Tax Newsletter

Welcome to the inaugural edition of our Tax Newsletter, your comprehensive guide to navigating the complex world of taxation. In this highly anticipated newsletter, we aim to demystify tax laws, provide valuable insights, and offer practical strategies to help individuals and businesses make informed decisions. With the ever-changing tax landscape, staying updated is crucial, and we are here to ensure you stay ahead of the curve. Join us as we explore the latest trends, unravel intricate tax regulations, and offer expert advice to optimize your financial well-being.

Unraveling Tax Complexity: A Comprehensive Guide

In the realm of finance and business, taxation is an indispensable yet often daunting aspect. The intricate web of tax laws and regulations can leave even the most seasoned professionals feeling perplexed. Our Tax Newsletter is designed to be your trusted companion, providing a deep dive into the complexities of taxation while offering practical solutions tailored to your unique needs.

As we embark on this journey, we will explore a myriad of tax-related topics, from the fundamentals to the advanced strategies. Whether you are an individual seeking to maximize your tax refunds or a business owner aiming to minimize liabilities, our newsletter promises to deliver valuable insights and expert guidance.

Key Focus Areas:

- Tax Legislation Updates: Stay abreast of the latest tax laws and amendments with our timely updates. We will dissect complex legislation, breaking it down into digestible chunks to ensure you understand the implications on your financial decisions.

- Tax Planning Strategies: Discover effective strategies to optimize your tax position. From leveraging deductions and credits to implementing tax-efficient investment strategies, we will provide actionable advice to minimize your tax burden.

- International Tax Considerations: In today’s globalized economy, cross-border transactions are common. We will explore the intricacies of international tax laws, helping you navigate the complexities and ensure compliance.

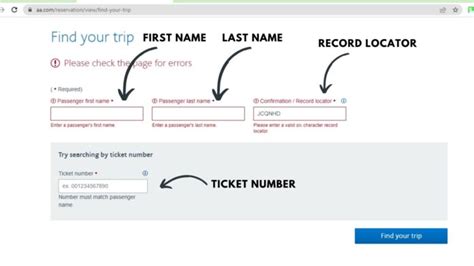

- Tax Technology and Automation: Embrace the power of technology to streamline your tax processes. We will introduce you to innovative tools and software that can simplify tax preparation, filing, and record-keeping, saving you time and effort.

- Industry-Specific Tax Insights: Recognizing that different industries face unique tax challenges, we will delve into sector-specific tax considerations. From startups to established enterprises, our newsletter will offer tailored advice to meet your industry’s specific needs.

| Topic | Key Insights |

|---|---|

| Tax Reform Implications | Explore the far-reaching effects of recent tax reforms, including changes to corporate tax rates, individual deductions, and international tax rules. |

| Estate Planning and Taxes | Learn how to navigate the complex world of estate planning, ensuring your assets are protected and your heirs benefit from efficient tax strategies. |

| Tax-Efficient Investment Strategies | Discover how to structure your investments to minimize tax liabilities, maximizing your returns and long-term financial goals. |

Stay Informed, Stay Ahead

In an era where tax laws are constantly evolving, staying informed is crucial. Our Tax Newsletter is your go-to resource for navigating the complexities of taxation with confidence. Whether you are a seasoned investor, a small business owner, or an individual seeking to optimize your finances, we are here to guide you every step of the way.

As we delve deeper into the world of taxes, we invite you to join us on this insightful journey. Subscribe to our newsletter to receive regular updates, exclusive insights, and expert guidance. Together, let's unlock the power of tax optimization and achieve financial success.

FAQs

How often will the Tax Newsletter be published?

+The Tax Newsletter will be published quarterly, ensuring you receive timely updates and insights. Additionally, we may release special editions or articles as significant tax-related events occur.

Is the newsletter suitable for both individuals and businesses?

+Absolutely! Our newsletter is designed to cater to a wide audience, providing valuable insights for individuals, small businesses, startups, and established enterprises. We understand that tax considerations vary, and our content is tailored to meet diverse needs.

What can I expect from the Tax Newsletter’s expert advice?

+Our expert advice is grounded in extensive industry experience and a deep understanding of tax laws. You can expect practical strategies, real-world examples, and actionable tips to optimize your tax position and achieve your financial goals. We aim to empower you with the knowledge to make informed decisions.