Minnesota Sales Tax Rate

In the state of Minnesota, sales tax is an essential aspect of the revenue generation system, contributing significantly to the state's financial stability. The sales tax rate in Minnesota is a topic of interest for businesses, consumers, and policymakers alike, as it influences economic decisions and the overall fiscal health of the state.

Understanding Minnesota’s Sales Tax Structure

Minnesota’s sales tax is a state-level tax applied to the sale of goods and some services. The state has a base sales tax rate, which is then subject to local government surcharges, resulting in a combined rate that varies across the state. This unique structure allows for a certain level of customization in tax rates, reflecting the diverse needs and economic realities of different regions.

The state sales tax rate in Minnesota is currently set at 6.875%, effective from July 1, 2022. This rate includes the state's base sales tax rate of 6.5% and a temporary 0.375% surcharge to support transportation projects, scheduled to expire on June 30, 2025. However, it's important to note that this is the minimum sales tax rate, and local jurisdictions have the authority to impose additional taxes, resulting in a higher combined rate.

Local Sales Tax Rates in Minnesota

The local sales tax rates in Minnesota can vary significantly, with some cities and counties adding surcharges to the state rate. For instance, the city of Minneapolis has a local sales tax rate of 0.5%, bringing the total sales tax rate to 7.375% for purchases within the city limits. On the other hand, the city of St. Paul imposes a 0.25% local sales tax, resulting in a total sales tax rate of 7.125% for consumers in that area.

| Locality | Additional Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Minneapolis | 0.5% | 7.375% |

| St. Paul | 0.25% | 7.125% |

| Duluth | 0.5% | 7.375% |

| Rochester | 0.25% | 7.125% |

| Bloomington | 0.75% | 7.625% |

These local variations can significantly impact the price of goods and services for consumers, highlighting the importance of understanding the sales tax structure in Minnesota.

Sales Tax Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax in Minnesota, there are certain exemptions and special considerations in place. These include:

- Food items for home consumption are generally exempt from sales tax, except for certain prepared foods and beverages.

- Clothing and footwear items priced under $130 are exempt from sales tax, providing some relief for consumers on essential items.

- Sales tax is not applied to the sale of prescription drugs, but over-the-counter medications are taxable.

- Certain agricultural equipment and supplies are exempt from sales tax, supporting the state's agricultural industry.

- Sales tax is not charged on residential rent, but it is applicable to various other types of rentals, such as equipment and vehicle rentals.

Special Tax Districts

Minnesota also has several special tax districts, where sales tax rates may be higher to support specific projects or initiatives. For instance, the Minnesota Zoo Tax District has a sales tax rate of 0.5%, while the Bloomington Convention Center District imposes an additional 0.5% tax.

| Special Tax District | Additional Sales Tax Rate |

|---|---|

| Minnesota Zoo Tax District | 0.5% |

| Bloomington Convention Center District | 0.5% |

| Metropolitan Sports Facilities Commission District | 0.15% |

These special tax districts are designed to generate funds for specific purposes, and they highlight the flexibility and adaptability of Minnesota's sales tax system.

Impact of Sales Tax on Minnesota’s Economy

The sales tax in Minnesota plays a critical role in the state’s economy, providing a significant source of revenue for state and local governments. This revenue is used to fund a wide range of public services and infrastructure projects, from education and healthcare to road maintenance and public safety.

The sales tax rate in Minnesota also influences consumer behavior and business strategies. For consumers, higher sales tax rates can affect purchasing decisions and budget planning. For businesses, managing sales tax obligations is a complex but necessary part of their operations, impacting pricing strategies and overall profitability.

Additionally, the sales tax structure in Minnesota can influence economic development and investment patterns. Areas with lower sales tax rates may be more attractive to businesses and consumers, potentially leading to shifts in economic activity across the state.

Conclusion: Minnesota’s Sales Tax Landscape

In conclusion, Minnesota’s sales tax structure is a dynamic and intricate system, characterized by a state-level base rate and local variations. This structure provides flexibility for local governments to address their unique financial needs while maintaining a level of uniformity across the state. The sales tax rate, currently at 6.875%, is subject to ongoing discussions and potential changes, reflecting the state’s commitment to fiscal responsibility and economic development.

As businesses and consumers navigate Minnesota's sales tax landscape, it is essential to stay informed about the latest rates and exemptions. This knowledge empowers stakeholders to make informed decisions, manage their tax obligations effectively, and contribute to the vibrant economic ecosystem of Minnesota.

Frequently Asked Questions

Are there any special sales tax holidays in Minnesota?

+Yes, Minnesota occasionally has sales tax holidays. These are specific periods when certain items, often back-to-school supplies or clothing, are exempt from sales tax. These holidays are designed to provide relief for consumers and boost local economies.

How often are sales tax rates updated in Minnesota?

+Sales tax rates in Minnesota can be updated periodically, typically as part of state legislation or local government initiatives. The current state rate of 6.875% is scheduled to expire on June 30, 2025, after which it may be subject to change.

What is the process for businesses to collect and remit sales tax in Minnesota?

+Businesses in Minnesota are required to register with the Minnesota Department of Revenue to collect and remit sales tax. They must collect the appropriate sales tax rate based on the location of the sale and remit these taxes periodically, typically monthly or quarterly, depending on their sales volume.

Are there any online resources to help businesses manage sales tax obligations in Minnesota?

+Yes, the Minnesota Department of Revenue provides a range of resources, including guides, webinars, and online tools, to help businesses understand and manage their sales tax obligations. These resources cover topics such as registration, collection, remittance, and compliance.

How do sales tax rates in Minnesota compare to other states in the region?

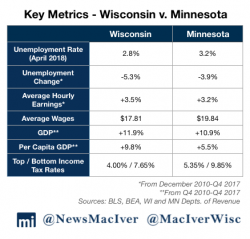

+Minnesota’s sales tax rates are generally competitive with other states in the region. For instance, Wisconsin has a similar structure with a state rate of 5% and local rates that can add up to a total rate of over 7%. Illinois has a higher state rate of 6.25%, but local rates can bring the total above 10% in some areas.