Property Tax Travis County

Property taxes are a significant aspect of homeownership, and in Travis County, Texas, they play a crucial role in the local economy. With a diverse range of properties and varying tax rates, understanding the ins and outs of property taxes in this region is essential for both homeowners and prospective buyers. In this comprehensive guide, we will delve into the specifics of Property Tax Travis County, covering everything from assessment processes to payment options and potential exemptions.

Understanding the Property Tax Landscape in Travis County

Travis County, home to the vibrant city of Austin and its surrounding areas, has a unique property tax system that is worth exploring in detail. The property tax landscape here is influenced by several factors, including the state’s laws, local tax rates, and the specific characteristics of each property. Let’s break down the key elements that contribute to the overall property tax picture in this region.

Property Tax Assessment Process

The journey of a property tax bill begins with the assessment process. In Travis County, the Travis Central Appraisal District (TCAD) is responsible for determining the taxable value of each property. This involves a comprehensive evaluation of factors such as:

- Market conditions in the area.

- Recent sales of comparable properties.

- Improvements made to the property.

- Physical condition and characteristics.

TCAD’s appraisers conduct on-site inspections and utilize specialized software to ensure accurate assessments. Property owners have the right to review and dispute these assessments, providing an opportunity for transparency and fairness in the process.

| Assessment Timeline | Key Dates |

|---|---|

| Appraisal Notices | Mailed by May 1st |

| Protest Deadline | 30 days after notice |

| Appraisal Review Board Hearings | Late May to July |

Note: It's essential for property owners to stay informed about these deadlines to ensure they can exercise their rights effectively.

