Nola Sales Tax

Understanding the intricacies of local sales tax laws is crucial for businesses and consumers alike. In the vibrant city of New Orleans, Louisiana, the sales tax system is an essential component of the local economy, influencing various aspects of daily life and business operations. This comprehensive guide aims to delve into the specifics of the Nola Sales Tax, shedding light on its rates, applications, and implications.

Unraveling the Nola Sales Tax: A Comprehensive Overview

The sales tax landscape in New Orleans is a multifaceted one, comprising a combination of state, local, and special district taxes. This complex structure can often pose challenges for both taxpayers and tax professionals. However, with a detailed understanding of the system, navigating the Nola sales tax becomes a more manageable task.

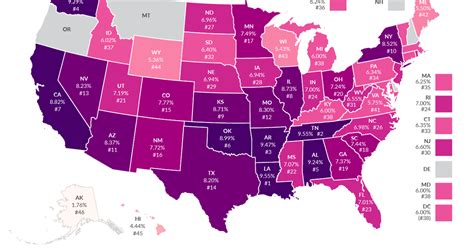

The state of Louisiana imposes a 4.45% sales tax on most goods and services. This base rate forms the foundation of the sales tax system in the state. However, when we zoom in on New Orleans specifically, the tax landscape becomes more nuanced.

New Orleans Parish Sales Tax

On top of the state sales tax, New Orleans Parish (also known as Orleans Parish) levies an additional 5.845% sales tax. This parish-level tax is a critical component of the city’s revenue stream, funding essential services and infrastructure projects. The total sales tax rate within Orleans Parish thus amounts to 10.295%, making it one of the higher sales tax rates in the state.

| Sales Tax Category | Rate |

|---|---|

| State Sales Tax | 4.45% |

| Orleans Parish Sales Tax | 5.845% |

| Total Sales Tax Rate | 10.295% |

It's worth noting that the parish-level tax is not uniform across Louisiana. Each parish has the authority to set its own sales tax rate, which can lead to significant variations across the state. For instance, neighboring parishes like Jefferson and St. Tammany have sales tax rates of 9.94% and 8.94% respectively, highlighting the diversity in sales tax structures within the state.

Special Tax Districts in New Orleans

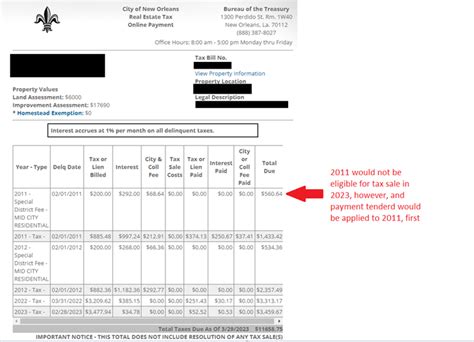

New Orleans is home to several special tax districts, each with its own unique sales tax rate. These districts are typically created to fund specific projects or initiatives, such as infrastructure improvements or economic development initiatives. The sales tax rates within these districts can vary significantly, with some adding an additional 0.5% to 2% to the total tax burden.

One notable example is the French Quarter Special Tax District, which imposes an extra 1% sales tax on top of the parish and state rates. This district-specific tax is designed to fund maintenance and improvement projects within the historic French Quarter, one of the city's most iconic neighborhoods.

| Special Tax District | Sales Tax Rate |

|---|---|

| French Quarter Special Tax District | 1% |

| Other Special Districts (e.g., New Orleans East) | Varies (0.5% - 2%) |

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in New Orleans is 10.295%, there are certain goods and services that are exempt from sales tax or have reduced rates. These exemptions can vary depending on the nature of the item or service and the intended use.

For instance, many food items, including groceries and prepared foods, are exempt from sales tax in Louisiana. This exemption provides a significant benefit to households, helping to reduce the overall cost of living. Additionally, certain services, such as medical services and educational services, are also exempt from sales tax.

It's important to note that while these exemptions provide financial relief, they also present a layer of complexity for businesses. Accurate categorization of products and services is essential to ensure compliance with the sales tax laws. Misclassification can lead to significant penalties and legal issues.

