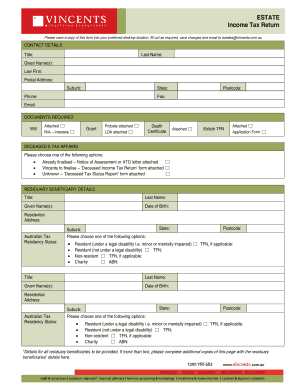

Estate Income Tax Return

For individuals who have inherited property, understanding the intricacies of estate income tax is crucial. This article aims to provide an in-depth guide, offering expert insights and practical advice to help navigate the complex world of estate taxation.

Estate Income Tax: A Comprehensive Guide

When it comes to managing inherited assets, one of the most important financial considerations is estate income tax. This tax, often overlooked, can significantly impact the value of an estate and the financial well-being of beneficiaries. In this comprehensive guide, we will delve into the world of estate income taxation, exploring its intricacies, offering practical strategies, and providing valuable insights to ensure a smooth and efficient process.

Understanding Estate Income Tax

Estate income tax is a crucial component of the overall tax landscape, specifically targeting the income generated by an estate during the administration period. Unlike the more widely known estate tax, which is levied on the value of the estate at the time of the owner’s death, income tax focuses on the earnings and profits derived from the estate’s assets.

The administration period, often referred to as the probate or settlement period, is the time between the owner's death and the final distribution of the estate's assets. During this phase, the executor or personal representative is responsible for managing the estate, which may include selling assets, investing funds, and generating income. It is during this period that estate income tax comes into play.

The tax implications can vary widely depending on the nature of the assets, the duration of the administration period, and the tax strategies employed. Proper planning and understanding of these tax nuances are essential to ensure that the estate's value is preserved and that beneficiaries receive the maximum benefit.

| Estate Income Tax Key Points | Description |

|---|---|

| Taxable Income | Includes interest, dividends, rents, royalties, and gains from asset sales. |

| Filing Requirements | Estate must file a tax return if gross income exceeds $600 during the tax year. |

| Tax Rates | Estate income is taxed at regular individual tax rates, with the highest rate applicable to income over $539,900 for single filers in 2023. |

| Deductions and Credits | Similar to individual returns, estates can claim deductions and credits, including the standard deduction, personal exemption, and itemized deductions. |

| Form 1041 | The primary tax form for estates and trusts, used to report income, expenses, and distributions. |

Taxable Income Sources

Estate income tax encompasses a range of sources, including:

- Interest Income: Earnings from savings accounts, certificates of deposit, and other interest-bearing assets.

- Dividends: Payments from stocks, mutual funds, and other investments.

- Rents and Royalties: Income from real estate properties and intellectual property, such as patents or copyrights.

- Capital Gains: Profits from the sale of assets, including stocks, bonds, and real estate.

Filing Requirements and Deadlines

Estates are generally required to file a tax return if the gross income exceeds $600 during the tax year. The filing deadline is typically the same as for individual tax returns, which is April 15th of the following year. However, if the estate’s tax year differs from the calendar year, the deadline may vary.

Tax Rates and Calculations

The tax rates applied to estate income are the same as those for individuals, with the highest rate applicable to income over a certain threshold. For instance, in 2023, the top tax rate of 37% is applied to income over $539,900 for single filers. Estates, like individuals, can benefit from various deductions and credits, including the standard deduction, personal exemption, and itemized deductions.

Form 1041: The Estate and Trust Tax Return

The primary tax form used for estates and trusts is Form 1041, which is used to report income, expenses, and distributions. This form requires a detailed accounting of the estate’s activities during the tax year, including income received, expenses incurred, and any distributions made to beneficiaries.

Schedule K-1, which is attached to Form 1041, provides each beneficiary with a breakdown of their share of the estate's income, deductions, and credits. This schedule is crucial for beneficiaries to properly report their share of the estate's income on their individual tax returns.

Estate Tax Planning Strategies

Effective tax planning is essential to minimize the impact of estate income tax. Here are some strategies to consider:

Timing of Asset Sales

The timing of asset sales can significantly impact the estate’s tax liability. By strategically timing sales to take advantage of market conditions and tax laws, executors can potentially reduce the estate’s tax burden. For instance, selling assets when capital gains rates are lower or when the estate’s income is in a lower tax bracket can result in substantial savings.

