Ma Tax Refund Status

Are you eager to know the status of your Ma Tax Refund? Understanding the process and timelines for tax refunds is crucial for effective financial planning. In this comprehensive guide, we'll explore the ins and outs of Ma Tax Refund status, offering expert insights and real-world examples to help you navigate this journey efficiently.

Unraveling the Mystery: Understanding Ma Tax Refund Status

The Ma Tax Refund status is a critical piece of information for taxpayers, providing insights into the progress of their refund journey. Delving into this topic, we'll cover everything from the initial processing stages to the factors that can impact refund timelines. By the end of this section, you'll have a clear understanding of what to expect and how to interpret the status updates you receive.

The Initial Processing Stage

When you submit your tax return, it enters the initial processing stage. This is where the tax authorities verify the information you've provided and ensure everything is in order. During this time, your refund status may show as "Processing" or "Pending." It's important to note that this stage can vary in duration, depending on the complexity of your return and the volume of submissions.

For instance, let's consider the case of Sarah, a self-employed individual who filed her taxes on April 15th. Due to the detailed nature of her business expenses, her return took slightly longer to process during the initial stage compared to a standard employee's return. However, understanding the reason behind the delay helped Sarah manage her expectations effectively.

Factors Affecting Refund Timelines

Several factors can influence the speed at which your Ma Tax Refund is processed. These include the method of filing (paper or electronic), the accuracy of the information provided, and any additional reviews or audits required by the tax authorities. Here's a closer look at each of these factors:

- Filing Method: Electronic filing tends to be faster than traditional paper filing. With e-filing, your return is automatically processed, reducing the potential for human error and speeding up the refund process.

- Accuracy of Information: Inaccurate or incomplete information can trigger additional reviews, leading to delays. It's crucial to double-check your tax forms and ensure all details are correct before submission.

- Reviews and Audits: In some cases, tax authorities may select returns for further review or audit. While this is a standard practice to ensure compliance, it can extend the refund timeline. If your return is chosen for review, be prepared for a slightly longer wait.

Consider the example of John, who claimed a significant number of deductions on his tax return. Due to the complexity of his deductions, his return was selected for a detailed review. While this process took longer than expected, it ultimately ensured that John received the correct refund amount.

Checking Your Ma Tax Refund Status: A Step-by-Step Guide

Knowing how to check your Ma Tax Refund status is essential for staying informed and avoiding unnecessary anxiety. Here's a detailed guide to help you navigate the process seamlessly.

Online Status Check

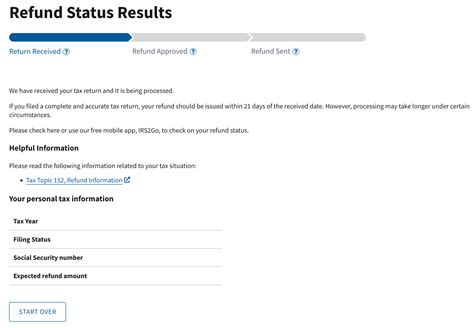

The most convenient way to check your Ma Tax Refund status is through the official online portal provided by the tax authorities. This portal offers a secure and efficient way to track your refund journey. To access this service, you'll need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and your filing information, including your filing status and the exact amount of your expected refund.

Once you've logged in to the portal, you'll be able to view your refund status in real time. The portal will display updates at each stage of the process, providing clarity on where your refund is in the pipeline. For instance, you might see status updates such as "Received," "Accepted," or "Sent," each indicating a specific step in the refund process.

Telephone Status Inquiry

If you prefer a more traditional approach, you can also check your Ma Tax Refund status by calling the tax authorities' dedicated hotline. This option is particularly useful if you encounter any issues with the online portal or if you simply prefer a more personalized experience.

When calling, have your tax return information readily available. The customer service representative will ask for details such as your SSN, filing status, and the amount of your expected refund. They'll then provide you with the latest status update and answer any questions you may have about the process.

