State Tax Refund Status Kentucky

Are you eagerly awaiting your Kentucky state tax refund? Knowing the status of your refund can provide much-needed peace of mind and help you plan your finances effectively. In this comprehensive guide, we'll delve into the specifics of checking the status of your Kentucky state tax refund, ensuring you have all the information you need. Whether you filed your taxes recently or are curious about the progress of a previous return, this article will provide detailed insights and expert advice.

Understanding the Kentucky Tax Refund Process

Kentucky, like many other states, offers tax refunds to eligible residents and businesses. The process begins with the filing of your state tax return, which can be done online, by mail, or through a tax professional. Once your return is received and processed by the Kentucky Department of Revenue, the refund journey commences.

It's important to note that the timeframe for receiving your refund can vary based on several factors. These include the method of filing, any errors or discrepancies in your return, and the overall volume of tax returns being processed by the state.

Key Factors Affecting Refund Timelines

Several key factors influence the time it takes for Kentucky to issue your tax refund. Understanding these factors can help manage your expectations and provide insights into the potential timeframe.

- Filing Method: Electronic filing generally results in faster processing times compared to traditional mail-in returns. Online submissions are typically processed within 4-6 weeks, while mailed returns may take slightly longer.

- Errors and Discrepancies: If your tax return contains errors or requires additional information, it may be flagged for manual review. This can extend the processing time as the state works to resolve the issue. Common errors include missing or incorrect Social Security numbers, mismatched tax forms, and inaccurate calculations.

- Refund Claim Type: The type of refund claim you make can also impact processing times. Simple refund claims, such as overpayments or excess withholding, are generally processed more quickly than complex claims involving business income, investments, or other unique circumstances.

- Peak Tax Season: The volume of tax returns being processed by the state can significantly affect your refund timeline. During peak tax season, which typically falls between January and April, the Kentucky Department of Revenue receives a surge of returns. This increased workload may result in slightly longer processing times for all refunds.

