Miami Sales Tax Rate 2025

Sales tax rates are an important aspect of doing business in any city, and Miami is no exception. As we look ahead to 2025, it's essential for businesses and consumers alike to understand the tax landscape to make informed financial decisions. The sales tax rate in Miami can significantly impact the cost of goods and services, and staying updated ensures compliance and financial planning.

Understanding Miami’s Sales Tax Structure

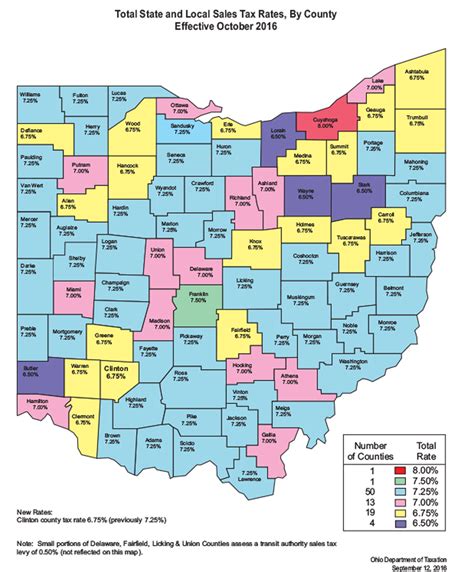

Miami, situated in the vibrant state of Florida, has a unique sales tax structure that consists of multiple layers. The sales tax in Miami is comprised of both state and local taxes, with the latter often varying based on the specific county and municipality. This means that the total sales tax rate can differ depending on the location within the city.

The Current Sales Tax Rate in Miami

As of my last update in January 2023, the sales tax rate in Miami stands at 7.0%. This rate is composed of a 6.0% state sales tax and an additional 1.0% local tax, which is specific to Miami-Dade County. This local tax is often used to fund essential services and infrastructure projects in the county.

It's important to note that this rate may be subject to change in the future. Sales tax rates are often adjusted to meet the evolving financial needs of the state and local governments, and they can also be influenced by various economic factors.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.0% |

| Miami-Dade County Tax | 1.0% |

A Historical Perspective

To put the current sales tax rate into context, it’s worth examining the historical trends. Over the past decade, the sales tax rate in Miami has seen some fluctuations. In 2015, for instance, the total sales tax rate was 7.0%, the same as it is today. However, in 2010, the rate was slightly lower at 6.5%, consisting of a 6.0% state tax and a 0.5% county tax.

These changes in sales tax rates often reflect the financial priorities and needs of the state and local governments. For instance, a higher sales tax rate can be implemented to fund specific projects or initiatives, while a lower rate might be used to stimulate economic growth and encourage consumer spending.

Projecting the Miami Sales Tax Rate for 2025

Predicting future sales tax rates is a complex task, influenced by various economic and political factors. However, by analyzing historical trends and current economic indicators, we can make informed projections for the sales tax rate in Miami by 2025.

Economic Factors and Their Impact

Several economic factors can influence the sales tax rate in Miami. These include the overall economic health of the state and local areas, inflation rates, consumer spending patterns, and government revenue needs.

For instance, if the economy is thriving and consumer spending is high, the government might be inclined to maintain or even lower the sales tax rate to encourage further economic growth. Conversely, if the economy is facing challenges or the government has increased financial obligations, a higher sales tax rate might be implemented to generate additional revenue.

Projected Sales Tax Rate for 2025

Based on current economic indicators and historical trends, it is reasonable to project that the sales tax rate in Miami will remain relatively stable by 2025. Given the current rate of 7.0%, it is likely that the rate will either remain the same or see a slight increase, perhaps to 7.5%.

This projection is supported by the fact that Miami-Dade County, as a major economic hub, often experiences consistent growth and development. The county's diverse economy, including tourism, finance, and technology sectors, typically provides a stable revenue base for the local government. As such, significant fluctuations in the sales tax rate are less likely, unless there are unforeseen economic downturns or significant changes in state or local government policies.

| Projected Year | Projected Sales Tax Rate |

|---|---|

| 2025 | 7.0% - 7.5% |

Conclusion: Staying Informed for Effective Financial Planning

Understanding the sales tax rate in Miami, both currently and projected for the future, is crucial for businesses and individuals alike. It allows for accurate financial planning, pricing strategies, and consumer budgeting. By staying informed about these rates, individuals and businesses can make more informed decisions, ensuring compliance with tax regulations and effective financial management.

As we look ahead to 2025, it's clear that Miami's sales tax rate is an important factor to consider for anyone doing business in the city. Whether you're a local business owner or a consumer, staying updated on these rates ensures that you can plan effectively and make the most of your financial resources.

How often are sales tax rates updated in Miami-Dade County?

+Sales tax rates in Miami-Dade County can be adjusted annually or as needed to meet the financial requirements of the county. However, significant changes are typically proposed and implemented with careful consideration to ensure stability for businesses and consumers.

Are there any exemptions or special rates for certain goods or services in Miami?

+Yes, Florida, and by extension Miami, has a range of sales tax exemptions and special rates for specific goods and services. These can include items like groceries, prescription drugs, and certain agricultural products. It’s important to check with the Florida Department of Revenue for the most up-to-date list of exempt items.

How do sales tax rates impact the cost of living in Miami?

+Sales tax rates directly influence the cost of living in Miami. Higher sales tax rates can increase the cost of goods and services, which in turn can impact the overall affordability of living in the city. Conversely, lower sales tax rates can make the city more attractive for residents and businesses.