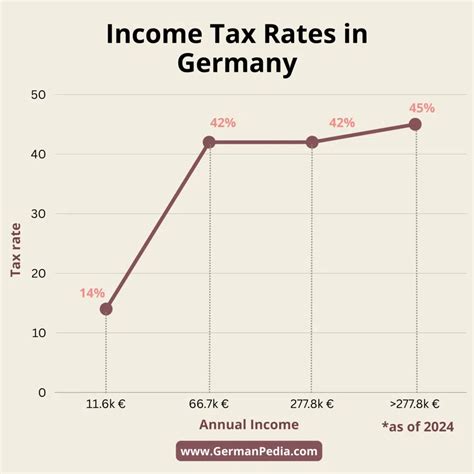

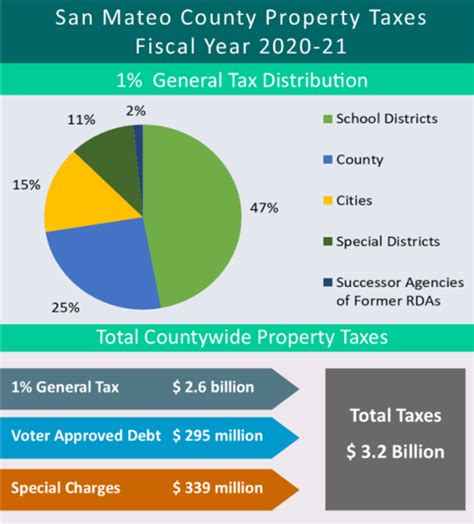

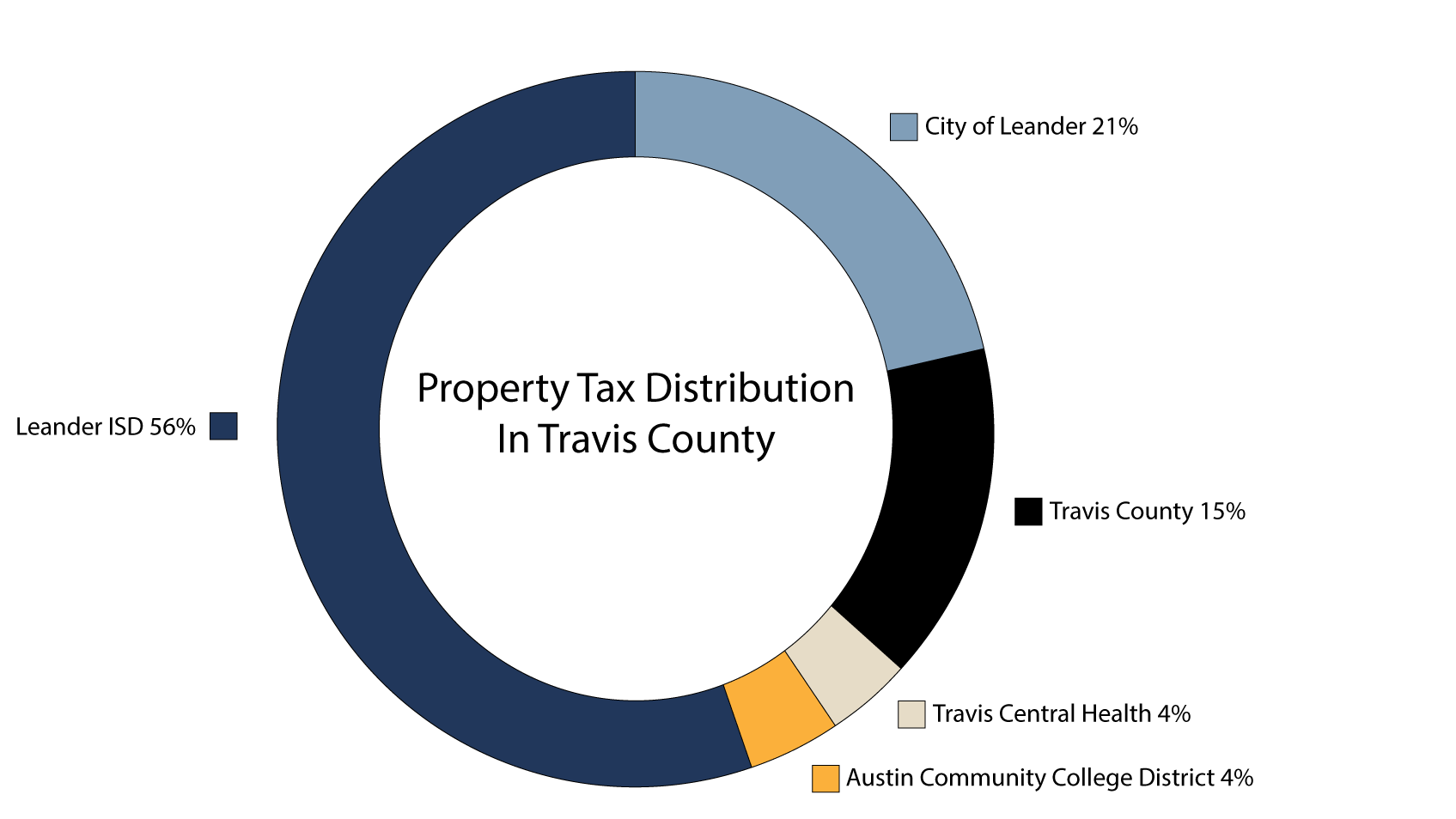

Tax Rates and Calculations

Once the taxable value of a property is determined, it is subjected to tax rates set by various taxing entities. In Travis County, these entities include the county itself, school districts, cities, and special districts. Each of these entities has its own tax rate, which is typically expressed as a percentage of the property’s taxable value.

The tax rate is applied to the taxable value to calculate the total property tax bill. For instance, if a property has a taxable value of $200,000 and the combined tax rate is 2%, the property tax bill would amount to $4,000. These rates can vary significantly depending on the location and the services provided by each taxing entity.

| Taxing Entity | Estimated Tax Rate (%) |

|---|---|

| Travis County | 0.35 |

| Austin Independent School District | 1.38 |

| City of Austin | 0.36 |

| Special Districts (e.g., MUDs) | Varies |

These tax rates are subject to change annually, so it's crucial for property owners to stay updated on the latest rates to accurately estimate their tax obligations.

Payment Options and Due Dates

Travis County offers a range of convenient payment options for property taxes, ensuring flexibility for homeowners. The most common methods include:

- Online Payment: Property owners can make secure online payments through the Travis County Tax Office’s website. This option is available 24⁄7 and provides a quick and efficient way to settle tax bills.

- Mail-in Payment: Traditionalists can opt for mailing in their payments. The tax office provides pre-addressed envelopes, making this process straightforward.

