Montgomery County Ohio Property Tax

Understanding property taxes is an essential aspect of homeownership, especially in Montgomery County, Ohio. Property taxes in this county play a crucial role in funding local services and infrastructure. This article aims to provide a comprehensive guide to Montgomery County's property tax system, exploring its calculation, payment processes, and the impact it has on residents.

The Montgomery County Property Tax Landscape

Montgomery County, nestled in the southwestern region of Ohio, is renowned for its vibrant communities and thriving urban centers. With a diverse range of residential areas, from historic neighborhoods to modern suburbs, the county’s property tax system is designed to support its unique character and growth.

The property tax in Montgomery County is a vital source of revenue for the local government, contributing to the maintenance and improvement of essential services like schools, public safety, and infrastructure development. It is a responsibility shared by all property owners, making it an important topic for homeowners and prospective buyers alike.

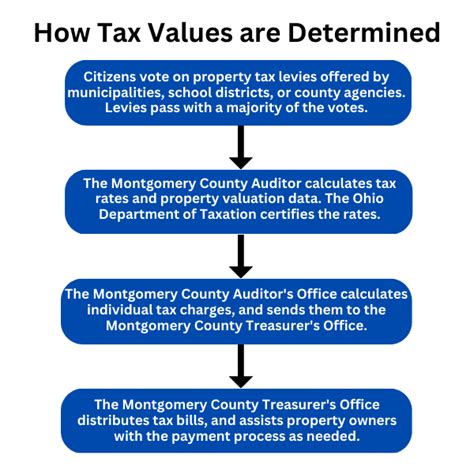

How Property Taxes Are Calculated

The process of determining property taxes in Montgomery County involves a series of steps that ensure fairness and accuracy. It begins with the assessment of the property’s value, a crucial phase that influences the tax amount.

Montgomery County employs a team of professional assessors who are responsible for evaluating properties based on various factors, including:

- The property's physical characteristics, such as size, age, and condition.

- Market trends and sales data in the area.

- Recent improvements or renovations made to the property.

- The property's potential income (for commercial properties).

Once the assessment is complete, the county applies a tax rate to the assessed value. This rate is determined annually by the county commissioners and is influenced by the budget needs of local government bodies and special districts. The tax rate is expressed as a percentage and is applied uniformly to all properties within the county.

| Tax Rate Components | Description |

|---|---|

| County Rate | Represents the county's share of the tax revenue. |

| City/Township Rate | Allocated to the specific municipality where the property is located. |

| School District Rate | Supports the local school system. |

| Special Districts Rate | Applies to specific areas or services, such as fire protection or transportation. |

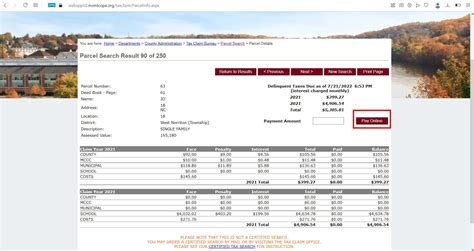

Payment Process and Deadlines

Property tax bills in Montgomery County are typically mailed to homeowners twice a year. The billing cycle is structured as follows:

- First Half Payment: Due in February and covers the period from January to June.

- Second Half Payment: Due in July and covers the period from July to December.

Homeowners have the option to pay their property taxes in full or choose to pay in two installments. Late payments are subject to penalties and interest, so it is essential to stay informed about the payment deadlines.

For added convenience, Montgomery County offers various payment methods, including online payment portals, mobile apps, and traditional mail-in payments. Property owners can also set up automatic payments to ensure timely remittance without the hassle of manual transactions.

Tax Relief Programs and Exemptions

Montgomery County recognizes the financial responsibilities of property ownership and offers several tax relief programs and exemptions to eligible residents. These initiatives aim to provide assistance to specific groups and promote homeownership.

- Homestead Exemption: Available to homeowners aged 65 and older or those with permanent disabilities. This exemption reduces the taxable value of the property, providing a direct savings on property taxes.

- Veterans' Exemption: Montgomery County honors its veterans by offering a partial exemption on property taxes. This exemption is based on the veteran's level of disability and service-related impairment.

- Tax Abatement Programs: The county periodically offers tax abatement programs to encourage economic development and support new construction or renovation projects. These programs provide temporary tax relief to eligible properties.

The Impact of Property Taxes on Residents

Property taxes in Montgomery County not only fund essential services but also contribute to the overall economic health of the community. The revenue generated supports the development of high-quality schools, efficient public safety services, and well-maintained infrastructure, which, in turn, enhances the county’s attractiveness as a place to live and do business.

For homeowners, property taxes are an ongoing commitment, but they also offer a sense of security and stability. The revenue generated ensures that vital services remain accessible and that the community continues to thrive. Additionally, property taxes play a role in maintaining property values, as well-funded local services can contribute to a neighborhood's desirability and long-term value.

Navigating Tax Challenges

While property taxes are an essential aspect of homeownership, they can sometimes present challenges. Montgomery County understands these concerns and provides resources to assist homeowners in managing their tax obligations.

- Appeal Process: Homeowners who believe their property assessment is inaccurate can initiate an appeal. The county's Board of Revision conducts hearings to review and adjust assessments as necessary, ensuring fairness in the tax system.

- Payment Plans: For homeowners facing temporary financial difficulties, Montgomery County offers payment plans to help manage tax obligations. These plans provide a structured approach to paying taxes over an extended period, alleviating the burden of a large, one-time payment.

By offering these resources, the county demonstrates its commitment to supporting homeowners and ensuring that property taxes remain manageable and fair.

Conclusion: A Comprehensive Approach to Property Taxes

Montgomery County’s property tax system is designed with fairness and efficiency in mind. From the assessment process to the various relief programs and payment options, the county strives to create a balanced approach that supports its residents and the local economy.

Understanding the intricacies of property taxes is an important step for homeowners and prospective buyers. By staying informed about the tax landscape, residents can make informed decisions, take advantage of available resources, and contribute to the vibrant community of Montgomery County.

How often are property assessments conducted in Montgomery County?

+Property assessments in Montgomery County are conducted on a triennial basis, meaning they occur once every three years. This ensures that property values remain current and that tax assessments are fair and accurate.

Are there any online tools to estimate property taxes before buying a home in the county?

+Yes, Montgomery County provides an online property tax estimator tool on its official website. This tool allows prospective buyers to input a property’s address and receive an estimated tax amount, helping them make informed purchasing decisions.

What happens if I miss a property tax payment deadline?

+Late payments of property taxes in Montgomery County incur penalties and interest. It is important to stay informed about payment deadlines and take advantage of the various payment options and reminders provided by the county to avoid any late fees.