Pay Detroit Property Taxes

Paying property taxes in Detroit, Michigan, is an important responsibility for property owners. The city's tax system plays a crucial role in funding various public services and infrastructure. Understanding the process and staying informed about deadlines and payment options is essential for ensuring timely and accurate tax payments.

Understanding Detroit Property Taxes

Property taxes in Detroit are levied based on the assessed value of real estate properties. These taxes contribute significantly to the city’s revenue, which is then allocated towards vital services such as education, public safety, transportation, and maintenance of public spaces.

The Detroit City Charter and Michigan Compiled Laws govern the assessment and collection of property taxes in the city. The tax rate is determined annually by the Detroit City Council, considering the budget requirements and the need to maintain essential services.

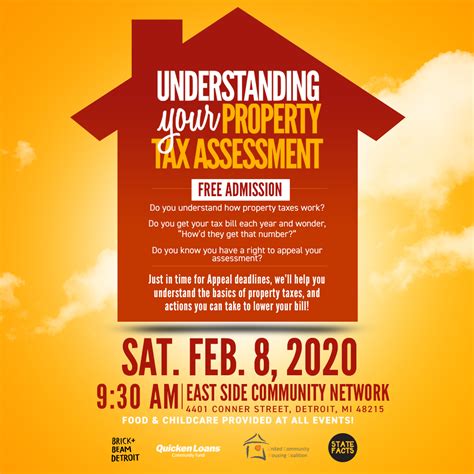

Property owners in Detroit receive a tax bill annually, typically in the summer months. This bill outlines the assessed value of the property, the applicable tax rate, and the total amount due. It is crucial for property owners to review this bill carefully, ensuring the accuracy of the assessed value and any applicable exemptions or deductions.

Payment Options and Deadlines

Detroit offers various convenient payment methods to accommodate different preferences and circumstances. Property owners can choose from the following options to pay their taxes:

- Online Payment: The Detroit Treasury Office provides an online payment portal, allowing property owners to pay their taxes securely using a credit card, debit card, or electronic check. This method is convenient and accessible, providing a quick and efficient way to settle tax liabilities.

- Mail-in Payment: Property owners can also opt to pay their taxes by mail. The tax bill provides the necessary information, including the remittance address and the account number. It is important to ensure that the payment is mailed in sufficient time to arrive before the deadline, typically around late summer or early fall.

- In-Person Payment: For those who prefer a more traditional approach, in-person payments are accepted at the Detroit Treasury Office. Property owners can visit the office, located at 2 Woodward Avenue, Detroit, MI 48226, during regular business hours to make their tax payments. This option allows for direct interaction with treasury staff and provides an opportunity to clarify any concerns or queries.

- Electronic Funds Transfer (EFT): Detroit also offers an Electronic Funds Transfer program, which allows property owners to set up automatic payments from their bank accounts. This method ensures timely payments without the need for manual intervention, providing a convenient and hassle-free experience.

It is essential to note that each payment method has its own deadlines. Online and mail-in payments typically have a cutoff date a few weeks before the official due date, while in-person payments can be accepted up until the due date. It is advisable to review the tax bill and the Detroit Treasury Office's website for specific deadlines and instructions.

Payment Plans and Exemptions

Detroit understands that paying property taxes can be a financial burden for some property owners. To alleviate this, the city offers various payment plans and exemptions to eligible individuals and organizations.

Payment Plans

Property owners facing financial difficulties can apply for a payment plan, allowing them to pay their taxes in installments. The Detroit Treasury Office offers two types of payment plans:

- Short-Term Payment Plan: This plan is suitable for property owners who can afford to pay their taxes within a shorter timeframe. It allows for payments to be made in three installments, typically over a period of three months. This option provides some flexibility while ensuring timely payment of taxes.

- Long-Term Payment Plan: Designed for property owners with more significant financial challenges, this plan allows for payments to be made over an extended period. The number of installments and the payment schedule are determined on a case-by-case basis, considering the property owner's financial circumstances.

