Connecticut State Tax

Taxation is an integral part of any state's economic framework, and Connecticut is no exception. With a diverse range of tax policies and structures, understanding the intricacies of Connecticut's state tax system is essential for both residents and businesses operating within its borders. This comprehensive guide aims to unravel the complexities, offering an expert-level analysis of Connecticut's state tax landscape.

Connecticut State Tax: An In-Depth Exploration

Connecticut, nestled in the northeastern region of the United States, boasts a rich history and a robust economy. Its state tax system plays a pivotal role in funding public services, infrastructure development, and social welfare programs. Delving into the specifics of this system provides valuable insights into the economic fabric of the state.

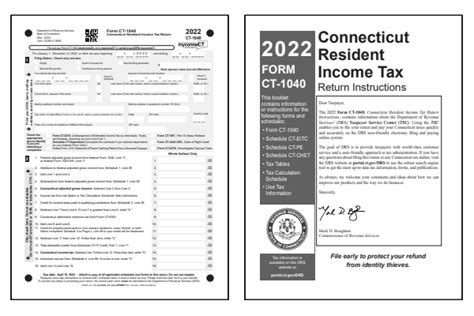

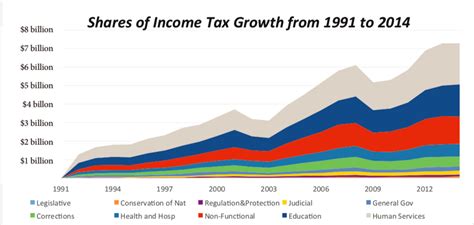

Income Tax: The Backbone of Connecticut's Revenue

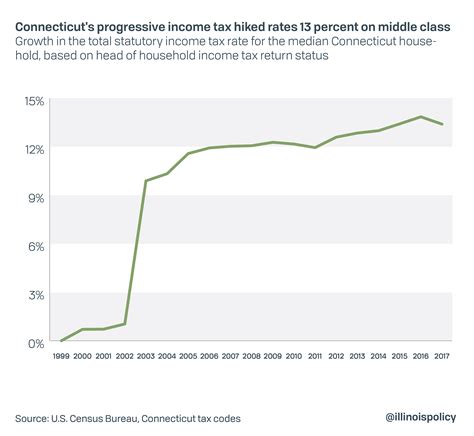

Connecticut's income tax is a significant revenue generator for the state. The tax structure is progressive, meaning the tax rate increases as income levels rise. This ensures a fair and equitable distribution of tax responsibilities among residents.

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 3.07% |

| $10,001 - $50,000 | 5.00% |

| $50,001 - $100,000 | 5.50% |

| $100,001 - $200,000 | 6.35% |

| Over $200,000 | 6.99% |

The state also offers various deductions and credits to alleviate the tax burden on certain individuals and families. For instance, residents can claim deductions for charitable contributions, medical expenses, and certain property taxes. Additionally, Connecticut provides tax credits for childcare expenses, low-income individuals, and those with disabilities.

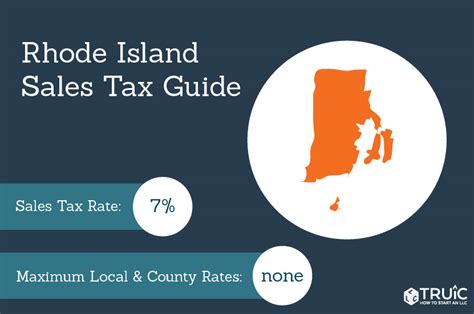

Sales and Use Tax: A Dual System for Efficient Revenue Collection

Connecticut employs a sales and use tax system, which is common across many states. The sales tax is applied to most retail transactions, including the sale of goods and certain services. The current sales tax rate in Connecticut is 6.35%, which is relatively moderate compared to other states.

