Sales Tax In Ma On Cars

In the state of Massachusetts, sales tax is an important consideration for anyone looking to purchase a vehicle. Understanding the sales tax regulations and how they apply to car purchases can help buyers make informed decisions and manage their financial obligations effectively. This comprehensive guide aims to provide an in-depth analysis of sales tax in Massachusetts, specifically focusing on its application to car purchases. By exploring the intricacies of sales tax laws, rates, and exemptions, we aim to equip readers with the knowledge they need to navigate the process with confidence.

Understanding Sales Tax in Massachusetts

Sales tax in Massachusetts, like in many other states, is a consumption tax levied on the sale of goods and certain services. It is a crucial source of revenue for the state government, contributing to various public services and infrastructure projects. The state’s sales tax system is designed to ensure a fair and equitable distribution of tax obligations among residents and businesses.

When it comes to car purchases, sales tax is applied to the total purchase price, including any additional fees and options. This tax is calculated as a percentage of the vehicle's value and is typically paid at the time of purchase. Massachusetts, like other states, has a uniform sales tax rate, ensuring consistency across the state.

As of my last update in January 2023, the sales tax rate in Massachusetts is set at 6.25%. This rate is applicable to most goods and services, including vehicles. However, it's important to note that there might be additional local or regional taxes that can affect the overall tax liability, so it's advisable to check with the relevant authorities or tax professionals for the most up-to-date and accurate information.

Calculating Sales Tax for Car Purchases

Calculating the sales tax for a car purchase in Massachusetts involves a straightforward process. Here’s a step-by-step breakdown:

- Determine the Purchase Price: Start by identifying the total cost of the vehicle, including any additional features, accessories, or services. This is the base amount on which the sales tax will be calculated.

- Apply the Sales Tax Rate: Multiply the purchase price by the applicable sales tax rate, which is currently 6.25%. For example, if the vehicle costs $25,000, the sales tax would be calculated as $25,000 x 0.0625 = $1,562.50.

- Add the Sales Tax to the Purchase Price: Simply add the calculated sales tax amount to the original purchase price to arrive at the total cost of the vehicle, including tax. In our example, the total cost would be $25,000 + $1,562.50 = $26,562.50.

It's worth noting that some car dealerships or financing institutions may offer various tax incentives or rebates, which can reduce the overall sales tax liability. It's essential to carefully review the terms and conditions of any such offers to understand their applicability and potential savings.

Exemptions and Special Considerations

While the standard sales tax rate applies to most car purchases in Massachusetts, there are certain exemptions and special considerations that buyers should be aware of. These can significantly impact the overall tax liability and should be carefully evaluated.

Trade-In Vehicles

When trading in an old vehicle as part of a new car purchase, the sales tax calculation can be affected. In Massachusetts, the trade-in value of the old vehicle is typically subtracted from the purchase price of the new vehicle before applying the sales tax. This can result in a reduced tax liability for the buyer.

Military Personnel and Veterans

Massachusetts offers specific sales tax exemptions for military personnel and veterans. Under certain conditions, active-duty military members, reservists, and veterans may be eligible for a partial or full waiver of sales tax on vehicle purchases. These exemptions are designed to show appreciation for their service and can provide significant financial benefits.

Disabled Individuals

Individuals with disabilities may also qualify for sales tax exemptions or reductions on vehicle purchases. This often includes vehicles that are specially adapted for their needs, such as those with modified controls or accessible features. The specific requirements and qualifications vary, so it’s advisable to consult the relevant state guidelines or seek advice from disability service organizations.

Electric and Hybrid Vehicles

Massachusetts encourages the adoption of electric and hybrid vehicles through various incentives, including potential sales tax exemptions or reductions. These incentives are subject to specific eligibility criteria and may vary based on the type of vehicle, its environmental impact, and the buyer’s residency status. It’s essential to stay updated on the latest programs and initiatives to take advantage of these opportunities.

