Nys Sales Tax Log In

The New York State (NYS) Sales Tax system is a crucial component of the state's revenue collection process, and understanding how to navigate and utilize its online portal is essential for businesses and individuals alike. This comprehensive guide will delve into the specifics of the NYS Sales Tax Log In process, offering an expert overview of the system's functionality and its impact on tax compliance.

Navigating the NYS Sales Tax Portal

The NYS Sales Tax portal serves as a digital gateway for taxpayers to manage their sales tax obligations. It provides a secure and efficient platform for registration, filing, and payment of sales and use taxes. The portal’s design aims to streamline the tax process, ensuring compliance while minimizing administrative burdens.

Accessing the NYS Sales Tax portal is straightforward. Taxpayers can visit the official website of the New York State Department of Taxation and Finance at https://www.tax.ny.gov. From the homepage, users can locate the "Sales Tax" section, which provides direct links to various resources and tools related to sales tax management.

Registration and Login Process

To begin using the NYS Sales Tax portal, businesses must first register for a sales tax account. This process involves providing essential business information, including the company’s name, address, and federal tax identification number (EIN). Once registered, a unique taxpayer identification number (TIN) is assigned, which serves as a key identifier for all future transactions and communications with the department.

After registration, logging in to the portal is simple. Users need to enter their TIN and a secure password, which can be set during the registration process or updated at any time through the portal's security settings. For added security, the portal offers two-factor authentication, ensuring that only authorized individuals can access sensitive tax information.

Key Features of the NYS Sales Tax Portal

The NYS Sales Tax portal offers a range of features to assist taxpayers in managing their sales tax obligations effectively. These include:

- Online Filing and Payment: Taxpayers can file sales tax returns and make payments directly through the portal. The system supports various payment methods, including credit cards, electronic funds transfers, and direct debits.

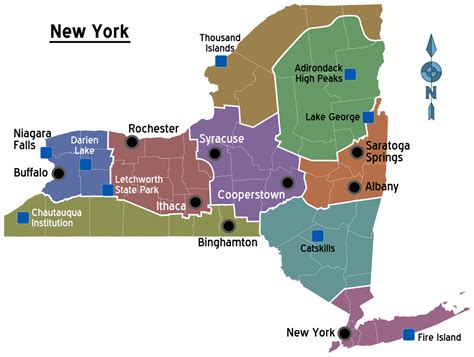

- Tax Rate Lookup: The portal provides a comprehensive database of sales tax rates across different jurisdictions in New York State. This feature is invaluable for businesses operating in multiple locations, ensuring accurate tax calculations.

- Tax Return History: Taxpayers can access their past sales tax returns and payment records, allowing for easy reference and comparison. This feature is particularly useful for tax planning and audit preparation.

- Electronic Notice Service: The portal offers an electronic notice service, which delivers important tax-related notifications and updates directly to the taxpayer's registered email address. This ensures timely communication and reduces the risk of missed deadlines.

- Tax Research and Guidance: The NYS Sales Tax portal provides access to a wealth of resources, including tax publications, regulations, and frequently asked questions (FAQs). These resources offer valuable insights and guidance on various sales tax topics, helping taxpayers navigate complex tax scenarios.

Benefits of Online Sales Tax Management

Adopting online sales tax management through the NYS Sales Tax portal offers several advantages to taxpayers:

- Convenience and Accessibility: The portal is accessible 24/7, allowing taxpayers to manage their sales tax obligations at their convenience. This is particularly beneficial for businesses with varying operational hours or those located in different time zones.

- Real-Time Data and Updates: Online management provides taxpayers with access to real-time data, including tax rate changes, legislative updates, and due dates. This ensures that taxpayers are always informed and can make timely decisions regarding their tax obligations.

- Reduced Administrative Burden: The portal automates many time-consuming tasks, such as filing returns, making payments, and maintaining records. This streamlines the tax process, reducing the need for manual paperwork and potential errors.

- Enhanced Security: The NYS Sales Tax portal employs robust security measures to protect taxpayer data. Two-factor authentication and secure encryption protocols ensure that sensitive information remains confidential and secure.

- Improved Compliance: By providing a user-friendly platform with clear guidelines and resources, the portal helps taxpayers stay compliant with sales tax regulations. This reduces the risk of penalties and interest charges associated with late or incorrect filings.

Future Implications and Innovations

The NYS Sales Tax portal continues to evolve to meet the changing needs of taxpayers and keep pace with technological advancements. Some potential future developments include:

- Mobile Optimization: The portal may introduce a mobile-friendly version or even a dedicated mobile app, allowing taxpayers to manage their sales tax obligations on the go.

- Data Integration: Integrating the portal with popular accounting and ERP systems could streamline data entry and synchronization, further reducing administrative burdens.

- Machine Learning and AI: Advanced technologies like machine learning could be utilized to enhance tax calculations, identify potential errors, and provide personalized tax recommendations.

- Blockchain Technology: Exploring the use of blockchain for secure and transparent tax transactions could enhance data integrity and reduce the risk of fraud.

- Enhanced Tax Research Tools: Developing more interactive and user-friendly tax research tools could make complex tax regulations more accessible and understandable for taxpayers.

As the NYS Sales Tax portal continues to innovate, it is essential for taxpayers to stay informed about these developments to leverage the full potential of the system. Regular updates and communication from the New York State Department of Taxation and Finance will ensure taxpayers can make the most of these advancements.

Conclusion

In conclusion, the NYS Sales Tax Log In process and the associated portal offer a powerful and secure platform for taxpayers to manage their sales tax obligations efficiently. By understanding the features and benefits of the portal, taxpayers can streamline their tax processes, ensure compliance, and leverage the potential of digital tax management. As technology continues to advance, the NYS Sales Tax portal will undoubtedly play a pivotal role in shaping the future of tax administration in New York State.

How often should I check the NYS Sales Tax portal for updates and notifications?

+It is recommended to check the portal regularly, especially during tax season and when there are known changes to tax regulations. Subscribing to the electronic notice service ensures you receive timely updates directly to your inbox.

Can I file amended sales tax returns through the NYS Sales Tax portal?

+Yes, the portal provides a dedicated section for filing amended returns. You can access this feature by logging in to your account and following the instructions provided.

What security measures are in place to protect my tax information on the NYS Sales Tax portal?

+The portal employs robust security measures, including two-factor authentication, secure encryption protocols, and regular security audits. These measures ensure that your tax information remains confidential and protected from unauthorized access.

How can I stay updated on the latest sales tax rates and regulations in New York State?

+The NYS Sales Tax portal provides a dedicated section for tax rate information and updates. Additionally, you can subscribe to the department’s email alerts and follow their social media channels for timely notifications and announcements.

Are there any training resources available to help me navigate the NYS Sales Tax portal effectively?

+Absolutely! The NYS Department of Taxation and Finance offers a range of training resources, including webinars, workshops, and step-by-step guides. These resources are designed to help taxpayers understand and utilize the portal’s features efficiently.