How Do You Become Tax Exempt

In the realm of finance and legal matters, the concept of tax exemption is a complex yet intriguing one. It offers organizations and individuals the opportunity to operate with reduced or no tax liabilities, providing significant financial advantages and contributing to the growth of various sectors. Understanding the process of becoming tax-exempt is a crucial step for those seeking to leverage these benefits.

This comprehensive guide aims to unravel the intricacies of tax exemption, providing a step-by-step roadmap for those seeking to navigate this complex process. By delving into the specific requirements, legal frameworks, and practical strategies, we aim to empower our readers with the knowledge to make informed decisions regarding tax-exempt status.

The Fundamentals of Tax Exemption

Tax exemption is a legal status granted to certain entities, allowing them to operate without the burden of certain taxes. This status is not a universal right but is instead conferred upon organizations and individuals that meet specific criteria and serve designated purposes. The primary objective of tax exemption is to encourage and support activities that benefit the public, such as charitable endeavors, educational initiatives, and religious practices.

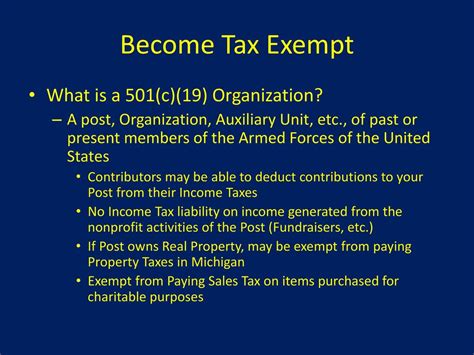

The tax-exempt status is governed by intricate legal frameworks, varying from jurisdiction to jurisdiction. In the United States, for instance, the Internal Revenue Service (IRS) is responsible for administering tax laws and granting tax-exempt status to qualifying organizations. The process involves a meticulous examination of an entity's structure, purpose, and activities to ensure compliance with the relevant laws and regulations.

Qualifying for Tax-Exempt Status

The journey towards tax-exempt status begins with understanding the eligibility criteria. While the specific requirements can differ based on jurisdiction and the type of tax involved, there are several common elements that organizations and individuals should consider.

Purpose and Activities

The primary criterion for tax exemption is often tied to an entity's purpose and activities. Organizations must demonstrate that they are formed and operated exclusively for religious, charitable, scientific, literary, or educational purposes. This purpose must be central to the organization's operations and reflected in its day-to-day activities.

For instance, a charitable organization focused on providing healthcare services to underserved communities would need to show that its primary objective is to improve public health and not merely to provide a service for profit. Similarly, an educational institution seeking tax exemption would need to prove that its primary focus is on educating students rather than generating revenue.

Structure and Governance

The structure and governance of an organization play a pivotal role in determining its eligibility for tax exemption. Tax-exempt organizations are typically required to have a defined structure with clear lines of authority and decision-making processes. This includes having a board of directors or trustees who oversee the organization's operations and ensure compliance with its stated purpose.

Additionally, tax-exempt organizations must maintain proper financial records and adhere to transparency standards. This ensures that their operations are open to public scrutiny and that they are accountable for the use of any funds they receive.

Limitation on Activities

While tax-exempt organizations are primarily focused on their designated purposes, they are generally not allowed to engage in certain activities. These limitations are in place to prevent abuse of the tax-exempt status and to ensure that organizations remain true to their public-benefit mission.

For example, tax-exempt organizations are typically prohibited from participating in political campaigns or influencing legislation. They must also avoid excessive private benefit, meaning that they cannot operate primarily for the benefit of a select few individuals or entities. This ensures that the benefits of tax exemption are distributed widely and equitably.

The Application Process

Once an organization or individual has determined their eligibility for tax-exempt status, the next step is to navigate the application process. This process can be complex and time-consuming, requiring careful attention to detail and a thorough understanding of the relevant laws and regulations.

Research and Preparation

Before initiating the application process, it is essential to conduct thorough research and preparation. This involves understanding the specific requirements and guidelines set forth by the relevant taxing authority. In the United States, for instance, the IRS provides detailed instructions and forms for organizations seeking tax-exempt status.

