Ct State Tax Calculator

When it comes to financial planning and understanding your tax obligations, having a reliable state tax calculator is essential. In Connecticut, also known as the "Constitution State," residents and businesses alike rely on accurate tax calculations to navigate their financial responsibilities. In this comprehensive guide, we will delve into the world of the Ct State Tax Calculator, exploring its features, functionality, and how it can benefit individuals and businesses alike. Get ready to unlock the secrets of tax calculations and discover a tool that simplifies the complex world of state taxes.

Unveiling the Ct State Tax Calculator: A Comprehensive Overview

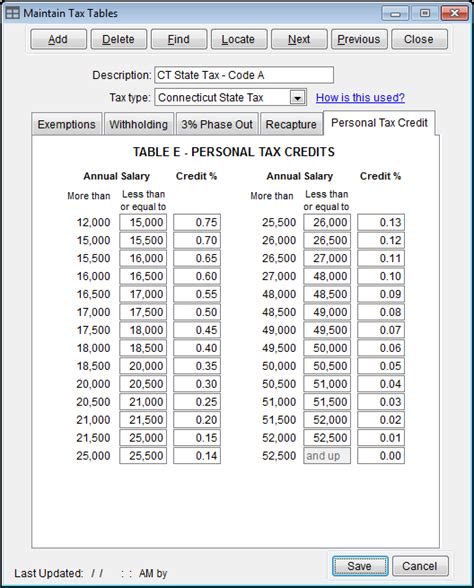

The Ct State Tax Calculator is an innovative and user-friendly tool designed to assist Connecticut residents and businesses in estimating their state tax liabilities. Developed with precision and ease of use in mind, this calculator has become an indispensable resource for anyone seeking clarity and accuracy in their tax calculations. Let’s explore its key features and understand why it is an essential tool for financial planning in the Nutmeg State.

Understanding Connecticut’s Tax Structure

Before we dive into the specifics of the calculator, let’s establish a foundation by understanding Connecticut’s tax landscape. Connecticut, like many other states, imposes taxes on income, sales, and property. The state’s tax structure is designed to generate revenue for essential services and infrastructure development. By familiarizing ourselves with these tax categories, we can better appreciate the role of the Ct State Tax Calculator in simplifying complex tax calculations.

| Tax Category | Description |

|---|---|

| Income Tax | Connecticut imposes a progressive income tax, with rates ranging from 3% to 6.99% based on taxable income. |

| Sales and Use Tax | A general sales tax of 6.35% applies to most retail sales, with additional local taxes in certain municipalities. |

| Property Tax | Property taxes are primarily levied by local governments and are based on the assessed value of real estate. |

The Power of the Ct State Tax Calculator

The Ct State Tax Calculator is a dynamic tool that simplifies the process of estimating state taxes. It is designed to cater to the unique tax landscape of Connecticut, ensuring accuracy and efficiency. Here’s a closer look at its key features and benefits:

- Income Tax Estimation: The calculator enables users to input their income details and calculate their estimated income tax liability. It takes into account Connecticut's progressive tax rates, ensuring an accurate estimate based on the user's specific circumstances.

- Sales Tax Calculator: For businesses and consumers, the sales tax component is invaluable. Users can input the cost of goods or services and instantly receive an estimate of the applicable sales tax, helping them plan their budgets and understand their tax obligations.

- Property Tax Estimator: While property taxes are primarily managed by local authorities, the Ct State Tax Calculator provides a helpful estimate of property tax liabilities. By inputting the assessed value of the property, users can gain insight into their potential tax burden.

- User-Friendly Interface: The calculator boasts an intuitive and user-friendly interface, making it accessible to individuals and businesses alike. With a simple step-by-step process, users can navigate through the different tax categories effortlessly, ensuring a seamless experience.

- Real-Time Calculations: One of the standout features is the calculator's ability to provide real-time estimates. As users input their data, the calculator instantly calculates the tax liability, offering immediate feedback and ensuring accuracy.

Benefits for Individuals and Businesses

The Ct State Tax Calculator offers a plethora of benefits for both individuals and businesses operating in Connecticut. Let’s explore how this tool can simplify financial planning and tax management:

Individuals

- Budgeting: By using the calculator, individuals can gain a clear understanding of their tax obligations, helping them create accurate budgets and plan their finances effectively.

- Tax Planning: With the ability to estimate income taxes, individuals can strategize their financial decisions to optimize their tax liabilities and make informed choices regarding investments and deductions.

- Sales Tax Awareness: The calculator’s sales tax feature empowers individuals to make informed purchasing decisions, ensuring they are aware of the tax implications associated with their purchases.

Businesses

- Tax Compliance: Businesses can utilize the calculator to ensure compliance with Connecticut’s tax regulations. By accurately estimating their tax liabilities, businesses can avoid penalties and maintain a positive relationship with the state’s tax authorities.

- Financial Planning: The calculator’s real-time estimates enable businesses to incorporate tax obligations into their financial planning. This helps in creating accurate cash flow projections and budgeting for the future.

- Pricing Strategies: With the sales tax calculator, businesses can determine the impact of sales tax on their products or services, allowing them to set competitive pricing strategies and understand the financial implications for their customers.

Exploring the Calculator’s Advanced Features

While the Ct State Tax Calculator provides a robust foundation for tax estimation, it also offers advanced features that cater to specific needs. These features enhance the calculator’s functionality and make it a versatile tool for diverse users.

