Va Sales Tax

The Virginia sales tax is an essential component of the state's revenue system, contributing significantly to its overall economic landscape. Understanding the intricacies of this tax is crucial for both businesses and consumers, as it impacts various sectors and daily transactions. This comprehensive guide aims to delve into the specifics of the Virginia sales tax, exploring its history, current rates, applicable goods and services, exemptions, and its broader economic implications.

History and Evolution of Virginia Sales Tax

The origins of the Virginia sales tax can be traced back to the early 20th century, with the first formal sales tax legislation enacted in 1948. Initially, the tax was imposed at a 3% rate, primarily to generate revenue for the state’s growing infrastructure and education needs. Over the years, the tax rate has undergone several adjustments, reflecting the evolving economic climate and the state’s fiscal requirements.

A significant milestone in the history of Virginia's sales tax was the introduction of locality-specific tax rates in 1966. This move granted local governments the authority to levy additional sales taxes to fund their specific projects and initiatives. Consequently, the state's sales tax landscape became more complex, with varying rates across different jurisdictions.

In recent years, the Virginia sales tax has seen further modifications, with the most recent changes taking effect in 2022. These adjustments aimed to address the state's fiscal challenges while also ensuring a competitive business environment. The state government also introduced measures to streamline the tax collection process, enhancing compliance and efficiency.

