How Is Severance Pay Taxed

Severance pay is a common benefit offered to employees who are terminated from their jobs, whether due to layoffs, company restructuring, or other reasons. It serves as a financial cushion during a period of transition and unemployment. While receiving severance pay can provide much-needed relief, it's important to understand the tax implications associated with it. In this comprehensive guide, we will delve into the intricacies of how severance pay is taxed, covering various scenarios and providing valuable insights for both employees and employers.

Understanding Severance Pay and Its Tax Treatment

Severance pay is considered a form of income and is generally subject to federal, state, and local income taxes. The tax treatment of severance pay depends on several factors, including the nature of the payment, the employment agreement, and the applicable tax laws. Here’s an in-depth look at how severance pay is taxed.

1. Ordinary Income Taxation

In most cases, severance pay is treated as ordinary income. This means that it is included in the employee’s gross income and is subject to the regular income tax rates applicable to their filing status and income level. The Internal Revenue Service (IRS) considers severance pay as a form of compensation for services rendered, and thus, it is taxed similarly to wages and salaries.

When an employee receives severance pay, the employer is responsible for withholding federal income tax, as well as any applicable state and local income taxes. The amount of tax withheld depends on the employee's withholding status and the amount of severance pay received. Employees can adjust their withholding allowances by submitting a new W-4 form to their employer.

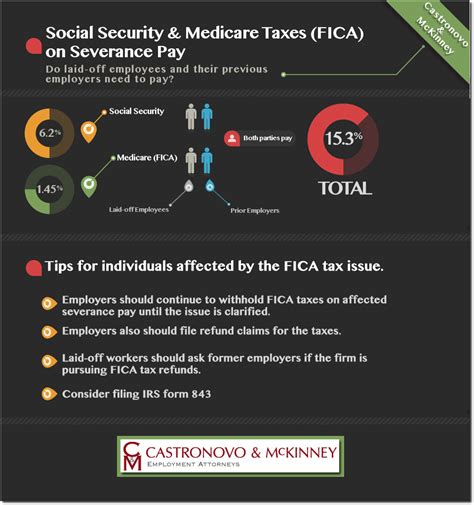

2. Inclusion in Wages for FICA Taxes

Severance pay is also subject to Federal Insurance Contributions Act (FICA) taxes, which include Social Security and Medicare taxes. These taxes are typically withheld from an employee’s wages and are matched by the employer. However, the treatment of severance pay for FICA purposes can vary depending on the terms of the severance agreement.

If the severance pay is considered a substitute for regular wages or salary, it is subject to FICA taxes. This means that both the employee and the employer must contribute their respective shares of FICA taxes. The employer is responsible for withholding the employee's share and remitting the total FICA tax amount to the appropriate tax authorities.

3. Exclusion from FICA Taxes

In some cases, severance pay may be excluded from FICA taxes. This exclusion applies when the severance pay is specifically designated as a “supplemental unemployment benefit” (SUB) and meets certain conditions. SUB payments are typically made through a plan established by the employer, and they must meet specific requirements outlined by the IRS.

To qualify for FICA exclusion, the SUB plan must be established in advance and be funded by the employer. The plan should also have a reasonable formula for determining the amount of severance pay, and it should not discriminate in favor of highly compensated employees. Additionally, the SUB payments must be made to individuals who are involuntarily separated from employment due to a lack of work or other specified reasons.

| FICA Exclusion Conditions | Description |

|---|---|

| Advance Establishment | The SUB plan must be established before the severance pay is offered. |

| Reasonable Formula | The severance pay amount should be based on a reasonable formula, such as a percentage of wages. |

| Non-Discrimination | The plan should not favor highly compensated employees. |

| Involuntary Separation | The employee must be involuntarily separated due to a lack of work or other specified reasons. |

4. Reporting and Documentation

Both employees and employers have specific reporting and documentation requirements when it comes to severance pay. Employees should receive a Form W-2 from their employer, which will include the amount of severance pay received and the applicable taxes withheld. This form is used to file their annual income tax returns.

Employers, on the other hand, must report and remit the appropriate taxes to the IRS and state tax authorities. They should also provide employees with a copy of their W-2 form and ensure that all tax obligations are fulfilled. It's crucial for employers to maintain accurate records of the severance payments and related tax withholdings.

