Pa State Inheritance Tax

The Pennsylvania Inheritance Tax is a crucial aspect of estate planning and administration in the state, impacting both residents and non-residents who have received property from a Pennsylvania resident who has passed away. Understanding this tax is essential for individuals navigating the complexities of inheritance and ensuring compliance with state regulations.

An Overview of the Pennsylvania Inheritance Tax

The Pennsylvania Inheritance Tax is a tax imposed on certain transfers of property occurring due to an individual’s death. It is a type of transfer tax, distinct from estate taxes, and is calculated based on the relationship between the decedent and the beneficiary receiving the property. The tax is administered by the Pennsylvania Department of Revenue and is applicable to various types of property, including real estate, personal property, and intangible assets.

Pennsylvania is one of the few states in the U.S. that imposes an inheritance tax, adding an additional layer of complexity to estate planning for individuals with ties to the state. This tax is separate from the federal estate tax and is calculated and paid at the state level.

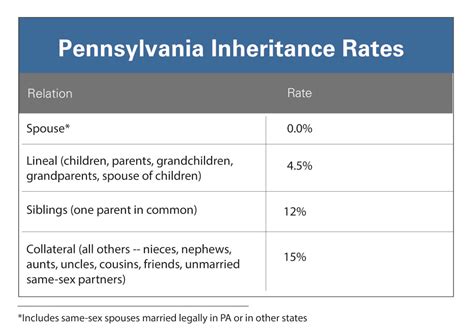

Tax Rates and Exemptions

The Pennsylvania Inheritance Tax operates on a sliding scale, with tax rates varying based on the beneficiary’s relationship to the decedent. Here’s a breakdown of the tax rates:

| Relationship to Decedent | Tax Rate |

|---|---|

| Spouse, Parent, Grandparent, Child, or Child's lineal descendant | 0% |

| Siblings, Half-Siblings, Nieces, Nephews, Aunts, Uncles, and First Cousins | 4.5% |

| Other individuals, including all others not specified | 15% |

It's important to note that Pennsylvania offers a spousal exemption, allowing an unlimited transfer of property to a surviving spouse without incurring inheritance tax. Additionally, there is a charitable exemption, where transfers to qualified charitable organizations are exempt from the tax.

Taxable Property and Exclusions

The Pennsylvania Inheritance Tax applies to a broad range of property, including:

- Real estate located in Pennsylvania.

- Tangible personal property, such as vehicles, jewelry, and furniture.

- Intangible assets, including stocks, bonds, and life insurance proceeds.

- Business interests, such as partnerships and corporations.

However, there are certain exclusions and deductions that can reduce the taxable value of an estate. These include:

- Funeral and burial expenses up to $7,500.

- Certain debts and mortgages owed by the decedent.

- Property distributed to a surviving spouse or to charity.

Tax Return Filing and Payment

The Pennsylvania Inheritance Tax return, known as Form PA-40, must be filed within nine months of the decedent’s death. This form is used to report the value of the property transferred and calculate the tax due. The tax return should be filed with the Pennsylvania Department of Revenue.

It's crucial to note that the tax is due and payable within nine months of the decedent's death. Failure to pay the tax on time may result in penalties and interest. The tax return and payment can be filed electronically or by mail, depending on the estate's preferences.

Who is Responsible for Filing the Tax Return?

The responsibility for filing the Pennsylvania Inheritance Tax return typically falls on the executor or personal representative of the estate. However, if there is no executor or the executor is unable to fulfill this duty, the responsibility may pass to the beneficiary receiving the property.

Special Considerations for Non-Residents

Pennsylvania’s Inheritance Tax also applies to non-residents who inherit property from a Pennsylvania resident. This means that individuals who are not domiciled in Pennsylvania but receive property from a Pennsylvania resident must still comply with the state’s inheritance tax laws.

Non-residents should be aware that the tax rate is based on their relationship to the decedent, as outlined in the table above. Additionally, non-residents may need to engage the services of a tax professional familiar with Pennsylvania's tax laws to ensure accurate reporting and compliance.

Estate Planning Strategies to Minimize Inheritance Tax

While the Pennsylvania Inheritance Tax is a significant consideration for estate planning, there are strategies that individuals can employ to minimize its impact. Some of these strategies include:

- Gifting: Individuals can make gifts during their lifetime to reduce the value of their taxable estate. However, it's important to stay within the annual exclusion limits to avoid gift taxes.

- Establishing Trusts: Trusts can be a powerful tool for estate planning, offering flexibility and control over the distribution of assets. Certain types of trusts, such as irrevocable trusts, can help reduce the taxable value of an estate.

- Charitable Giving: Making charitable donations can provide both personal satisfaction and tax benefits. Gifts to qualified charitable organizations are exempt from the Pennsylvania Inheritance Tax.

- Life Insurance: Life insurance proceeds are generally included in the taxable estate. However, by properly structuring life insurance policies and naming a charity as the beneficiary, individuals can reduce the taxable value of their estate.

It's crucial to consult with a qualified estate planning attorney and tax professional to develop a comprehensive plan that aligns with individual goals and maximizes tax efficiencies.

The Future of Pennsylvania’s Inheritance Tax

The future of the Pennsylvania Inheritance Tax remains uncertain. While there have been discussions and proposals to abolish or reform the tax, no significant changes have been made in recent years. The tax continues to be a source of revenue for the state and a consideration for individuals with estate planning needs.

As with any tax-related matter, staying informed about potential changes and seeking professional advice is essential. The landscape of inheritance and estate taxes can evolve, and being proactive in estate planning can help individuals adapt to any future modifications in Pennsylvania's tax laws.

Conclusion

The Pennsylvania Inheritance Tax is a complex and essential component of estate planning for individuals with ties to the state. Understanding the tax rates, exemptions, and filing requirements is crucial for ensuring compliance and minimizing tax liabilities. By working with qualified professionals and employing strategic estate planning techniques, individuals can navigate the complexities of the Pennsylvania Inheritance Tax and secure a more favorable outcome for their heirs.

What is the difference between the Pennsylvania Inheritance Tax and the Federal Estate Tax?

+The Pennsylvania Inheritance Tax is a state-level tax imposed on certain transfers of property due to an individual’s death. It is calculated based on the relationship between the decedent and the beneficiary. In contrast, the Federal Estate Tax is a federal tax imposed on the transfer of a decedent’s entire estate, regardless of the beneficiary’s relationship. The federal tax applies to estates with a value exceeding a certain threshold, while the Pennsylvania Inheritance Tax applies to specific transfers of property.

Are there any ways to reduce the impact of the Pennsylvania Inheritance Tax?

+Yes, there are several strategies to minimize the impact of the Pennsylvania Inheritance Tax. These include gifting assets during one’s lifetime, establishing trusts, making charitable donations, and properly structuring life insurance policies. Consulting with an estate planning attorney and tax professional can help individuals implement these strategies effectively.

What happens if the Pennsylvania Inheritance Tax is not paid on time?

+Failure to pay the Pennsylvania Inheritance Tax on time can result in penalties and interest. The tax is due and payable within nine months of the decedent’s death, and late payments may incur additional costs. It’s crucial to ensure timely payment to avoid these penalties and maintain compliance with state tax laws.