Customizable Tax Scenarios

One of the standout advanced features is the ability to create customizable tax scenarios. Users can input specific details, such as deductions, credits, or unique tax circumstances, to obtain tailored tax estimates. This feature is particularly beneficial for individuals with complex financial situations or businesses operating in specialized industries.

Historical Tax Data

The calculator also incorporates historical tax data, allowing users to analyze past tax trends. By accessing this data, individuals and businesses can make informed predictions about future tax obligations and plan their financial strategies accordingly. This feature is invaluable for long-term financial planning and understanding the historical context of Connecticut’s tax landscape.

Tax Filing Assistance

In addition to estimation, the Ct State Tax Calculator offers assistance with tax filing. Users can access helpful resources and guides, ensuring they have the necessary information to complete their tax returns accurately. This feature simplifies the tax filing process and reduces the risk of errors, providing peace of mind to users.

Real-World Applications and Success Stories

The Ct State Tax Calculator has proven to be an invaluable tool for individuals and businesses across Connecticut. Let’s explore a few real-world success stories that showcase the impact and benefits of this innovative calculator.

Case Study: Small Business Tax Compliance

Meet Sarah, a small business owner in Connecticut who specializes in handmade crafts. With a growing online presence, Sarah needed a reliable tool to manage her tax obligations effectively. The Ct State Tax Calculator became her trusted companion, helping her estimate her sales tax liabilities accurately. By using the calculator, Sarah was able to incorporate tax obligations into her pricing strategies, ensuring she remained competitive while maintaining compliance with state regulations. The calculator’s user-friendly interface and real-time estimates made tax management a seamless part of her business operations.

Individual Tax Planning: A Personal Story

John, a resident of Connecticut, was facing a unique financial situation with multiple sources of income and a complex tax landscape. He turned to the Ct State Tax Calculator to gain clarity and make informed decisions. By inputting his income details and exploring different tax scenarios, John was able to optimize his tax planning. The calculator’s customizable features allowed him to understand the impact of deductions and credits, helping him minimize his tax liability. With the calculator’s assistance, John felt empowered to take control of his financial future and make confident decisions regarding his investments and savings.

The Future of Tax Calculations: Innovations and Implications

As technology continues to advance, the future of tax calculations looks promising. The Ct State Tax Calculator, with its innovative features and user-centric design, sets the stage for further developments in tax management. Here’s a glimpse into the potential future implications and innovations in this field:

Artificial Intelligence Integration

The integration of artificial intelligence (AI) is poised to revolutionize tax calculations. AI-powered algorithms can analyze vast amounts of data, including tax regulations, historical trends, and individual financial circumstances, to provide even more accurate estimates. By leveraging AI, tax calculators like the Ct State Tax Calculator can offer personalized recommendations and strategic insights, taking tax planning to a whole new level.

Blockchain Technology and Tax Transparency

Blockchain technology has the potential to enhance tax transparency and security. By utilizing blockchain, tax calculators can provide immutable records of tax calculations and transactions, ensuring accuracy and reducing the risk of fraud. This technology can also streamline the tax filing process, making it more efficient and secure for individuals and businesses.

Mobile Accessibility and Convenience

With the increasing reliance on mobile devices, tax calculators are likely to become even more accessible and convenient. Mobile apps, optimized for smartphones and tablets, can bring tax estimation and management to users’ fingertips. This accessibility empowers individuals and businesses to manage their taxes on the go, making tax calculations a seamless part of their daily lives.

Community-Driven Tax Insights

The future of tax calculations may also involve community-driven platforms where users can share their experiences, insights, and best practices. By creating a community around tax management, individuals and businesses can benefit from collective knowledge and support, fostering a sense of collaboration and shared understanding.

Conclusion: Simplifying Tax Calculations in Connecticut

The Ct State Tax Calculator has emerged as a powerful tool, simplifying the complex world of state taxes for Connecticut residents and businesses. With its user-friendly interface, accurate estimations, and advanced features, it has become an essential resource for financial planning and tax management. As technology continues to evolve, the future of tax calculations looks promising, with innovations in AI, blockchain, and community-driven platforms on the horizon. By embracing these advancements, individuals and businesses can continue to navigate the tax landscape with confidence and ease.

How accurate are the calculations provided by the Ct State Tax Calculator?

+The Ct State Tax Calculator is designed to provide highly accurate estimates based on the information entered by the user. It utilizes the latest tax rates and regulations, ensuring that the calculations are up-to-date and reliable. However, it’s important to note that the calculator provides estimates and may not account for all unique circumstances. For precise tax obligations, users should consult with tax professionals or refer to official tax guidelines.

Can the calculator handle complex tax scenarios, such as multiple income streams or business deductions?

+Absolutely! The Ct State Tax Calculator is equipped to handle complex tax scenarios. It offers customizable features where users can input specific details, such as multiple income sources, deductions, and credits. This allows individuals and businesses with unique tax situations to obtain accurate estimates tailored to their specific circumstances.

Is the Ct State Tax Calculator accessible on mobile devices?

+Yes, the Ct State Tax Calculator is designed with mobile accessibility in mind. Users can access the calculator through their smartphones or tablets, ensuring they can estimate their tax obligations on the go. The mobile version is optimized for a seamless user experience, making tax calculations convenient and accessible anytime, anywhere.

Are there any additional resources or guides available for users who need further assistance?

+Absolutely! The Ct State Tax Calculator platform often includes a comprehensive resource section. Here, users can find helpful guides, FAQs, and informative articles related to tax calculations and compliance. These resources provide additional support and guidance for users seeking a deeper understanding of tax matters.