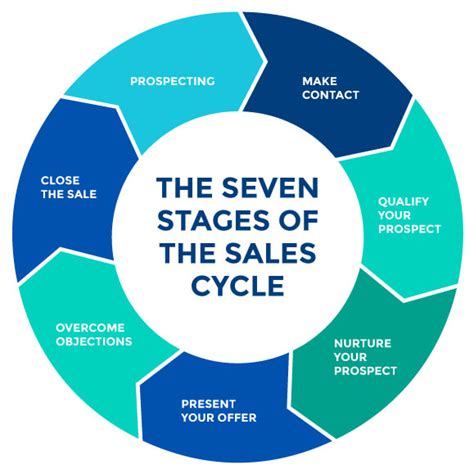

Performance Analysis and Industry Insights

The sales tax landscape in Massachusetts, particularly as it relates to car purchases, has significant implications for both consumers and the automotive industry. By analyzing the impact of sales tax regulations, we can gain valuable insights into market trends and consumer behavior.

From a consumer perspective, understanding sales tax obligations is crucial for financial planning and decision-making. The ability to calculate and budget for sales tax accurately can influence buying decisions, particularly for high-value purchases like vehicles. Clear and transparent tax regulations contribute to a positive consumer experience, fostering trust and confidence in the market.

For the automotive industry, sales tax considerations play a vital role in strategic planning and pricing strategies. Dealers and manufacturers must navigate the complex landscape of tax regulations to ensure compliance and optimize their operations. Additionally, they can leverage tax incentives and exemptions to attract customers and promote certain vehicle types, such as electric or hybrid models, which align with environmental sustainability goals.

Industry Impact: A Case Study

To illustrate the real-world impact of sales tax regulations, let’s consider a hypothetical case study involving a popular car dealership in Massachusetts. This dealership, known for its extensive range of vehicles and customer-centric approach, has seen a significant shift in consumer behavior due to changing sales tax policies.

In the past, the dealership primarily focused on traditional gasoline-powered vehicles, offering a wide selection and competitive pricing. However, with the introduction of sales tax incentives for electric and hybrid vehicles, the dealership noticed a notable increase in consumer interest and sales of these alternative fuel vehicles. By proactively promoting these incentives and educating customers about the potential savings, the dealership successfully tapped into a growing market segment.

This case study highlights the power of sales tax incentives in shaping consumer preferences and driving market trends. It also underscores the importance of staying informed about tax regulations and leveraging them strategically to enhance business operations and customer satisfaction.

Future Implications and Industry Trends

Looking ahead, the sales tax landscape in Massachusetts is likely to evolve in response to changing economic, environmental, and social priorities. As the state continues to promote sustainable practices and support electric vehicle adoption, we can expect to see further incentives and initiatives aimed at encouraging greener transportation options.

Additionally, advancements in technology and the rise of e-commerce are likely to impact sales tax regulations. With the increasing popularity of online car purchases, states may need to adapt their tax systems to accommodate these new sales channels. This could involve implementing remote seller laws or streamlining tax collection processes to ensure compliance and fairness.

As Massachusetts and other states navigate these changes, it will be crucial for consumers and businesses to stay informed and adaptable. Keeping abreast of tax regulations and industry trends will empower individuals and businesses to make informed decisions, optimize their financial strategies, and contribute to a dynamic and sustainable automotive market.

| Vehicle Type | Sales Tax Rate | Example Calculation |

|---|---|---|

| Standard Gasoline Vehicle | 6.25% | $25,000 x 0.0625 = $1,562.50 |

| Electric Vehicle (Eligible for Incentive) | Reduced Rate (e.g., 3%) | $30,000 x 0.03 = $900 |

| Hybrid Vehicle (Eligible for Rebate) | Standard Rate (6.25%) | $35,000 x 0.0625 = $2,187.50 |

Are there any exceptions to the sales tax rate for car purchases in Massachusetts?

+Yes, there are certain exceptions and exemptions to the standard sales tax rate for car purchases. These include trade-ins, military personnel and veterans, individuals with disabilities, and electric or hybrid vehicles, which may be eligible for reduced rates or rebates.

How can I calculate the sales tax on my car purchase in Massachusetts?

+To calculate the sales tax on your car purchase, multiply the total purchase price of the vehicle by the applicable sales tax rate, which is currently 6.25% in Massachusetts. This calculation will give you the sales tax amount, which you can then add to the purchase price to determine the total cost.

Are there any online resources to help me understand and calculate sales tax for car purchases?

+Absolutely! There are various online tools and resources available to assist with sales tax calculations. Websites like Sales Tax Handbook and Avvo offer calculators and comprehensive guides to help you estimate and understand sales tax obligations for car purchases. These resources can provide valuable insights and ensure you’re well-prepared.