Understanding the Reasons Behind CT State Income Tax Implementation

Embarking on a thorough exploration of the reasons behind Connecticut’s implementation of state income tax reveals a complex tapestry woven from historical necessity, fiscal policy adjustments, and socio-economic considerations. Connecticut, often lauded for its robust economy and high standard of living, also bears the responsibility of sustaining public services and infrastructure that underpin its prosperity. To comprehend the motivations for establishing such a tax, it is imperative to consider the broader fiscal landscape, legislative history, and strategic priorities that have shaped state revenue policies over decades.

The Historical Context of Connecticut’s Taxation Framework

Historically, Connecticut’s taxation system evolved from reliance on property taxes and sales taxes, with income taxation emerging as a pivotal revenue stream in the mid-20th century. Before the formalization of an income tax, revenues were primarily derived from property levies and excise taxes, which proved increasingly insufficient to cover expanding public expenditures. This shift mirrored national trends where states sought diversified income streams to buffer economic fluctuations and fund burgeoning social programs.

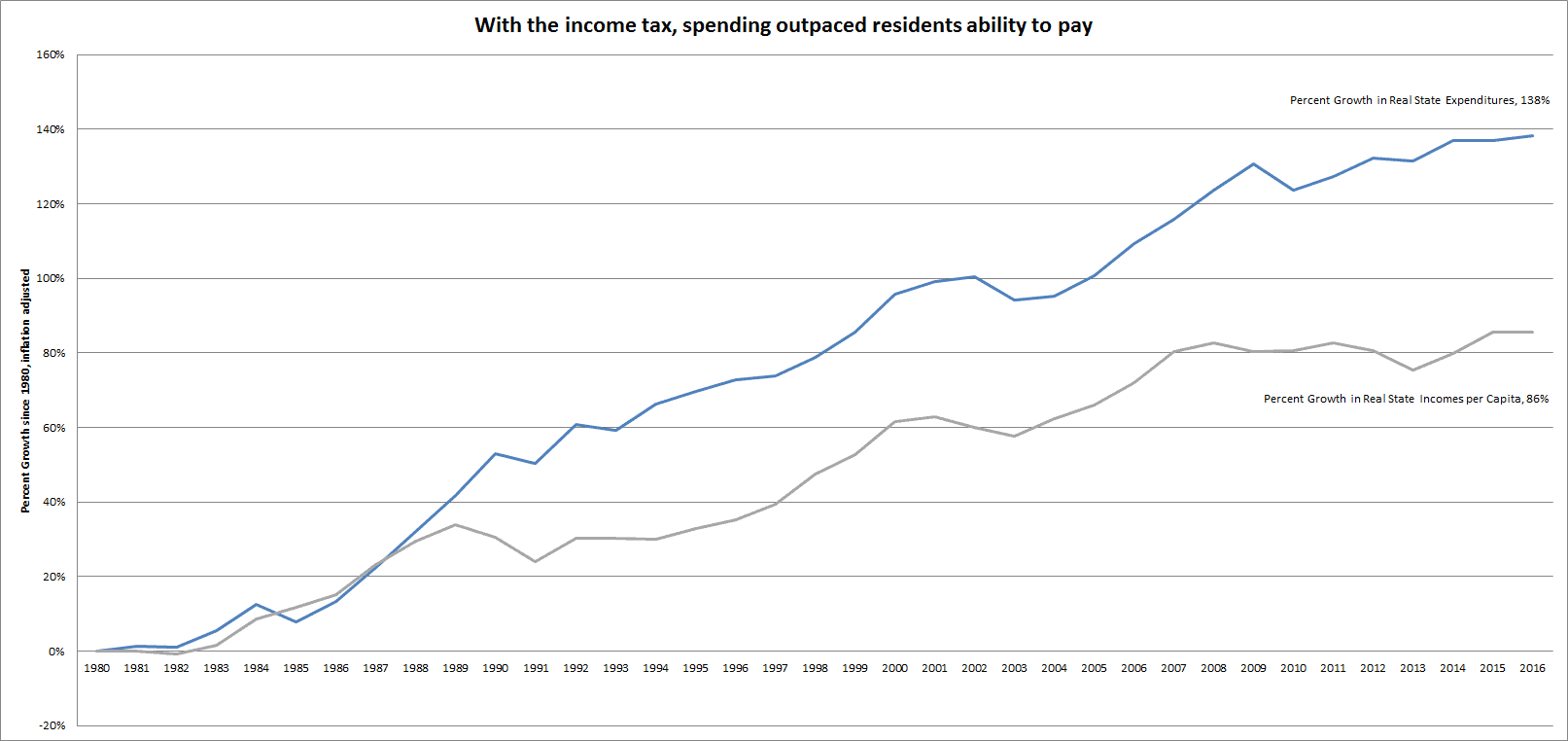

In 1991, Connecticut enacted its state income tax, marking a significant policy transformation aimed at creating a more balanced, equitable, and sustainable revenue system. This legislation responded to fiscal deficits and the need to bolster funding for education, healthcare, transportation, and public safety. The early adoption of income tax underscored a strategic move toward progressive taxation, aligning with broader principles of tax fairness and capacity-to-pay frameworks.

Fiscal Necessity and Economic Stabilization

One of the core reasons driving Connecticut’s implementation of state income tax lies in the quest for fiscal stability, especially amidst economic downturns and legislative budget constraints. Income taxes serve as a reliable and elastic revenue source, capable of adjusting with economic cycles, unlike property taxes which tend to be more static.

