City Of Boston Ma Tax Collector

The City of Boston is a bustling hub of economic activity and a major metropolitan center in the United States. As with any bustling city, efficient tax collection and management are essential for the smooth operation of its financial systems. The Boston Tax Collector's Office plays a crucial role in this process, ensuring the city's fiscal responsibilities are met and its residents understand their tax obligations.

An Overview of the Boston Tax Collector’s Office

The Boston Tax Collector’s Office is a dedicated department within the City of Boston government, responsible for the administration and collection of various taxes and fees imposed by the city. It is a vital component of the city’s revenue generation and financial management strategies, contributing to the overall economic stability and growth of Boston.

The office's primary objective is to ensure that all taxes and fees owed to the city are collected in a timely and efficient manner. This includes a range of taxes such as property taxes, motor vehicle excise taxes, business taxes, and other miscellaneous fees. The Tax Collector's Office also plays a role in managing the city's debt collection and ensuring compliance with tax regulations.

Under the leadership of the Tax Collector, who is appointed by the Mayor of Boston, the office works diligently to provide clear communication and guidance to residents and businesses regarding their tax obligations. This involves issuing tax bills, providing payment options, offering assistance with tax-related inquiries, and enforcing tax regulations when necessary.

The Role of Technology in Tax Collection

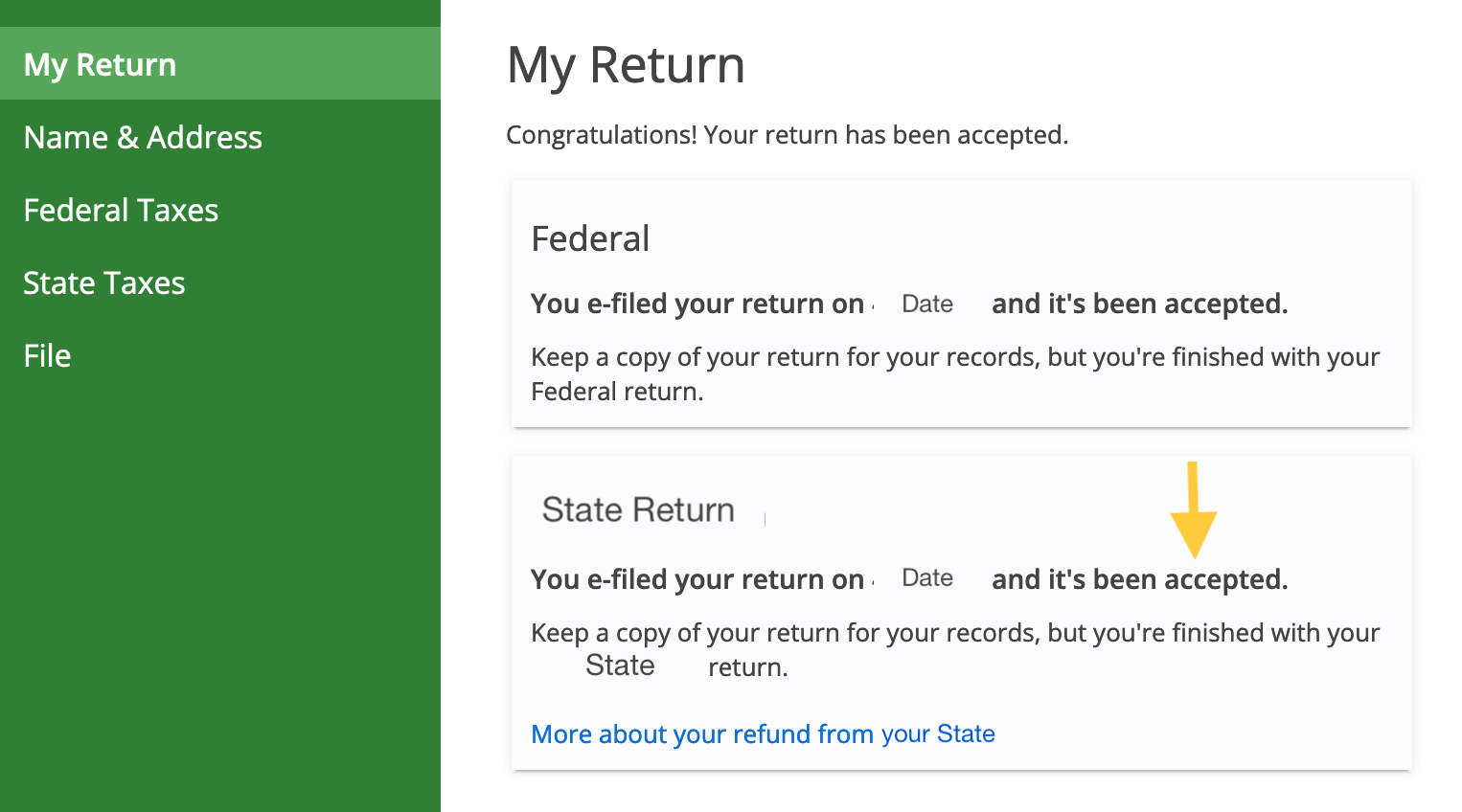

The Boston Tax Collector’s Office has embraced technology to streamline its operations and enhance the taxpayer experience. The city’s official website provides a dedicated portal where residents and businesses can access a wealth of information related to taxes, including tax rates, due dates, payment options, and frequently asked questions.

The online portal also allows taxpayers to register their accounts, view their tax bills, make online payments, and track the status of their payments. This digital platform has significantly improved the efficiency of tax collection, reducing the need for physical visits to the tax office and providing taxpayers with convenient, 24/7 access to their tax information.

| Tax Type | Due Dates | Payment Options |

|---|---|---|

| Property Taxes | Four quarterly installments due in February, May, August, and November | Online, check, money order, cash, credit/debit card, and wire transfer |

| Motor Vehicle Excise Tax | Due annually in February for registered vehicles | Online, check, money order, or in-person at designated payment centers |

| Business Taxes | Varies based on the type of business and tax category | Online, check, money order, or in-person at the Tax Collector's Office |

Tax Assistance and Support

The Boston Tax Collector’s Office understands that tax matters can be complex and often lead to confusion or disputes. To address these challenges, the office provides dedicated support and assistance to taxpayers.

Taxpayers facing difficulties in meeting their tax obligations can reach out to the office's customer service team, who are trained to provide guidance and resolve issues. The office also offers a tax relief program for eligible residents who are experiencing financial hardship, providing temporary relief from tax payments or penalties.

