Arkansas Used Car Sales Tax

When purchasing a used car in Arkansas, understanding the sales tax implications is crucial for budgeting and ensuring a smooth transaction. This comprehensive guide will delve into the intricacies of Arkansas' used car sales tax, providing valuable insights for prospective buyers and sellers. From tax rates to exemptions and calculation methods, we'll explore the essential aspects of this process.

Understanding Arkansas Used Car Sales Tax

Arkansas imposes a sales and use tax on the sale of vehicles, including used cars. This tax is applied to the purchase price of the vehicle and is collected by the seller, who then remits it to the Arkansas Department of Finance and Administration (DFA). The sales tax rate varies across the state, as some cities and counties impose additional local taxes. However, for the purposes of this guide, we’ll focus on the state-level sales tax rate.

The state of Arkansas applies a 6.5% sales tax rate to most vehicle purchases, including used cars. This tax is calculated based on the gross sales price of the vehicle, which includes any additional fees or charges associated with the sale. The tax is calculated as follows:

Sales Tax = Gross Sales Price x Tax Rate

For example, if a used car is sold for $15,000, the sales tax due would be:

Sales Tax = $15,000 x 0.065 = $975

So, in this case, the buyer would need to pay an additional $975 in sales tax on top of the purchase price.

Exemptions and Special Cases

While the standard sales tax rate applies to most used car purchases, there are certain exemptions and special cases to consider. These include:

- Trade-Ins: When trading in a vehicle as part of the purchase, the sales tax is calculated based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that tax is only paid on the net amount.

- Vehicle Value: If the value of the used car is less than $4,000, a reduced tax rate of 3% applies. This provision aims to provide relief for lower-cost vehicle purchases.

- Military Exemptions: Active-duty military personnel stationed in Arkansas may be eligible for sales tax exemptions. This applies to both new and used vehicle purchases and requires proper documentation.

- Title Transfers: If a vehicle is gifted or transferred between family members, no sales tax is due. However, proper documentation and title transfer procedures must be followed.

It's crucial for buyers and sellers to understand these exemptions to ensure compliance with Arkansas' tax laws.

Calculating Sales Tax for Used Car Purchases

Calculating the sales tax for a used car purchase involves several steps. Here’s a breakdown of the process:

- Determine the Gross Sales Price: This is the total price agreed upon by the buyer and seller, including any additional fees and charges. It's essential to clarify all costs associated with the sale to accurately calculate the tax.

- Identify the Applicable Tax Rate: As mentioned earlier, the standard tax rate is 6.5%, but for vehicles valued under $4,000, the rate is 3%. Ensure you apply the correct rate based on the vehicle's value.

- Calculate the Sales Tax: Using the gross sales price and the applicable tax rate, compute the sales tax using the formula provided earlier. This will give you the exact amount of tax due.

- Include Sales Tax in the Purchase Price: The sales tax is an additional cost to the buyer and should be added to the purchase price. This ensures that the buyer is aware of the total amount they need to pay.

- Remit Sales Tax to the DFA: The seller is responsible for collecting and remitting the sales tax to the Arkansas DFA. This process involves completing the necessary forms and submitting the tax payment within the designated timeframe.

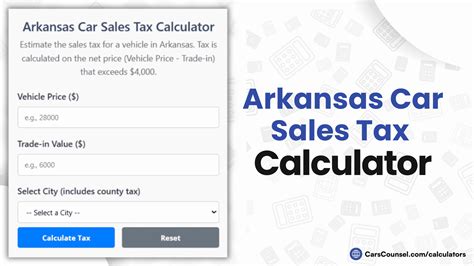

Using Online Calculators

To simplify the sales tax calculation process, several online tools and calculators are available. These calculators can provide an estimate of the sales tax based on the vehicle’s purchase price and location. While these tools can be helpful, it’s essential to verify the accuracy of the calculation with official sources or tax professionals.

Remitting Sales Tax to the Arkansas DFA

Once the sales tax amount has been calculated, it’s the seller’s responsibility to remit this tax to the Arkansas DFA. The process involves the following steps:

- Register as a Seller: If the seller is not already registered with the DFA, they must complete the necessary registration forms. This ensures that the seller can legally collect and remit sales tax.

- Complete Sales Tax Return: The seller must complete a sales tax return form, which includes details of the sale, such as the vehicle's make, model, and VIN, along with the calculated sales tax amount.

- Submit Payment: Along with the completed sales tax return, the seller must remit the calculated tax amount to the DFA. This can be done through various payment methods, including online payments, checks, or money orders.

- Recordkeeping: It's essential for sellers to maintain proper records of all sales transactions, including sales tax calculations and payments. This documentation is crucial for compliance and potential audits.

The DFA provides detailed guidelines and resources to assist sellers in navigating the sales tax remittance process. It's advisable to consult these resources to ensure accuracy and compliance.

Sales Tax and Vehicle Registration

The sales tax on a used car purchase is a separate transaction from the vehicle registration process. However, both are crucial steps in finalizing a vehicle purchase. After paying the sales tax and obtaining the necessary documentation from the seller, the buyer must register the vehicle with the Arkansas Department of Finance and Administration (DFA) or the local Revenue Office.

The registration process involves providing proof of ownership, such as the vehicle's title, along with other required documents. The buyer will also need to pay a registration fee, which varies based on the vehicle's age, weight, and intended use. Additionally, the buyer may need to obtain insurance coverage and provide proof of insurance to complete the registration.

It's important to note that the sales tax and registration fees are separate costs and should be budgeted for accordingly. Failing to complete the registration process within the required timeframe may result in penalties and additional fees.

Conclusion

Navigating the used car sales tax process in Arkansas requires a thorough understanding of the applicable tax rates, exemptions, and calculation methods. By following the guidelines outlined in this comprehensive guide, buyers and sellers can ensure compliance with Arkansas’ tax laws and avoid potential penalties. Remember to consult official resources and tax professionals for accurate and up-to-date information.

Frequently Asked Questions

What happens if I buy a used car from a private seller in Arkansas?

+When purchasing a used car from a private seller in Arkansas, it is the buyer’s responsibility to pay the sales tax. The buyer should calculate the tax based on the purchase price and applicable tax rate and include it in the total cost. The seller is not required to collect or remit the sales tax in this scenario.

Are there any online tools to help calculate the sales tax for a used car purchase in Arkansas?

+Yes, there are several online calculators and tools available that can assist in estimating the sales tax for a used car purchase in Arkansas. These tools typically require inputting the vehicle’s purchase price and location to provide an estimated tax amount. However, it’s essential to verify the accuracy of these calculations with official sources or tax professionals.

Can I claim a sales tax refund if I move out of Arkansas with my recently purchased used car?

+Yes, if you purchase a used car in Arkansas and then move out of state within a certain timeframe (typically 30 days), you may be eligible for a sales tax refund. This refund is applicable if you register the vehicle in your new state of residence. However, the refund process and requirements may vary, so it’s advisable to consult the Arkansas DFA or a tax professional for specific guidance.

What documentation do I need to provide when remitting sales tax to the Arkansas DFA as a seller?

+As a seller, you need to provide the Arkansas DFA with a completed sales tax return form, which includes details of the sale, such as the vehicle’s make, model, and VIN. Additionally, you must include the calculated sales tax amount and provide proof of payment. It’s crucial to maintain proper records of the sale and tax payment for future reference.