Sales Tax San Mateo City

Understanding sales tax is essential for both businesses and consumers, as it directly impacts financial transactions and the economy. This article will delve into the specifics of sales tax in San Mateo City, California, providing an in-depth analysis of its rates, regulations, and implications.

The Fundamentals of Sales Tax in San Mateo City

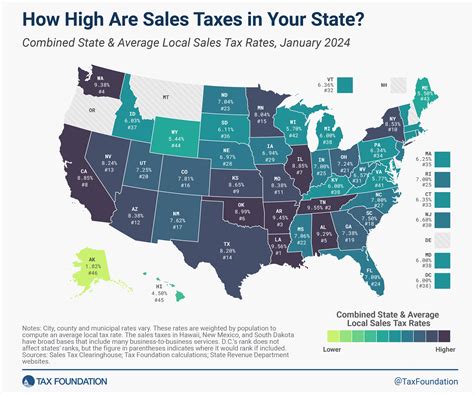

Sales tax is a consumption tax levied on the sale of goods and services. In the United States, it is typically administered at the state and local levels, resulting in varying tax rates across different regions. San Mateo City, located in the heart of the San Francisco Bay Area, has a unique sales tax structure that contributes to its vibrant economy.

The sales tax system in San Mateo City is a combination of state, county, and city taxes, each with its own rate and purpose. This multifaceted tax structure can sometimes be complex, but it plays a crucial role in funding essential public services and infrastructure development.

State Sales Tax

California, the state in which San Mateo City resides, has a statewide sales and use tax rate of 7.25%. This rate is applied uniformly across the state and serves as the foundation for local taxes.

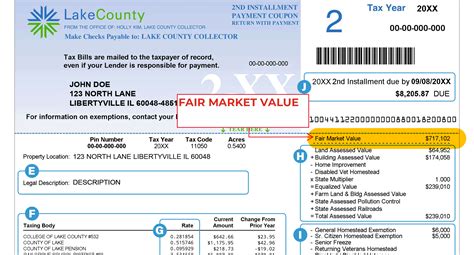

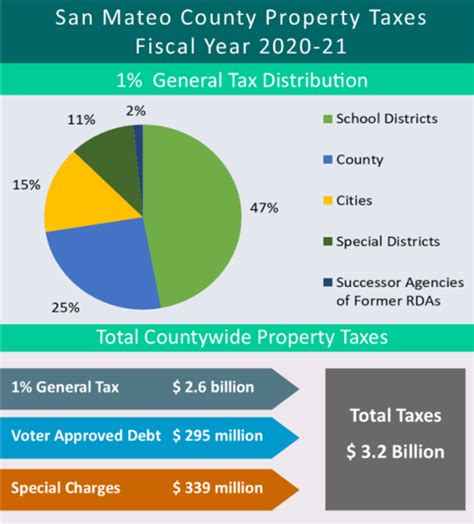

County Sales Tax

San Mateo County, where San Mateo City is located, adds an additional sales tax of 0.75%. This tax is specifically allocated for transportation projects and improvements, ensuring efficient movement of goods and people throughout the county.

City Sales Tax

San Mateo City itself imposes a sales tax of 0.5%, bringing the total sales tax rate in the city to 8.5%. This city-specific tax is vital for funding local services, community programs, and infrastructure maintenance, directly impacting the daily lives of San Mateo City residents.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| San Mateo County | 0.75% |

| San Mateo City | 0.5% |

| Total Sales Tax in San Mateo City | 8.5% |

Sales Tax Regulations and Compliance

Navigating sales tax regulations is crucial for businesses operating in San Mateo City. Compliance with these regulations ensures that businesses fulfill their tax obligations and avoid legal repercussions.

Registration and Permits

Businesses in San Mateo City must register with the California Department of Tax and Fee Administration (CDTFA) to obtain a seller’s permit. This permit authorizes the business to collect and remit sales tax on taxable goods and services sold within the state.

Taxable Items and Exemptions

Not all goods and services are subject to sales tax. California, and by extension San Mateo City, exempts certain items from sales tax, including:

- Prescription medications

- Certain food items

- Clothing under a specific value

- Select educational materials

- Some agricultural products

However, it's important to note that while these items are exempt from state sales tax, they may still be subject to local taxes. It's crucial for businesses to stay updated on the latest tax regulations to accurately determine the tax liability for each transaction.

Filing and Remittance

Businesses in San Mateo City are required to file sales tax returns with the CDTFA on a regular basis, typically quarterly. These returns must include the total taxable sales made during the reporting period, along with the calculated sales tax due. The remittance of sales tax must be made electronically, ensuring timely and accurate payments.

Impact of Sales Tax on Businesses and Consumers

The sales tax structure in San Mateo City influences both business operations and consumer behavior.

Business Operations

For businesses, sales tax compliance is an integral part of their financial strategy. Properly managing sales tax obligations can help businesses avoid penalties and maintain a positive relationship with tax authorities. Additionally, understanding sales tax rates can influence pricing strategies and affect a business’s competitiveness in the market.

Consumer Behavior

Consumers in San Mateo City, like elsewhere, are influenced by sales tax rates when making purchasing decisions. Higher sales tax rates can deter consumers from making certain purchases, especially for non-essential items. On the other hand, sales tax exemptions and incentives can encourage consumer spending, particularly for specific categories of goods.

Economic Implications

The sales tax revenue generated in San Mateo City contributes significantly to the local economy. It funds essential public services, infrastructure development, and community initiatives. However, it’s important to strike a balance between generating revenue and maintaining a competitive business environment to ensure long-term economic sustainability.

Future Trends and Potential Changes

Sales tax regulations are subject to change, often driven by economic conditions, political decisions, and technological advancements.

Economic Factors

Economic downturns or periods of high inflation can prompt discussions about adjusting sales tax rates to maintain revenue stability. Conversely, economic prosperity may lead to calls for tax reforms to stimulate growth and investment.

Political Decisions

Political leadership plays a crucial role in shaping sales tax policies. Changes in leadership or shifts in political priorities can result in amendments to tax rates or the introduction of new taxes to address specific public needs.

Technological Advancements

The rise of e-commerce and online sales has presented new challenges for sales tax administration. States and local governments are adapting to these changes, often through the implementation of new tax regulations and collection mechanisms to ensure compliance in the digital marketplace.

Conclusion

Understanding the intricacies of sales tax in San Mateo City is essential for businesses and consumers alike. By staying informed about tax rates, regulations, and potential changes, individuals and businesses can make informed financial decisions and contribute to the vibrant economy of San Mateo City.

What is the total sales tax rate in San Mateo City, including all applicable taxes?

+The total sales tax rate in San Mateo City is 8.5%, including the state sales tax of 7.25%, the county sales tax of 0.75%, and the city sales tax of 0.5%.

Are there any sales tax holidays in San Mateo City or California?

+Yes, California occasionally offers sales tax holidays for specific items, such as back-to-school supplies or energy-efficient appliances. These holidays provide temporary relief from sales tax on qualifying purchases. However, San Mateo City may or may not participate in these state-wide initiatives.

How often do businesses in San Mateo City need to file sales tax returns?

+Businesses in San Mateo City are typically required to file sales tax returns on a quarterly basis. However, the filing frequency can vary based on the business’s annual sales volume. Larger businesses with higher sales may need to file more frequently, such as monthly or semi-annually.