Common Challenges and Solutions: Navigating Ma Tax Refund Delays

While most taxpayers receive their refunds within a reasonable timeframe, delays can occur. Understanding the common challenges and their solutions is crucial for managing expectations and taking appropriate action.

Addressing Delays: A Comprehensive Approach

If you find that your Ma Tax Refund is taking longer than expected, there are several steps you can take to address the delay and potentially expedite the process.

- Review Your Return: Start by carefully reviewing your tax return for any errors or omissions. Even a small mistake can trigger additional reviews and cause delays. If you find an error, amend your return as soon as possible.

- Check for Missing Information: Ensure that you've provided all the necessary documentation and information. Missing items, such as W-2 forms or supporting schedules, can delay the processing of your refund.

- Contact the Tax Authorities: If you've confirmed that your return is accurate and complete, it's time to reach out to the tax authorities. They can provide specific insights into the status of your refund and offer guidance on any further actions you may need to take.

- Consider Alternative Methods: If the delay persists, explore alternative methods for receiving your refund. For instance, you might consider opting for direct deposit instead of a paper check, as this can often speed up the process.

In the case of Emily, her refund was delayed due to a missing W-2 form. After realizing the error, she promptly provided the missing document, and her refund was processed within a week of submitting the additional information.

Maximizing Your Ma Tax Refund: Expert Tips and Strategies

Maximizing your Ma Tax Refund is not just about receiving the largest possible refund; it's about optimizing your financial situation and ensuring you receive the benefits you're entitled to. Here, we'll explore expert tips and strategies to help you make the most of your tax refund.

Strategic Planning for a Larger Refund

To maximize your Ma Tax Refund, it's essential to plan strategically throughout the year. Here are some key strategies to consider:

- Utilize Tax Credits and Deductions: Research and understand the various tax credits and deductions available to you. From the Child Tax Credit to the Student Loan Interest Deduction, there are numerous ways to reduce your taxable income and increase your refund.

- Maximize Retirement Contributions: Contributions to retirement accounts, such as 401(k)s and IRAs, can provide significant tax benefits. By maximizing your contributions, you can reduce your taxable income and potentially increase your refund.

- Review Your Withholding: Ensure that your tax withholding is accurate by completing a Paycheck Checkup annually. This simple tool helps you adjust your withholding to ensure you're not overpaying throughout the year.

Consider the example of David, who strategically increased his retirement contributions throughout the year. By maximizing his 401(k) contributions, he not only reduced his taxable income but also qualified for additional tax credits, resulting in a larger refund come tax season.

Conclusion: Empowering Your Financial Journey with Ma Tax Refund Knowledge

Understanding your Ma Tax Refund status is a powerful tool for effective financial management. By staying informed and taking proactive steps, you can navigate the refund process with confidence and ensure that your financial journey remains on track. Remember, knowledge is power, and when it comes to your taxes, being informed can make all the difference.

Frequently Asked Questions (FAQ)

How long does it typically take to receive a Ma Tax Refund?

+

The typical timeframe for receiving a Ma Tax Refund is around 21 days for electronic returns and 6 weeks for paper returns. However, this can vary based on factors such as the accuracy of your return and the volume of submissions.

What should I do if my Ma Tax Refund status shows as “Pending” for an extended period?

+

If your refund status remains “Pending” for an unusually long time, it’s advisable to contact the tax authorities. They can provide specific insights into your case and guide you on any necessary actions.

Can I track my Ma Tax Refund status if I filed a paper return?

+

Yes, you can track the status of your paper return online or by calling the tax authorities’ hotline. However, electronic filing generally provides more timely and detailed status updates.

What happens if my Ma Tax Refund is delayed due to an error on my return?

+

If your refund is delayed due to an error, the tax authorities will typically notify you and provide instructions on how to correct the error. Once the error is rectified, your refund will be processed as usual.