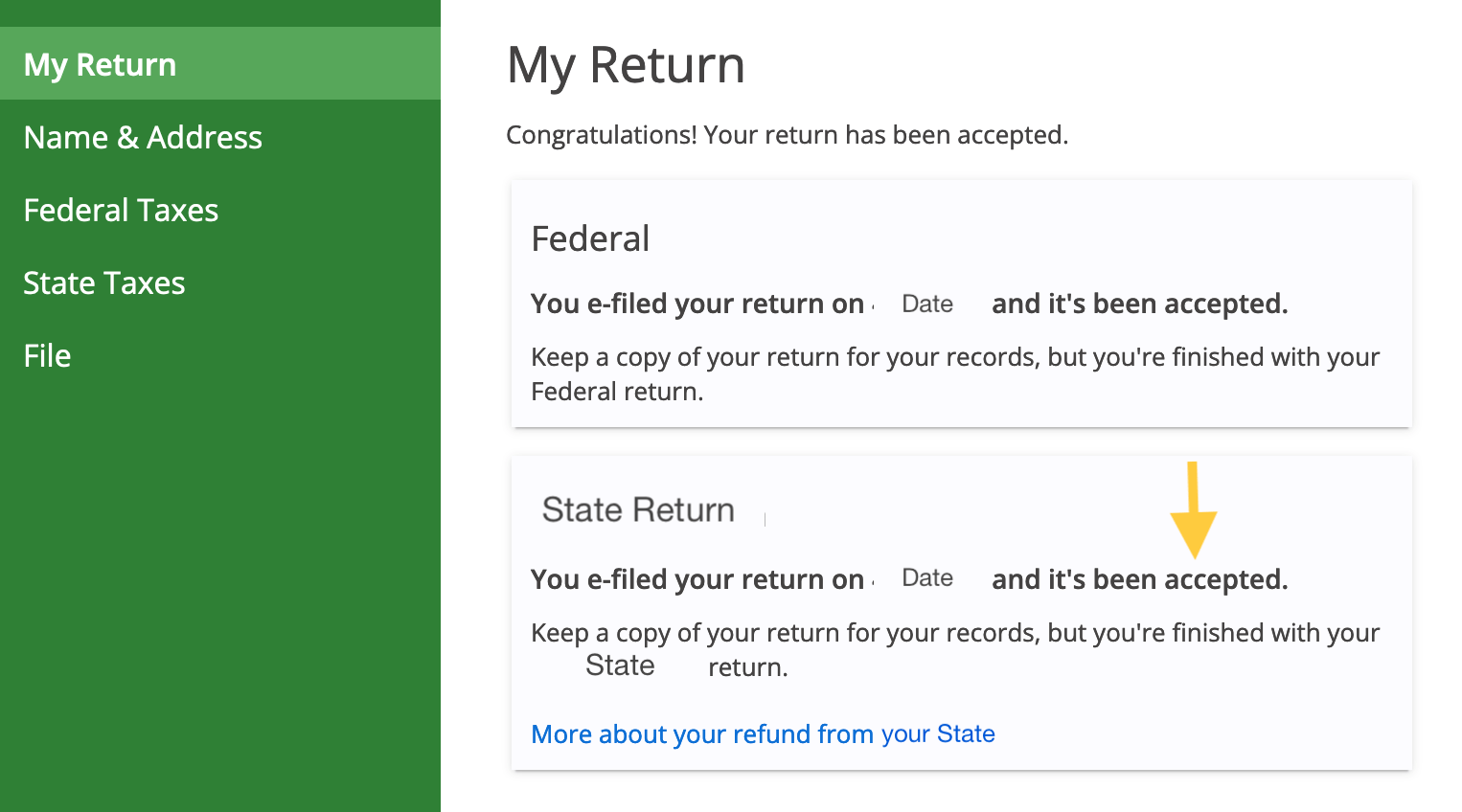

Checking Your Kentucky State Tax Refund Status

Now that we understand the factors influencing refund timelines, let’s explore the various methods available to check the status of your Kentucky state tax refund.

Online Status Check

The most convenient and efficient way to check your Kentucky tax refund status is through the Kentucky Department of Revenue’s online portal. This user-friendly platform allows you to securely access your refund information with just a few clicks.

- Visit the Kentucky Department of Revenue's website and navigate to the Taxpayer Login section.

- Create an account or log in to your existing account. You'll need your Social Security number, date of birth, and Kentucky tax filing number to verify your identity.

- Once logged in, navigate to the Refund Status section. Here, you'll find detailed information about your refund, including the date it was processed, the amount, and the anticipated payment method.

- If your refund is still pending, the portal will provide an estimated timeframe for processing. Keep in mind that this is an estimate, and actual processing times may vary.

Telephone Inquiry

If you prefer a more personalized approach or encounter difficulties with the online portal, you can inquire about your refund status over the phone. The Kentucky Department of Revenue offers a dedicated Taxpayer Assistance Center to assist with various tax-related matters, including refund status.

- Call the Kentucky Department of Revenue's Taxpayer Assistance Center at 502-564-4581 during regular business hours.

- Provide the representative with your name, Social Security number, and Kentucky tax filing number for verification purposes.

- The representative will access your tax information and provide an update on the status of your refund. They can also answer any questions you may have about the processing timeline or potential delays.

Written Correspondence

In certain situations, you may prefer to communicate with the Kentucky Department of Revenue through written correspondence. This method is ideal for those who value a detailed and formal record of their interactions.

- Prepare a written request for your Kentucky tax refund status. Include your name, address, Social Security number, and Kentucky tax filing number in the letter.

- Clearly state the purpose of your inquiry, such as, "I am writing to request an update on the status of my Kentucky state tax refund for the tax year [insert year]."

- Mail your letter to the Kentucky Department of Revenue at the following address: P.O. Box 5204, Frankfort, KY 40602.

- Allow sufficient time for your letter to be received and processed. The Department of Revenue will respond to your inquiry within 30 days.

Expected Timelines for Kentucky State Tax Refunds

While the exact timeline for receiving your Kentucky state tax refund can vary, the Kentucky Department of Revenue provides general guidelines to help taxpayers manage their expectations.

| Filing Method | Expected Processing Time |

|---|---|

| Electronic Filing (e-File) | 4-6 weeks |

| Mailed Return | 6-8 weeks |

| Amended Return | 12-16 weeks |

It's important to note that these timelines are estimates and may be subject to change based on the factors mentioned earlier, such as errors, discrepancies, or peak tax season.

Common Issues and How to Resolve Them

Occasionally, taxpayers may encounter issues or delays with their Kentucky state tax refunds. Understanding these common issues and knowing how to resolve them can help expedite the process and ensure a smoother experience.

Delayed Refunds Due to Errors

If your tax return contains errors or discrepancies, it may be flagged for manual review, resulting in a delayed refund. Common errors include:

- Missing or incorrect Social Security numbers

- Mismatched tax forms

- Inaccurate calculations

- Omissions or inconsistencies in reported income

To resolve these issues, carefully review your tax return for any errors or discrepancies. If you identify an error, amend your return using the appropriate form and submit it to the Kentucky Department of Revenue. It's important to note that amending a return may result in a delay in processing, but it's essential to correct any inaccuracies to ensure a smooth refund process.

Missing or Incorrect Information

In some cases, the Kentucky Department of Revenue may request additional information or documentation to process your refund. This can occur if there are discrepancies in your return or if the department requires further verification.

If you receive a notice requesting additional information, respond promptly with the requested documentation. Ensure that you provide accurate and complete information to avoid further delays. You can typically respond to such notices through the online portal, by mail, or by contacting the Taxpayer Assistance Center.

Refund Offset Programs

Kentucky participates in various refund offset programs, which allow the state to intercept tax refunds to collect outstanding debts. These programs include child support arrears, unpaid state taxes, and other government debts.

If your refund is offset, you will receive a notice explaining the reason for the offset and providing information on how to dispute or resolve the issue. It's important to carefully review this notice and take the necessary steps to address the outstanding debt or dispute the offset if you believe it was made in error.