Current Virginia Sales Tax Rates

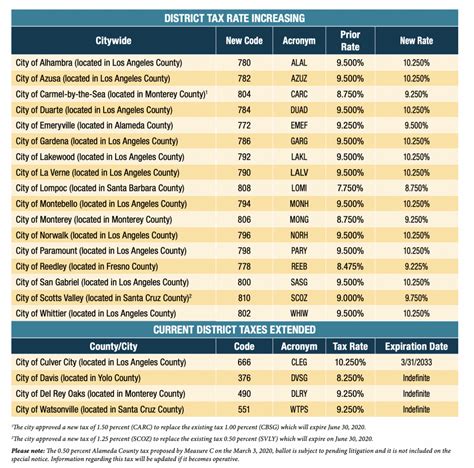

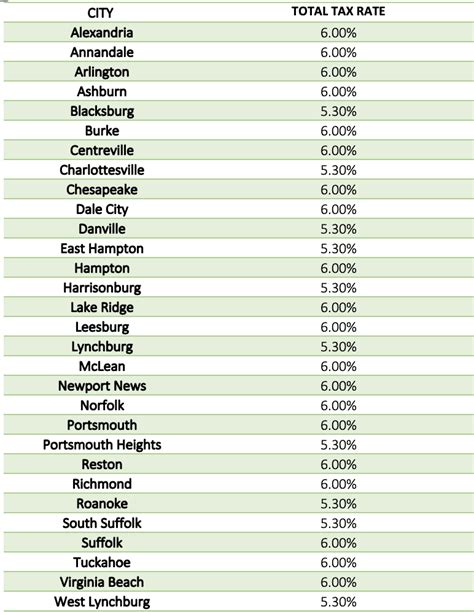

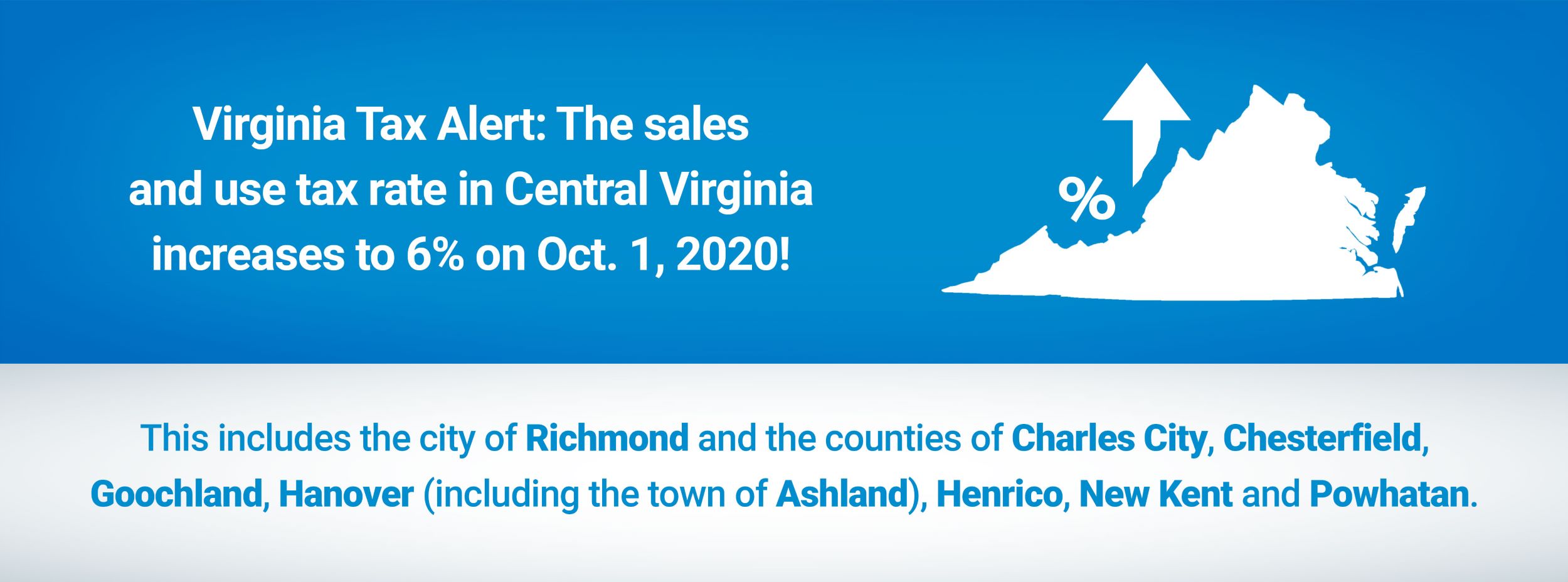

As of my last update in January 2023, the base Virginia sales tax rate stands at 4.3%, applicable across the state. However, it’s important to note that this base rate is often combined with local sales tax rates, resulting in a combined sales tax rate that can vary significantly from one locality to another.

For instance, in the city of Norfolk, the combined sales tax rate is 6.8%, with a local tax rate of 2.5% added to the state's base rate. On the other hand, in the city of Chesapeake, the combined sales tax rate is 6.3%, with a local tax rate of 2% applied. These variations in local tax rates highlight the complexity of the Virginia sales tax system and the need for businesses and consumers to stay informed about the specific rates applicable in their areas.

It's also worth mentioning that certain localities in Virginia have additional tax rates for specific purposes. For example, the City of Richmond imposes a 0.25% meals tax, while the City of Newport News levies a 0.75% tourism tax. These special taxes are designed to fund targeted initiatives and projects within these localities.

Goods and Services Subject to Virginia Sales Tax

The Virginia sales tax applies to a broad range of tangible personal property and selected services. This includes items like clothing, electronics, furniture, and groceries. Additionally, certain services such as repairs, installations, and admissions to entertainment events are also subject to sales tax.

However, it's important to note that not all goods and services are taxed at the same rate. For instance, prepared food and beverages are taxed at a reduced rate of 1.5% in most localities. This reduced rate is intended to encourage tourism and support the hospitality industry.

Furthermore, certain items are specifically exempt from sales tax in Virginia. These exemptions often relate to essential items or services that the state wants to promote or make more accessible to its residents. For example, prescription medications, non-prepared food (such as raw produce), and educational materials are typically exempt from sales tax.

Virginia Sales Tax Exemptions and Special Considerations

Virginia’s sales tax system includes several exemptions and special considerations that businesses and consumers should be aware of. These exemptions are designed to support specific industries, promote economic growth, and alleviate the tax burden on certain sectors.

Agriculture and Forestry Exemptions

Virginia recognizes the importance of its agricultural and forestry sectors and has implemented sales tax exemptions to support these industries. Agricultural equipment, supplies, and inputs are generally exempt from sales tax, helping to reduce costs for farmers and promote agricultural productivity.

