Solano County Property Taxes

In Solano County, California, property taxes are a significant aspect of the local economy and a key component of the county's financial landscape. Understanding the ins and outs of Solano County property taxes is crucial for homeowners, businesses, and anyone interested in real estate investments in the area. This comprehensive guide aims to shed light on the intricacies of property taxes in Solano County, covering everything from assessment processes to payment options and tax relief programs.

Understanding Solano County Property Taxes

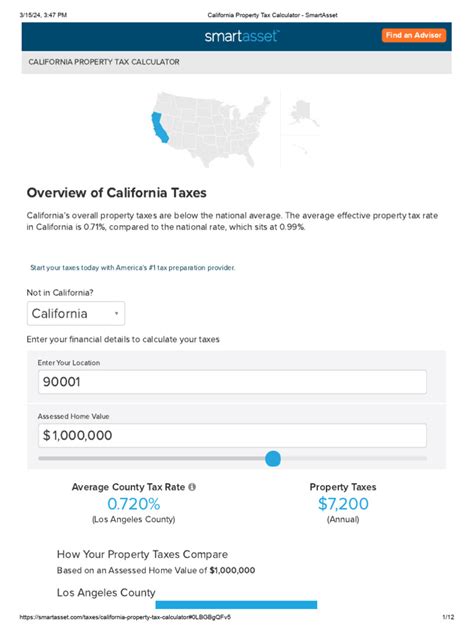

Property taxes in Solano County, like in many other jurisdictions, are an annual levy imposed on real estate property owners. These taxes are a primary source of revenue for local governments, funding essential services such as schools, fire protection, police services, road maintenance, and other public amenities. The amount of property tax an individual or entity owes is determined by a combination of factors, including the assessed value of the property and the tax rate set by local governing bodies.

Solano County's property tax system operates under the principles of Proposition 13, a landmark initiative passed in California in 1978. Proposition 13 established limits on property tax assessments and increases, providing a degree of predictability for property owners. It also introduced the concept of a "base year value," which is the assessed value of a property when it is purchased or when new construction is completed.

Property Assessment and Valuation

The process of assessing property value is a critical step in determining property taxes. In Solano County, the Assessor’s Office is responsible for establishing the assessed value of each property. This value is based on a combination of factors, including the property’s location, size, age, improvements, and recent sales of comparable properties.

The assessed value of a property is not necessarily its market value. Proposition 13 limits the annual increase in assessed value to a maximum of 2% or the inflation rate, whichever is lower. This means that even if a property's market value increases significantly in a given year, its assessed value for tax purposes may only rise by a small percentage.

The Assessor's Office also handles changes in property ownership, new construction, and improvements. When a property is sold or transferred, the new owner's tax bill is based on the property's base year value or the market value at the time of transfer, whichever is lower. Similarly, when improvements or additions are made to a property, the increased value is added to the assessed value.

| Assessment Year | Assessed Value | Tax Rate | Estimated Property Tax |

|---|---|---|---|

| 2022 | $400,000 | 1.25% | $5,000 |

| 2023 | $408,000 (2% increase) | 1.25% | $5,100 |

| 2024 | $416,160 (2% increase) | 1.25% | $5,204 |

This table illustrates a hypothetical property's assessed value and estimated property tax over three years, assuming a 2% annual increase in assessed value and a tax rate of 1.25%.

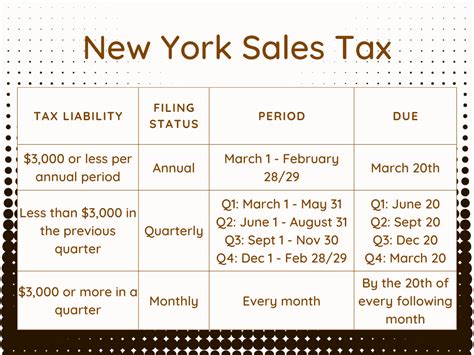

Tax Rates and Revenue Distribution

The tax rate applied to a property’s assessed value is determined by the Board of Supervisors and other local taxing agencies, such as school districts and special districts. These tax rates are set annually and vary depending on the specific services provided by each agency. The tax rate is typically expressed as a percentage of the assessed value.

For instance, if the combined tax rate for a particular property is 1.5%, and the property's assessed value is $500,000, the estimated property tax for that year would be $7,500. The revenue generated from these taxes is then distributed among the various agencies according to their assessed needs and the services they provide to the community.

Payment Options and Deadlines

Property owners in Solano County have several options for paying their property taxes. The most common method is to pay in two installments, with due dates typically falling around February 1st and November 1st of each year. These installments correspond to the fiscal year, which runs from July 1st to June 30th.

Property owners can pay their taxes online through the County Treasurer-Tax Collector's website, by mail, or in person at the Treasurer-Tax Collector's office or designated payment locations. It's important to note that if the installment due date falls on a weekend or holiday, the payment is considered timely if received on the next business day.

Late payments are subject to penalties and interest. If the first installment is not received by the due date, a 10% penalty is added to the tax bill. If the second installment is late, an additional 10% penalty is applied. Interest is also charged on late payments at a rate of 1.5% per month or fraction of a month.

Payment Plans and Alternative Options

Solano County recognizes that property tax payments can be a significant financial burden, especially for low-income households or those facing financial difficulties. To assist such individuals, the County offers a Senior Citizen’s Homeowner and Disabled Person’s Property Tax Deferral Program and the Property Tax Postponement Program for low-income seniors.