However, Connecticut also has a use tax, which is often overlooked by many residents. The use tax applies to purchases made outside the state but used or stored in Connecticut. This tax ensures that residents pay their fair share, regardless of where they make their purchases. The use tax rate mirrors the sales tax rate, standing at 6.35%.

Certain items, such as food and clothing, are exempt from sales tax, providing some relief for essential purchases. On the other hand, luxury items and services, like boats, aircraft, and certain entertainment services, may be subject to additional taxes.

Property Tax: A Localized Approach to Funding Communities

Property tax in Connecticut is primarily a local responsibility, with each municipality setting its own tax rates. This decentralized approach allows for a customized tax structure that aligns with the unique needs and demographics of each community.

The property tax rate in Connecticut can vary significantly from one town to another. On average, the rate hovers around 1.5% to 2% of the assessed property value. However, some towns may have rates as low as 0.75% or as high as 3% or more.

Assessed property values are determined through a complex process that considers factors like property type, location, and recent sales data. The state also offers exemptions and abatements for certain properties, such as those owned by religious institutions, non-profits, and elderly or disabled residents.

Corporate Tax: Attracting Businesses and Investing in Growth

Connecticut's corporate tax structure is designed to attract businesses and promote economic growth. The state levies a corporate income tax on businesses operating within its borders, with rates that are competitive with other states.

| Corporate Income Bracket | Tax Rate |

|---|---|

| Up to $25,000 | 7.5% |

| $25,001 - $250,000 | 8.25% |

| $250,001 and above | 9.00% |

To encourage business investment and job creation, Connecticut offers various tax incentives and credits. These include tax credits for research and development, job creation, and investment in certain industries. Additionally, the state provides tax breaks for businesses that locate in economically distressed areas.

Estate and Gift Tax: Ensuring Equity in Wealth Transfer

Connecticut levies an estate tax and a gift tax to ensure a fair distribution of wealth. The estate tax applies to the transfer of property at the time of death, while the gift tax applies to large gifts made during a person's lifetime.

The estate tax is imposed on estates valued at $4,000,000 or more, with a tax rate of 12% on the portion exceeding this threshold. However, Connecticut offers a credit for any federal estate tax paid, reducing the state's tax burden.

The gift tax in Connecticut mirrors the federal gift tax. Gifts valued at $15,000 or less per recipient per year are exempt from tax. Any gifts exceeding this amount are subject to a tax rate of 10% to 37%, depending on the value of the gift.

FAQs

How does Connecticut’s income tax compare to other states?

+

Connecticut’s income tax structure is progressive and competitive with other states. The highest tax rate of 6.99% is comparable to other states with progressive tax systems. However, the state’s tax brackets and rates may be more favorable for middle- and lower-income earners compared to some states with flatter tax structures.

Are there any tax breaks for homeowners in Connecticut?

+

Yes, Connecticut offers several tax breaks for homeowners. These include property tax abatements for elderly and disabled residents, as well as tax credits for energy-efficient home improvements. Additionally, the state has a homestead exemption, which can provide relief from property taxes for certain individuals.

How does Connecticut’s sales tax compare to its neighboring states?

+

Connecticut’s sales tax rate of 6.35% is relatively moderate compared to its neighboring states. For instance, Massachusetts has a sales tax rate of 6.25%, while New York’s rate is 4%. However, it’s important to note that sales tax rates can vary within a state, and certain jurisdictions may have additional local sales taxes.

Are there any special tax incentives for small businesses in Connecticut?

+

Absolutely! Connecticut offers a range of tax incentives to support small businesses. These include tax credits for job creation, investment in certain industries, and locating in economically distressed areas. Additionally, the state has programs to help small businesses navigate the tax system and take advantage of available incentives.

How often do Connecticut’s tax rates change?

+

Tax rates in Connecticut can change periodically, often as a result of legislative decisions or economic factors. Income tax rates, for instance, have been adjusted over the years to align with the state’s fiscal needs. It’s essential to stay updated with the latest tax information to ensure compliance.