Organizations should review these guidelines carefully, ensuring that they meet all the necessary criteria. This includes understanding the specific tax forms to be filed, such as Form 1023 for organizations seeking recognition of exemption under Section 501(c)(3) of the Internal Revenue Code.

Document Preparation

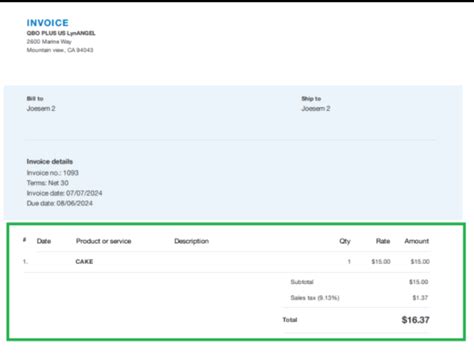

The application process often requires the submission of extensive documentation. This can include articles of incorporation, bylaws, financial statements, and detailed descriptions of the organization's activities and purpose. These documents must be prepared with precision, ensuring that they accurately reflect the organization's operations and comply with the relevant legal requirements.

For instance, an organization seeking tax-exempt status as a charitable entity would need to provide a detailed description of its charitable activities, including the populations served, the services provided, and the impact of these activities on the community. This information must be supported by evidence, such as financial records, photographs, and testimonials.

Filing and Processing

Once all the necessary documents have been prepared, the next step is to file the application with the relevant taxing authority. This process can vary depending on the jurisdiction and the type of tax involved. In some cases, the application may be submitted electronically, while in others, physical copies of documents may be required.

After the application is filed, it undergoes a rigorous review process. Taxing authorities, such as the IRS, examine the application materials to ensure that the organization meets all the necessary criteria for tax exemption. This process can take several months, and organizations should be prepared to provide additional information or clarification if requested.

Maintaining Tax-Exempt Status

Obtaining tax-exempt status is just the beginning. To maintain this status, organizations must continue to operate in compliance with the relevant laws and regulations. This involves ongoing monitoring of activities, financial records, and governance structures to ensure that the organization remains true to its designated purpose.

Compliance and Reporting

Tax-exempt organizations are subject to ongoing compliance requirements. This includes filing annual information returns, such as Form 990 in the United States, which provide detailed financial and operational information to the taxing authority. These returns must be accurate and complete, reflecting the organization's activities and financial status.

Additionally, tax-exempt organizations must maintain proper records and documentation to support their compliance with the relevant laws. This includes keeping detailed financial records, board meeting minutes, and records of activities and transactions.

Governance and Accountability

Maintaining tax-exempt status requires a commitment to good governance and accountability. This means that organizations must have effective oversight and control mechanisms in place. The board of directors or trustees plays a crucial role in ensuring that the organization operates in compliance with its designated purpose and with the relevant laws and regulations.

The board should regularly review the organization's activities, financial records, and strategic direction to ensure that it remains on track. They should also be prepared to address any issues or concerns that arise, taking corrective action when necessary to maintain compliance.

Public Disclosure and Transparency

Tax-exempt organizations are often required to make certain information publicly available. This can include financial statements, board member lists, and descriptions of activities. By providing this information, organizations demonstrate their commitment to transparency and accountability, building trust with stakeholders and the public.

In the United States, for example, Form 990 is publicly available, allowing anyone to review an organization's financial and operational information. This level of transparency ensures that tax-exempt organizations are held accountable for their activities and that the public can assess the impact and effectiveness of these organizations.

The Benefits and Challenges of Tax Exemption

Tax exemption offers a range of benefits to qualifying organizations and individuals. The most obvious advantage is the reduction or elimination of tax liabilities, which can provide significant financial relief and allow entities to allocate more resources towards their designated purposes.

For instance, a charitable organization that receives tax-exempt status can use its resources to provide more services to the community, expand its operations, or invest in new initiatives. Similarly, an educational institution can use its tax savings to reduce tuition fees, making education more accessible to a wider range of students.

However, tax exemption also comes with certain challenges and responsibilities. Organizations must ensure ongoing compliance with the relevant laws and regulations, which can be complex and time-consuming. They must also maintain transparency and accountability, which can involve significant administrative burdens.