Additionally, the Tax Collector's Office works closely with other city departments and agencies to ensure a coordinated approach to tax collection and compliance. This includes collaborations with the Assessing Department, Treasurer's Office, and the Office of Housing Stability to address tax-related concerns and provide holistic support to residents.

Future Initiatives and Technological Advancements

Looking ahead, the Boston Tax Collector’s Office is committed to continuous improvement and innovation. The office is exploring new technologies and strategies to further enhance its tax collection processes and improve the taxpayer experience.

One area of focus is the integration of data analytics and machine learning to optimize tax assessment and collection. By leveraging advanced technologies, the office aims to improve accuracy, efficiency, and fairness in tax administration. This includes exploring predictive analytics to identify potential tax issues or irregularities and developing more personalized and targeted communication strategies for taxpayers.

Additionally, the Tax Collector's Office is working towards enhancing its online services and platforms to make them more user-friendly and accessible. This includes mobile-optimized versions of the online tax portal, allowing taxpayers to access their accounts and make payments on the go.

The office is also committed to fostering a culture of transparency and accountability. It aims to provide clear and concise information to taxpayers regarding their rights, obligations, and the city's tax policies. This includes regular updates and communications through various channels, such as social media, email newsletters, and community outreach programs.

By embracing these initiatives and staying at the forefront of technological advancements, the Boston Tax Collector's Office aims to continue providing efficient and effective tax collection services, ensuring the city's financial stability and promoting a positive taxpayer experience.

What are the payment options available for Boston taxes?

+

The City of Boston offers a variety of payment options for taxes, including online payments through the official website, payments by check or money order sent via mail, cash payments at designated payment centers, and credit/debit card payments over the phone or in person. Wire transfers are also accepted for certain tax types.

How can I obtain a tax certificate or a receipt for my tax payments?

+

Taxpayers can obtain tax certificates or receipts by contacting the Tax Collector’s Office directly. The office can provide official documentation confirming tax payments and compliance with tax obligations. These documents are often required for various purposes, such as real estate transactions or loan applications.

What happens if I miss a tax payment deadline in Boston?

+

Missing a tax payment deadline may result in late payment penalties and interest charges. It is important for taxpayers to stay informed about their tax obligations and due dates to avoid such penalties. The Tax Collector’s Office provides resources and assistance to help taxpayers manage their tax payments effectively.

How can I dispute a tax assessment or bill in Boston?

+

Taxpayers who wish to dispute a tax assessment or bill have the right to appeal the decision. The process typically involves submitting a written request for a review, providing supporting documentation, and attending a hearing or meeting with the relevant city departments. It is advisable to seek professional advice or assistance when disputing tax assessments.