State Of Tennessee Sales Tax

In the United States, sales tax is a crucial aspect of state and local revenue generation. Each state has its own unique tax structure, rates, and regulations. This article will delve into the intricacies of the State of Tennessee's sales tax system, exploring its history, current rates, exemptions, and the impact it has on businesses and consumers.

Understanding Tennessee’s Sales Tax Landscape

Tennessee, known as the “Volunteer State”, has a rich history and a vibrant economy. Its sales tax system plays a significant role in funding essential state services and infrastructure development. The state’s tax code is complex, offering a range of rates and exemptions that vary across counties and municipalities.

The history of sales tax in Tennessee dates back to the early 20th century. It was first implemented in 1947 as a means to generate revenue for state operations. Over the years, the sales tax system has evolved, adapting to the changing economic landscape and the needs of the state's residents.

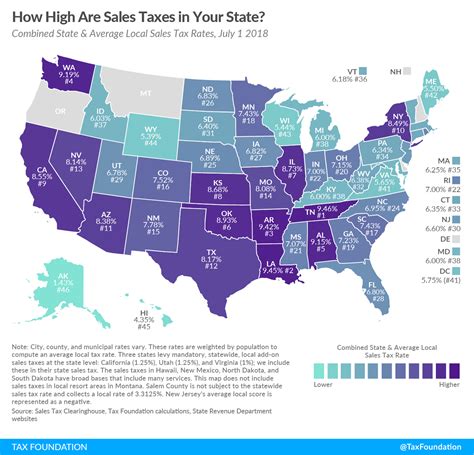

Tennessee's sales tax is a combined state and local tax, meaning that both the state and local governments impose taxes on retail sales. This combined system allows for a more localized approach to taxation, with rates varying across the state's 95 counties and numerous municipalities.

Key Features of Tennessee’s Sales Tax

- Statewide Base Rate: Tennessee has a uniform base sales tax rate of 7%, which is applied to most retail sales across the state.

- Local Add-Ons: In addition to the state rate, local governments can impose their own additional sales tax rates, often referred to as local option taxes. These rates can vary significantly, with some counties and cities having higher rates than others.

- Taxable Items: Tennessee’s sales tax applies to a broad range of goods and services, including clothing, electronics, groceries, and even streaming services. However, there are certain exemptions and special rates for specific items, which we will explore in detail.

- Registration and Compliance: Businesses operating in Tennessee must register for a sales tax permit and collect and remit sales tax on behalf of the state. The Tennessee Department of Revenue provides guidelines and resources to help businesses navigate the sales tax process.

The Impact of Tennessee’s Sales Tax on Businesses

For businesses operating within Tennessee, understanding and managing sales tax is crucial for compliance and financial health. Here’s how the state’s sales tax system affects businesses:

Registration and Permits

To collect and remit sales tax, businesses must first obtain a sales tax permit from the Tennessee Department of Revenue. This process involves providing business details, such as legal name, address, and tax identification number. The permit allows businesses to legally collect and remit sales tax to the state.

Sales Tax Calculation and Collection

Businesses are responsible for calculating the applicable sales tax rate for each transaction. This involves considering the state base rate, any local add-ons, and potential exemptions. The calculated tax amount is then added to the purchase price, and the business collects it from the customer at the point of sale.

For example, if a customer purchases an item in a county with a total sales tax rate of 9.25% (state rate of 7% plus a local rate of 2.25%), the business would add 9.25% to the item's price, and the customer would pay the additional tax.

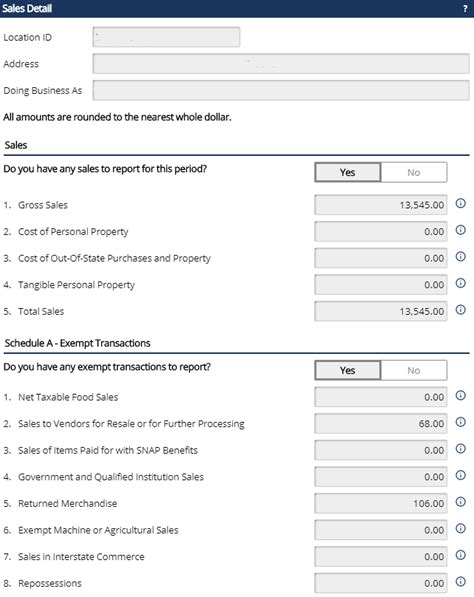

Remittance and Reporting

Regularly, typically monthly or quarterly, businesses must remit the collected sales tax to the Tennessee Department of Revenue. This involves filing sales tax returns, providing transaction details, and submitting the tax payments. Accurate reporting is essential to avoid penalties and maintain compliance.

Compliance Challenges

The complexity of Tennessee’s sales tax system, with its varying rates and exemptions, can pose challenges for businesses. Keeping up with rate changes, understanding local ordinances, and ensuring accurate tax calculation and collection can be time-consuming and resource-intensive. Many businesses utilize tax software or outsourcing solutions to streamline this process.

