Lee County Taxes

In the realm of financial planning and management, understanding the intricacies of tax systems is crucial. This comprehensive guide will delve into the specifics of Lee County Taxes, offering an insightful exploration of the tax landscape in this region. By breaking down the various tax components, we aim to provide a clear and detailed overview for individuals and businesses navigating the financial obligations within Lee County.

An In-Depth Exploration of Lee County’s Tax System

Lee County, with its vibrant communities and diverse economy, presents a unique tax environment. The tax structure here is designed to support the county’s growth while ensuring a fair distribution of financial responsibilities. Let’s embark on a journey to uncover the key aspects of this tax system.

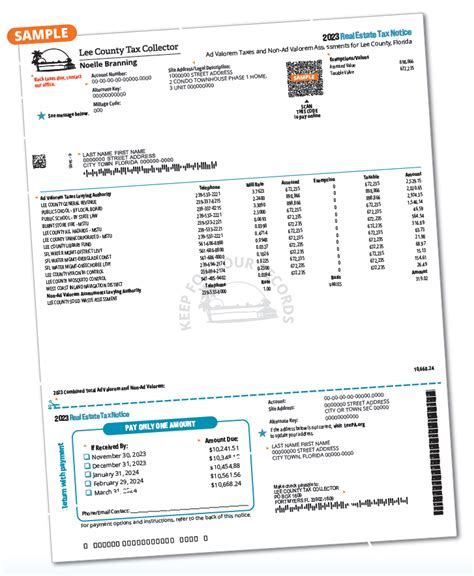

Property Taxes: A Cornerstone of Lee County’s Revenue

One of the primary sources of revenue for Lee County is property taxes. These taxes are levied on both residential and commercial properties, with rates that vary depending on the property’s location and assessed value. The assessment process is rigorous, taking into account factors such as property size, improvements, and market trends.

For instance, consider a residential property located in the heart of Lee County. Its taxable value is determined through a meticulous assessment process, considering factors like the property’s age, condition, and recent sales data of comparable properties in the area. This ensures fairness and accuracy in the tax assessment.

| Property Type | Tax Rate (%) | Average Assessment Value |

|---|---|---|

| Residential | 1.5% | 250,000</td> </tr> <tr> <td>Commercial</td> <td>2.0%</td> <td>500,000 |

Income Taxes: A Key Component for Individuals and Businesses

Lee County also imposes income taxes on both individuals and businesses. These taxes contribute significantly to the county’s revenue stream, providing funds for essential services and infrastructure development.

For individuals, the income tax rates are progressive, meaning the tax liability increases as income rises. This ensures that those with higher incomes contribute proportionally more to the county’s finances. On the other hand, businesses are subject to a flat tax rate, simplifying their tax obligations.

| Income Bracket (Individuals) | Tax Rate (%) |

|---|---|

| Up to 50,000</td> <td>2.5%</td> </tr> <tr> <td>50,001 - 100,000</td> <td>3.0%</td> </tr> <tr> <td>Over 100,000 | 3.5% |

Businesses, regardless of their size or industry, face a flat income tax rate of 2.0%. This uniformity simplifies the tax calculation process and provides a level playing field for all businesses operating within Lee County.

Sales and Use Taxes: Supporting Local Businesses and Infrastructure

Lee County levies sales and use taxes on various goods and services sold within its boundaries. These taxes contribute significantly to the county’s revenue, supporting essential services and infrastructure projects.

The sales tax rate in Lee County is currently 6.5%, which includes both the state and county portions. This rate applies to most tangible goods and certain services. However, certain items, such as groceries and prescription medications, are exempt from sales tax, ensuring that essential goods remain accessible to all residents.

Additionally, Lee County imposes a 1.5% use tax on goods purchased outside the county and brought into Lee County for use or consumption. This use tax ensures fairness and prevents tax evasion, ensuring that all purchases contribute to the county’s revenue.

Special Taxes and Fees: Supporting Specific Initiatives

In addition to the aforementioned taxes, Lee County also imposes special taxes and fees to support specific initiatives and projects. These taxes are often tied to particular industries or activities, providing dedicated funding for critical areas.

For instance, a tourism development tax is levied on short-term rentals and accommodations within Lee County. This tax, typically around 5%, supports tourism-related infrastructure and promotional activities, enhancing the county’s appeal as a tourist destination.

Furthermore, a transportation impact fee is charged on new construction projects, particularly residential developments. This fee helps fund transportation infrastructure improvements, ensuring that the county’s growing population has access to efficient and reliable transportation systems.

Tax Incentives and Exemptions: Encouraging Economic Growth

To attract businesses and encourage economic growth, Lee County offers a range of tax incentives and exemptions. These initiatives aim to create a business-friendly environment, fostering innovation and job creation.

One notable incentive is the Enterprise Zone Program, which offers reduced tax rates and other benefits to businesses that locate or expand within designated Enterprise Zones. These zones are typically in areas where economic development is a priority, providing opportunities for businesses to thrive while contributing to the local economy.

Additionally, Lee County provides property tax exemptions for certain types of properties, such as those owned by nonprofit organizations or used for agricultural purposes. These exemptions help support the county’s diverse economy and promote the well-being of its residents.

Conclusion: Navigating Lee County’s Tax Landscape

Understanding the tax landscape of Lee County is crucial for individuals and businesses alike. By exploring the various tax components, from property taxes to income taxes and special initiatives, we’ve gained a comprehensive insight into the financial obligations within this vibrant county.

As we conclude this guide, it’s essential to emphasize the dynamic nature of tax systems. Lee County’s tax landscape is subject to change, influenced by economic conditions, budgetary needs, and legislative decisions. Staying informed and seeking professional advice is crucial for navigating these complexities effectively.

For those seeking further insights or personalized guidance, consider reaching out to local tax professionals or financial advisors who specialize in Lee County’s tax system. They can provide tailored advice and ensure compliance with the county’s evolving tax regulations.

What are the current tax rates for property taxes in Lee County?

+

The current property tax rates in Lee County vary depending on the type of property. For residential properties, the tax rate is 1.5%, while commercial properties face a rate of 2.0%. These rates are subject to change annually.

Are there any tax incentives for businesses in Lee County?

+

Yes, Lee County offers several tax incentives to attract and support businesses. The Enterprise Zone Program, for instance, provides reduced tax rates and other benefits to businesses operating within designated zones.

How does Lee County determine the assessed value of properties for tax purposes?

+

Lee County employs a rigorous assessment process to determine the taxable value of properties. This process considers factors such as property size, improvements, and market trends, ensuring fairness and accuracy in tax assessments.

Are there any tax exemptions available for homeowners in Lee County?

+

Yes, Lee County offers certain property tax exemptions to homeowners. These exemptions include discounts for senior citizens, veterans, and those with disabilities, helping to reduce the financial burden of property ownership.

What is the sales tax rate in Lee County, and are there any exemptions?

+

The sales tax rate in Lee County is currently 6.5%, including both state and county portions. However, certain items like groceries and prescription medications are exempt from sales tax, ensuring essential goods remain affordable.