Similarly, forestry-related equipment and supplies are also exempt from sales tax. This exemption encourages sustainable forestry practices and supports the state's timber industry.

Manufacturing and Wholesale Exemptions

The manufacturing sector is a key driver of Virginia’s economy, and the state offers several sales tax exemptions to support this industry. Manufacturing machinery and equipment are exempt from sales tax, as are raw materials used in the manufacturing process. These exemptions aim to reduce costs for manufacturers and enhance their competitiveness in the global market.

Additionally, wholesale transactions are generally exempt from sales tax in Virginia. This exemption ensures that businesses can purchase goods for resale without incurring unnecessary tax burdens.

Government and Nonprofit Exemptions

Virginia extends sales tax exemptions to government entities and certain nonprofit organizations. This includes state, local, and federal government agencies, as well as nonprofit organizations that are properly registered and meet specific criteria.

These exemptions recognize the important work of these entities and organizations and help them manage their budgets more effectively.

Remote Sellers and Marketplace Facilitators

With the rise of e-commerce, Virginia has implemented regulations for remote sellers and marketplace facilitators. Remote sellers, who sell goods into Virginia but have no physical presence in the state, are required to collect and remit sales tax on their transactions. This ensures a level playing field for in-state businesses and helps maintain fair competition.

Marketplace facilitators, such as large online platforms, are also responsible for collecting and remitting sales tax on behalf of their third-party sellers. This measure simplifies the tax collection process and enhances compliance.

Compliance and Enforcement in Virginia

The Virginia Department of Taxation plays a crucial role in ensuring compliance with sales tax regulations. The department employs a range of strategies to enforce tax laws, including audits, educational initiatives, and penalty assessments for non-compliance.

For businesses, it's essential to maintain accurate records of sales transactions and to remit sales tax payments in a timely manner. Failure to comply with sales tax regulations can result in significant penalties and interest charges.

Virginia also offers resources and support to help businesses understand and meet their sales tax obligations. The Department of Taxation provides guidance materials, workshops, and online tools to assist businesses in navigating the complexities of sales tax compliance.

Economic Impact and Future Considerations

The Virginia sales tax has a significant impact on the state’s economy, influencing consumer behavior, business operations, and government revenue. The revenue generated from sales tax is vital for funding public services, infrastructure projects, and education initiatives.

Looking ahead, several factors may influence the future of Virginia's sales tax. These include changes in consumer behavior, shifts in the economy, and evolving technologies. For instance, the growth of e-commerce and online sales presents unique challenges and opportunities for sales tax collection and enforcement.

Additionally, the state may consider policy changes to address emerging issues, such as the increasing use of digital services and the impact of remote work on sales tax jurisdiction. Balancing the need for revenue with the competitiveness of the business environment will be a key consideration for policymakers in the years to come.

Conclusion

The Virginia sales tax is a complex and dynamic component of the state’s fiscal system, with a rich history and ongoing evolution. Understanding the nuances of this tax is essential for businesses and consumers alike, as it impacts daily transactions and contributes to the state’s economic health.

As Virginia continues to adapt to changing economic conditions and technological advancements, the sales tax system will likely undergo further refinements. Staying informed about these changes will be crucial for all stakeholders, ensuring compliance, fairness, and economic prosperity.

What is the sales tax rate in Virginia for online purchases?

+

Online purchases in Virginia are subject to the same sales tax rates as in-store purchases. The applicable rate depends on the location where the goods are delivered or the services are provided. This includes both the state’s base sales tax rate and any applicable local tax rates.

Are there any sales tax holidays in Virginia?

+

Yes, Virginia occasionally offers sales tax holidays, typically during specific periods like back-to-school season. During these holidays, certain items are exempt from sales tax, making them a great time for consumers to save on essential purchases. The dates and items eligible for the tax holiday vary each year, so it’s important to stay updated.

How does Virginia handle sales tax for out-of-state businesses?

+

Out-of-state businesses that sell goods or services into Virginia are required to register with the Virginia Department of Taxation and collect sales tax on their transactions. This includes remote sellers and marketplace facilitators. The state has implemented laws to ensure these businesses comply with sales tax regulations, fostering a level playing field for in-state businesses.