Tax Implications for Different Severance Payment Scenarios

The tax treatment of severance pay can vary depending on the specific circumstances of the termination and the terms of the severance agreement. Let’s explore some common scenarios and their tax implications.

1. Lump-Sum Severance Payments

Many employers offer severance pay as a lump-sum payment, typically based on the employee’s years of service or a predetermined formula. Lump-sum payments are fully taxable and are included in the employee’s gross income for the year they receive the payment. Employers must withhold the appropriate taxes and report the payment on the employee’s W-2 form.

2. Severance Pay as a Continuation of Wages

In some cases, severance pay may be structured as a continuation of regular wages. This means that the employee continues to receive their regular salary or a portion of it for a specified period after their termination. This type of severance pay is subject to the same tax treatment as regular wages, including income tax withholding and FICA taxes.

3. Severance Pay with Stock Options or Incentives

When severance pay is combined with stock options or other incentives, the tax treatment can become more complex. Stock options granted as part of a severance package may be subject to capital gains tax if they are exercised and sold. Additionally, any incentive payments, such as bonuses or performance-based rewards, are typically taxable as ordinary income.

4. Severance Pay in Installments

Some employers may offer severance pay in installments over a period of time. In such cases, each installment is treated as a separate payment and is subject to income tax withholding and reporting for the year in which it is received. Employers should ensure that the appropriate taxes are withheld and reported for each installment.

5. Severance Pay Negotiations and Tax Planning

Employees and employers can engage in negotiations to structure severance pay in a tax-efficient manner. For example, employees may request a higher severance amount in exchange for a lower salary during the notice period, which can result in tax savings. Additionally, employers can consider offering non-cash benefits, such as healthcare coverage or outplacement services, which may be tax-deductible for the employer and tax-free for the employee.

Potential Tax Considerations and Strategies

Understanding the tax implications of severance pay is crucial for both employees and employers. Here are some potential tax considerations and strategies to keep in mind.

1. Tax Withholding and Adjustments

Employees should carefully review their tax withholdings during the severance period. They can adjust their withholding allowances by submitting a new W-4 form to ensure that the appropriate amount of tax is withheld. This can help avoid underpayment or overpayment of taxes and reduce the likelihood of owing taxes at the end of the year.

2. Tax Deductions and Credits

Employees may be eligible for certain tax deductions or credits related to their severance pay. For example, job search expenses, such as resume preparation, career counseling, and relocation costs, may be deductible if they meet specific criteria. Additionally, employees who are self-employed or start a new business may be able to deduct business-related expenses from their severance pay.

3. Tax Planning and Financial Advice

Seeking professional tax advice can be beneficial for both employees and employers. Tax professionals can provide guidance on optimizing tax strategies, understanding the tax implications of different severance payment structures, and ensuring compliance with tax laws. They can also assist in preparing tax returns and addressing any potential tax liabilities.

Conclusion: Navigating the Tax Landscape of Severance Pay

Severance pay provides financial support during a challenging period of transition, but it is essential to navigate the tax implications associated with it. By understanding the tax treatment of severance pay, employees can make informed decisions about their tax withholdings and deductions. Employers, on the other hand, must ensure compliance with tax laws and properly report and remit the applicable taxes.

This comprehensive guide has covered the various aspects of severance pay taxation, including ordinary income taxation, FICA taxes, and the potential exclusion from FICA for SUB payments. It has also explored different severance payment scenarios and provided insights into tax considerations and strategies. Remember, seeking professional advice and staying informed about tax laws can help individuals and businesses navigate the complex world of severance pay taxation effectively.

How do I calculate the tax on my severance pay?

+The tax on severance pay is calculated based on your income tax bracket and the amount of severance received. It’s recommended to consult a tax professional or use tax software to accurately calculate the tax liability.

Are there any tax advantages for employers when offering severance pay?

+Employers may be able to deduct severance pay as a business expense, reducing their taxable income. However, the deductibility depends on various factors, including the terms of the severance agreement and the tax laws in your jurisdiction.

Can I negotiate the tax treatment of my severance pay with my employer?

+While the tax treatment of severance pay is largely governed by tax laws, you can negotiate certain aspects with your employer. For example, you can discuss the timing of the payment to optimize your tax situation or request additional non-cash benefits that may have tax advantages.