Exemptions

Detroit offers several exemptions to eligible property owners, reducing their tax liability. These exemptions are designed to support specific groups and promote certain initiatives within the city.

- Homestead Exemption: This exemption provides a significant reduction in property taxes for homeowners who occupy their property as their primary residence. To qualify, homeowners must meet certain residency and ownership requirements and submit an application to the Detroit Tax Assessor's Office.

- Senior Citizen Exemption: Detroit offers an exemption for senior citizens aged 62 and above who meet certain income and residency criteria. This exemption helps alleviate the financial burden of property taxes for Detroit's senior population.

- Veteran's Exemption: The city also provides an exemption for qualified veterans who have served in the United States military. This exemption recognizes the service and sacrifice of veterans and aims to support their transition into civilian life.

- Other Exemptions: Additionally, Detroit offers various other exemptions, including those for certain types of agricultural land, historic properties, and properties owned by nonprofit organizations. These exemptions serve specific purposes and contribute to the overall development and preservation of the city.

It is important for property owners to research and understand the eligibility criteria and application processes for these exemptions. The Detroit Tax Assessor's Office provides detailed information and guidance on its website, ensuring that eligible property owners can take advantage of these benefits.

Consequences of Non-Payment

While Detroit aims to provide flexible payment options and support systems, non-payment of property taxes can have significant consequences. The city takes a proactive approach to ensure tax compliance, and failure to pay taxes may result in the following actions:

- Interest and Penalties: Late payments of property taxes incur interest and penalties, which can quickly accumulate, making the tax liability even more burdensome.

- Tax Foreclosure: In cases of persistent non-payment, the city may initiate tax foreclosure proceedings. This process involves the city taking ownership of the property and offering it for sale to recover the outstanding taxes. Property owners facing foreclosure have the opportunity to redeem their property by paying the outstanding taxes and associated costs.

- Legal Action: Extreme cases of non-payment may lead to legal action, including lawsuits and potential liens on the property. These actions can have severe financial and legal implications for property owners.

To avoid these consequences, it is crucial for property owners to prioritize their tax obligations and explore the available payment options and exemptions. Staying informed and engaging with the Detroit Treasury Office and Tax Assessor's Office can help ensure a smooth and compliant tax payment process.

Stay Informed and Seek Assistance

Paying property taxes in Detroit is an essential responsibility for property owners. By understanding the assessment process, exploring payment options, and considering available exemptions, property owners can ensure timely and accurate tax payments. The Detroit Treasury Office and Tax Assessor’s Office are valuable resources, providing guidance and support throughout the tax payment journey.

For further assistance or specific inquiries, property owners can reach out to the Detroit Treasury Office at treasury@detroitmi.gov or by phone at (313) 224-3950. Additionally, the Tax Assessor's Office can be contacted at tax@detroitmi.gov or by phone at (313) 224-3038. Their dedicated staff is ready to assist property owners in navigating the tax payment process and ensuring compliance.

Stay informed, utilize the available resources, and take advantage of the payment plans and exemptions to make paying Detroit property taxes a manageable and stress-free process.

How often are property taxes assessed in Detroit?

+Property taxes in Detroit are assessed annually. The Detroit Tax Assessor’s Office conducts assessments to determine the value of properties, which forms the basis for tax calculations.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The Detroit Tax Assessor’s Office provides a formal appeals process, allowing property owners to present their case and seek a reassessment.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline may result in additional interest and penalties. It is important to note that late payments can quickly accumulate, so it is advisable to pay taxes promptly to avoid unnecessary financial burdens.

Are there any penalties for paying taxes late?

+Yes, Detroit imposes penalties for late tax payments. The specific penalty amount and interest rate may vary depending on the circumstances and the duration of the delay. It is essential to pay taxes on time to avoid these additional costs.

Can I pay my property taxes in installments without a formal payment plan?

+While formal payment plans offer structured installment options, property owners may also have the flexibility to pay their taxes in installments without a formal plan. However, it is important to communicate with the Detroit Treasury Office to ensure compliance and avoid penalties.