Pa State Income Tax Status

Pennsylvania's tax landscape is a complex and ever-evolving subject, especially when it comes to income taxation. Understanding the nuances of Pennsylvania's tax system is crucial for individuals and businesses operating within the state. In this comprehensive guide, we will delve into the intricacies of the Pennsylvania State Income Tax, exploring its history, current status, and future prospects.

A Historical Perspective on PA State Income Tax

To grasp the current state of affairs, it’s essential to look back at the evolution of Pennsylvania’s income tax system. The Commonwealth of Pennsylvania has a long history of taxation, dating back to its early days as a colony. However, the modern-day income tax system in Pennsylvania has its roots in the post-World War II era.

The Personal Income Tax (PIT) in Pennsylvania was introduced in the 1970s to provide a stable source of revenue for the state. This move was a significant shift from the previous reliance on property and sales taxes. The PIT was designed to be a progressive tax, meaning that higher-income earners would pay a higher percentage of their income in taxes.

Over the years, the PIT has undergone several modifications and adjustments. One of the most notable changes occurred in 2003 when the tax rates were restructured to create a flatter tax structure. This reform aimed to simplify the tax system and make it more competitive with neighboring states.

The Current State of Pennsylvania’s Income Tax

As of [CURRENT YEAR], Pennsylvania’s income tax system remains a critical component of the state’s fiscal policy. The current PIT structure is relatively straightforward, with a flat tax rate applied to all taxable income.

Here are the key aspects of Pennsylvania’s current income tax system:

- Tax Rate: As of 2023, the flat tax rate for individuals and businesses in Pennsylvania is 3.07%. This rate applies to all taxable income, including wages, salaries, interest, dividends, and capital gains.

- Taxable Income: Pennsylvania’s income tax is levied on all income earned or received by individuals, businesses, and entities within the state. This includes income from employment, self-employment, investments, and other sources.

- Filing Requirements: All Pennsylvania residents, as well as non-residents with income sourced from the state, are required to file income tax returns. The filing deadlines align with the federal tax calendar, typically falling on April 15th.

- Tax Credits and Deductions: Pennsylvania offers various tax credits and deductions to reduce the tax burden for eligible individuals and businesses. These include credits for research and development, job creation, and investments in certain industries. Additionally, deductions are available for medical expenses, charitable contributions, and certain business expenses.

- Withholding and Estimated Taxes: Employers in Pennsylvania are required to withhold income taxes from their employees’ wages. This ensures that taxes are collected throughout the year. Additionally, individuals with income from self-employment or other sources may need to make estimated tax payments to cover their tax liability.

Pennsylvania’s Income Tax in Comparison

Pennsylvania’s flat tax rate of 3.07% positions it in the middle range when compared to other states. While some states have no income tax at all, others impose higher rates, especially for high-income earners. Pennsylvania’s approach aims to strike a balance between competitiveness and revenue generation.

For instance, New York has a progressive income tax system with rates ranging from 4% to 8.82%, depending on income levels. On the other hand, Texas and Florida have no state income tax, making them attractive destinations for businesses and individuals seeking tax advantages.

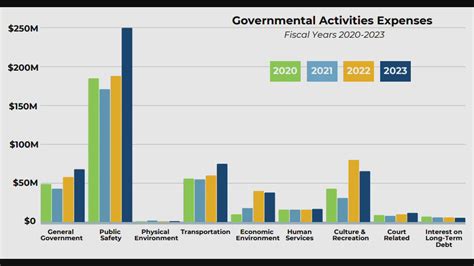

Performance Analysis and Economic Impact

Understanding the performance and economic impact of Pennsylvania’s income tax system is crucial for evaluating its effectiveness.

Here’s a breakdown of key performance indicators:

| Indicator | Value |

|---|---|

| Revenue Generation | The Personal Income Tax is a significant revenue source for Pennsylvania, contributing over $12 billion to the state’s annual budget as of [CURRENT YEAR]. This revenue is vital for funding public services, infrastructure, and education. |

| Tax Compliance | Pennsylvania’s tax administration has a relatively high level of compliance. The state’s Department of Revenue employs various enforcement measures to ensure tax compliance, including audits, penalties, and collections. |

| Economic Impact | The flat tax rate in Pennsylvania has both positive and negative economic impacts. On one hand, it simplifies the tax system and provides a stable tax environment for businesses. However, some argue that a progressive tax system could be more equitable, especially for lower-income earners. |

| Tax Burden | The 3.07% flat tax rate places Pennsylvania’s tax burden in the lower-middle range among states. This rate is seen as competitive and attractive for businesses considering relocation or expansion. However, it may not provide the same level of tax relief for lower-income individuals compared to states with progressive tax systems. |

Future Implications and Potential Reforms

The future of Pennsylvania’s income tax system is a subject of ongoing debate and policy discussions. Here are some key considerations and potential reforms on the horizon:

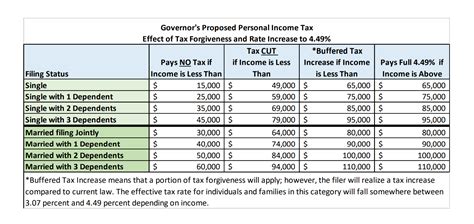

- Progressive Tax Reform: There have been calls for a return to a progressive income tax system in Pennsylvania. Advocates argue that a progressive structure would be more equitable, allowing higher-income earners to contribute a larger share of their income to state revenues. This could potentially provide additional funding for public services and infrastructure.

- Tax Rate Adjustments: With the state’s fiscal challenges and changing economic landscape, there may be considerations to adjust the flat tax rate. While a rate increase could generate more revenue, it might also impact the state’s competitiveness in attracting businesses and talent.

- Tax Incentives and Credits: Pennsylvania could explore expanding its tax credit programs to encourage specific economic activities. For instance, offering enhanced tax incentives for renewable energy projects, small business investments, or job creation initiatives could drive economic growth and development.

- Digital Tax Reforms: As the digital economy continues to grow, Pennsylvania may need to address the taxation of digital services and remote work. Implementing a fair and efficient system for taxing digital transactions and remote workers could be a priority in the coming years.

Conclusion: Navigating the PA Tax Landscape

Pennsylvania’s income tax system is a critical component of the state’s fiscal policy, shaping the economic landscape and impacting individuals and businesses alike. While the current flat tax rate provides simplicity and stability, the ongoing discussions about tax reform highlight the need for a dynamic and adaptive tax system.

As Pennsylvania navigates the complexities of taxation, it must strike a delicate balance between generating sufficient revenue for essential services and maintaining a competitive business environment. The future of Pennsylvania’s income tax system will undoubtedly be influenced by economic trends, policy decisions, and the evolving needs of its residents and businesses.

When is the deadline for filing Pennsylvania income tax returns?

+The deadline for filing Pennsylvania income tax returns typically aligns with the federal tax calendar, falling on April 15th. However, in years when April 15th falls on a weekend or holiday, the deadline may be extended to the next business day.

Are there any income tax reciprocity agreements between Pennsylvania and other states?

+Yes, Pennsylvania has income tax reciprocity agreements with several neighboring states, including New Jersey, Delaware, and Maryland. These agreements simplify the tax filing process for individuals who work in one state but reside in another.

How can I estimate my Pennsylvania income tax liability?

+You can estimate your Pennsylvania income tax liability using online tax calculators or by referring to the state’s tax tables and worksheets. These resources provide guidelines for calculating your taxable income and determining your tax liability based on the flat tax rate.