Maximizing Deductions and Credits

Estates, like individuals, can benefit from a range of deductions and credits. These include the standard deduction, personal exemption, and itemized deductions such as medical expenses, taxes, and charitable contributions. Proper documentation and record-keeping are essential to maximize these deductions and ensure compliance with tax regulations.

Utilizing Tax-Efficient Investments

Choosing tax-efficient investment strategies can help minimize the estate’s tax liability. For instance, investing in tax-exempt municipal bonds or utilizing tax-advantaged accounts like 529 plans or IRAs can reduce the tax burden on the estate’s income.

Estate Tax Compliance

Compliance with tax regulations is crucial to avoid penalties and ensure a smooth administration process. This includes accurate reporting of income, expenses, and distributions on Form 1041 and ensuring that beneficiaries receive their Schedule K-1 in a timely manner.

Real-World Examples and Case Studies

To illustrate the practical application of estate income tax, let’s explore a few real-world examples and case studies:

Estate of John Doe

John Doe, a successful entrepreneur, passed away, leaving behind a substantial estate primarily comprised of stocks and real estate. During the administration period, the executor, Jane Smith, made several strategic decisions to minimize the estate’s tax liability. She timed the sale of certain stocks to take advantage of lower capital gains rates and utilized tax-efficient investment strategies to reduce the estate’s overall tax burden. As a result, the estate was able to preserve a significant portion of its value for distribution to beneficiaries.

Estate of Mary Johnson

Mary Johnson, a retired teacher, left behind a modest estate primarily consisting of savings accounts and a small rental property. The executor, Michael Brown, faced the challenge of managing the estate’s income tax liability while ensuring the preservation of the estate’s value. He implemented a careful investment strategy, focusing on tax-exempt municipal bonds and utilizing the standard deduction to minimize the estate’s tax burden. This approach allowed the estate to maintain its financial integrity and provide for the beneficiaries as intended.

Future Implications and Tax Reform

The world of estate taxation is subject to continuous change and reform. As tax laws evolve, it is crucial for executors and beneficiaries to stay informed and adapt their strategies accordingly. Here are some key considerations for the future:

Potential Tax Law Changes

Tax laws are often subject to legislative changes, which can significantly impact estate taxation. Staying updated on proposed and enacted tax reforms is essential to ensure compliance and take advantage of any new opportunities. For instance, changes in tax rates, deductions, or the estate tax exemption amount can have a direct impact on the tax liability of estates.

Estate Planning for the Future

Effective estate planning is an ongoing process that requires regular review and adaptation. As an estate’s circumstances change, so too should its tax strategies. Regular consultations with tax professionals and legal advisors can help ensure that the estate’s tax plan remains aligned with its goals and the evolving tax landscape.

Impact of Economic and Market Factors

Economic conditions and market fluctuations can also influence estate tax planning. For instance, during periods of economic growth, the value of assets may increase, leading to higher capital gains taxes. Conversely, in economic downturns, the value of assets may decline, potentially reducing the estate’s tax liability. Understanding these economic and market factors can help executors make informed decisions and adapt their strategies accordingly.

How often should an estate file income tax returns during the administration period?

+Generally, estates should file income tax returns annually during the administration period if the gross income exceeds $600. This is the same requirement as for individual tax returns.

Are there any special deductions or credits available exclusively for estates?

+While estates do not have exclusive deductions or credits, they can benefit from the standard deduction, personal exemption, and itemized deductions, similar to individual tax returns.

How does the estate's tax year impact the filing deadline for income tax returns?

+If the estate's tax year differs from the calendar year, the filing deadline may vary. In such cases, the estate should consult with a tax professional to determine the appropriate filing deadline.

Can an estate carry forward losses from one tax year to another?

+Yes, estates can carry forward losses, similar to individual taxpayers. These losses can be used to offset future income and reduce the estate's tax liability.

What are some common mistakes to avoid when filing estate income tax returns?

+Common mistakes include failing to report all income sources, improperly calculating deductions and credits, and missing filing deadlines. It is crucial to maintain accurate records and seek professional guidance to avoid these pitfalls.

Estate income tax is a complex but crucial aspect of managing inherited assets. By understanding the tax implications, implementing effective planning strategies, and staying informed about tax reforms, executors and beneficiaries can navigate the process with confidence and ensure the preservation of the estate’s value.