Attorneys Tax

Taxation is an essential aspect of any attorney's practice, as it impacts their income, business operations, and overall financial health. Navigating the complex world of tax laws and regulations can be challenging, especially for legal professionals who are primarily focused on their legal expertise. This article aims to provide an in-depth guide for attorneys, offering insights and strategies to effectively manage their tax obligations while optimizing their financial position.

Understanding the Attorney’s Tax Landscape

For attorneys, taxation extends beyond the typical income tax considerations. The legal profession introduces unique tax implications, including business structure, client billing, and expense management. Additionally, attorneys may encounter specific tax issues related to their practice areas, such as tax law, estate planning, or corporate transactions.

Key Tax Considerations for Attorneys

Here are some critical tax considerations that attorneys should be aware of:

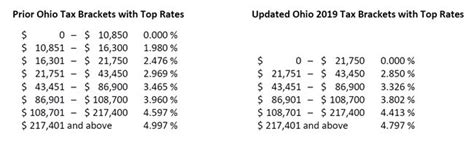

- Income Tax: Attorneys are subject to personal income tax on their earnings. Understanding the tax brackets, deductions, and credits applicable to their income is essential for effective tax planning.

- Business Structure: The choice of business entity, such as a sole proprietorship, partnership, or LLC, has significant tax implications. Each structure offers different tax advantages and disadvantages, impacting areas like self-employment tax, pass-through income, and tax filing requirements.

- Client Billing and Expenses: Accurate tracking of client billings and expenses is crucial for tax purposes. Attorneys must ensure that their billing systems capture all relevant information, allowing for proper tax treatment of income and expenses.

- Practice Area-Specific Taxes: Certain practice areas bring unique tax considerations. For instance, tax attorneys must stay updated on the latest tax laws and regulations, while estate planning attorneys may need to navigate estate and gift taxes. Corporate attorneys may deal with complex tax issues related to business entities and transactions.

- Record Keeping: Maintaining meticulous records is vital for tax compliance and audit preparedness. Attorneys should implement robust record-keeping systems to track income, expenses, and any tax-related documentation.

Strategies for Effective Tax Management

Navigating the tax landscape as an attorney requires a proactive approach and a deep understanding of tax laws. Here are some strategies to help attorneys effectively manage their tax obligations and optimize their financial position:

Engage a Tax Professional

Given the complexity of tax laws and the unique considerations of the legal profession, it is advisable for attorneys to engage the services of a qualified tax professional. A tax expert can provide specialized guidance tailored to the attorney’s practice and help navigate the ever-changing tax landscape.

Stay Informed on Tax Updates

Tax laws are subject to frequent changes and updates. Attorneys should make it a priority to stay informed about any new tax legislation, regulations, or court rulings that may impact their practice. This ensures compliance and allows for timely adjustments to tax strategies.

Optimize Deductions and Credits

Attorneys should take advantage of all available deductions and credits to minimize their tax liability. This includes claiming deductions for business expenses, such as office rent, supplies, and professional development costs. Additionally, attorneys may be eligible for specific credits, such as the Small Business Health Care Tax Credit or the Work Opportunity Tax Credit, which can further reduce their tax burden.

Implement Efficient Billing and Expense Management

Streamlining the billing and expense management processes is crucial for accurate tax reporting. Attorneys should utilize efficient billing systems that capture all relevant details, including the nature of the work, client information, and billing rates. Similarly, implementing a robust expense management system ensures that all business expenses are properly tracked and categorized, making tax reporting more straightforward.

Consider Tax-Advantaged Retirement Plans

Attorneys can benefit from tax-advantaged retirement plans, such as a Solo 401(k) or a Simplified Employee Pension (SEP) IRA. These plans offer tax deductions on contributions, providing a tax-efficient way to save for retirement. Additionally, certain retirement plans allow for pre-tax contributions, further reducing taxable income.

Review and Adjust Tax Strategies Annually

Tax planning is an ongoing process. Attorneys should review their tax strategies annually to ensure they remain aligned with their financial goals and the latest tax laws. This includes evaluating deductions, credits, and retirement plan contributions to maximize tax benefits and optimize their overall financial position.

Case Study: Tax Strategies for a Successful Law Firm

Let’s consider the example of Baker & Associates, a successful law firm specializing in corporate law. Baker & Associates has implemented several tax strategies to optimize their financial position and ensure compliance with tax laws.

Business Structure Optimization

Baker & Associates operates as an LLC, which offers several tax advantages. As an LLC, the firm benefits from pass-through taxation, allowing profits and losses to be reported on the partners’ individual tax returns. This structure simplifies tax filing and reduces the firm’s tax liability.

Efficient Billing and Expense Management

The firm has implemented a robust billing system that captures all relevant details, including client information, billing rates, and the nature of legal services provided. This ensures accurate tax reporting and facilitates efficient expense management. By tracking expenses closely, Baker & Associates can maximize deductions and minimize taxable income.

Strategic Retirement Plan Selection

Baker & Associates has chosen to establish a Solo 401(k) plan for its partners. This tax-advantaged retirement plan allows for pre-tax contributions, reducing the partners’ taxable income and providing a tax-efficient way to save for retirement. Additionally, the firm contributes matching funds to the plan, further enhancing its retirement savings potential.

Tax Planning and Compliance

The firm engages a tax professional who provides specialized guidance on tax laws and regulations. This expert ensures that Baker & Associates remains compliant with all tax obligations and helps the firm navigate any changes in tax legislation. The tax professional also assists with tax planning, identifying opportunities to optimize deductions and credits, and ensuring the firm’s financial health.

Future Implications and Conclusion

The tax landscape for attorneys is dynamic and ever-evolving. As tax laws continue to change, attorneys must remain vigilant and adapt their tax strategies accordingly. By staying informed, engaging tax professionals, and implementing efficient tax management practices, attorneys can effectively navigate the complexities of taxation and optimize their financial position.

Frequently Asked Questions

What are the key tax considerations for attorneys?

+Attorneys should consider income tax, business structure, client billing, and practice area-specific taxes. They should also prioritize record keeping and stay informed about tax updates.

How can attorneys optimize their tax deductions and credits?

+Attorneys can optimize deductions and credits by claiming business expenses, such as office rent and professional development costs. They should also explore specific credits applicable to their practice area.

What are the advantages of tax-advantaged retirement plans for attorneys?

+Tax-advantaged retirement plans, like the Solo 401(k) or SEP IRA, offer tax deductions on contributions and pre-tax funding options. These plans provide a tax-efficient way to save for retirement and reduce taxable income.

How often should attorneys review their tax strategies?

+Attorneys should review their tax strategies annually to ensure they remain aligned with their financial goals and the latest tax laws. This allows for timely adjustments and optimization of tax benefits.