Comparing S Corp Tax Brackets to LLC Tax Benefits

Choosing the appropriate business structure can significantly influence a company’s financial health, legal obligations, and operational flexibility. Among the myriad options, Subchapter S Corporations (S Corps) and Limited Liability Companies (LLCs) stand out for their distinct tax benefits and structural advantages. As practitioners and entrepreneurs strive for optimal tax strategies, understanding the nuanced differences between S Corp tax brackets and LLC tax benefits becomes essential. This field guide synthesizes current tax codes, practical applications, and expert insights to assist in making well-informed decisions rooted in comprehensive analysis.

Understanding Tax Frameworks: S Corp Brackets Versus LLC Benefits

At the core of business taxation lies a fundamental divergence in how S Corps and LLCs are treated under federal income tax law. The distinction primarily involves the allocation of income, self-employment taxes, and the flexibility of profit distribution. An in-depth comprehension of the tax brackets applicable to S Corps and the strategic advantages of LLC tax benefits is vital for optimizing fiscal outcomes and ensuring compliance.

S Corp Tax Brackets: An Evolution in Progressive Taxation

The taxation of S Corps is characterized by its pass-through nature, which means that income is taxed at the shareholder level rather than at the corporate level. The Internal Revenue Service (IRS) stipulates that the net income or loss of the S Corp flows directly through to its shareholders, who then report it on their individual tax returns. This structure subjects S Corp income to the individual tax brackets, which are progressive and vary based on income levels and filing status.

The current federal tax brackets for individuals, as of 2024, range from 10% to 37%, affecting shareholders on income derived from the S Corp. For example, in 2024, single filers with taxable income up to 11,000 are taxed at 10%, while income exceeding 578,125 reaches the 37% bracket. S Corps themselves are not taxed separately; instead, their distributions reflect these brackets directly onto shareholder tax liabilities. Consequently, the distribution of income within these brackets can be a strategic tool for tax planning, particularly for businesses with fluctuating or seasonal income.

| Relevant Category | Substantive Data |

|---|---|

| Federal Income Tax Brackets (2024) | 10% to 37% based on income levels and filing status |

| Top Marginal Bracket | 37% for incomes over $578,125 (single filer) |

| Number of Brackets | 7 progressive brackets for individual taxpayers |

LLC Tax Benefits: Flexibility in Profit Allocation and Self-Employment Taxes

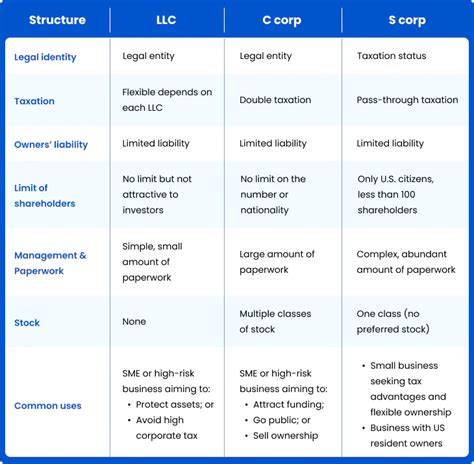

LLCs are designed for versatile operation, granting owners—called members—the ability to choose how they are taxed. By default, single-member LLCs are treated as sole proprietorships, and multi-member LLCs as partnerships. These structures provide pass-through taxation similar to S Corps, but with additional strategic benefits and fewer restrictions.

One of the hallmark advantages of LLCs lies in their tax flexibility. Members may opt to have the LLC taxed as a corporation (either C or S), or remain as a disregarded entity for single-member LLCs. This choice allows for tailored tax planning that aligns with business goals. For example, a multi-member LLC can plan distributions in a manner that minimizes employment taxes or maximizes favorable tax brackets depending on the members’ personal income levels.

Moreover, LLCs enable members to take advantage of self-employment tax benefits. Since members are often considered self-employed, they typically must pay self-employment taxes (15.3% combined Social Security and Medicare taxes) on the net income. However, through strategic salary distributions and profit-sharing arrangements, LLC owners can sometimes mitigate these taxes, especially if taxed as an S Corp, where only salaries are subject to employment taxes, not distributions.

| Relevant Category | Substantive Data |

|---|---|

| Self-Employment Tax Rate | 15.3% on net earnings up to $160,200 (2024), with additional Medicare taxes above thresholds |

| Tax Classification Options | Disregarded entity, partnership, S Corp, or C Corp |

| Profit-Sharing Flexibility | Individualized allocations independent of ownership percentage when structured appropriately |

