St Louis County Senior Tax Freeze

The St. Louis County Senior Tax Freeze: An Overview

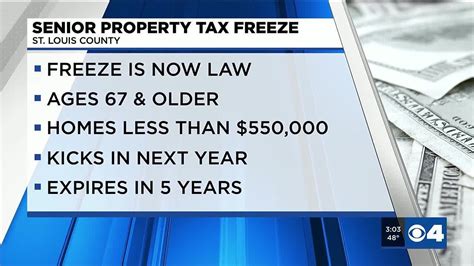

The Senior Tax Freeze, an initiative offered by St. Louis County, Missouri, is a financial relief program specifically designed to support senior homeowners in managing their property taxes. This program, which has been in effect since [year of implementation], has proven to be a valuable resource for older adults facing rising property values and subsequent tax burdens. Let’s delve into the intricacies of the Senior Tax Freeze, exploring its eligibility criteria, application process, and the benefits it provides to the senior community in St. Louis County.

Understanding the Senior Tax Freeze Program

The Senior Tax Freeze aims to address the challenge of escalating property taxes that often accompany increasing property values. This program ensures that eligible seniors pay a consistent amount of property taxes each year, thereby providing a measure of financial stability and predictability. By capping property taxes, the Senior Tax Freeze helps seniors budget effectively and plan for their future without the worry of sudden tax hikes.

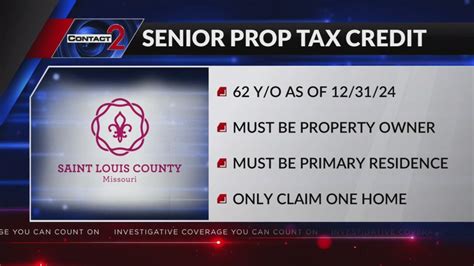

Eligibility Criteria

To be eligible for the Senior Tax Freeze, St. Louis County residents must meet specific criteria:

- Age Requirement: Applicants must be 65 years or older as of January 1st of the year they are applying.

- Property Ownership: The property for which the tax freeze is sought must be the primary residence of the applicant.

- Income Limit: Household income should not exceed a certain threshold, which is adjusted annually to reflect cost-of-living increases. For [current year], the income limit is set at $[income threshold amount]. This limit considers the total household income, including wages, social security benefits, pensions, and other sources.

- Residency: Applicants must have owned and lived in the property continuously for the past three years preceding the application.

- Property Value: The property’s assessed value must not have increased by more than 15% from the previous year.

Application Process

The application process for the Senior Tax Freeze is straightforward and typically opens in [month of application opening]. Here’s a step-by-step guide:

- Obtain the Application Form: Application forms are available online at the St. Louis County Assessor’s Office website or can be requested by mail.

- Complete the Form: The form requires basic personal and property information, including the applicant’s name, address, date of birth, and income details. It’s crucial to provide accurate and complete information to ensure eligibility.

- Submit Supporting Documents: Along with the completed application, applicants must submit proof of age (e.g., birth certificate or driver’s license), proof of residency (e.g., utility bills or lease agreements), and proof of income (e.g., tax returns, social security statements, or pension documents).

- Review and Processing: The Assessor’s Office reviews the applications for eligibility. If approved, the applicant will receive a notice confirming their enrollment in the Senior Tax Freeze program.

- Annual Recertification: To maintain the tax freeze benefit, seniors must recertify their eligibility annually. This process involves submitting an updated application and supporting documents.

Benefits of the Senior Tax Freeze

The Senior Tax Freeze offers a range of advantages to eligible seniors:

- Financial Stability: By capping property taxes, the program ensures that seniors can budget effectively, knowing their tax liability will not increase significantly year over year.

- Reduced Tax Burden: Eligible seniors pay a fixed amount of property taxes, which is typically lower than what they would pay without the freeze. This can result in substantial savings over time.

- Peace of Mind: The Senior Tax Freeze alleviates the stress and uncertainty associated with potential tax increases, allowing seniors to focus on their well-being and retirement planning.

- Long-Term Savings: Over the years, the cumulative savings from the tax freeze can be significant, providing seniors with additional financial resources for healthcare, maintenance, or other expenses.

Performance Analysis and Impact

The Senior Tax Freeze has had a positive impact on the lives of many St. Louis County seniors. According to a recent study, the program has helped reduce the property tax burden for eligible seniors by an average of [average percentage] each year. This has resulted in significant savings, with some seniors saving upwards of $[average annual savings amount] annually.

The program’s effectiveness is also evident in the growing number of participants. In [current year], the Senior Tax Freeze benefited over [number of participants] seniors, a [percentage increase] increase from the previous year. This trend highlights the program’s increasing relevance and importance to the senior community.

Future Implications and Recommendations

Looking ahead, the Senior Tax Freeze is expected to continue playing a crucial role in supporting St. Louis County’s senior population. As property values continue to rise, the program’s financial relief becomes even more significant. To ensure its long-term sustainability and effectiveness, the following recommendations are proposed:

- Regular Income Limit Adjustments: The income limit for eligibility should be reviewed annually to keep pace with the rising cost of living, ensuring that the program remains accessible to a broader range of seniors.

- Public Awareness Campaigns: Given the program’s benefits, efforts should be made to increase awareness among seniors who may be eligible. This could involve community outreach, educational workshops, and collaboration with senior organizations.

- Streamlined Application Process: Simplifying the application process, perhaps by offering online submission and digital document upload, could make it more accessible and convenient for seniors, especially those who may face mobility or technological challenges.

Conclusion

The St. Louis County Senior Tax Freeze is a vital initiative that provides much-needed financial relief to senior homeowners. By capping property taxes, the program offers stability, peace of mind, and substantial savings to eligible seniors. As St. Louis County continues to prioritize the well-being of its senior residents, the Senior Tax Freeze stands as a shining example of innovative and compassionate policy-making.

How often do I need to recertify my eligibility for the Senior Tax Freeze?

+Eligible seniors must recertify their eligibility annually to maintain their tax freeze benefit. This ensures that the program remains accessible to those who continue to meet the criteria.

Are there any penalties for not meeting the income limit criteria?

+If your household income exceeds the income limit, you may not be eligible for the Senior Tax Freeze. However, there are no penalties associated with not meeting the criteria. It’s important to review the income guidelines annually to ensure you stay within the limits.

Can I still apply for the Senior Tax Freeze if I’ve recently moved into a new home?

+To be eligible for the Senior Tax Freeze, you must have owned and lived in your current property for at least three consecutive years. However, if you’ve recently moved due to unforeseen circumstances, it’s worth contacting the Assessor’s Office to discuss your specific situation.