Navigating the Nola Sales Tax: Tips and Insights

Understanding the Nola sales tax is just the first step; effectively navigating this complex system is where the real challenge lies. Here are some practical tips and insights to help businesses and consumers manage their sales tax obligations in New Orleans.

Stay Informed about Rate Changes

Sales tax rates are not static and can change over time due to various factors, including legislative decisions and special initiatives. It’s crucial for businesses to stay informed about any rate changes, as even minor adjustments can have a significant impact on their bottom line. Subscribing to sales tax newsletters or using automated sales tax software can help businesses stay up-to-date with the latest rate changes.

Implement Accurate Tax Calculation Systems

With the diverse range of sales tax rates in New Orleans, implementing an accurate tax calculation system is essential. This system should take into account not only the state and parish-level taxes but also the rates specific to special tax districts. Manual calculations can lead to errors, so investing in a reliable sales tax calculation software or consulting with tax professionals is recommended.

Understand the Impact on Pricing Strategies

The sales tax rate in New Orleans can significantly influence pricing strategies for businesses. A high sales tax rate can deter customers, especially if they have the option to shop in neighboring parishes or online where tax rates might be lower. Businesses should carefully consider the impact of sales tax on their pricing and explore ways to mitigate the tax burden, such as offering discounts or promotions.

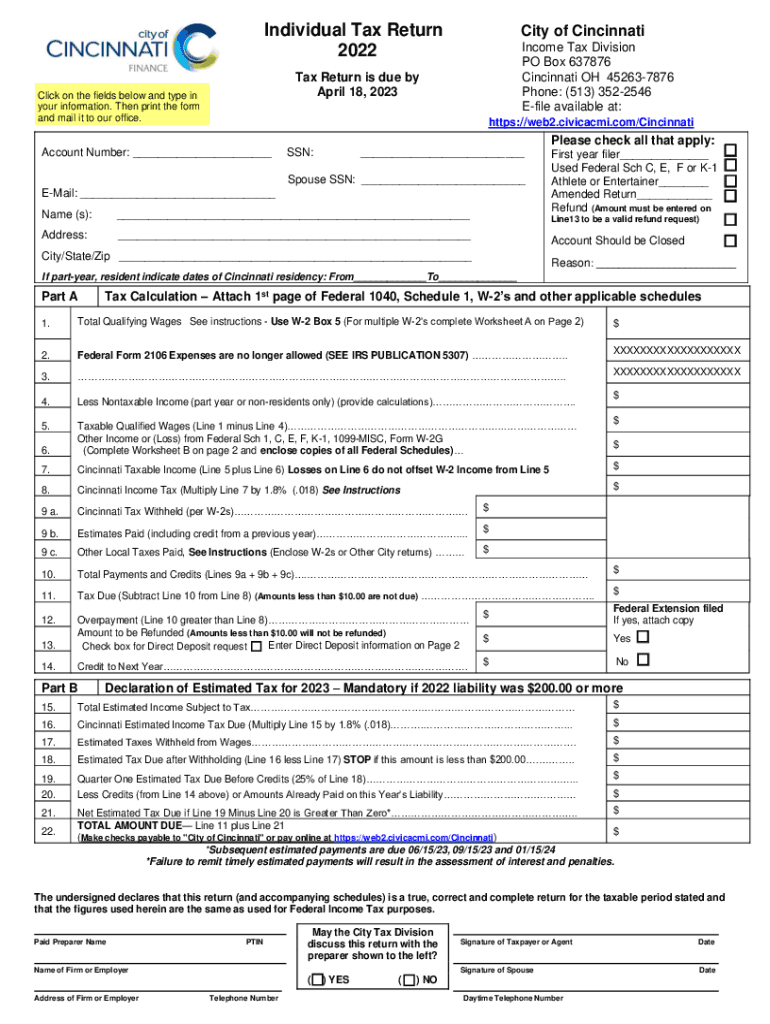

Stay Compliant with Sales Tax Laws

Navigating the complex sales tax system in New Orleans requires a strong understanding of the laws and regulations. Businesses must ensure they are compliant with all aspects of sales tax collection and remittance. This includes accurate record-keeping, timely filing of tax returns, and proper registration with the Louisiana Department of Revenue.