- In-Person Payment: For those who prefer face-to-face interactions, the Travis County Tax Office has multiple locations where payments can be made in person.

- Automatic Payment Plans: Homeowners can set up automatic payment plans to ensure timely payments without the hassle of manual transactions.

The payment due dates vary depending on the taxing entity and the type of property. Generally, property taxes are due by January 31st of each year. Failure to pay by the deadline may result in penalties and interest charges, so it's crucial to stay on top of these deadlines.

Property Tax Exemptions and Relief Programs

Travis County recognizes the financial burden that property taxes can place on certain individuals and offers a range of exemptions and relief programs to provide assistance. These programs aim to make homeownership more accessible and affordable for eligible residents.

Residential Homestead Exemption

The Residential Homestead Exemption is a widely utilized program in Travis County. It allows homeowners to reduce the taxable value of their primary residence, effectively lowering their property tax bill. To be eligible, the homeowner must own the property and use it as their principal residence.

The exemption amount varies depending on the property's value and the homeowner's income. For example, a homeowner with a property valued at $200,000 and an income below a certain threshold may be eligible for an exemption of up to $25,000. This exemption is automatically applied once the homeowner files the necessary paperwork with the Travis County Tax Office.

Over-65 Exemption and Freeze

Seniors aged 65 and older can benefit from the Over-65 Exemption, which provides a significant reduction in property taxes. This exemption ensures that seniors are not burdened with increasing tax bills as their property values rise over time. To qualify, seniors must meet specific income requirements and file an application with the tax office.

Additionally, the Over-65 Freeze program further protects seniors by locking in their taxable value, ensuring that their tax bills do not increase due to rising property values. This program provides stability and peace of mind for seniors on fixed incomes.

Other Exemptions and Relief Programs

Travis County offers a variety of other exemptions and relief programs to support specific groups, including:

- Disability Exemption: Provides relief for homeowners with disabilities.

- Veterans’ Exemptions: Recognizes the service of veterans with various exemption programs.

- Historical Property Exemptions: Encourages the preservation of historical properties.

- Low-Income Exemptions: Assists low-income homeowners with limited resources.

These programs aim to create a more equitable tax system and ensure that property taxes remain manageable for all residents.

Challenges and Future Outlook

While Travis County’s property tax system has its strengths, it also faces certain challenges. One of the primary concerns is the potential for rising property values to outpace income growth, leading to increased tax burdens for homeowners. As the county’s real estate market continues to thrive, striking a balance between revenue generation and homeowner affordability becomes increasingly crucial.

To address these challenges, Travis County has implemented strategies such as:

- Revenue Diversification: Exploring alternative revenue streams to reduce reliance on property taxes.

- Tax Rate Adjustments: Carefully considering tax rate changes to ensure fairness and sustainability.

- Community Engagement: Involving residents in decision-making processes to foster transparency and trust.

Looking ahead, the future of property taxes in Travis County is closely tied to the region's economic growth and development. As the county continues to attract new residents and businesses, finding innovative solutions to manage property tax burdens will be essential for maintaining a healthy and vibrant community.

Frequently Asked Questions

How often are property tax assessments conducted in Travis County?

+Property tax assessments are conducted annually in Travis County. The Travis Central Appraisal District (TCAD) sends out appraisal notices by May 1st each year, and property owners have the right to protest the assessed value within 30 days.

Can I appeal my property tax assessment if I disagree with the value?

+Absolutely! If you believe your property’s assessed value is inaccurate, you have the right to appeal. The TCAD provides a formal protest process, allowing you to present evidence and argue your case. It’s essential to gather supporting documentation, such as recent comparable sales data, to strengthen your appeal.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in penalties and interest charges. It’s crucial to stay informed about the due dates and make timely payments to avoid additional costs. If you face financial difficulties, consider reaching out to the Travis County Tax Office to explore potential payment plans or relief options.

Are there any programs to assist low-income homeowners with property taxes?

+Yes, Travis County offers the Low-Income Homestead Exemption program, which provides a reduction in taxable value for qualifying low-income homeowners. This exemption can significantly lower the property tax burden for eligible residents. To apply, homeowners should contact the Travis County Tax Office for the necessary forms and guidelines.