Mo State Income Tax Refund

The state of Missouri, known for its vibrant culture and diverse economy, has a unique approach to state income tax refunds. Unlike some states that offer direct deposit options or pre-loaded debit cards, Missouri takes a more traditional route, mailing paper checks to residents who are due a refund.

This process, while familiar to many, presents a unique set of challenges and opportunities for taxpayers and the state alike. From the moment a resident files their tax return, a journey begins that involves various stages of processing, scrutiny, and ultimately, the much-awaited refund.

The Journey of a Missouri State Income Tax Refund

The process of receiving a state income tax refund in Missouri can be broken down into several key stages, each with its own set of intricacies and potential pitfalls.

Filing Your Tax Return

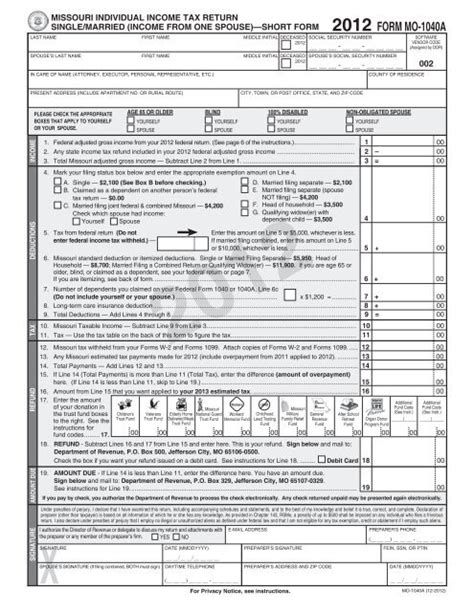

The first step in the journey towards a state income tax refund is the filing of your tax return. In Missouri, residents have the option to file their returns electronically or via traditional paper methods. The state's Department of Revenue provides both options, catering to the diverse preferences and technological capabilities of its residents.

Electronic filing, often touted for its speed and convenience, allows taxpayers to transmit their return data directly to the state's processing system. This method is not only faster but also reduces the margin for error, as it minimizes the potential for illegible handwriting or other human errors associated with paper filing.

On the other hand, paper filing remains a viable option for those who prefer a more traditional approach or who lack access to electronic filing resources. This method involves completing the necessary forms, gathering the required documentation, and physically mailing the package to the Department of Revenue.

Regardless of the filing method chosen, accuracy is paramount. Mistakes or omissions on tax returns can lead to delays in processing, additional scrutiny, or even audits. Therefore, it is crucial for taxpayers to review their returns thoroughly before submission, ensuring that all information is accurate and complete.

Processing and Verification

Once a tax return is filed, it enters the processing phase. This stage is where the state's Department of Revenue scrutinizes the return, verifying the information provided and calculating the taxpayer's refund or balance due.

The processing stage is a complex and meticulous process. The Department of Revenue employs a series of automated checks and manual reviews to ensure the accuracy and integrity of each return. These checks include verifying the taxpayer's identity, cross-referencing income and deduction claims with third-party data, and confirming the accuracy of calculations.

In cases where discrepancies are identified, the Department may request additional documentation or clarification from the taxpayer. This could include proof of income, expense receipts, or other supporting evidence. Responding promptly to such requests is crucial, as it can expedite the processing of your return and the issuance of your refund.

For those who file their returns electronically, the processing stage may be quicker, as the data is directly transmitted into the state's system. However, even with electronic filing, there may be instances where further verification is required, especially if the return is complex or involves unique circumstances.

Issuing the Refund

After the processing and verification stages, the moment of truth arrives: the issuance of the refund. In Missouri, refunds are issued in the form of paper checks, which are mailed to the taxpayer's address on record with the Department of Revenue.

The mailing process is a critical stage, as it involves the physical delivery of the refund check to the taxpayer. This stage can be influenced by various factors, including the efficiency of the postal service, the accuracy of the taxpayer's address, and any unforeseen delays or disruptions in the mail system.

To ensure a smooth delivery process, taxpayers should verify their address with the Department of Revenue regularly, especially if they have recently moved or anticipate a move in the near future. Keeping this information up-to-date can help prevent delays or misdeliveries, ensuring that the refund check reaches its intended recipient promptly.

Once the refund check is mailed, the taxpayer should allow sufficient time for delivery. While the state aims to issue refunds promptly, factors beyond its control, such as postal service efficiency, can influence the timing of receipt. Taxpayers should therefore exercise patience and allow for a reasonable period before inquiring about the status of their refund.

Tracking and Receiving Your Refund

In today's digital age, the ability to track the status of one's refund is a valuable tool. Missouri, recognizing the importance of transparency and convenience, provides taxpayers with the option to track the progress of their refund online.

The Missouri Department of Revenue offers an online refund tracking service, accessible through its official website. This service allows taxpayers to enter their personal identification information and obtain real-time updates on the status of their refund. It provides information on whether the refund has been processed, is in transit, or has been delivered.

By leveraging this tracking service, taxpayers can stay informed about the progress of their refund, reducing anxiety and uncertainty. It also allows them to plan their finances more effectively, knowing when to expect the arrival of their refund and how to budget accordingly.

In addition to online tracking, taxpayers can also receive notifications about their refund status via email or text message. This real-time communication channel provides an added layer of convenience, ensuring that taxpayers are promptly informed of any updates or changes to the status of their refund.

Conclusion: The Importance of a Smooth Refund Process

The process of receiving a state income tax refund in Missouri, while traditional in its approach, is nonetheless critical to the financial well-being of many residents. A smooth and efficient refund process can provide much-needed financial relief, allowing taxpayers to address immediate financial needs or pursue long-term financial goals.

For the state, a well-managed refund process also carries significant benefits. It fosters trust and confidence in the state's tax system, encouraging compliance and timely filing. Furthermore, a streamlined refund process can enhance the state's reputation for efficiency and taxpayer service, attracting businesses and individuals who value a transparent and reliable tax administration system.

As such, the journey of a Missouri state income tax refund is not merely a bureaucratic process but a critical component of the state's financial ecosystem. By understanding and navigating this process effectively, taxpayers can ensure they receive their refunds promptly, while the state can maintain its commitment to transparency, efficiency, and taxpayer service.

| Key Takeaways | Description |

|---|---|

| Filing Options | Missouri offers both electronic and paper filing methods, catering to diverse taxpayer preferences. |

| Processing and Verification | The Department of Revenue employs rigorous checks to ensure the accuracy of tax returns. |

| Refund Issuance | Refunds are issued as paper checks, mailed to the taxpayer's address on record. |

| Tracking Your Refund | Taxpayers can track their refund status online, providing real-time updates and convenience. |

When can I expect to receive my state income tax refund in Missouri?

+

The timing of your refund depends on several factors, including when you file your return, the method of filing (electronic or paper), and the complexity of your tax situation. Generally, refunds are issued within 4-6 weeks of filing. However, it’s important to note that this timeframe can vary, and factors such as processing delays or additional verification requirements can extend the wait.

How can I track the status of my state income tax refund in Missouri?

+

Missouri provides an online refund tracking service through its Department of Revenue website. By accessing this service, you can enter your personal identification information and obtain real-time updates on the status of your refund. Additionally, you can opt for email or text notifications to receive timely updates on your refund’s progress.

What should I do if I haven’t received my state income tax refund check in Missouri?

+

If you haven’t received your refund check within a reasonable timeframe (typically 6-8 weeks after filing), it’s recommended to contact the Missouri Department of Revenue. They can provide you with the status of your refund and assist in resolving any issues that may have caused a delay.