The Senior Citizen's program allows eligible homeowners aged 62 and older or disabled persons of any age to defer payment of their property taxes until the property is sold, transferred, or until the borrower dies. The Property Tax Postponement Program offers similar relief to low-income seniors aged 62 and older who meet certain income and asset limits.

Additionally, property owners who anticipate difficulty in paying their property taxes may apply for a Payment Plan with the County Treasurer-Tax Collector's office. This plan allows for the payment of delinquent taxes over an extended period, with interest accruing at the same rate as for late payments.

Appeals and Exemptions

Property owners who believe their property has been over-assessed or that their tax bill contains errors have the right to appeal. The Assessment Appeals Board in Solano County handles these appeals, which can be based on factors such as incorrect property characteristics, incorrect market value, or an inequitable assessment compared to similar properties.

The appeals process typically involves submitting an application, providing evidence to support the appeal, and potentially attending a hearing. The Assessment Appeals Board's decision can result in a reduction of the assessed value, which would subsequently lower the property tax bill.

Exemptions and Reductions

Solano County offers several types of property tax exemptions and reductions to eligible homeowners and organizations. These exemptions can significantly reduce the tax burden for certain groups.

- Homeowner's Exemption: Eligible homeowners can apply for a $7,000 reduction in their property's assessed value, which directly lowers their annual property tax bill. This exemption is available to all homeowners, regardless of income.

- Veteran's Exemption: Qualified veterans may be eligible for a property tax exemption based on their service-connected disability. The exemption can be up to $150,000 of the assessed value, and it is transferable to a surviving spouse.

- Disability Exemption: This exemption is available to individuals with a service-connected disability of at least 10% who are receiving disability compensation from the Department of Veterans Affairs. The exemption reduces the assessed value by $100,000, which can lead to significant tax savings.

- Nonprofit Organization Exemption: Properties owned and operated by qualified nonprofit organizations may be exempt from property taxes. This includes churches, schools, and other charitable organizations.

Impact on the Local Economy

Property taxes play a pivotal role in the economic landscape of Solano County. They are a primary source of revenue for local governments, allowing them to fund essential services and infrastructure projects that benefit the entire community. The predictable nature of property tax assessments, thanks to Proposition 13, provides a stable financial foundation for the county’s operations.

However, the complexity of the property tax system can present challenges for homeowners and investors. The interplay of assessed values, tax rates, and various exemptions can make it difficult to predict exact tax liabilities. Additionally, the potential for assessed values to lag behind market values can impact property transactions and investment decisions.

For real estate investors, understanding the property tax landscape is crucial. Investors should consider the potential impact of property taxes on their return on investment, especially when evaluating long-term hold strategies. The availability of tax relief programs and exemptions can also be a significant factor in choosing investment properties.

Future Implications and Potential Reforms

The property tax system in Solano County, like many other California counties, is subject to ongoing discussions and potential reforms. As the state’s population and real estate market continue to evolve, so too must the systems that govern property taxation.

Proposition 13, while providing much-needed tax relief and stability for homeowners, has also been the subject of debate. Critics argue that it can lead to an uneven tax burden, with some properties paying significantly less in taxes than others due to the restrictions on assessed value increases. There have been proposals to modify or replace Proposition 13, but any changes would require a significant shift in public opinion and political will.

In the meantime, Solano County continues to administer its property tax system under the existing framework. Property owners and investors should stay informed about any potential changes and consult with tax professionals to ensure they are maximizing the benefits of the current system.

Conclusion

Solano County’s property tax system, while complex, is a critical component of the local economy and the financial stability of the county’s communities. By understanding the assessment process, tax rates, payment options, and available exemptions, property owners and investors can navigate the system effectively and plan their financial strategies accordingly.

As the real estate market in Solano County continues to evolve, staying informed about property taxes and their implications will be essential for making informed decisions. Whether you're a homeowner, a business owner, or a real estate investor, keeping up with the latest developments in property taxation can help you make the most of your investments and contribute to the vibrant economy of Solano County.

How often are property taxes assessed in Solano County?

+Property taxes are assessed annually in Solano County. The assessed value of a property is determined based on various factors, including its location, size, and improvements. This assessed value is then used to calculate the property tax bill for the year.

What happens if I miss the property tax payment deadline in Solano County?

+If you miss the property tax payment deadline, you will incur penalties and interest on the unpaid amount. The penalty for the first installment is 10%, and for the second installment, it is also 10%. Additionally, interest is charged at a rate of 1.5% per month on the unpaid balance.

Are there any property tax exemptions or reductions available in Solano County?

+Yes, Solano County offers several property tax exemptions and reductions. These include the Homeowner’s Exemption, which reduces the assessed value by $7,000, the Veteran’s Exemption for service-connected disabilities, the Disability Exemption for individuals with disabilities, and exemptions for nonprofit organizations. These exemptions can significantly reduce the property tax burden for eligible individuals and organizations.

How can I appeal my property’s assessed value in Solano County?

+If you believe your property has been over-assessed, you can appeal to the Assessment Appeals Board in Solano County. The appeals process involves submitting an application, providing evidence to support your case, and potentially attending a hearing. The Assessment Appeals Board will review your appeal and make a decision, which could result in a reduction of your property’s assessed value.