Maximizing Your Kentucky State Tax Refund

While checking the status of your refund is essential, it’s equally important to understand how to maximize your Kentucky state tax refund. By taking advantage of available tax credits, deductions, and exemptions, you can potentially increase the amount of your refund or reduce your tax liability.

Tax Credits and Deductions

Kentucky offers a range of tax credits and deductions that can help reduce your tax liability and increase your refund. Some of the most common credits and deductions include:

- Earned Income Tax Credit (EITC): The EITC is a federal tax credit that benefits low- to moderate-income earners. Kentucky allows residents to claim this credit on their state tax returns, potentially resulting in a significant refund.

- Child and Dependent Care Credit: If you incur expenses for childcare or dependent care, you may be eligible for this credit. It can help offset the cost of childcare, allowing you to claim a portion of these expenses on your tax return.

- Education Credits: Kentucky offers several education credits, including the Kentucky Education Excellence Scholarship (KEES) and the Kentucky Tuition Grant. These credits can help reduce your tax liability if you or your dependents are pursuing higher education.

- Property Tax Deduction: Kentucky residents can deduct a portion of their property taxes from their taxable income. This deduction can significantly reduce your tax liability, especially for homeowners.

Exemptions and Tax-Free Benefits

In addition to credits and deductions, Kentucky offers several exemptions and tax-free benefits that can further reduce your tax liability and increase your refund.

- Personal Exemptions: Kentucky allows taxpayers to claim personal exemptions for themselves, their spouse, and their dependents. These exemptions reduce your taxable income, resulting in a lower tax liability.

- Veterans' Exemption: Kentucky provides a property tax exemption for qualifying veterans and their surviving spouses. This exemption can significantly reduce property taxes, providing financial relief for those who have served our country.

- Sales Tax Holidays: Kentucky occasionally holds sales tax holidays, during which certain items are exempt from sales tax. These holidays typically apply to back-to-school supplies, clothing, and energy-efficient appliances. Taking advantage of these holidays can save you money and potentially increase your refund.

Tax Planning Strategies

To maximize your Kentucky state tax refund, it’s beneficial to engage in strategic tax planning throughout the year. Here are some tips to consider:

- Keep Detailed Records: Maintain organized records of your income, expenses, and deductions throughout the year. This will make filing your taxes and claiming credits and deductions easier and more accurate.

- Stay Informed about Tax Changes: Stay updated on any changes to Kentucky's tax laws and regulations. Being aware of new credits, deductions, or exemptions can help you take advantage of them when filing your taxes.

- Seek Professional Advice: Consider consulting a tax professional or financial advisor. They can provide personalized guidance based on your unique financial situation, helping you maximize your refund and minimize your tax liability.

- Utilize Tax Preparation Software: Tax preparation software can simplify the tax filing process and help you identify potential credits and deductions. These tools often provide step-by-step guidance and can ensure an accurate and efficient filing experience.

Conclusion

Checking the status of your Kentucky state tax refund is a straightforward process, thanks to the Kentucky Department of Revenue’s online portal, telephone assistance, and written correspondence options. By understanding the factors that influence refund timelines and staying proactive in resolving any issues, you can ensure a smooth and efficient refund process.

Additionally, by maximizing your refund through strategic tax planning, credits, deductions, and exemptions, you can make the most of your Kentucky state tax return. Remember to stay informed, seek professional advice when needed, and take advantage of the resources available to you. With careful planning and a proactive approach, you can navigate the Kentucky tax landscape with confidence and potentially increase your refund.

Frequently Asked Questions

How long does it typically take to receive my Kentucky state tax refund after filing electronically?

+

The typical processing time for electronic filings is 4-6 weeks. However, it’s important to note that this is an estimate, and actual processing times may vary based on factors such as errors, discrepancies, or the volume of returns being processed.

Can I check my Kentucky state tax refund status over the phone?

+

Yes, you can inquire about your refund status by calling the Kentucky Department of Revenue’s Taxpayer Assistance Center at 502-564-4581 during regular business hours. Be prepared to provide your personal information for verification purposes.

What should I do if I receive a notice requesting additional information for my refund?

+

If you receive a notice requesting additional information, respond promptly with the requested documentation. You can typically respond through the online portal, by mail, or by contacting the Taxpayer Assistance Center. Ensure that you provide accurate and complete information to avoid further delays.

Are there any tax credits or deductions that can help increase my Kentucky state tax refund?

+

Yes, Kentucky offers various tax credits and deductions that can help reduce your tax liability and increase your refund. Some common credits include the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, Education Credits, and the Property Tax Deduction. It’s beneficial to explore these options and consult a tax professional to maximize your refund.

Can I file an amended return if I made a mistake on my original Kentucky state tax return?

+

Yes, if you discover an error on your original return, you can file an amended return using the appropriate form. However, keep in mind that amending your return may result in a delay in processing. It’s important to carefully review your return and correct any inaccuracies to ensure a smooth refund process.