeal.

Understanding Tax Exemptions and Deductions

Indiana offers various tax exemptions and deductions that can help reduce your property tax liability. These include homestead deductions, veterans’ exemptions, and agricultural land deductions, among others. Understanding the eligibility criteria and applying for these exemptions can significantly impact your tax bill.

For example, the homestead deduction reduces the assessed value of your primary residence, resulting in a lower tax bill. To qualify, you must own and occupy the property as your primary residence and meet certain income requirements. The deduction amount varies based on income and age, so it's important to review the specific criteria for your situation.

Additionally, agricultural land may be eligible for a lower assessment if it is actively used for agricultural purposes. This exemption can provide substantial savings for landowners who meet the necessary criteria.

| Exemption/Deduction | Description |

|---|---|

| Homestead Deduction | Reduces assessed value of primary residence based on income and age. |

| Veterans' Exemption | Provides a tax exemption for eligible veterans and their spouses. |

| Agricultural Land Deduction | Lowers assessment for land actively used for agriculture. |

| Senior Citizen Deduction | Reduces tax liability for seniors based on income. |

Payment Options and Tax Relief Programs

Indiana offers several payment options and tax relief programs to assist property owners in managing their tax liabilities. These options include:

- Installment Plans: Property owners can request to pay their tax bill in installments to avoid a large, one-time payment.

- Senior Citizen Tax Relief: Eligible seniors may qualify for a reduction in their property taxes based on income and age.

- Disabled Veteran Exemption: Veterans with a service-connected disability may be exempt from property taxes.

- Property Tax Deduction: Indiana residents can deduct a portion of their property taxes from their state income taxes.

It's important to research and understand the eligibility criteria for these programs and ensure you meet the necessary requirements to take advantage of the available benefits.

Strategies for Reducing Property Taxes

While the Indiana Property Tax Bill is a necessary obligation, there are strategies property owners can employ to potentially reduce their tax liability. These strategies involve a combination of understanding the assessment process, utilizing exemptions, and implementing cost-saving measures.

Appealing Your Assessment

If you believe your property has been overassessed, you have the right to appeal the assessment. The appeal process typically involves submitting a written request to the county assessor’s office, providing evidence to support your claim, and attending a hearing to present your case. It’s important to gather comprehensive evidence, such as recent sales data of comparable properties, to strengthen your appeal.

By appealing your assessment, you may be able to reduce the assessed value of your property, which directly impacts your tax liability. It's a proactive step that can lead to significant savings over time.

Maximizing Exemptions and Deductions

Indiana offers a range of exemptions and deductions that can reduce your property tax bill. It’s crucial to understand these options and ensure you are taking advantage of all available benefits. For example, the homestead deduction can significantly lower your tax liability if you qualify. Similarly, agricultural land exemptions can provide substantial savings for landowners.

Stay informed about the eligibility criteria and application processes for these exemptions. By staying up-to-date and proactively applying for the relevant benefits, you can effectively manage your property tax obligations.

Implementing Cost-Saving Measures

Beyond exemptions and appeals, there are other cost-saving measures property owners can implement to reduce their tax liability. These measures may include:

- Home Improvements: Certain home improvements, such as energy-efficient upgrades or renovations, may increase your property's value but also qualify for tax incentives or deductions.

- Landscaping and Maintenance: Well-maintained properties can command higher values, but it's important to keep records of expenses to support any potential appeals or exemptions.

- Renting Out Property: If you own multiple properties, renting out a secondary property can generate income and potentially offset some of the tax liability.

By strategically investing in your property and staying informed about tax incentives, you can effectively manage your tax obligations while also improving the value and appeal of your real estate assets.

The Impact of Property Taxes on Real Estate Investments

Property taxes are an essential consideration for real estate investors, as they directly impact the profitability and long-term viability of investment properties. Understanding the implications of property taxes is crucial for making informed investment decisions and managing cash flow effectively.

Impact on Cash Flow and Returns

Property taxes are a recurring expense that must be factored into an investor’s cash flow projections. High property taxes can significantly reduce the net operating income (NOI) of an investment property, impacting the overall return on investment (ROI). Investors must carefully evaluate the tax liability associated with a property to ensure it aligns with their financial goals and risk tolerance.

For example, consider an investment property with a high assessed value and correspondingly high property taxes. In this scenario, the investor may need to allocate a larger portion of their income to cover tax obligations, potentially reducing the cash flow available for other expenses or investments.

Strategic Property Management and Tax Planning

Real estate investors can employ various strategies to manage their property tax liabilities effectively. These strategies include:

- Appealing Assessments: As discussed earlier, appealing an assessment can lead to a reduced tax bill. Investors should stay informed about the assessment process and consider appealing if they believe the assessed value is inaccurate.

- Utilizing Tax Incentives: Many states, including Indiana, offer tax incentives for certain types of properties or investments. Investors should research and take advantage of these incentives to reduce their tax burden.

- Managing Tenant Occupancy: For rental properties, managing tenant occupancy can impact the property's assessed value and, consequently, the tax liability. A well-managed rental property with high occupancy rates may command a higher assessed value, but it can also provide a larger tax base to offset expenses.

By actively managing their properties and staying informed about tax regulations and incentives, investors can optimize their tax obligations and enhance the overall financial performance of their real estate investments.

The Future of Property Taxation in Indiana

As Indiana continues to evolve, the property tax landscape is also subject to change. Staying informed about potential reforms and initiatives is crucial for property owners and investors to adapt to future developments effectively.

Potential Reforms and Initiatives

Indiana has a history of implementing reforms aimed at improving the fairness and efficiency of the property tax system. Some potential reforms that may impact property owners in the future include:

- Assessment Reform: Efforts to streamline the assessment process and ensure more accurate and consistent valuations could impact property owners' tax liabilities.

- Tax Rate Adjustments: Local governments and taxing entities may propose changes to tax rates to address budgetary needs or economic shifts.

- Exemption and Deduction Revisions: The state may consider expanding or modifying existing exemptions and deductions to support specific industries or populations.

Staying engaged with local government initiatives and attending public meetings can provide valuable insights into potential changes and allow property owners to voice their concerns or support.

Preparing for Future Changes

To prepare for future changes in property taxation, property owners can take proactive steps such as:

- Stay Informed: Subscribe to newsletters or follow local government websites to receive updates on proposed changes and initiatives.

- Build Relationships: Engage with local officials and express your concerns or support for proposed reforms. Building relationships can help ensure your voice is heard.

- Review and Optimize: Regularly review your property's assessment and tax obligations. Ensure you are taking advantage of all available exemptions and deductions to minimize your tax liability.

By staying informed and actively participating in the discussion around property taxation, property owners can better navigate future changes and continue to manage their tax obligations effectively.

How often are property assessments conducted in Indiana?

+Property assessments in Indiana are conducted every odd-numbered year, resulting in a general assessment covering all properties in the county. In even-numbered years, partial reassessments are performed on specific properties with recent improvements or changes in value.

What happens if I don’t pay my property taxes on time in Indiana?

+Failure to pay your property taxes on time in Indiana can result in penalties, interest, and potential legal consequences. In extreme cases, the property may be subject to a tax sale to recover the outstanding taxes.

Are there any tax relief programs available for seniors in Indiana?

+Yes, Indiana offers the Senior Citizen Tax Relief program, which provides a reduction in property taxes for eligible seniors based on their income and age. This program helps alleviate the tax burden for older adults.