Comparative Analysis: Key Divergences and Strategic Implications

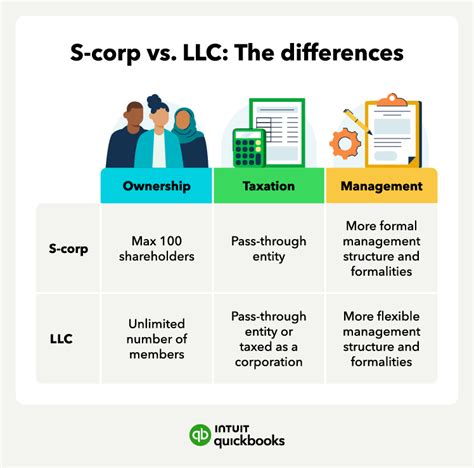

While both structures offer pass-through taxation, their differences are notable in areas like income distribution, tax bracket application, and compliance complexity. These distinctions influence decision-making, particularly for businesses balancing growth, owner compensation, and long-term planning.

Income Recognition and Distribution

S Corps restrict profit and loss allocations to shareholder proportionate interests, aligning with strict IRS guidelines. Distributions are typically taxed at the individual’s applicable tax brackets, allowing for precise tax planning. Conversely, LLCs endowed with flexible profit-sharing methods enable members to allocate income disproportionately, potentially optimizing tax brackets or aligning with operational contributions.

Tax Brackets and Rate Optimization

The progressive nature of individual tax brackets applies directly to S Corp income, prompting owners to consider income splitting, salary vs. distribution strategies, and timing. LLCs, through strategic elections and profit allocations, may offer more latitude to optimize overall tax position, especially if structured to minimize high-bracket income in high earners.

Operational and Compliance Considerations

Complexity varies: S Corps require adherence to formalities such as shareholder meetings and limited eligibility (e.g., 100 shareholder limit, only individuals as shareholders). LLCs generally face fewer formalities, allowing for streamlined operation but potentially requiring more sophisticated tax planning to navigate self-employment taxes and member distributions.

Key Points

- Tax brackets influence how S Corp income is effectively taxed, enabling strategic income timing and distribution decisions.

- LLC flexibility in profit sharing combined with election options offers tailored tax advantages, including self-employment tax mitigation.

- Operational simplicity favors LLCs, but complex tax strategies favor S Corps in certain high-income scenarios.

- Professional consultation remains essential to optimize benefits and ensure compliance across structures.

- Long-term considerations involve growth projections, ownership succession, and industry-specific regulations, all impacting the strategic choice.

Strategic Decision-Making: Applying Knowledge in Practice

In choosing between an S Corp and LLC, practitioners must consider a spectrum of factors—from immediate tax savings to long-term operational flexibility. For high-income entrepreneurs, the ability to contain self-employment taxes by electing S Corp status is often advantageous, provided they are comfortable with requisite formalities and restrictions. Conversely, startups or businesses valuing operational simplicity and flexible profit allocations may favor LLCs, especially when planning for scaling and ownership diversification.

Methodological Approaches for Optimal Structuring

Effective tax planning encompasses several key steps, including:

- Analyzing projected income volumes and tax bracket implications.

- Assessing the feasibility of salary versus distribution strategies within S Corps.

- Evaluating the impact of profit-sharing flexibility in LLCs on overall tax position.

- Consulting with tax professionals to model different scenarios considering state-specific regulations and future growth.

Potential Limitations and Common Pitfalls

Despite numerous advantages, both structures present potential pitfalls. S Corps face restrictions such as ownership eligibility and formal compliance requirements. LLCs, while flexible, may inadvertently expose owners to higher self-employment taxes if not properly structured. Misalignment between chosen structure and business goals can result in increased tax burdens or legal complications.

Moreover, recent legislative changes and IRS audits targeting disguised salary schemes caution practitioners to maintain transparent and compliant arrangements.

Conclusion: Navigating the Crossroads of Tax Strategy

Marrying the benefits of S Corp tax brackets with the flexible advantages of LLC tax benefits demands a nuanced approach rooted in current tax law, business realities, and strategic aims. While both options offer pathways to optimize taxation, the optimal choice hinges on specific income profiles, operational needs, and long-term visions. Ongoing consultation with tax and legal experts, along with meticulous scenario planning, remains the cornerstone of sustained tax efficiency.

What is the main difference between S Corp brackets and LLC tax benefits?

+The primary difference is that S Corp income is taxed at individual progressive tax brackets, while LLCs offer flexibility in profit-sharing and can also be taxed as partnerships or corporations, enabling strategic tax planning.

Can LLCs always avoid self-employment taxes?

+Not automatically; LLCs must elect S Corp taxation and ensure reasonable salary practices to minimize self-employment taxes legally. Without this, members typically pay self-employment taxes on all income.

Which structure is better for high-income earners?

+Typically, S Corps can offer tax savings through salary and distribution strategies, reducing self-employment taxes, but the decision depends on operational flexibility and compliance willingness.