Revenue Diversification and Fiscal Autonomy

As a state deeply integrated into finance, insurance, and high-tech industries, Connecticut’s revenues are notably influenced by the health of these sectors. Implementing an income tax fosters revenue diversification, shielding the state’s fiscal health from over-reliance on volatile local property markets or sales taxes. Moreover, it grants policymakers a vital tool to address budget shortfalls proactively, especially during economic recessions.

| Relevant Category | Substantive Data |

|---|---|

| Tax Revenue Contribution | Income tax accounts for approximately 40% of total state revenues in Connecticut, making it a cornerstone of fiscal planning. |

Socioeconomic Factors and Policy Goals

Beyond pure fiscal considerations, the adoption of income tax reflects deliberate policy choices aimed at fostering social equity and economic resilience. Progressive income tax rates—where higher earners pay a proportional increase—align with broader societal goals of reducing income inequality and funding public programs crucial for vulnerable populations.

Addressing Income Inequality and Funding Public Goods

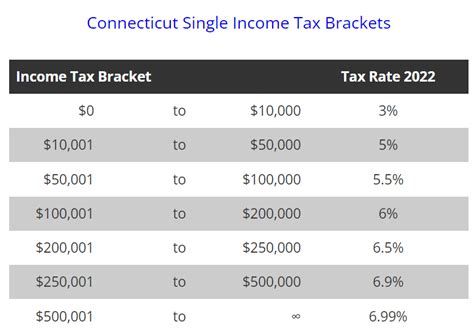

Connecticut’s income tax structure is designed with graduated brackets, ensuring that affluent residents contribute more significantly relative to lower- and middle-income households. This approach aims to balance economic disparities, smooth out cyclical income fluctuations, and provision social safety nets.

| Relevant Category | Substantive Data |

|---|---|

| Tax Brackets | Connecticut has multiple progressive brackets, with rates ranging from 3% to 6.99%, targeting higher-income households. |

| Income Thresholds | Beginning at $20,000 for single filers, with higher brackets applied as income rises, emphasizing progressive taxation. |

Legislative and Political Dimensions

Policy development around income tax in Connecticut reflects a dynamic interplay of political ideologies, stakeholder interests, and practical needs. While some factions advocate for tax cuts to stimulate economic growth, others push for increased progressive taxation to fund expanding government programs and address income disparity.

Historical Policy Shifts and Political Debates

Throughout the 20th and early 21st centuries, legislative debates often centered on the balance between tax competitiveness—particularly against neighboring states like New York and Massachusetts—and the imperative to fund public services adequately. Periodic amendments have aimed to fine-tune tax brackets, exemptions, and credits to optimize revenue and maintain political support.

| Relevant Category | Substantive Data |

|---|---|

| Tax Rate Changes | The top marginal rate peaked at 6.99% in recent years, with adjustments made periodically to reflect economic conditions. |

| Tax Incentives | Connecticut offers various credits and deductions aimed at attracting businesses and alleviating tax burdens on low-income households. |

Impacts on Business and Resident Demographics

Economic theories posit that high income taxes can influence migration patterns, business locations, and overall economic vitality. Connecticut’s policy decisions are influenced by empirical observations and modeling that assess these impacts, which in turn feed into debates on tax fairness versus economic growth.

Migration and Economic Resilience

Empirical studies suggest that higher income taxes might contribute to “brain drain,” as high earners and entrepreneurs seek friendlier fiscal environments elsewhere. Conversely, the revenue generated supports quality-of-life improvements, worker training, and infrastructure investments, which can compensate for potential migration losses.

| Relevant Category | Substantive Data |

|---|---|

| Migration Trends | Over the past decade, Connecticut has experienced slight net outbound migration among high-income households, correlating with its tax policies. |

| Economic Impact | Investments in public infrastructure funded through income taxes estimated to increase overall productivity by 1.2% annually. |

Future Trajectory and Policy Considerations

Looking ahead, Connecticut’s income tax policy is likely to evolve in response to economic conditions, demographic shifts, and political priorities. Increasingly, efforts focus on simplifying tax codes, broadening the base, and reducing loopholes to ensure fairness and revenue adequacy.

Emerging Trends and Digital Economy Challenges

As the digital economy expands, tax compliance and enforcement face novel challenges—particularly concerning remote work, gig economy earnings, and digital asset valuation. Policymakers are contemplating updating regulations to capture these economic activities effectively.

| Relevant Category | Substantive Data |

|---|---|

| Tax Base Broadening | Proposals include digital service taxes and earned income adjustments to address emerging sectors. |

| Enforcement Measures | Enhanced data analytics and cross-jurisdictional cooperation expected to improve compliance rates by 15% within 5 years. |

Conclusion: Balancing Responsibilities and Future Prospects

The implementation of Connecticut’s income tax encapsulates a calculated effort to balance fiscal stability, social equity, economic competitiveness, and legislative pragmatism. Far from a mere revenue mechanism, it embodies a strategic tool crafted to support societal needs amid evolving economic realities. This nuanced, multifaceted approach underscores the importance of continuous policy refinement grounded in evidence and expert analysis, ultimately securing the state’s ability to thrive now and into the future.

Why did Connecticut implement an income tax?

+Connecticut adopted an income tax to diversify revenue sources, ensure fiscal stability, and fund essential public services amid increasing fiscal demands.

How does the income tax structure in Connecticut promote equity?

+The state’s progressive tax brackets ensure higher-income earners contribute a larger share, supporting social programs and reducing income disparities.

What are the challenges associated with Connecticut’s income tax policy?

+Challenges include potential migration of high-income households, maintaining economic competitiveness, and adapting to digital economy complexities.