Explore Sales Tax Incentives and Credits

Louisiana, including New Orleans, offers various sales tax incentives and credits to businesses. These incentives can help offset the cost of doing business in the city. For instance, the Louisiana Enterprise Zone Program provides sales tax credits for businesses that locate or expand in designated economically distressed areas. Staying informed about these incentives can help businesses reduce their tax burden and improve their bottom line.

The Future of Nola Sales Tax: Trends and Predictions

The sales tax landscape in New Orleans is constantly evolving, driven by economic trends, political decisions, and societal changes. Understanding these trends can provide valuable insights into the future of the Nola sales tax system.

Economic Growth and Development

New Orleans has experienced a period of economic growth and redevelopment in recent years, particularly in the tourism and hospitality sectors. This growth has led to increased revenue for the city, which in turn can influence sales tax rates. As the city continues to develop and attract new businesses and residents, the sales tax base is likely to expand, potentially leading to more stable and lower tax rates over time.

Political and Legislative Changes

Political decisions at the state and local levels can have a significant impact on sales tax rates. Changes in leadership or shifts in political priorities can lead to proposals for tax reforms or new initiatives funded by sales tax revenue. For instance, a shift towards more progressive tax policies could result in higher sales tax rates to fund social programs or infrastructure projects. Conversely, a focus on economic development might lead to incentives and lower tax rates to attract businesses.

Technological Innovations

The rise of e-commerce and online shopping has had a profound impact on sales tax collection. In response, many states, including Louisiana, have implemented laws to ensure online retailers collect and remit sales tax on transactions with in-state customers. As technology continues to evolve, we can expect further innovations in sales tax collection, potentially simplifying the process for both businesses and consumers.

Consumer Behavior and Preferences

The behavior and preferences of consumers can also influence sales tax rates. If consumers increasingly shop online or in neighboring parishes with lower tax rates, it could lead to a decrease in sales tax revenue for New Orleans. Conversely, if consumers value the experience of shopping in the city and are willing to pay the higher sales tax, it can provide a stable revenue stream for the city.

Environmental and Social Initiatives

New Orleans, like many cities, is increasingly focused on environmental sustainability and social equity. As part of these initiatives, we may see the introduction of new sales tax categories or rates to fund specific projects. For instance, a dedicated sales tax for environmental initiatives or social programs could be implemented, providing a stable funding source for these important causes.

What is the purpose of the special tax districts in New Orleans?

+Special tax districts are created to fund specific projects or initiatives, such as infrastructure improvements or economic development initiatives. The additional sales tax revenue within these districts is used to finance these targeted projects.

Are there any sales tax holidays in New Orleans?

+Yes, Louisiana does have sales tax holidays, during which certain items are exempt from sales tax. These holidays typically occur around major shopping events like back-to-school season or hurricane preparedness month. Check the Louisiana Department of Revenue website for specific dates and eligible items.

How often do sales tax rates change in New Orleans?

+Sales tax rates can change at any time due to legislative decisions or special initiatives. While there is no set schedule for rate changes, it’s crucial for businesses and consumers to stay informed and updated on any alterations to the sales tax landscape.

What are the consequences of non-compliance with sales tax laws in New Orleans?

+Non-compliance with sales tax laws can result in significant penalties, including fines and interest charges. In severe cases, it can also lead to criminal charges. It’s essential for businesses to ensure they are accurately calculating and remitting sales tax to avoid these consequences.

How can businesses stay updated on sales tax laws and changes in New Orleans?

+Businesses can stay informed by subscribing to sales tax newsletters, using automated sales tax software, and regularly checking the Louisiana Department of Revenue website for updates and announcements. Consulting with tax professionals can also provide valuable insights and guidance.