Impact on Consumers

Tennessee’s sales tax system also has a direct impact on consumers. Here’s how it affects their purchasing decisions and overall financial well-being:

Visible Tax at Checkout

When making purchases in Tennessee, consumers see the sales tax amount added to their total bill. This transparency allows them to understand the impact of sales tax on their spending. For example, a 100 item in a county with a 9.25% sales tax rate would result in a total cost of 109.25, including tax.

Comparing Prices Across Counties

With varying local sales tax rates, consumers may find that the same item has a different total cost depending on the county or city they purchase it from. This can influence shopping choices, with some consumers opting to travel to areas with lower tax rates to save money.

Exemptions and Special Rates

Tennessee offers sales tax exemptions and special rates for certain items, which can provide savings for consumers. For instance, the state exempts certain food items, prescription drugs, and certain medical devices from sales tax. Additionally, there are special rates for specific services, such as automotive repairs.

Sales Tax Exemptions and Special Considerations

Tennessee’s sales tax system includes a range of exemptions and special considerations that impact both businesses and consumers. Here are some key exemptions and rates to be aware of:

Food and Groceries

Tennessee offers a partial exemption for certain food items. Prepared foods and restaurant meals are subject to the full sales tax rate. However, unprepared foods, such as raw produce, meats, and staple groceries, are exempt from sales tax, providing a financial benefit to consumers.

Prescription Drugs and Medical Devices

Tennessee exempts prescription drugs and certain medical devices from sales tax. This exemption is aimed at reducing the financial burden on individuals with medical needs. However, it’s important to note that over-the-counter medications and non-prescription items are subject to the full sales tax rate.

Clothing and Footwear

Tennessee has a clothing and footwear exemption up to a certain value. Clothing and footwear items costing $6,000 or less per transaction are exempt from sales tax. This exemption provides a significant savings for consumers, especially when purchasing essential items.

Automotive Services

Tennessee imposes a special sales tax rate for automotive repair and maintenance services. These services are taxed at a reduced rate of 4%, providing a financial incentive for vehicle owners to maintain their vehicles.

Other Exemptions and Special Rates

Tennessee offers various other exemptions and special rates for specific industries and services. These include exemptions for manufacturing machinery, certain agricultural equipment, and special rates for lodging and rental car services. It’s essential for businesses and consumers to stay informed about these exemptions to ensure compliance and take advantage of potential savings.

| Category | Sales Tax Rate |

|---|---|

| Clothing and Footwear | Exempt up to $6,000 |

| Prescription Drugs | Exempt |

| Unprepared Groceries | Exempt |

| Automotive Repairs | 4% |

Conclusion

Tennessee’s sales tax system is a vital component of the state’s revenue generation and plays a significant role in funding public services and infrastructure. With its combined state and local tax structure, varying rates, and exemptions, it presents both challenges and opportunities for businesses and consumers alike. By understanding the intricacies of Tennessee’s sales tax, businesses can ensure compliance, while consumers can make informed choices to optimize their spending.

Frequently Asked Questions

How often do businesses need to remit sales tax in Tennessee?

+Businesses in Tennessee typically remit sales tax on a monthly or quarterly basis, depending on their sales volume. Larger businesses with higher sales may be required to remit monthly, while smaller businesses may have the option to remit quarterly. It’s important for businesses to consult with the Tennessee Department of Revenue to determine their specific remittance schedule.

Are there any online resources to help businesses calculate sales tax in Tennessee?

+Yes, the Tennessee Department of Revenue provides an online sales tax calculator on their website. This tool allows businesses to input the county and city where the sale occurs, along with the sale amount, to calculate the applicable sales tax rate and amount. It’s a valuable resource for accurate tax calculation.

What happens if a business fails to collect or remit sales tax in Tennessee?

+Failing to collect or remit sales tax in Tennessee can result in significant penalties and legal consequences. The Tennessee Department of Revenue has the authority to assess penalties, interest, and even pursue legal action against non-compliant businesses. It’s crucial for businesses to stay informed and comply with sales tax regulations to avoid these issues.

Are there any special sales tax holidays in Tennessee?

+Yes, Tennessee occasionally offers sales tax holidays to provide consumers with tax-free shopping opportunities. These holidays are typically designated for specific items, such as back-to-school supplies or energy-efficient appliances. The dates and eligible items for these holidays are announced by the state government, and businesses must comply with the temporary tax exemption.

How does Tennessee’s sales tax system compare to other states in the region?

+Tennessee’s sales tax system, with its combined state and local rates, is similar to many neighboring states in the region. However, the specific rates and exemptions can vary significantly. It’s important for businesses operating across state lines to stay informed about the sales tax regulations in each state to ensure compliance and avoid unexpected tax liabilities.