Public Scrutiny and Accountability

Tax-exempt organizations are often subject to public scrutiny, particularly in the wake of high-profile scandals involving misuse of funds or failure to comply with the law. This means that organizations must be vigilant in maintaining their integrity and reputation. They must demonstrate their commitment to their designated purpose and ensure that their activities align with public expectations.

For example, a charitable organization that fails to properly account for its funds or engage in activities that benefit a select few individuals may face public backlash and lose the trust of its donors and supporters. This can have significant implications for the organization's ability to raise funds and continue its operations.

Limitation on Resources

While tax exemption can provide significant financial benefits, it can also limit an organization's access to certain resources. For instance, tax-exempt organizations are often restricted from engaging in certain types of business activities, such as lobbying or engaging in political campaigns. This can restrict their ability to advocate for their causes or influence policy decisions.

Additionally, tax-exempt organizations may face challenges in securing funding from certain sources. Some donors or investors may prefer to support organizations that are not tax-exempt, as they can offer certain tax benefits or incentives that are not available to tax-exempt entities.

The Future of Tax Exemption

The landscape of tax exemption is continually evolving, shaped by changing social, economic, and political dynamics. As societies evolve and new challenges emerge, the criteria and processes for tax exemption are likely to adapt to meet these changing needs.

Social and Economic Impact

The role of tax-exempt organizations in society is increasingly recognized and valued. These entities play a crucial role in addressing social and economic challenges, providing essential services and support to communities in need. As such, the tax-exempt sector is likely to continue growing and evolving to meet these changing needs.

For instance, the rise of social entrepreneurship and impact investing has led to the emergence of new types of tax-exempt organizations focused on social and environmental causes. These organizations are leveraging innovative business models to create positive social and environmental impact while also generating financial returns.

Regulatory Changes and Reforms

The legal and regulatory frameworks governing tax exemption are subject to ongoing review and reform. Taxing authorities, such as the IRS, regularly update their guidelines and procedures to address emerging issues and ensure that tax exemption remains effective and equitable.

These reforms can include changes to the eligibility criteria, application processes, and ongoing compliance requirements. For example, the IRS has implemented various initiatives to improve transparency and accountability within the tax-exempt sector, such as requiring more detailed financial disclosures and increasing oversight of high-risk organizations.

International Perspectives

The concept of tax exemption is not limited to a single country or jurisdiction. Many countries around the world have their own systems of tax exemption, each with its own unique criteria and processes. As global collaboration and connectivity increase, there is growing interest in harmonizing these systems and establishing international standards for tax exemption.

This can involve sharing best practices, developing common criteria for eligibility, and establishing mechanisms for mutual recognition of tax-exempt status across borders. By facilitating cross-border collaboration and reducing administrative burdens, these efforts can enhance the effectiveness and impact of tax-exempt organizations operating on a global scale.

Frequently Asked Questions

What is the primary benefit of tax exemption for organizations?

+The primary benefit of tax exemption for organizations is the reduction or elimination of tax liabilities, allowing them to allocate more resources towards their designated purposes and activities.

How long does the tax exemption application process typically take?

+The duration of the tax exemption application process can vary widely depending on the jurisdiction and the complexity of the organization’s structure and activities. In the United States, for instance, the IRS estimates that the process can take several months to a year or more.

What are some common challenges faced by tax-exempt organizations?

+Tax-exempt organizations often face challenges related to ongoing compliance, transparency, and accountability. They must ensure that their activities and financial records are in line with the relevant laws and regulations, maintain proper governance structures, and be prepared to address public scrutiny and expectations.

Can individuals also apply for tax-exempt status?

+In certain cases, individuals may be eligible for tax-exempt status, such as in the case of certain religious or charitable activities. However, the criteria and processes for individual tax exemption can be highly specific and may vary based on jurisdiction and the type of tax involved.

What happens if an organization loses its tax-exempt status?

+If an organization loses its tax-exempt status, it becomes subject to the same tax liabilities as any other entity. This can result in significant financial implications, as the organization may need to pay back taxes and penalties. It may also face challenges in maintaining its operations and reputation.